- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Opinions on utilization thresholds/FICO scoring?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Opinions on utilization thresholds/FICO scoring?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Opinions on utilization thresholds/FICO scoring?

We talk a lot in this section of the forum about the 8.9%, 28.9%, 48.9% etc. thresholds related to utilization and FICO scoring. I'd like to discuss this topic a bit and get opinions from everyone as to whether you feel this makes "sense" and/or if you feel it's the "best" way for the algorithm to work. Obviously the opinion(s) of those that develop the algorithm are going to very greatly from our hardcore niche here, so no doubt what we may think will likely be different. Ultimately of course it doesn't matter, as we can't change anything, but I do think it's fun to talk about.

I think the biggest obstacle to me sort of accepting the current system as making "sense" is that it doesn't take into consideration [utilization] dollars at all. And, even if it did, without knowing income vs expenses, debt dollars do become somewhat irrelevant, which I of course get.

For me, it all comes back to assessing risk. If a credit score is going to change (for better or worse) it's supposed to do so according to risk and be a representation of that risk. That being said, I don't really see how the current system/algorithm that looks at thresholds every 20 percentage points makes much sense.

While I'm not saying that every percentage point should be perfectly linear and impact score from 0%-100%, having just a handful of of them all 20 percentage points apart seems like a copout. Someone that goes from 10% utilization to 28% utilization may see no score change, where if someone goes from 8% utilization to 10% utilization they may see a 15 point change (for example). To bring dollars into the discussion for S&Gs, if this person has $1000 in total limits we're talking $180 vs $20. $10,000 in limits? $1800 vs $200. $100k in limits? $18,000 vs $2000. Does it really seem logical from a risk-perspective (scoring) that someone who raises their utilization 2% ($20, $200, $2000) would take a 15 point hit compared to someone otherwise equal that raises their debt 18% ($180, $1800, $18,000) that sees no scoring impact? No one said FICO scoring had to be "logical" of course, but hopefully you all see my point.

Whether we're talking percentages or dollars in the above example, either way I'm not sold that the current system with respect to utilization doesn't carry some major opportunities.

I think one potential mini-solution if we're going to roll with percentages and thresholds is simply to have more of them. Why every 20 percentage points? If they were 10 or even 5 points apart wouldn't they be a bit more representative of what's trying to be accomplished?

As always I look forward to all of the different opinions out there and thanks in advance for all that contribute to a fun discussion.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on utilization thresholds/FICO scoring?

My guess is initially it was due to coding/storage limitations. Now my guess would be habit and ease on the CRA's ends.

That is assuming these actually do exist in the manner we believe they do. For instance on my 'clean' card with the only negatives being high util and closed CFA accounts, I got major points going from the 70s to the mid 60s aggregate, but didn't gain any points going from 60s to 47 threshold, not until I went from 47 > 42 aggregate. There was one card considered maxed the whole time through the 42, perhaps that was the key limiting factor though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on utilization thresholds/FICO scoring?

Regarding raw dollar values, I do not in fact know that none of the big FICO models take them into account. Here are three reasons to consider the possibility that FICO might do that:

(1) In FICO's negative reason statements, there are codes that specifically call out proportion of revolving amounts to credit limits and others that simply indicate that revolving "amounts" are too high (no reference to credit limits). Unclear why there should be different reason statements if all that FICO cares about is proportions

(2) In FICO's published Learn About Scores section on this web site, it clearly distinguishes as separate scoring factors (a) the "amounts" you owe on revolving accounts vs. (b) the credit utilization ratio on revolving accounts

(3) In terms of anecdotal testing data, we have people who believe that FICO starts to penalize as low as 5%. They believe they have seen this on their actual scoring and are often highly reliable people (like SouthJ). Other folks cannot reproduce their experience and appear to reconfirm the orthodox claim that there is no penalty under 8.99%.. My guess is that, if the test results of SouthJ and others are valid, it's because they have a ginormous total credit limit. Thus when SouthJ goes from 0.1% to 5%, he's going from a raw dollar value of a few hundred to 25k.

