- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Need help with tricky combination

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Need help with tricky combination

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with tricky combination

@SouthJamaica wrote:

@ntickrs wrote:We're about to do a loan on a property that is a private mortgage, not a typical home loan. It's more of a business type loan, and for a variety of reasons, this is the only option. They are checking my personal credit and that's the issue -- I need a middle score of at least 720, and really would like 740 ... and I need to do it right now. I can have have them re-pull my credit for an update about 10-15 days from now.

Currently, my Score 8: Equifax 714, TransUnion 732, and Experian 740

but my Score 5, 4 & 2 are: Equifax 705, TransUnion 743, and Experian 700

The issue is entirely that I have some personal cards that the business pays for, but that carry high balances, and have for a while now. (Yes, I get why this is a problem, but first things first). Everything else on my credit is awesome -- long history, nothing new, nothing bad. Because of COVID SBA loans, there's inqueries -- but there's nothing I can do about that.

Because this is complex, some real data.

Card | Balance | Limit | Utilization

Amex | $ 1,049 | $ 35,000 | 3%

Citi | $ 305 | $ 2,560 | 12%

Amex | $ 3,021 | $ 4,000 | 76%

Citi Costco | $ 47,955 | $ 48,300 | 99%

Citi Silver | $ 62,207 | $ 63,000 | 99%

Discover | $ 19,995 | $ 20,500 | 98%

Chase | $ 7,719 | $ 8,000 | 96%

Chase | $ 19,622 | $ 20,100 | 98%

Wells Fargo | $ 0 | $ 1,000 | 0%

Wells Fargo | $ 0 | $ 7,000 | 0%I've got just under $35k to play with that I can pay some of these down. I'll get both Amex to near zero, as well as the small Citi. Should these be higher than $0? Am I understanding right that these should they be $50-99 balances?

Then, I'm thinking that I should pay the $7719 down to $0 -- but maybe it should be down to $50? And, then to spread the rest on the two larger Citi cards so that that they come to 75-79% utilization.

When I do that in the myFico simulator, which is obviously Score 8, shows a change of Equifax +35, TransUnion +25, and Experian +10 ... how will this translate to Fico 5, 4 & 2?

Any other ideas of how to get my middle score almost immediately to at least 720, and hopefully 740?

Thanks!

1. Your idea of leaving small balances rather than zero balances is the exact opposite of what you should be doing. The mortgage scores love zero balances. So if you're paying down, pay to zero. Pay extra, so the interest won't show up as the reported balance.

2. I have discovered that the mortgage scores are even more sensitive to the NUMBER of revolving accounts with balances of 50% or more.

So bottom line:

get all high utilization balances down to 48% or less

pay anything you can down to zero, and be sure to pay extra so trailing interest doesn't spoil the zero balance

Holy Toldeo! This changes things for a lot of us (at least, I believe so). Do you have any data points for that? I am guessing that it is from personal experience (or information that you have vicariously through others)? I will admit to total ignorance to this point. And I am SO VERY SORRY that I posted something (getting the balance down to 85% for as many cards as remained) that would not have helped. Not my plan or intention to post incorrect information. Thank you, @SouthJamaica , for that information.

FICO 9 Scores as of 2022 JULY 04:

FICO Auto 8 Scores as of 2022 JULY 04:

FICO Auto 9 Scores as of 2022 JULY 04:

FICO Bankcard 8 Scores as of 2022 JULY 04:

FICO Mortgage 2/4/5 Scores as of 2022 JULY 04:

Starting Score: Exp 627

Starting Score: Exp 627Current Score: Exp 713

Goal Score: Exp 750+

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with tricky combination

@HowDoesThisAllWork wrote:

@SouthJamaica wrote:

@ntickrs wrote:We're about to do a loan on a property that is a private mortgage, not a typical home loan. It's more of a business type loan, and for a variety of reasons, this is the only option. They are checking my personal credit and that's the issue -- I need a middle score of at least 720, and really would like 740 ... and I need to do it right now. I can have have them re-pull my credit for an update about 10-15 days from now.

Currently, my Score 8: Equifax 714, TransUnion 732, and Experian 740

but my Score 5, 4 & 2 are: Equifax 705, TransUnion 743, and Experian 700

The issue is entirely that I have some personal cards that the business pays for, but that carry high balances, and have for a while now. (Yes, I get why this is a problem, but first things first). Everything else on my credit is awesome -- long history, nothing new, nothing bad. Because of COVID SBA loans, there's inqueries -- but there's nothing I can do about that.

