- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: How low will my scores go?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How low will my scores go?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

@HeavenOhio wrote:

@Anonymous wrote:With the utilization brought back into check I think you'd return to 820-830.

I agree. Maybe a bit higher.

I have six open cards, three closed cards, and no loans at all. My AoOA is 19 years, 1 month. My EQ and EX AAoA is 8 years, 9 months. My TU AAoA is 8 years, 6 months due to the presence of a closed utility account. And my AoYA is 3 years, 8 months. I have no inquiries, my scores are currently all at their AZEO levels, and it seems that I have little left to gain for aging.

These are my scores:

- Equifax 04 (FICO 5) Classic: 810

- Transunion 04 (FICO 4) Classic: 808

- Experian 98 (FICO 2) Classic: 825

- Equifax 04 (FICO 5) Auto: 828

- Transunion 04 (FICO 4) Auto: 817

- Experian 98 (FICO 2) Auto: 807

- Equifax 04 (FICO 5) Bankcard: 819

- Transunion 04 (FICO 4) Bankcard: 842

- Experian 98 (FICO 2) Bankcard: 845

- Experian 04 (FICO 3) Bankcard: 817

- Equifax FICO 8 Classic: 823

- Transunion FICO 8 Classic: 815

- Experian FICO 8 Classic: 815

- Equifax FICO 8 Auto: 793

- Transunion FICO 8 Auto: 821

- Experian FICO 8 Auto: 797

- Equifax FICO 8 Bankcard: 836

- Transunion FICO 8 Bankcard: 832

- Experian FICO 8 Bankcard: 835

- Equifax FICO 9 Classic: 837

- Transunion FICO 9 Classic: 821

- Experian FICO 9 Classic: 823

- Equifax FICO 9 Auto: 852

- Transunion FICO 9 Auto: 829

- Experian FICO 9 Auto: 837

- Equifax FICO 9 Bankcard: 847

- Transunion FICO 9 Bankcard: 833

- Experian FICO 9 Bankcard: 835

@HeavenOhio Since you have no loan, AAOA =AAORA. Watch the 9 year AAoRA for me, i have a 9 yr threshold report. TIA!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

@Anonymous wrote:

@Thomas_Thumb wrote:The card has now been paid to zero and fewer cards will be reporting balances next cycle. Not sure why the the mortgage company has not updated the loan to report as paid and closed.

Side note: My Fico sensitivity index went from 48 to 57.

That EQ 5 score is interesting to me.

All 3 mortgage scores have 'Too many accounts with balances', but EQ 5 has an additional code for 'Number of bank or national revolving accounts with balances' (#23). (See mortgage scores reason differential here.)

Yet another data point showing the EQ FICO Resilience Index cares most about balances. Someone with an EQ 850 has a 39 on it right now, and of course balances are very low.

Below is a side by side comparison of all Classic scores for the two reports. Fico 9 reacted more strongly than did Fico 8 to the jump in revolving utilization across the board. This could be due to potentially having a larger buffer on Fico 8. However, I don't think that is the case because I have seen TU Fico 8 drop below 850 a few times while my TU Fico 9 stayed at 850. So, my conclusion is Fico 9 is more responsive to changes in utilization than is Fico 8.

Also of note is the disproportionately large drop in EX score on the older Fico models.

Edit add - For completeness and future reference Industry Enhanced scores are presented in the table below:

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

Below are the negative reason statements I received on my 11-5-2020 report for elevated revolving utilization with all 6 of my open accounts showing balances. I believe the count includes my mortgage but excludes the AU card which had a balance on it.

Side note:

1. TU VantageScore 3.0 dropped from 828 to 810 due to the increase in utilization.

2. EX VantageScore 3.0 dropped to 810 as well due to the increase in utilization.

3. Ag utilization per VS 3.0 is 11% vs 13% for Fico because VS includes my high CL AU card which was reporting a small balance.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

@Thomas_Thumb wrote:

So, my conclusion is Fico 9 is more responsive to changes in utilization than is Fico 8.

Also of note is the disproportionately large drop in EX score on the older Fico models.

Very nice data!

EQ/TU FICO 9 is very sensitive to accounts with balances as well.

These are the changes from 3 of 4 to 2 of 4 reporting a balance. (Full details)

| 8 | BC8 | AU8 | MTG | AUT | BKC | 9 | BC9 | AU9 | 3 |

EQ | 0 | +3 | 0 | +3 | +3 | +2 | +9 | +9 | +13 | |

TU | 0 | 0 | 0 | 0 | 0 | 0 | +16 | +16 | +16 |

|

EX | 0 | +2 | 0 | -2 | -2 | -2 | +1 | +1 | +1 | +4 |

EX 3 gave me +4 at 2-of-4 with a balance compared with prior month at 3-of-4.

