- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Inquiries drop from 4 to 3 --> EX FICO 8 +7

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Inquiries drop from 4 to 3 --> EX FICO 8 +7

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiries drop from 4 to 3 --> EX FICO 8 +7

@Thomas_Thumb wrote:

@SouthJamaica wrote:

@keekers wrote:

For whatever it's worth I went from 0 scoreable (1 total) to 3 scoreable (4 total) last month and my scores didn't budge.I believe it takes 45 days for the impact to be felt from new inquiries.

I believe the buffer (delay in counting toward score) is 30 days. The Dedupe where multiple inquiries count as 1 HP for installment loans is 45 days for Fico 8. The Dedupe does not apply to revolving credit HPs.

Unfortunately poster data often does not consider these nuisances. Or, as in ExpatCanucks case, the headline says going 4 => 5 lowered score but, the post then mentions 1 inq was over 12 months. Data can be misleading if not vetted.

I will report back shortly then ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiries drop from 4 to 3 --> EX FICO 8 +7

@Thomas_Thumb wrote:More data is needed by others.

As mentioned in another thread, I did see the 7-pt drop on Experian when inquiries went from 2/12 to 3/12 on April 12. Scores have been pretty stable over the last few months.

On May 1 inquiries will go back down from 3/12 to 2/12. We'll see what happens. Nothing else should be changing other than minor differences in utilization. (Like 2.4% down to 2.1% sort of minor.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiries drop from 4 to 3 --> EX FICO 8 +7

@mgood wrote:

@Thomas_Thumb wrote:More data is needed by others.

As mentioned in another thread, I did see the 7-pt drop on Experian when inquiries went from 2/12 to 3/12 on April 12. Scores have been pretty stable over the last few months.

On May 1 inquiries will go back down from 3/12 to 2/12. We'll see what happens. Nothing else should be changing other than minor differences in utilization. (Like 2.4% down to 2.1% sort of minor.)

More support for 3 inquiries being a significant threshold, all by itself. Most likely when the anniversary of inquiry number 3 hits in May, and your scorable inquiries drop back down to 2, you'll get your 7 points back.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 699 TU 696 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiries drop from 4 to 3 --> EX FICO 8 +7

@SouthJamaica wrote:

@mgood wrote:

@Thomas_Thumb wrote:More data is needed by others.

As mentioned in another thread, I did see the 7-pt drop on Experian when inquiries went from 2/12 to 3/12 on April 12. Scores have been pretty stable over the last few months.

On May 1 inquiries will go back down from 3/12 to 2/12. We'll see what happens. Nothing else should be changing other than minor differences in utilization. (Like 2.4% down to 2.1% sort of minor.)

More support for 3 inquiries being a significant threshold, all by itself. Most likely when the anniversary of inquiry number 3 hits in May, and your scorable inquiries drop back down to 2, you'll get your 7 points back.

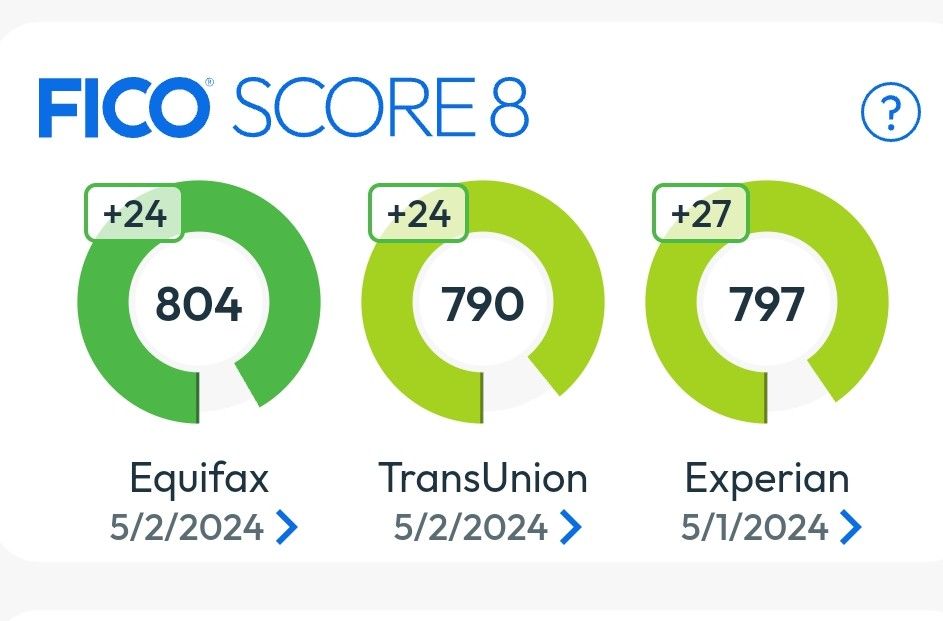

Well, my scores did go up, by considerably more than 7 points. My only installment loan went down from 12% to 9% and I saw big score increases across the board. Good for me, but I can't tell how much, if any, my change in inquiries affected the score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiries drop from 4 to 3 --> EX FICO 8 +7

@mgood wrote:

@SouthJamaica wrote:

@mgood wrote:

@Thomas_Thumb wrote:More data is needed by others.