I would love to see some repeated well-designed tests of this. You'd just need somebody with a few cards with huge credit limits (50k) and a couple cards with tiny limits. If a person has no tiny card he'd just need to be willing to open some card and lower the CL. What we are interested in doing is keeping total U low, number of cards reporting a balance fixed, and individual utilization fixed (e.g. at 47% in both tests). The thing that would differ is the raw dollar value of debt.

I am completely open to the possibility that no FICO models consider raw dollar value. I am just not convinced that this is so, given the three things I mention above.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on utilization thresholds/FICO scoring?

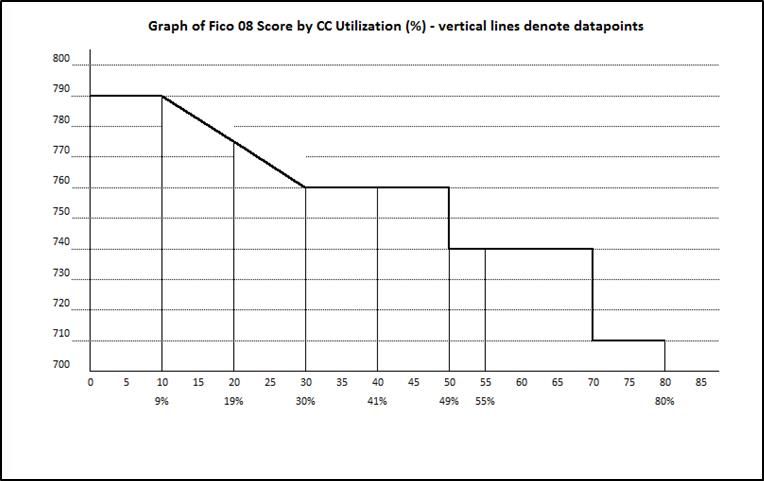

Presented below is some data I graphed from another poster that summarized a utilization study from another web site a couple years ago. The poster left out (or did not have) important details. I believe it was a one card profile so individual utilization = aggregate utilization but, no verification on this.

Personally, I have no doubt that Fico (and other models) have discrete utilization thresholds with step changes - not a linear relationship. As CGID mentions, other attributes may be impacting score that are misinterpteted as being caused by a minor change in utilization.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on utilization thresholds/FICO scoring?

While raw dollar values may matter based on some reason statements that we see, I believe that their impact if they do matter is far inferior to utilization percentages. I feel like if they mattered all that much that we'd have far more data points on them... certainly more than a, "well, they may matter based on reason statements available..." compared to finite threshold percentages we've come to determine since they're pretty well-documented and tested at this point and are discussed dozens of times per day on this forum.

That being said, when considering just the utilization percentage portion of this discussion, does anyone else take issue with the supposed thresholds being 20 percentage points apart from one another? It simply doesn't make much sense to me that a 1%-2% change in utilization may result in a big score change [if a threshold is crossed] where a 18%-19% change in utilization may result in no score change at all [if no threshold is crossed]. A pretty obvious (from my perspective) work-around for this would simply be more frequent threshold points. Am I over (or under) thinking this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on utilization thresholds/FICO scoring?

