- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Reducing utilization and scoring impact

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Reducing utilization and scoring impact

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reducing utilization and scoring impact

Hi All,

Someone mentioned to me that when you reduce our utilization from 75% to less than10% you will get a score bump but not as high as one would think. The scores would gradually increase in the coming months providing you keep your utilization down.

Can anyone confirm this.

Bank of America: Alaska Air Atmos Summit Visa Infinite

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Globe WLMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 12.24, EX: 816 / EQ: 825 / TU: 818

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

You might need to take another shot at stating your question. It sounds like you may be asking three things, all connected with reducing CC utilization from 75% to less than 10%:

(1) Will my scores increase?

Yes. They should increase a lot: at least 20 points for most profiles, possibly much more.

(2) Will the score increase be less than I expect it to be?

I am unsure what you expect it to be. So it's hard to answer this question.

(3) "The scores would gradually increase in the coming months providing you keep your utilization down."

Unsure what you are asking in #3. A guess might be this.

"After I get my big score bump from lowering my util, would my scores tend to gradually increase even further due to other reasons (provided I kept my util under 10%)?"

Probably. A good guess is that your AAoA (average age of accounts) is not high. Therefore if you let all your accounts age, then that will increase your scores. As time goes by, any derogs you have will fall off, which will help your scores. Likewise any inquiries you have on your report right now will stop affecting your score after anough months go by -- which will help your scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

I do not claim to be an expert, however I would believe that for most profiles, dropping Util from 75% to below 10% would be a pretty significant score jump. I assume that an exception might be if there are some recent baddies holding scores down, but for most I would think this would be a significant positive.

Are you speaking of such a large drop on one account or all revolving accounts combined?

Sept 2024: EX8: 847; EQ8: 850; TU8: 848 -- Middle Mortgage Score: 821

In My Wallet: Discover $73.7K; Cap1 Venture $51.7K; Amex ED $38K; Amex Optima $2.5K; Amex Delta Gold $18K; Citi Costco $24.5K; Cap1 Plat $8.4K; Barclay $7K; Chase Amazon $6K; BoA Plat $21.6K; Citi TY Pref $22K; US Bank $4K; Dell $5K; Care Credit $6.5K. Total Revolving CL: $300K+

My UTIL: Less than 1% - Only allow about $20 a month to report, on one account. .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

It really depends on the personal profile. I dropped my overall utilization from about 35% to 6% one month when I paid off $3500 on an account. While this drop is 2 complete thresholds above a drop from the 70's to below 10%, it's still a drop crossing 2 thresholds at 29% and 9%. When I asked on here how much I should expect my scores to rise prior to this drop taking place most answers ranged from 10-20 points with a few outliers below 10 points and a few above 20 points.

When I actually dropped my utilization and the account reported I ran my scores only to find 2-3 point gains across all 3 bureaus. So, for me, a fairly solid utilization drop didn't result in a solid point gain at all. I know others have had completely different results, though, so it is certainly a profile-specific thing here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

@sjt wrote:Hi All,

Someone mentioned to me that when you reduce our utilization from 75% to less than10% you will get a score bump but not as high as one would think. The scores would gradually increase in the coming months providing you keep your utilization down.

Can anyone confirm this.

Aggregate utilization (all cards combined) is a significant factor in Fico scoring models. The impact of utilization on score is "point in time". Thus, if data is pulled to calculate your credit score, you will see the full impact based on current utilization.

For example, if you drop aggregate utilization from 75% to 8% and maintain it there the full benefit will be seen the 1st time your score is computed at the lower utilization. If everything in your file is maintained "constant" and utilization remains below 9% your score would not continue to rise due to any cummulative effect of low utilization. Other factors such as increased AAoA, HPs falling off over time and paydown of loans contribute to increases over time.

As a general rule aggregate utilization under 30% is considered responsible credit management. That being said, if you want to leverage the utilization factor to optomize score, you should maintain aggregate utilization below 9%. Aggregate utilization at 70% and above is a red flag and represents elevated risk which translates to a significant drop in Fico score relative to an under 30% condition. Aggregate utilization above 90% is in "max out" territory and this threshold has major impact on score.

