- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Installment tradeline utilization thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Installment tradeline utilization thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Installment tradeline utilization thread

Last Month:

"Alliant added a $0.10 insurance charge to my Shared Secure Loan. This caused the remaining balance on a $1200 loan to be reported as $120 (10%). The reporting balance was $119 (<10%). This change had a major impact on my FICO8 scores:

Stats: Clean Files, AAoA 4.1 years, Oldest Account: 12 years

EX FICO8 from 811 to 779

EQ FICO8 from 817 to 781

TU FICO8 from 825 to 788"

This Month:

With $117 reporting (under 10%)

EX FICO8 from 811 to 779 return to 811

EQ FICO8 from 817 to 781 return to 817

TU FICO8 from 825 to 788 increase to 828

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Installment tradeline utilization thread

@SouthJamaica wrote:Update: Crossing from 15% to 9% on my share secured loan resulted in (a) a 25 point pop on my TU FICO 8, and (b) the previously mentioned 28 point pop on my EX FICO 8 and 39 point pop on my EX FICO 9

Update 4/8/16, 7:32 AM

EQ FICO 8 increased 33 points ![]()

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Installment tradeline utilization thread

Went back through my reports to calculate the effect of my share secured loan on my FICO Auto 8 scores.

At the time I had no open installment debt, 2 closed share secured loans, and no other installment history showing.

Took out share secured loan & paid down to 15% before it reported:

EQ -4 TU +-0 EX -7

Paid down to 9%:

EQ +23 TU +22 EX +28

Net gains of 19, 22, and 21 points respectively for taking out a small share secured loan and paying it down to 9%.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Installment tradeline utilization thread

@SouthJamaica wrote:Went back through my reports to calculate the effect of my share secured loan on my FICO Auto 8 scores.

At the time I had no open installment debt, 2 closed share secured loans, and no other installment history showing.

Took out share secured loan & paid down to 15% before it reported:

EQ -4 TU +-0 EX -7

Paid down to 9%:

EQ +23 TU +22 EX +28

Net gains of 19, 22, and 21 points respectively for taking out a small share secured loan and paying it down to 9%.

Nice progress with those scores SJ

This CU is also very efficient with offers on any number of other financial products with competitive rates as you already know.

It demands some serious expanding of doing other business with them as i see it.

Totally amazed at the great interest rates across all of various products too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Installment tradeline utilization thread

@CreditMagic7 wrote:

@SouthJamaica wrote:Went back through my reports to calculate the effect of my share secured loan on my FICO Auto 8 scores.

At the time I had no open installment debt, 2 closed share secured loans, and no other installment history showing.

Took out share secured loan & paid down to 15% before it reported:

EQ -4 TU +-0 EX -7

Paid down to 9%:

EQ +23 TU +22 EX +28

Net gains of 19, 22, and 21 points respectively for taking out a small share secured loan and paying it down to 9%.

Nice progress with those scores SJ

This CU is also very efficient with offers on any number of other financial products with competitive rates as you already know.

It demands some serious expanding of doing other business with them as i see it.

Totally amazed at the great interest rates across all of various products too.

Thanks CM. Yes they seem to be a good outfit. I took out a credit card with them.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Installment tradeline utilization thread

@SouthJamaica wrote:Went back through my reports to calculate the effect of my share secured loan on my FICO Auto 8 scores.

At the time I had no open installment debt, 2 closed share secured loans, and no other installment history showing.

Took out share secured loan & paid down to 15% before it reported:

EQ -4 TU +-0 EX -7

Paid down to 9%:

EQ +23 TU +22 EX +28

Net gains of 19, 22, and 21 points respectively for taking out a small share secured loan and paying it down to 9%.

Huh, if you got the FICO 8 AU scores can you dig out the earlier auto enhanced versions as well?

There's been a massive amount of anecodtal evidence suggesting there's a "first time buyer" penalty on auto loans, but I haven't seen any concrete data, and it'd be interesting to see if the secured loan and an auto loan count similarly. You bought a car recently, do you have a snapshot of the AU scores post car buying? I'd be VERY interested to see the explicit movement and see if you gained or lost the same amount there.

No difference between mortgage and auto and secured loan on classic scores, I'd love to see if we could tease out impact on the auto enhanced scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Installment tradeline utilization thread

@Revelate wrote:

@SouthJamaica wrote:Went back through my reports to calculate the effect of my share secured loan on my FICO Auto 8 scores.

At the time I had no open installment debt, 2 closed share secured loans, and no other installment history showing.

Took out share secured loan & paid down to 15% before it reported:

EQ -4 TU +-0 EX -7

Paid down to 9%:

EQ +23 TU +22 EX +28

Net gains of 19, 22, and 21 points respectively for taking out a small share secured loan and paying it down to 9%.

Huh, if you got the FICO 8 AU scores can you dig out the earlier auto enhanced versions as well?

Boy you're a tough taskmaster.