Because this is complex, some real data.

Card | Balance | Limit | Utilization

Amex | $ 1,049 | $ 35,000 | 3%

Citi | $ 305 | $ 2,560 | 12%

Amex | $ 3,021 | $ 4,000 | 76%

Citi Costco | $ 47,955 | $ 48,300 | 99%

Citi Silver | $ 62,207 | $ 63,000 | 99%

Discover | $ 19,995 | $ 20,500 | 98%

Chase | $ 7,719 | $ 8,000 | 96%

Chase | $ 19,622 | $ 20,100 | 98%

Wells Fargo | $ 0 | $ 1,000 | 0%

Wells Fargo | $ 0 | $ 7,000 | 0%I've got just under $35k to play with that I can pay some of these down. I'll get both Amex to near zero, as well as the small Citi. Should these be higher than $0? Am I understanding right that these should they be $50-99 balances?

Then, I'm thinking that I should pay the $7719 down to $0 -- but maybe it should be down to $50? And, then to spread the rest on the two larger Citi cards so that that they come to 75-79% utilization.

When I do that in the myFico simulator, which is obviously Score 8, shows a change of Equifax +35, TransUnion +25, and Experian +10 ... how will this translate to Fico 5, 4 & 2?

Any other ideas of how to get my middle score almost immediately to at least 720, and hopefully 740?

Thanks!

1. Your idea of leaving small balances rather than zero balances is the exact opposite of what you should be doing. The mortgage scores love zero balances. So if you're paying down, pay to zero. Pay extra, so the interest won't show up as the reported balance.

2. I have discovered that the mortgage scores are even more sensitive to the NUMBER of revolving accounts with balances of 50% or more.

So bottom line:

get all high utilization balances down to 48% or less

pay anything you can down to zero, and be sure to pay extra so trailing interest doesn't spoil the zero balance

Holy Toldeo! This changes things for a lot of us (at least, I believe so). Do you have any data points for that? I am guessing that it is from personal experience (or information that you have vicariously through others)? I will admit to total ignorance to this point. And I am SO VERY SORRY that I posted something (getting the balance down to 85% for as many cards as remained) that would not have helped. Not my plan or intention to post incorrect information. Thank you, @SouthJamaica , for that information.

1. Yes it is totally from my experience. And it goes against the conventional wisdom that has been often repeated here, that high individual account utilization is significant only as to the highest utilized account, and that those with less utilization do not receive additional penalties. Here's my post on the subject: https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/High-Utilization-Accts-FICO-2-vs-FICO-8/... At that point I was formally testing. But since then, the number of high utilization accounts has been going up and down, and the scores have behaved as they did during the test.

2. Of course getting maxed out cards down to 85% would help, but I don't know how much. I just know that reducing the number of accounts with > 50% utilization helps both FICO 2 and FICO 8, and I have it more or less quantified for my profile.

So if I were in OP's position and wanted to shoot for a quick boost in the mortgage scores I would (a) try to get all accounts to 48% or less and (b) knock any low hanging fruit (accounts with small balances) down to zero reporting.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with tricky combination

@SouthJamaica wrote:

@HowDoesThisAllWork wrote:

@SouthJamaica wrote:

@ntickrs wrote:We're about to do a loan on a property that is a private mortgage, not a typical home loan. It's more of a business type loan, and for a variety of reasons, this is the only option. They are checking my personal credit and that's the issue -- I need a middle score of at least 720, and really would like 740 ... and I need to do it right now. I can have have them re-pull my credit for an update about 10-15 days from now.

Currently, my Score 8: Equifax 714, TransUnion 732, and Experian 740

but my Score 5, 4 & 2 are: Equifax 705, TransUnion 743, and Experian 700

The issue is entirely that I have some personal cards that the business pays for, but that carry high balances, and have for a while now. (Yes, I get why this is a problem, but first things first). Everything else on my credit is awesome -- long history, nothing new, nothing bad. Because of COVID SBA loans, there's inqueries -- but there's nothing I can do about that.

Because this is complex, some real data.

