- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Largest CL that still counts towards UTL

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Largest CL that still counts towards UTL

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest CL that still counts towards UTL

I'm new to this concept of certain large CL being excluded from scoring so please forgive the naivety of my question:

If a CL is excluded as too large, does that card's usage (balance) also get excluded?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest CL that still counts towards UTL

This can really screw somebody up if they’re going for a mortgage.

I think it’s also excluded from the number of accounts/revolvers with the balance metric, but hopefully someone can confirm this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest CL that still counts towards UTL

@FinStar wrote:If you are approved by PenFed it will count. Their max exposure across all CCs is $50K.

Something to keep in mind about PenFed's recent policies was a cap of $25K being placed on recent CLIs or reallocations. You'll have to check with them to see whether that's still viable. Nonetheless, even if $50K was possible, it would still factor into the FICO utilization formulas.

I have not tested any recent DPs as far as which FICO version excludes specific revolving tradelines, but at one point, anything north of $70K (single revolver) was excluded in the older versions. A few that I have above $100K were excluded the last time I checked.

Wait, $70k is the cut-off now? The only cards I ever have a balance report on is a NPSL (so $0) and a card with a $90k limit. Am I shooting myself in the foot with AZEO and not even realizing it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest CL that still counts towards UTL

@iced , you could be, to the tune of 20 something points.

Pretty easy to test, allow a different card to report a balance and see if there are any scoring changes

The experiment wont work if you're firmly planted at 850s, and have large enough of a buffer to absorb the points loss.

That's for FICO 8 classic, I'm not sure about older scoring models.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest CL that still counts towards UTL

@Remedios wrote:@iced , you could be, to the tune of 20 something points.

Pretty easy to test, allow a different card to report a balance and see if there are any scoring changes

The experiment wont work if you're firmly planted at 850s, and have large enough of a buffer to absorb the points loss.

That's for FICO 8 classic, I'm not sure about older scoring models.

I'm in the 840s, so in theory this would launch me head-first into a wall.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest CL that still counts towards UTL

If it's true, you'd be eight fiddy overnight

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest CL that still counts towards UTL

@K-in-Boston wrote:

@Cred4All wrote:

@K-in-Boston wrote:I can confirm that my $50k Delta Reserve is still completely factored in. There's a lot going on with my balances and profile, but I'm trying to figure out if $99.9k and $90k BOA cards are factoring in or not, but it'll be a few months before I can confirm for sure.

I just did the math on my reported balances, with my $75k BOA limit as well to be sure. I'm confident my BOA is still factored in, otherwise my numbers would be drastically different as to what's reported currently to the 3 bureaus.

The balances and limits definitely are reported and display on the front-end of whatever you're looking at, but I'm not 100% convinced they still factor into the actual scoring. I've never been able to time it perfectly when a new large balance posts after being at $0 while other things weren't also changing pretty drastically. In a perfect world, I could just use a $90k card as my "one" in an All Zero Except One scenario and see if I lose points, but unfortunately I am not in a position to do so.

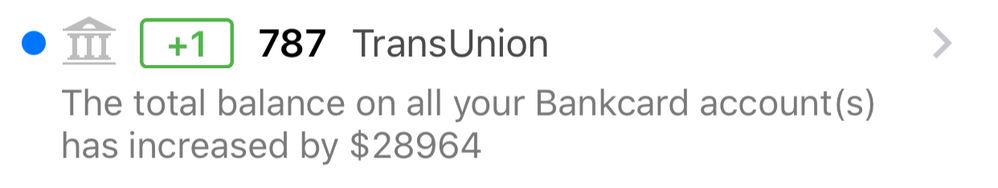

Edit: It didn't take place in a vacuum as a few other balances changed but due to BT shuffling, this might be a pertinent DP since I didn't lose anything:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest CL that still counts towards UTL

@Anonymous wrote:I'm new to this concept of certain large CL being excluded from scoring so please forgive the naivety of my question:

If a CL is excluded as too large, does that card's usage (balance) also get excluded?

Yes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest CL that still counts towards UTL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest CL that still counts towards UTL

@Anonymous wrote:

@icedAre you gonna test and let us know? Just report a nominal balance on anything. Got me curious.

It's going to take a couple of cycles to get the data. If I remember to post again, I can.