As mentioned in another thread, I did see the 7-pt drop on Experian when inquiries went from 2/12 to 3/12 on April 12. Scores have been pretty stable over the last few months.

On May 1 inquiries will go back down from 3/12 to 2/12. We'll see what happens. Nothing else should be changing other than minor differences in utilization. (Like 2.4% down to 2.1% sort of minor.)

More support for 3 inquiries being a significant threshold, all by itself. Most likely when the anniversary of inquiry number 3 hits in May, and your scorable inquiries drop back down to 2, you'll get your 7 points back.

Well, my scores did go up, by considerably more than 7 points. My only installment loan went down from 12% to 9% and I saw big score increases across the board. Good for me, but I can't tell how much, if any, my change in inquiries affected the score.

When my only installment loan would drop to 9%, my FICO 8 scores went up ~ 30 points.

Are you 100% sure that May 1st was the anniversary date of the inquiry?

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 699 TU 696 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiries drop from 4 to 3 --> EX FICO 8 +7

@SouthJamaica wrote:When my only installment loan would drop to 9%, my FICO 8 scores went up ~ 30 points.

@SouthJamaica wrote:

Are you 100% sure that May 1st was the anniversary date of the inquiry?

Yes, I know that's the date I applied for and was approved for the card, and it is the inquiry date shown on the report, but when I got my 3B pull on the evening of the 1st, it still showed that May 2023 inquiry on Experian ![]()

Maybe I should have waited a day to do the pull, but I usually do it after the close of business on the 1st of each month because I have statements that cut on the 2nd and 3rd that could change things.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiries drop from 4 to 3 --> EX FICO 8 +7

@mgood wrote:@SouthJamaica wrote:When my only installment loan would drop to 9%, my FICO 8 scores went up ~ 30 points.

@SouthJamaica wrote:

Are you 100% sure that May 1st was the anniversary date of the inquiry?

Yes, I know that's the date I applied for and was approved for the card, and it is the inquiry date shown on the report, but when I got my 3B pull on the evening of the 1st, it still showed that May 2023 inquiry on Experian

Maybe I should have waited a day to do the pull, but I usually do it after the close of business on the 1st of each month because I have statements that cut on the 2nd and 3rd that could change things.

Well, we'll probably find out within a couple of days whether the increase for expired scorable inquiry was or was not jammed in with the increase for dropping installment utilization below 10%.

The main thing is: you've got some pretty scores there now ![]()

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 699 TU 696 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiries drop from 4 to 3 --> EX FICO 8 +7

@SouthJamaica wrote:The main thing is: you've got some pretty scores there now

![]() It's very temporary. I'm planning to buy a car this week or next. But they did peak at the right time to help me with the auto loan.

It's very temporary. I'm planning to buy a car this week or next. But they did peak at the right time to help me with the auto loan.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiries drop from 4 to 3 --> EX FICO 8 +7

@SouthJamaica wrote:

@Thomas_Thumb wrote:

@SouthJamaica wrote:Today my EX scorable inquiries dropped from 4 to 3, and my EX FICO 8 gained 7 points.

This contradicts my previous theory that 3-5 is a bin, since under that theory dropping from 4 to 3 should have been a non-event.

This supports a theory that @Thomas_Thumb postulated that 4-5 is a bin.

Based on my recent experience with EQ, it now appears to me that 3 is a threshold all by itself. I.e. dropping to 3 gains points, and dropping from 3 to 2 gains points. Most likely I'll be finding out shortly if what happened with EQ will also happen with EX.

ExpatCanuck reported going from 4 to 5 and losing 7 points. But, he then mentions 4 are less than 12 months. So, in reality he went from 3 scoreable to 4 scoreable which supports 4 being a threshold.

So data between you two supports 4-5 as a bin. As of now it is looking like

0, 1, 2, 3, 4-5, 6-9 and 10+ for bins. More data is needed by others. I suspect some profiles may not see a score penalty at all the above thresholds.

I knew you could make sense out of it. So far, my experiences are consistent with 4-5 and with 3.

UPDATE 6/6/24

Consistent with (a) 7 points being my FICO 8 score value for passing a scorable inquiry threshold and (b) 3 scorable inquiries being a threshold all by itself, my EX FICO 8 gained another 7 points when, today, my scorable inquiries dropped from 3 to 2.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 699 TU 696 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiries drop from 4 to 3 --> EX FICO 8 +7

@SouthJamaica wrote:Today my EX scorable inquiries dropped from 4 to 3, and my EX FICO 8 gained 7 points.

This contradicts my previous theory that 3-5 is a bin, since under that theory dropping from 4 to 3 should have been a non-event.

This supports a theory that @Thomas_Thumb postulated that 4-5 is a bin.

Based on my recent experience with EQ, it now appears to me that 3 is a threshold all by itself. I.e. dropping to 3 gains points, and dropping from 3 to 2 gains points. Most likely I'll be finding out shortly if what happened with EQ will also happen with EX.

Indeed it did. Dropping from 4 to 3 gained 7 points. And dropping from 3 to 2 gained another 7 points.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 699 TU 696 EX 682