Card | Balance | Limit | Utilization

Amex | $ 1,049 | $ 35,000 | 3%

Citi | $ 305 | $ 2,560 | 12%

Amex | $ 3,021 | $ 4,000 | 76%

Citi Costco | $ 47,955 | $ 48,300 | 99%

Citi Silver | $ 62,207 | $ 63,000 | 99%

Discover | $ 19,995 | $ 20,500 | 98%

Chase | $ 7,719 | $ 8,000 | 96%

Chase | $ 19,622 | $ 20,100 | 98%

Wells Fargo | $ 0 | $ 1,000 | 0%

Wells Fargo | $ 0 | $ 7,000 | 0%I've got just under $35k to play with that I can pay some of these down. I'll get both Amex to near zero, as well as the small Citi. Should these be higher than $0? Am I understanding right that these should they be $50-99 balances?

Then, I'm thinking that I should pay the $7719 down to $0 -- but maybe it should be down to $50? And, then to spread the rest on the two larger Citi cards so that that they come to 75-79% utilization.

When I do that in the myFico simulator, which is obviously Score 8, shows a change of Equifax +35, TransUnion +25, and Experian +10 ... how will this translate to Fico 5, 4 & 2?

Any other ideas of how to get my middle score almost immediately to at least 720, and hopefully 740?

Thanks!

1. Your idea of leaving small balances rather than zero balances is the exact opposite of what you should be doing. The mortgage scores love zero balances. So if you're paying down, pay to zero. Pay extra, so the interest won't show up as the reported balance.

2. I have discovered that the mortgage scores are even more sensitive to the NUMBER of revolving accounts with balances of 50% or more.

So bottom line:

get all high utilization balances down to 48% or less

pay anything you can down to zero, and be sure to pay extra so trailing interest doesn't spoil the zero balance

Holy Toldeo! This changes things for a lot of us (at least, I believe so). Do you have any data points for that? I am guessing that it is from personal experience (or information that you have vicariously through others)? I will admit to total ignorance to this point. And I am SO VERY SORRY that I posted something (getting the balance down to 85% for as many cards as remained) that would not have helped. Not my plan or intention to post incorrect information. Thank you, @SouthJamaica , for that information.

1. Yes it is totally from my experience. And it goes against the conventional wisdom that has been often repeated here, that high individual account utilization is significant only as to the highest utilized account, and that those with less utilization do not receive additional penalties. Here's my post on the subject: https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/High-Utilization-Accts-FICO-2-vs-FICO-8/... At that point I was formally testing. But since then, the number of high utilization accounts has been going up and down, and the scores have behaved as they did during the test.

2. Of course getting maxed out cards down to 85% would help, but I don't know how much. I just know that reducing the number of accounts with > 50% utilization helps both FICO 2 and FICO 8, and I have it more or less quantified for my profile.

So if I were in OP's position and wanted to shoot for a quick boost in the mortgage scores I would (a) try to get all accounts to 48% or less and (b) knock any low hanging fruit (accounts with small balances) down to zero reporting.

VERY INTERESTING.....I read all 16 contributions to that post. I wonder how "profile-specific" your results might be?

FICO 9 Scores as of 2022 JULY 04:

FICO Auto 8 Scores as of 2022 JULY 04:

FICO Auto 9 Scores as of 2022 JULY 04:

FICO Bankcard 8 Scores as of 2022 JULY 04:

FICO Mortgage 2/4/5 Scores as of 2022 JULY 04:

Starting Score: Exp 627

Starting Score: Exp 627Current Score: Exp 713

Goal Score: Exp 750+

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with tricky combination

First, thank you to @SouthJamaica , @HowDoesThisAllWork , @HeavenOhio , @SoonerSoldier33 and @FireMedic1 -- you are all so incredibly helpful you all are, and I truly appreciate it. Shoutout: If you haven't looked, you should take the time to read through Credit Scoring Primer

In part to make sure that I have it straight, and in part to make it easier for others to learn from, here's what I'm hearing ... not just as a recap, but what the focus should be, in order of priority:

About percentages

- All % mentioned below are numbers you need to be BELOW, not at.

- Scores only use whole number percentages, and round to nearest point. So 69.5% rounds to 70%, but 69.4% rounds to 69%.

- Watch out for extra interest or fees that creep in even as you think you’re at a zero balance. If you’ve been carrying a balance, you need to ask what those charges are, and pay for them ahead of statement close (e.g., pay extra so that the interest will not show up in the new balance).

- Be safe, have room for error. e.g., if the threshold is 70%, go to 68.5% or at least 68.9% to avoid errors.