Then +6pts at 1-of-4 with a balance, and +9 at All Zero - all compared to prior month at 2-of-4.

On this same report, EX 2 went up +11 at 1-of-4, +8 at All Zero.

You're definitely right about these older EX FICO models.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

Below is a more comprehensive comparison of 3B data sets. Although they span a significant perion of time, change in aging is not a factor when comparing these data sets. The last account I opened was in 2011. I have maintained the same open accounts throughout.

When reviewing this data (2018 to 2017/2020), I noted a peak in Fico 98 (EX score 2, highlighted in green) on the 2018 report. However, all Fico 04 scores (EQ score 5, TU score 4 and EX score 3) and their Industry Enhanced counterparts all dropped substantially from the prior 2017 report values (highlighted in red). EQ score 5 values (highlighted in blue) were influenced heavily by # of card accounts with balances.

My report shows a substantial increase in AU card utilization but, low utilization if the AU card is excluded. My conclusion is that the Fico 04 algorithm is factoring in my AU card account but, Fico 9/Fico 8/Fico 98 versions are not.

The primary variables influencing score amoung these 3B reports are change in # of accounts reporting balances and changes in individual/aggregate revolving utilization. A secondary factor is number of INQ going from zero to one and back to zero on EQ/TU.

My file is still showing my mortgage as open with a balance of $1819 remaining. I guess if it never gets reported as paid and closed that's a plus for my scores.