*Share secured loan reporting at 15%:

EQ Auto5 -13 TU Auto4 +-0 EX Auto2 -9

*Share secured loan dropping to 9%:

EQ Auto5 -2 TU Auto4 +-0 EX Auto2 +10

There's been a massive amount of anecodtal evidence suggesting there's a "first time buyer" penalty on auto loans, but I haven't seen any concrete data, and it'd be interesting to see if the secured loan and an auto loan count similarly. You bought a car recently, do you have a snapshot of the AU scores post car buying? I'd be VERY interested to see the explicit movement and see if you gained or lost the same amount there.

As to the auto loan impact, I've already given you the FICO Auto8 numbers from my car loan hitting at 87.7% in this table:

FICO8 EQ 691 -30 TU 768 -41 EX 703 -20

FICO9 EQ 742 -49 TU 796 -33 EX 728 -47

FICO Auto 8 EQ 698 -19 TU 794 -30 EX 700 -16

FICO Bankcard 8 EQ 701 -20 TU 800 -40 EX 717 -25

Mortgage FICO5 EQ 697 +2 FICO4 TU 746 -2 FICO2 EX 690 -13

The older auto models were impacted as follows:

EQ Auto5 -3 TU Auto4 -11 EX Auto2 -10

PS I'm not doing this again, it's too much work. ![]()

No difference between mortgage and auto and secured loan on classic scores, I'd love to see if we could tease out impact on the auto enhanced scores.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Installment tradeline utilization thread

I don't have any auto loans on my reports. My data points for secured installment loans suggest that Classic, Auto and Bankcard scores are all affected equally by non auto installment loans. There doesn't seem to be any extra benefit to the Auto Enhanced scores.

When my first installment loan was paid below 10% there was only a negligible difference (2 points) between the score increase for Auto and Bankcard Enhanced scores.

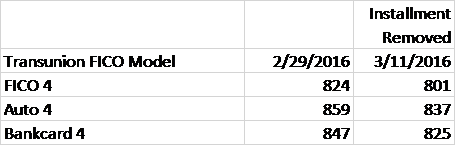

I conducted an experiment to determine the effect of aged installment loans on Fico 04. I had a closed installment loan removed from my Transunion report. TU Classic dropped 23 points. TU Auto and BC enhanced scores dropped 22 points each. No special treatment for Auto Enhanced scores was observed. When my current installment loan reaches 1 year of age in August, I will be checking to see if I recover the lost points from the removed loan.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Installment tradeline utilization thread

Note: The real world limit on TU Auto Fico 04 is 20 points higher than the real world limit on TU Bankcard Fico 04. See below

| Real World | Fico Model | ||

| TransUnion Score Description | Fico Model Version | Score Range | Score Range |

| TU Fico score 8 Classic | Fico 08 | 341 - 850 | 300 - 850 |

| TU Fico score 4 Classic | Fico 04 | 309 - 839 | 300 - 850 |

| TU Fico score 8 Auto | Fico 08 AU | 250 - 900 | 250 - 900 |

| TU Fico score 4 Auto | Fico 04 AU | 253 - 893 | 250 - 900 |

| TU Fico score 8 Bankcard | Fico 08 BC | 265 - 900 | 250 - 900 |

| TU Fico score 4 Bankcard | Fico 04 BC | 250 - 873 | 250 - 900 |

I had results like your's but realized the score flip-flop was likely due to the lower ceiling on TU Fico 04 bankcard relative to Auto. I have one open mortgage. No other loans open or closed on file anymore. Only Auto loan was 1986 - 1989.

| Base Model | Enhancement | 3/25/2016 | 12/2/2015 |

| TU Fico 08 | Auto | 891 | 897 |

| TU Fico 08 | Bankcard | 899 | 900 |

| TU Fico 04 | Auto | 872 | 864 |

| TU Fico 04 | Bankcard | 858 | 850 |

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Installment tradeline utilization thread

@Thomas_Thumb wrote:Note: The real world limit on TU Auto Fico 04 is 20 points higher than the real world limit on TU Bankcard Fico 04. See below

Real World Fico Model TransUnion Score Description Fico Model Version Score Range Score Range TU Fico score 8 Classic Fico 08 341 - 850 300 - 850 TU Fico score 4 Classic Fico 04 309 - 839 300 - 850 TU Fico score 8 Auto Fico 08 AU 250 - 900 250 - 900 TU Fico score 4 Auto Fico 04 AU 253 - 893 250 - 900 TU Fico score 8 Bankcard Fico 08 BC 265 - 900 250 - 900 TU Fico score 4 Bankcard Fico 04 BC 250 - 873 250 - 900

I had results like your's but realized the score flip-flop was likely due to the lower ceiling on TU Fico 04 bankcard relative to Auto. I have one open mortgage. No other loans open or closed on file anymore. Only Auto loan was 1986 - 1989.

Base Model Enhancement 3/25/2016 12/2/2015 TU Fico 08 Auto 891 897 TU Fico 08 Bankcard 899 900 TU Fico 04 Auto 872 864 TU Fico 04 Bankcard 858 850

Thank you for the information Thomas_Thumb. Yes, the flip-flop is probably due to the lower ceiling on TU Fico 04 bankcard.