- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Really 8pts drop for paying down Discover to $...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Really 8pts drop for paying down Discover to $0 from $40 with a CL of $9100!!!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Really 8pts drop for paying down Discover to $0 from $40 with a CL of $9100!!!

Have you ever let all 6 report? Because unless you let 100% of your cards report (all 6) you are comparing apples to oranges with the OP as he let 100% of his (2) cards report. Percentage of cards is what's relevant here, not number of cards.

I'd like to hear the opinions of the other veterans on this forum about this subject, as I've never heard of anyone achieving a HIGHER score with 100% of their cards reporting verses a lesser (non-zero) percentage of cards reporting.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Really 8pts drop for paying down Discover to $0 from $40 with a CL of $9100!!!

@Anonymous wrote:Have you ever let all 6 report? Because unless you let 100% of your cards report (all 6) you are comparing apples to oranges with the OP as he let 100% of his (2) cards report. Percentage of cards is what's relevant here, not number of cards.

I'd like to hear the opinions of the other veterans on this forum about this subject, as I've never heard of anyone achieving a HIGHER score with 100% of their cards reporting verses a lesser (non-zero) percentage of cards reporting.

1 or 2 cards is squirrley; there aren't many users on this forum for any non-trivial period of time which only have 2 or less revolving tradelines, but others that have come through have reported strange data which doesn't fit thicker files. I suspect there may be a different metric when we're talking painfully thin files, sort of like the AAOA floor of 1 year that's been long pontificated, otherwise it's kind of a damned if one does and damned if one doesn't as 0, 50% and 100% of revolvers reporting a balance are all well characterized penalties.

Personally I'm skeptical of a thick file scoring better with 4 cards reporting instead of 1 assuming we rule out the corner cases; I'd believe equal given enough cards sure but better, not so much as that doesn't hold with the overwhelming anecdotal data. I'm not saying it's impossible, it just is statistically unlikely in my opinion. Similarly people have reported higher scores with 4% instead fo 1% utilization... usually something else is going on.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Really 8pts drop for paying down Discover to $0 from $40 with a CL of $9100!!!

I have no doubt that under certain circumstances people may see higher Fico 08 scores with more cards reporting than with fewer cards reporting.

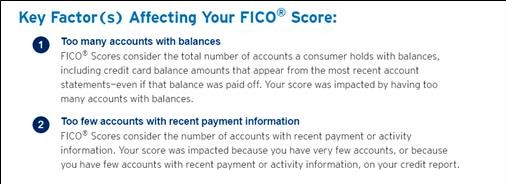

How? Take a look at the below which I saw as reason statements for my EQ Fico 8 Bankcard score.

Those with thin (or even non thin) files that limit credit use to a couple accounts (or three) likely are having their score hurt by factor #2 above.

Now if someone has 6 open accounts (1 installment loan + 5 credit cards) shows activity on 5 accounts factor #2 would not come into play.

Let's say the above profile has activity on 5 of 6 accounts in a month. Assume the mortgage and 2 of 5 credit cards reported balances to the CRAs while the other 2 CCs were paid off before statement cut. The net result is 5 of 6 accounts showing activity with 3 of 6 accounts showing a balance.

Going from 2 of 6 to 3 of 6 total accounts reporting balances - [1 of 5] to [2 of 5] CCs - may NOT trigger factor #1 above and but the increase in account activity [2 accounts] to [5 accounts] may eliminate factor #2. Result - possible net gain in score due to increasing # accounts with recent payment history.

The "typical" MyFico poster would not experience this because factor #2 never comes into play. They show use AND limit accounts reporting balances by paying a majority of balances before their respective post dates.

* Showing account use does not require reporting a non zero balance.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Really 8pts drop for paying down Discover to $0 from $40 with a CL of $9100!!!

@Thomas_Thumb wrote:I have no doubt that under certain circumstances people may see higher Fico 08 scores with more cards reporting than with fewer cards reporting.

TT, I appreciate your reply, but that's not the argument here. I agree that under certain circumstances a higher score may be achieved with more cards reporting. However, "more" doesn't equate to "all" which is what is the topic at hand.

If someone has 6 total revolvers, have you heard of them achieving a higher score with all 6 reporting balance as opposed to say 2 or 3?

While there are outliers in every situation, this is one that I have not heard of yet. If it is possible, as Rev said, it's statistically very unlikely I'm sure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Really 8pts drop for paying down Discover to $0 from $40 with a CL of $9100!!!

Pasted below is the OP

If tjmolly only has 2 cards, I suspect % of cards reporting thresholds are considered differently as the profile will be on a thin scorecard. In this case, both cards showing a balance (100%) may not experience a score penalty relative to one card. If so, a reduction in account activity could ding score.

Did tjmolly ever mention how many cards he had?

Based on testing from Inverse (he had 3 cards) we have data showing % cards reporting was a scoring factor for him - but he also had 4 open installment loans and quite a few closed ones. Thus, his profile was not thin.

If the OP does have a thin file, form a scoring perspective it may be best to show activity on all accounts but limit account reported balances to a single revolving CC account. Showing sufficient activity can be a challenge with thin files or non thin files having only a handful of open accounts.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Really 8pts drop for paying down Discover to $0 from $40 with a CL of $9100!!!

@Thomas_Thumb wrote:I have no doubt that under certain circumstances people may see higher Fico 08 scores with more cards reporting than with fewer cards reporting.

