- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Interesting FICO Score change

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Interesting FICO Score change

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Interesting FICO Score change

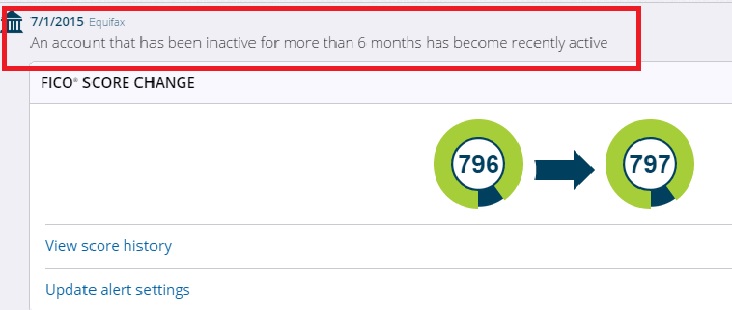

My oldest CC was opened in 2000 - my Capital One Platinum VISA. After I paid it off back in November, it sat dormant and my new cards took over. I don't want to close it so I decided I better use it before I lose it. Today gave me a little chuckle, but also found it interesting that this can actually positively affect my score:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interesting FICO Score change

Did it continue to report an "ok" status through those 6 months of inactivity?

758 TU FICO 08 (01/12/2016)

753 TU FICO 08 (11/21/2015)

740: EQ Score Power (Beacon 5.0) FICO 04 (01/23/2015)

755 TU FICO 08 (01/21/2015)

652 TU Lender Pull (06/10/2014)

665 TU FICO 08 (05/21/2014)

Goal: 800+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interesting FICO Score change

@tufa4311 wrote:Did it continue to report an "ok" status through those 6 months of inactivity?

Yes it did - Only EX has it for May, the other two don't have it listed for May yet though. Maybe those scores will go up a point or two. It just was surprising to see it go up at all.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interesting FICO Score change

@Vulcan1600 wrote:

@tufa4311 wrote:Did it continue to report an "ok" status through those 6 months of inactivity?

Yes it did - Only EX has it for May, the other two don't have it listed for May yet though. Maybe those scores will go up a point or two. It just was surprising to see it go up at all.

Well if that's the case then...it has been stated many times here that is doesn't matter which cards you use for your UTIL and that you don't need to rotate. I like to rotate to give the luv back if you will, and to show usage. This seems to be saying that indeed it does matter that all your cards get usage, even if they keep reporting without usage. No usage for a certain period of time equals an inactive card that, when made active again, increases your score? Thoughts?

I assume the first comment will be that we don't know that the reason for the one point score increase was the card returning to an active state (even if FICO says that's the reason).

758 TU FICO 08 (01/12/2016)

753 TU FICO 08 (11/21/2015)

740: EQ Score Power (Beacon 5.0) FICO 04 (01/23/2015)

755 TU FICO 08 (01/21/2015)

652 TU Lender Pull (06/10/2014)

665 TU FICO 08 (05/21/2014)

Goal: 800+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interesting FICO Score change

@tufa4311 wrote:

@Vulcan1600 wrote:

@tufa4311 wrote:Did it continue to report an "ok" status through those 6 months of inactivity?

Yes it did - Only EX has it for May, the other two don't have it listed for May yet though. Maybe those scores will go up a point or two. It just was surprising to see it go up at all.

Well if that's the case then...it has been stated many times here that is doesn't matter which cards you use for your UTIL and that you don't need to rotate. I like to rotate to give the luv back if you will, and to show usage. This seems to be saying that indeed it does matter that all your cards get usage, even if they keep reporting without usage. No usage for a certain period of time equals an inactive card that, when made active again, increases your score? Thoughts?

I assume the first comment will be that we don't know that the reason for the one point score increase was the card returning to an active state (even if FICO says that's the reason).

That's why I posted in my first message - it points to the 1 point increase due to using a previously inactive card. I guess it shows I'll never understand FICO scoring!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interesting FICO Score change

How much was the new balance reporting on this CapOne card?

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interesting FICO Score change

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interesting FICO Score change

That message is an information message configurable in the interface for Equifax. Can set it for 3 months as an example, more of a fraud prevention / unexpected use notification.

No bearing on FICO scoring.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interesting FICO Score change

@Vulcan1600 wrote:

@tufa4311 wrote:

@Vulcan1600 wrote:

@tufa4311 wrote:Did it continue to report an "ok" status through those 6 months of inactivity?

Yes it did - Only EX has it for May, the other two don't have it listed for May yet though. Maybe those scores will go up a point or two. It just was surprising to see it go up at all.

Well if that's the case then...it has been stated many times here that is doesn't matter which cards you use for your UTIL and that you don't need to rotate. I like to rotate to give the luv back if you will, and to show usage. This seems to be saying that indeed it does matter that all your cards get usage, even if they keep reporting without usage. No usage for a certain period of time equals an inactive card that, when made active again, increases your score? Thoughts?

I assume the first comment will be that we don't know that the reason for the one point score increase was the card returning to an active state (even if FICO says that's the reason).

That's why I posted in my first message - it points to the 1 point increase due to using a previously inactive card. I guess it shows I'll never understand FICO scoring!

I don't think anybody understands Fico scoring. Including Fico. It's been taken over by the machines and is now beyond the grasp of humans.