| Description | 11/5/2020 | 10/13/2020 | 4/7/2020 | 4/16/2018 | 3/25/2017 |

| Ag UT $ (Exclude AU) | $11,005 | $2,951 | $285 | $620,$506 | $354 |

| Ag UT % (Exclude AU) | 13% | 3% | 1% | 1% | 1% |

| High card $ (no AU) | $9,664 | $1,829 | $165 | $469 | $270 |

| High card UT % (no AU) | 54% | 15% | 1% | 2% | 1% |

| AU card UT $ | $2,658 | $908 | $775 | $5,707 | $918 |

| AU card UT % | 8% | 3% | 2% | 17% | 3% |

| AG UT $ (inc AU) | $13,663 | $3,859 | $1,060 | $6,327 | $1,272 |

| AG UT % (inc AU) | 11% | 3% | 1% | 6% | 2% |

| INQ by CRA | 0,0,0 | 0,0,0 | 0,0,0 | 1,1,0 | 0,0,0 |

| Accts with bal (no AU) | 6,6,6 | 6,6,6 | 5,5,5 | 4,4,3 | 3,3,3 |

| EQ Fico 8 | 843 | 850 | 850 | 850 | 850 |

| TU Fico 8 | 835 | 850 | 850 | 850 | 850 |

| EX Fico 8 | 846 | 850 | 850 | 850 | 850 |

| EQ Fico 04 (score 5) | 749 | 764 | 790 | 777 | 804 |

| TU Fico 04 (score 4) | 806 | 818 | 823 | 801 | 823 |

| EX Fico 04 (score 3) | 791 | 819 | 830 | 809 | 830 |

| EX Fico 98 (score 2) | 787 | 820 | 839 | 842 | 839 |

| EQ Fico 9 | 830 | 850 | 850 | 850 | 850 |

| TU Fico 9 | 834 | 850 | 850 | 850 | 850 |

| EX Fico 9 | 842 | 850 | 850 | 850 | 850 |

| EQ BCE Fico 8 | 850 | 878 | 881 | 881 | 887 |

| TU BCE Fico 8 | 862 | 880 | 880 | 891 | 899 |

| EX BCE Fico 8 | 878 | 900 | 900 | 900 | 900 |

| EQ BCE Fico 04 | 743 | 776 | 808 | 786 | 822 |

| TU BCE Fico 04 | 817 | 853 | 858 | 812 | 858 |

| EX BCE Fico 98 | 792 | 845 | 861 | 867 | 864 |

| EQ BCE Fico 9 | 838 | 867 | 873 | 868 | 876 |

| TU BCE Fico 9 | 839 | 869 | 870 | 873 | 879 |

| EX BCE Fico 9 | 844 | 874 | 874 | 878 | 879 |

| EQ Auto Fico 8 | 857 | 878 | 884 | 881 | 887 |

| TU Auto Fico 8 | 861 | 879 | 879 | 882 | 891 |

| EX Auto Fico 8 | 871 | 899 | 899 | 895 | 897 |

| EQ Auto Fico 04 | 778 | 795 | 818 | 807 | 831 |

| TU Auto Fico 04 | 822 | 867 | 872 | 837 | 872 |

| EX Auto Fico 98 | 787 | 832 | 858 | 861 | 858 |

| EQ Auto Fico 9 | 836 | 867 | 878 | 870 | 885 |

| TU Auto Fico 9 | 842 | 871 | 871 | 870 | 880 |

| EX Auto Fico 9 | 856 | 882 | 882 | 886 | 887 |

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

@Thomas_Thumb wrote:Below is a more comprehensive comparison of 3B data sets. Although they span a significant perion of time, change in aging is not a factor when comparing these data sets. The last account I opened was in 2011. I have maintained the same open accounts throughout.

When reviewing this data (2018 to 2017/2020), I noted a peak in Fico 98 (EX score 2, highlighted in green) on the 2018 report. However, all Fico 04 scores (EQ score 5, TU score 4 and EX score 3) and their Industry Enhanced counterparts all dropped substantially from the prior 2017 report values (highlighted in red). EQ score 5 values (highlighted in blue) were influenced heavily by # of card accounts with balances.

My report shows a substantial increase in AU card utilization but, low utilization if the AU card is excluded. My conclusion is that the Fico 04 algorithm is factoring in my AU card account but, Fico 9/Fico 8/Fico 98 versions are not.

The primary variables influencing score amoung these 3B reports are change in # of accounts reporting balances and changes in individual/aggregate revolving utilization. A secondary factor is number of INQ going from zero to one and back to zero on EQ/TU.

My file is still showing my mortgage as open with a balance of $1819 remaining. I guess if it never gets reported as paid and closed that's a plus for my scores.

Description 11/5/2020 10/13/2020 4/7/2020 4/16/2018 3/25/2017 Ag UT $ (Exclude AU) $11,005 $2,951 $285 $620,$506 $354 Ag UT % (Exclude AU) 13% 3% 1% 1% 1% High card $ (no AU) $9,664 $1,829 $165 $469 $270 High card UT % (no AU) 54% 15% 1% 2% 1% AU card UT $ $2,658 $908 $775 $5,707 $918 AU card UT % 8% 3% 2% 17% 3% AG UT $ (inc AU) $13,663 $3,859 $1,060 $6,327 $1,272 AG UT % (inc AU) 11% 3% 1% 6% 2% INQ by CRA 0,0,0 0,0,0 0,0,0 1,1,0 0,0,0 Accts with bal (no AU) 6,6,6 6,6,6 5,5,5 4,4,3 3,3,3 EQ Fico 8 843 850 850 850 850 TU Fico 8 835 850 850 850 850 EX Fico 8 846 850 850 850 850 EQ Fico 04 (score 5) 749 764 790 777 804 TU Fico 04 (score 4) 806 818 823 801 823 EX Fico 04 (score 3) 791 819 830 809 830 EX Fico 98 (score 2) 787 820 839 842 839 EQ Fico 9 830 850 850 850 850 TU Fico 9 834 850 850 850 850 EX Fico 9 842 850 850 850 850 EQ BCE Fico 8 850 878 881 881 887 TU BCE Fico 8 862 880 880 891 899 EX BCE Fico 8 878 900 900 900 900 EQ BCE Fico 04 743 776 808 786 822 TU BCE Fico 04 817 853 858 812 858 EX BCE Fico 98 792 845 861 867 864 EQ BCE Fico 9 838 867 873 868 876 TU BCE Fico 9 839 869 870 873 879 EX BCE Fico 9 844 874 874 878 879 EQ Auto Fico 8 857 878 884 881 887 TU Auto Fico 8 861 879 879 882 891 EX Auto Fico 8 871 899 899 895 897 EQ Auto Fico 04 778 795 818 807 831 TU Auto Fico 04 822 867 872 837 872 EX Auto Fico 98 787 832 858 861 858 EQ Auto Fico 9 836 867 878 870 885 TU Auto Fico 9 842 871 871 870 880 EX Auto Fico 9 856 882 882 886 887

@Thomas_Thumb awesome data and analysis as always! Thank you for sharing!