How? Take a look at the below which I saw as reason statements for my EQ Fico 8 Bankcard score.

Those with thin (or even non thin) files that limit credit use to a couple accounts (or three) likely are having their score hurt by factor #2 above.

Now if someone has 6 open accounts (1 installment loan + 5 credit cards) shows activity on 5 accounts factor #2 would not come into play.

Let's say the above profile has activity on 5 of 6 accounts in a month. Assume the mortgage and 2 of 5 credit cards reported balances to the CRAs while the other 2 CCs were paid off before statement cut. The net result is 5 of 6 accounts showing activity with 3 of 6 accounts showing a balance.

Going from 2 of 6 to 3 of 6 total accounts reporting balances - [1 of 5] to [2 of 5] CCs - may NOT trigger factor #1 above and but the increase in account activity [2 accounts] to [5 accounts] may eliminate factor #2. Result - possible net gain in score due to increasing # accounts with recent payment history.

The "typical" MyFico poster would not experience this because factor #2 never comes into play. They show use AND limit accounts reporting balances by paying a majority of balances before their respective post dates.

* Showing account use does not require reporting a non zero balance.

What were the DOLA's on your accounts when you got that Bankcard reason code?

If you leave balances on all your cards does it go away, likewise if you hit the all zero but one and everything with a DOLA of call it this month, is it there?

I think the more likely theory when we're talking about maxxing out Bankcard scores may be simply too few credit cards, maybe. I'll try to track that on EQ which is my only reliable BC score (Citi) when I'm clean in a year, nothing much more I can contribute to that now though I do appreciate your data. Bankcard is fundamentally different than mainline FICO though, if you'd seen that on a Classic score I'd be more likely to agree with that one though I agree it doesn't rule it out completely. Interesting none-the-less.

Bankcard just isn't a well characterized industry option, nor is auto I suppose either.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Really 8pts drop for paying down Discover to $0 from $40 with a CL of $9100!!!

I use all my cards at least once every 4 months. I do have a critical mass of CCs (4 credit cards + 1 charge card) for Fico 08 BC based on scoring 900 on TU and EX Fico 08 BC multiple times [max on EQ is 892]. Auto enhanced is another story - it may be looking for something additional relating to installment loans.

I saw the above pasted reason codes last month and saw them again when I checked my account (AT&T Citi) this afternoon - paste below.

I used all 5 cards this month (January) and all have reported balances. I expect reason statement #2 will disappear but obviously not #1 as charges post unpaid on statements and then the balances are PIF by due date.

I suspect account activity looks at prior month payments while cards reporting balances looks at current month. Either way key point to avoid #2 statement is to show activity on enough accounts (my guess is threshold may be more than 3 open accounts showing activity).

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Really 8pts drop for paying down Discover to $0 from $40 with a CL of $9100!!!

@Thomas_Thumb wrote:I use all my cards at least once every 4 months. I do have a critical mass of CCs (4 credit cards + 1 charge card) for Fico 08 BC based on scoring 900 on TU and EX Fico 08 BC multiple times [max on EQ is 892]. Auto enhanced is another story - it may be looking for something additional relating to installment loans.

I saw the above pasted reason codes last month and saw them again when I checked my account (AT&T Citi) this afternoon - paste below.

I used all 5 cards this month (January) and all have reported balances. I expect reason statement #2 will disappear but obviously not #1 as charges post unpaid on statements and then the balances are PIF by due date.

I suspect account activity looks at prior month payments while cards reporting balances looks at current month. Either way key point to avoid #2 statement is to show activity on enough accounts (my guess is threshold may be more than 3 open accounts showing activity).

Except the fly in the proverbial ointment is *how* does the algorithm look at prior information unless it is recording snapshots? Which to date given how FICO works I would suggest simply doesn't happen.

FICO 8 was developed prior to trended data becoming a major thing, and even now not every lender reports the additional data (actually, at least one of the big 5 has stopped reporting the additional data), so unless there was a major revision to the algorithm which is patently unlikely unless there was something utterly broken... historically FICO doesn't update the released algorithms for new features to the best of my knowledge.

I assume based on your post you're getting them from Citi?

Also as another point, buffering may apply here to your godlike perfect score, so I don't know that we can assume that you have a critical mass of CC's for every nook and cranny of the algorithm ![]() .

.

Wish I could help you test this but until I'm clean in about a year isn't much I can do to assist.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Really 8pts drop for paying down Discover to $0 from $40 with a CL of $9100!!!

So if I had 2 cards one of which is Discover reporting 6% utilization, and the other is not being used and reporting 0% utilization, then I would be hurting. In a case like this it seems like as soon FICO generates I need to get my next CC asap and use it. Btw TT, how were you able to access the reason codes for Bankcard model?

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Really 8pts drop for paying down Discover to $0 from $40 with a CL of $9100!!!

@Subexistence wrote:So if I had 2 cards one of which is Discover reporting 6% utilization, and the other is not being used and reporting 0% utilization, then I would be hurting.

Hurting relative to what? Relative to having both cards report 0%, you're in a better place with one of the two reporting a small balance.

Relative to maximizing your score for the utilization sector of scoring, you'd need to add 1 more card to your revolver collection so that you have the ability to let 1 of 3 report a small balance (33%) which is a number less than 50% and greater than 0% which is believed to be the most ideal situation.

Basically with only 2 cards you are doing the best you can (letting 1 of 2 report a small balance) but you could be doing better with the addition of a 3rd card.