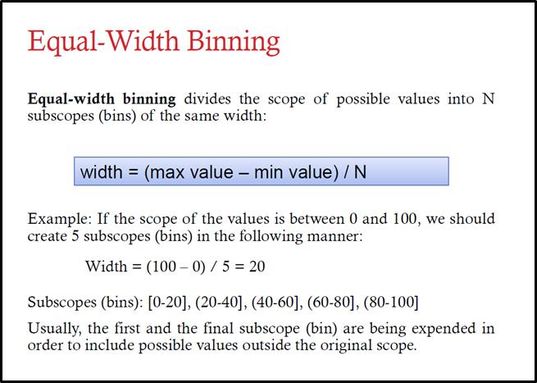

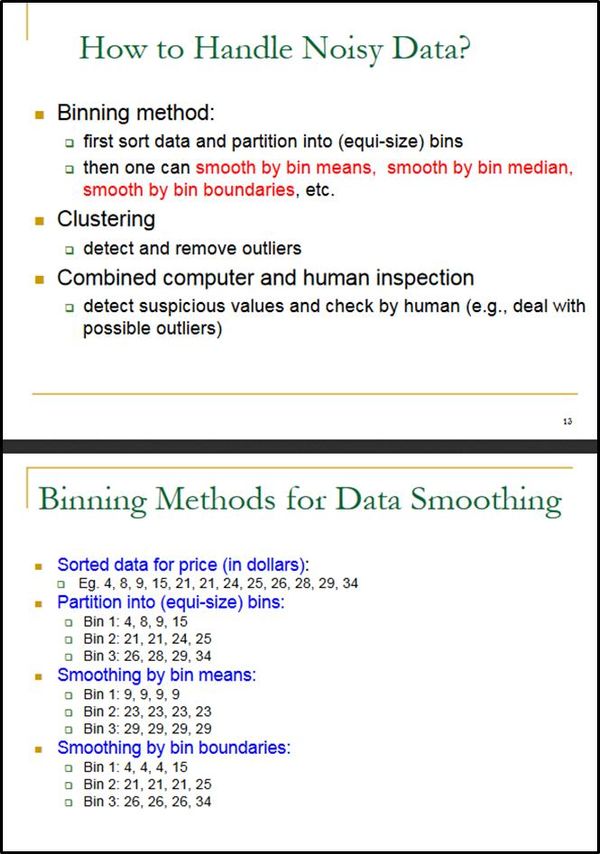

It's all about scorecards and binning. Populations are segmented and sub groups are assigned levels of risk.

Binning makes perfect sense to me and statistical analysis supports the practice.

https://plug-n-score.com/learning/scorecard-development-stages.htm

https://www.cse.wustl.edu/~zhang/teaching/cs514/Spring11/Data-prep.pdf

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on utilization thresholds/FICO scoring?

That's all fine and well, TT, but I don't think "binning" and magically coming up with 20-point bins makes any sense with respect to risk. Again, using my example from above, a 2% shift in utilization that crosses into the next "bin" isn't going to make someone more of a risk than a 18% shift in utilization that doesn't cross into the next bin. I think that's especially true when you're talking larger dollar values (higher overall limits) but then the conversation veers off the path again.

I guess my thought process is that if bins are what are going to be used, having more bins would create a smoother response to changes. Like if a 20 percentage point bin resulted in a 20 point score change (on average, say) than a 10 point bin could be used and result in a 10 point score change. Having the changes be more gradual just seems to make more sense than them being so abrupt.

It would be like if a school was built along a freeway for some reason and the speed limit dropped from 65 mph to 15 mph for the school zone in one step. People would be slamming on their brakes and it would cause what I would consider to be an unnecessary and avoidable result. Instead, if a mile out the limit dropped to 45mph and then a quarter mile out it dropped to 30 mph leading up to the 15 mph zone, it would create a smoother transition and simply make more sense. Not the greatest example I'm sure, but you get the idea.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on utilization thresholds/FICO scoring?

Of course bins are driven by data, not opinions. One of the objectives of binning is to take something continuous and create discrete increments for differentiation. The algorithms were derived based on data mining and comparative analysis of model outputs to actual results. I don't buy the argument that finer means better. Typical binning seen routinely takes a range and partitions it into 4ths (quartiles), 5ths (quintiles) and 10ths (deciles). Whatever Fico (and others) are using for bins works effectively as shown in white papers.

Essentially grades are a form of binning. You can bin as A, B, C, D, F and W or go finer and add triple the # of bins by adding + and -. Is one approach better than the other? What does the data suggest as the percentile range for each letter grade?