May I ask why the authorized user account is not counting on 98? Is the credit limit over the cut off?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

@Anonymous wrote:

@Thomas_Thumb wrote:The last account I opened was in 2011. The primary variables influencing score amoung these 3B reports are change in # of accounts reporting balances and changes in individual/aggregate revolving utilization. A secondary factor is number of INQ going from zero to one and back to zero on EQ/TU.

A review of 3B reports from 2017 thru 2020 indicates my AU account is affecting Fico 04 algorithm scores but not Fico 98 algorithm scores. The AU card is also not affecting Fico 8 or Fico 9 scores.

@Thomas_Thumb awesome data and analysis as always! Thank you for sharing!

May I ask why the authorized user account is not counting on 98? Is the credit limit over the cut off?

I was a bit surprised the AU card was not in play for Fico 98 (EX score 2) but, it clearly is not.

I had thought that the CL for revolving accounts counting on Fico 98 and Fico 04 was $35k. I suspect the limit for Fico 98 is actually less than Fico 04. The AU card is $34.9k and has been at that CL since the account was opened in 1996.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

@Thomas_Thumb wrote:

@Anonymous wrote:

@Thomas_Thumb wrote:The last account I opened was in 2011. The primary variables influencing score amoung these 3B reports are change in # of accounts reporting balances and changes in individual/aggregate revolving utilization. A secondary factor is number of INQ going from zero to one and back to zero on EQ/TU.

A review of 3B reports from 2017 thru 2020 indicates my AU account is affecting Fico 04 algorithm scores but not Fico 98 algorithm scores. The AU card is also not affecting Fico 8 or Fico 9 scores.

@Thomas_Thumb awesome data and analysis as always! Thank you for sharing!

May I ask why the authorized user account is not counting on 98? Is the credit limit over the cut off?

I was a bit surprised the AU card was not in play for Fico 98 (EX score 2) but, it clearly is not.

I had thought that the CL for revolving accounts counting on Fico 98 and Fico 04 was $35k. I suspect the limit for Fico 98 is actually less than Fico 04. The AU card is $34.9k and has been at that CL since the account was opened in 1996.

@Thomas_Thumb Yes sir that explains it perfectly, the cut off for EX2 is somewhere between $26,000 and $29,000.

Edit: update we have now learned the cutoff for EX2 is between $31,000 and $34,900.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How low will my scores go?

I logged into Credit Karma today to check on my mortgage status. The loan shows paid in full and closed on EQ but, still shows open with one payment remaining on TU. Interestingly my EQ VS 3.0 score went up 3 points on EQ while my TU score remained unchanged. TU appear to be 3 business days behind on updating their database from my experiences. I'll wait until late next week to pull a 3B which should by then show my mortgage as paid and closed on all three CAs.

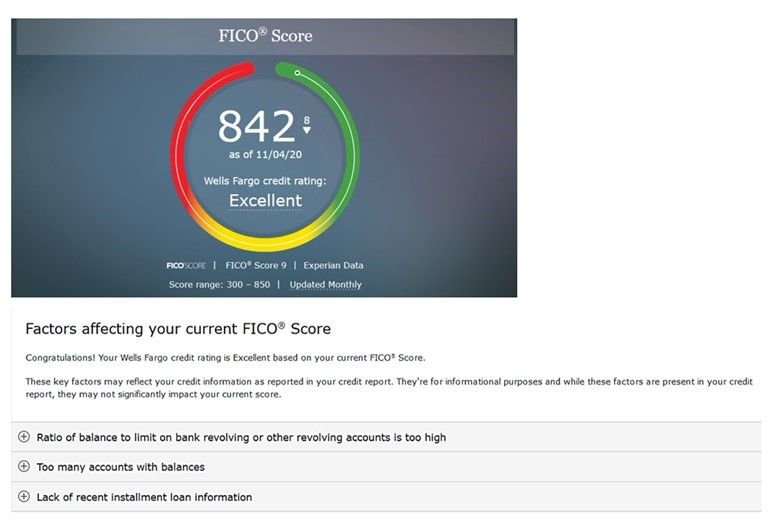

FWIW - I looked at my WF account to see what they were reporting for EX Classic Fico 9 score and what, if any, reason codes were displayed. Fortunately, unlike reports from FICO, WF does list negative reason statements for classic scores in the 800 - 849 range.

Below is what WF showed (based on Ag UT at 13%, 6 cards reporting balances and high card at 54% UT):

All as expected. My mortgage was still reporting as open. However, I had no other installment loans.

The "lack of recent installment loan information" is present because this particular metric excludes mortgages..

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content