- Penalties are based on percentages, not dollar amounts. A $1000 limit card with 80% utilization is worse than a $20,000 limit card with the same % utilization, even though the actual dollar amounts are vastly different. As @aj2121 said, “If any card reports at 90%, even if that amount is less than 1% of your overall utilization, it is going to cost you quite a few points.”

Priorities:

Note: This is when focused on mortgage Scores 5, 4 & 2 — not necessarily on other types of scores.

- Overall (aggregate) utilization is “king” and is higher priority than individual. The aggregate utilization thresholds are believed to occur at 5%, 10%, 30%, 50%, 70%, 90% and 100%.

- For mortgage Scores 5, 4 & 2, as many $0 balance (true 0% utilization) cards as possible is important the mortgage scores are incredibly sensitive to the Accounts With Balances (AWB) metric.

- AZEO (all zero except one) is the goal for your accounts (e.g., all credit cards at zero balance each month except one).

- Even more sensitivity for the number of accounts with balances greater than 50% utilization

- The major recognized INDIVIDUAL revolving utilization thresholds are believed to occur at 30%, 50%, 70%, 90%, and 100% (Some scorecards may also have lower thresholds.)

- I’ve heard Individual utilization is taken as the highest of any of the cards, and not as an average. Is this true?

Additional Notes:

- Most credit cards will report to all 3 credit bureaus within a few days of statement due date, the amount reflected at statement close (the amount that goes on the next statement).

- You can ask the credit card companies to force an update to report earlier to the credit bureaus between the normal update dates, but they may or may not. Discover, for example, is good about reporting “off-cycle” on request. No problem in asking, even ask for a supervisor to push — the worst they will say is “no”

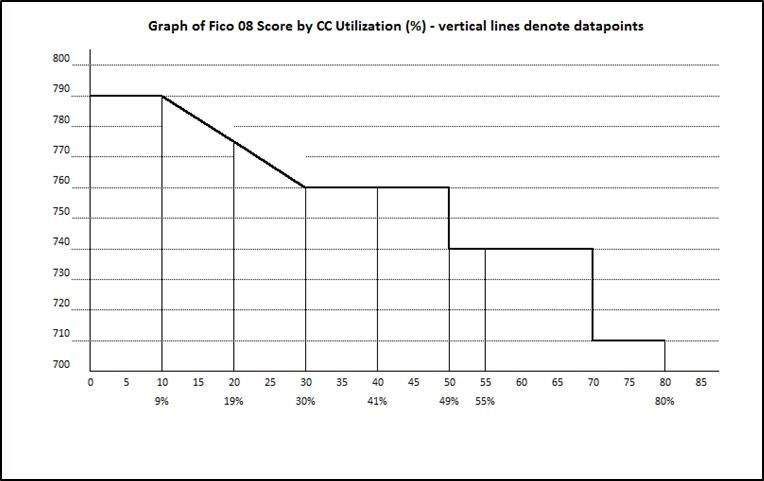

- Really good illustration that I saw in a thread here (but I'm sorry, I cannot find it again) that showed this graph (note: FICO 8 Score):

- Does anyone know if graph would be similar when it applies to Mortgage Scores?

The Specific Action Plan (in my case):

Presuming that we can push Amex, Discover, Citi, and Chase to report early (anyone know if any of those are an issue?), then I think the plan is this. (Note: Total estimated interest rounded up is $2110 — so that’s added to all plans to stay level, and not mentioned below, but would be done as well. Note2: Presume any additional spending will be paid for as well.)

As of this writing, this is what my Scores look like:

Score 8: EQ/714 -- TU/723 -- EX/740

Scores 5/4/2: EQ/705 -- TU/753 -- EX/700

Note: I only care about the Scores 5/4/2 right now -- and even at that, I only care about the middle Score 5/4/2. That likely means a focus on Equifax. There's big savings on the loan we're approved on at 720 and 740 for the middle score. Makes a massive difference ... $7-14k or more in points to achieve the same monthly payment depending on the LTV and rate I choose.

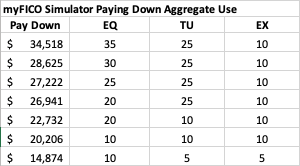

The myFICO simulator (yeah, I know, figuring some data is better than no data) shows these increases if each amt in the first column is paid (in addition to the interest). Of course, the simulator is only looking at aggregate utilization %, and not each card, or how many are at 0. These are the lowest pay down amounts for each of those.