What's the purpose of the credit score and is it meeting the intended objective for the primary customer (lender)? The established under 9%, 9% to under 29%, 29% to under 49%, 49% to under 69%, 69% to under 89%, 89% and above utilization bins get my vote as milestone benchmarks.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on utilization thresholds/FICO scoring?

Hi BBS. To circle back to the issue of raw dollar figures, one more reason to believe that they might be used in models is because they are used. As in, we know already for a fact that they are used. Here are a couple ways we know about for sure:

FICO 8 uses raw dollar values in determining whether to ignore a collection. If a collection is for < $100, then FICO 8 ignores it completely (paid or unpaid). The $100 figure is hard coded into the algorithm.

FICO 8 (and other FICO models) ignore CC balances in the utilization calculation based on raw dollar figures hard coded into the assessment of credit limits. In FICO 98 the dollar number is $34,999 -- if the card has a credit limit greater than that the model drops the balance from consideration. In FICO 8 the cutoff is much higher. I think we were able to determine that the model's cutoff was some dollar figure between $50,002 and $79,999 -- and the community never did the extra testing to figure out exactly where.

So we know the models use raw dollar figures in some parts of it. Thus there is certainly precedent.

I do not myself have an opinion about whether FICO models do in fact use them in the way you originally mentioned. I.e. suppose Bob and Jane have total credit limits of $4000 and $400,000 respectively. Both start at $20 of CC debt. Bob goes to $320 and Jane goes to $32,000 (8% each). Will FICO view Jane's higher dollar figure of debt as an additional risk (with a scoring penalty)? I don't know because nobody here has ever tested it. I have never tested it because I keep my spending low.

Once upon a time (two years ago?) Citi permitted you to fund new bank accounts with a credit card and for any dollar amount you wished (and as a purchase rather than cash transaction). It was the Shangri-lah for people who chased CC bonuses and bank bonuses. I myself opened a Citi checking account and funded it using a new credit card with 17k. Some people funded their new deposit accounts with 40k or much more. But Citi stopped all that so I have no easy way of running up a huge credit card bill -- short of actually buying an s-ton of stuff I don't need.

PS. One more reason to consider the possibility is that every other credit scoring model that has given a very detailed look into its algorithm does in fact use raw dollar figures. The LexisNexis model uses them. The VantageScore model uses them. LexisNexis is extraordinarily minute in its dozens and dozens of dollar value cutoffs for different factors.

Naturally it is still possible that FICO is the exception and does not use them in the Bob and Jane sense above. But given all the reasons I have mentioned, I think it is reasonable to say FICO might. For me there's just no way to know unless some definitive testing were done.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on utilization thresholds/FICO scoring?

@AnonymousI do not myself have an opinion about whether FICO models do in fact use them in the way you originally mentioned. I.e. suppose Bob and Jane have total credit limits of $4000 and $400,000 respectively. Both start at $20 of CC debt. Bob goes to $320 and Jane goes to $32,000 (8% each). Will FICO view Jane's higher dollar figure of debt as an additional risk (with a scoring penalty)? I don't know because nobody here has ever tested it. I have never tested it because I keep my spending low.

CGID, thanks for the reply. In your example above where you say you don't know if the dollar amounts are taken into consideration, naturally I don't either. But, IMO, they should. I think without question Jane above has become a greater risk than Bob. If Jane loses her job, incurs massive medical expenses, dies, etc. the chance of default/default on her 8% is far greater than Bob's 8%.

This exact example above goes back to where TT and I aren't seeing eye to eye above. Where TT is talking about different bins and statistics, I'm not sure I can be convinced that Jane above isn't a greater risk than Bob even if Jane is in the same "bin" where Bob has moved to a different bin. To me, that just doesn't make logical sense. Of couse, no one said the FICO algorithm had to be logical or make sense to us... so it's fine that we have our own opinions on these things ![]()