If EQ would really jump by 35 points (not just on Score 8 as shown in the simulator, but on Score 2/4/5 where I need it), that would take me to 740 and would be AWESOME. Do we think the changes seen in Score 8 would be seen in Score 2/4/5 as well?

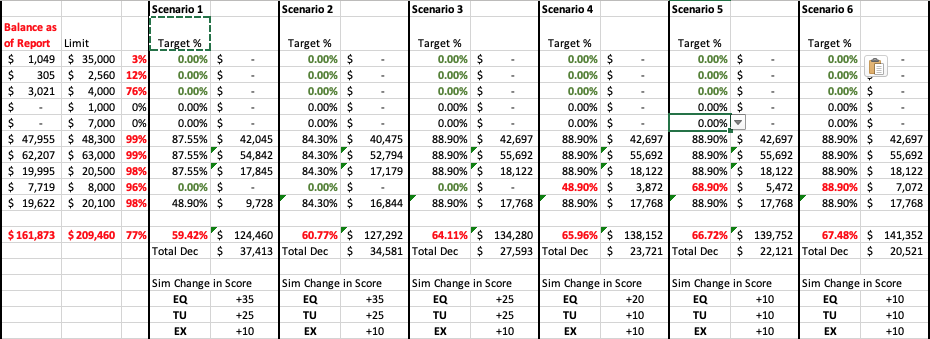

Maybe to be more specific, with these calculations, I think these are the options that I have.

NOTE: See updated post below -- Plot twist!

Scenario 1: Get aggregate cc utilization below 60%. This is expensive -- do we think that it really would make a difference compared to Scenario 2 (just over 60%)? or 64% as in Scenario 3?

Scenario 4: About $4k less to do, seems that compared to Scenario 3, Scenario 4 is definitely not a good idea.

Scenario 5: Not a lot of savings, not worth it.

Scenario 6: The minimum approach to do.

So, the decision comes down to ...

- Is there a real difference between Scenarios 1/2/3?

- With whatever answer(s) to #1 to compare to, compared to Scenario 6

I know there's a lot here, and I so appreciate everyone's help. I hope this detail and layout will really make a difference, not just for me, but others.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with tricky combination

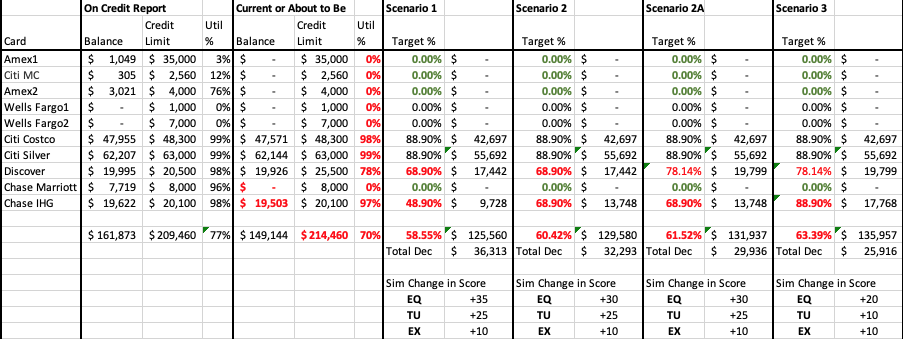

Plot twist!

This morning I woke to find an email from Discover that, without asking, they had bumped my credit limit from $20,500 to $25,500. Everything else equal, I think this can only help on mortgage FICO Scores 5/4/2 because it would decrease utilization % ... right?

This changes my earlier scenarios. And, since I had to decide last night (payment date was yesterday), I decided to clear one card completely.

This is a screenshot of my scenarios from Excel:

The question now is:

Scenario 1 vs. 2: Two cards brought down to lowest possible thresholds (68.9% and 48.9%), and the aggregate goes below 60%.

- Does it matter if two cards are lower threshholds, if there are two other cards at higher threshholds?

- I don't believe there's an aggregate thresshold at 60%, right?

Scenario 2 vs. 2A: Same but 2A leaves a card at 78%

- Similar to last comparison -- effectively, for individual utilization %, is only the highest % considered? Or (aside from aggregate utilization, and presuming no card is more than 88.9%), does the individual utilization matter?

Scenario 3 vs. 2/2A: Same as 2A except both Discover and Chase IHG left as is, or at 88.9% to avoid maxed out flag

- Same question as last comparison, I believe.

I need to execute the next steps today because of there's some payment dates today and this weekend that I want to get payments in so they report as I want next week!

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with tricky combination

@ntickrs wrote:Plot twist!

This morning I woke to find an email from Discover that, without asking, they had bumped my credit limit from $20,500 to $25,500. Everything else equal, I think this can only help on mortgage FICO Scores 5/4/2 because it would decrease utilization % ... right?

This changes my earlier scenarios. And, since I had to decide last night (payment date was yesterday), I decided to clear one card completely.

Sorry to do this as a link, but I'm unable to put in a picture, or table. This is a screenshot of my scenarios from Excel:

https://paste.pics/6982dd3e24c8bbfe878b9fb5a9f72110

The question now is:

Scenario 1 vs. 2: Two cards brought down to lowest possible thresholds (68.9% and 48.9%), and the aggregate goes below 60%.

- Does it matter if two cards are lower threshholds, if there are two other cards at higher threshholds?

- I don't believe there's an aggregate thresshold at 60%, right?

Scenario 2 vs. 2A: Same but 2A leaves a card at 78%

- Similar to last comparison -- effectively, for individual utilization %, is only the highest % considered? Or (aside from aggregate utilization, and presuming no card is more than 88.9%), does the individual utilization matter?

Scenario 3 vs. 2/2A: Same as 2A except both Discover and Chase IHG left as is, or at 88.9% to avoid maxed out flag

- Same question as last comparison, I believe.

I need to execute the next steps today because of closing dates -- so any advice would help ... sorry again about having to link the screenshot. (Same as one above: https://paste.pics/6982dd3e24c8bbfe878b9fb5a9f72110 )

Thanks!

1. I don't know the answers to your questions.

2. I don't think 10-15 days is enough time to let the changes filter through the system.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with tricky combination

@SouthJamaica Thanks!

I believe that timing is typically about a few things.

1) when something is reported on the normal cycle (e.g., a few days after billing cycle closes)

2) whether or not you can force an update of reporting by a manual request for an off-cycle report

3) when the credit report is pulled again by the lender

I think that between coordinating all the above, along with making the right payments at the right time, I may be able to pull this off. Is there another part of "filter through the system" that I'm missing?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with tricky combination

@ntickrs wrote:I’ve heard Individual utilization is taken as the highest of any of the cards, and not as an average. Is this true?

Individual utilization is per card. The card with the highest utilization is going to have an effect on your score, especially if it is greater than 30%, smaller thresholds may exist but haven't been identified. As @SouthJamaica's theory and testing shows the individual utilization of cards other than the highest one can impact the score. There are some people that do not think this is true; but I believe it to be true based on SJ's data and on my own data (I don't know if I have posted all of it on the forums yet, but it supports SJ's theory and results). Not sure if that answers your question??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with tricky combination

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need help with tricky combination

@ntickrs wrote:Plot twist!

This morning I woke to find an email from Discover that, without asking, they had bumped my credit limit from $20,500 to $25,500. Everything else equal, I think this can only help on mortgage FICO Scores 5/4/2 because it would decrease utilization % ... right?

Correct, more utilization padding will only help. It may not give you a direct score improvment, but it might.

The question now is:

Scenario 1 vs. 2: Two cards brought down to lowest possible thresholds (68.9% and 48.9%), and the aggregate goes below 60%.

- Does it matter if two cards are lower threshholds, if there are two other cards at higher threshholds?

- I don't believe there's an aggregate thresshold at 60%, right?

Scenario 2 vs. 2A: Same but 2A leaves a card at 78%

- Similar to last comparison -- effectively, for individual utilization %, is only the highest % considered? Or (aside from aggregate utilization, and presuming no card is more than 88.9%), does the individual utilization matter?

Individual utilization matters a lot more for F8 than mortgage scores, I would focus more on overall utilization and getting all cards below 90%, as there is definitely a penalty on mortgage scores and F8 for having >90% utilization on ANY card.

Scenario 3 vs. 2/2A: Same as 2A except both Discover and Chase IHG left as is, or at 88.9% to avoid maxed out flag

- Same question as last comparison, I believe.

I need to execute the next steps today because of there's some payment dates today and this weekend that I want to get payments in so they report as I want next week!

Thanks!