As mentioned above, the improvement in score associated with a drop in utilization % is profile dependent. Regardless, dropping aggregate utilization from above 75% to under 9% should result in a substantial point increase that will be realized as soon as scores are pulled after the lower utilization is reflected on CRA reports.

Note: Utilization % on individual credit cards does NOT influence scores to the degree that aggregate utilization does. Many profiles can allow a card to show utilizations in the 70% to 80% range without negative affect if aggregate utilization is maintained.

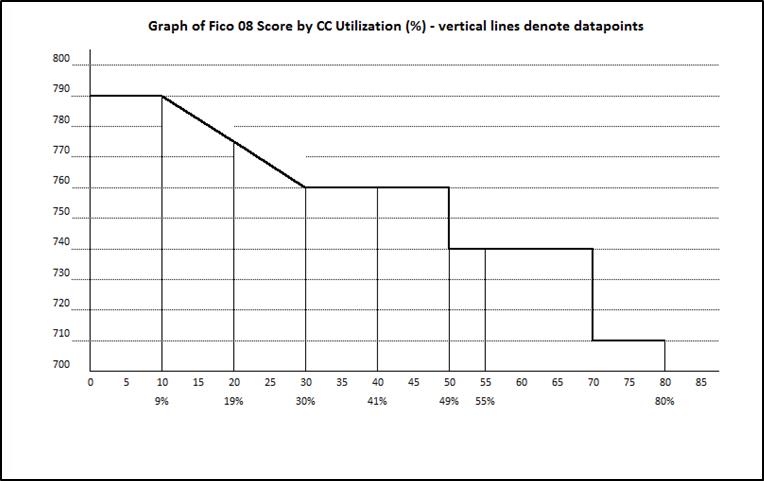

Shown below is a graph based on illustrative data presented by another poster possibly relating to a thin file. I think it is insightful but the score shifts are rather extreme and not representative.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

Thanks all for your responses. They are very insightful.

A little background on my friend's credit profile:

- AAOA is 13 years.

- Several charge-offs from 2011-12, all but two are paid.

- Last charge-offs paid were in full to the original creditor in 2015, but those accounts were charged off in 2011-12.

- Two unpaid charge-offs are still owned by the original creditor and reports monthly to all three CRA.

- Current Experian Score is 606.

- Utilization is around 70-75%

- Three open credit cards. one was opened in 2008, the other two in 2015.

- Action Plan:

- Pay off the three credit cards.

- Pay off the charge off in full. Will then show a zero balance, bring accounts to current, and stop monthly reporting. I think the monthly reporting of a charge off balance is suppressing his score.

When we went through the FICO simulator it showed a score bump to 621, a 15 point increase. I though the bump would be higher, considering he is paying off a couple of charge-offs that continue to report monthly.

Bank of America: Alaska Air Atmos Summit Visa Infinite

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Globe WLMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 12.24, EX: 816 / EQ: 825 / TU: 818

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

@sjt wrote:Thanks all for your responses. They are very insightful.

A little background on my friend's credit profile:

- AAOA is 13 years.

- Several charge-offs from 2011-12, all but two are paid.

- Last charge-offs paid were in full to the original creditor in 2015, but those accounts were charged off in 2011-12.

- Two unpaid charge-offs are still owned by the original creditor and reports monthly to all three CRA.

- Current Experian Score is 606.

- Utilization is around 70-75%

- Three open credit cards. one was opened in 2008, the other two in 2015.

- Action Plan:

- Pay off the three credit cards.

- Pay off the charge off in full. Will then show a zero balance, bring accounts to current, and stop monthly reporting. I think the monthly reporting of a charge off balance is suppressing his score.

When we went through the FICO simulator it showed a score bump to 621, a 15 point increase. I though the bump would be higher, considering he is paying off a couple of charge-offs that continue to report monthly.

Note: The plan to pay off all cards and avoid ongoing interest penalties is the right strategy. However, once they are all paid off your friend should allow a small balance to report on one card every month. After balance reports on statement then pay statement balance in full before the due date. This will avoid any ongoing interest penalties. If a zero balance reports on all credit cards that hurts credit score - typically a 10 to 25 point score drop compared to one cards reporting a "small" balance.

I would anticipate a bit higher score potential if the above is done with one card reporting a small balance. Perhaps a Fico 08 score in the 640 to 650 range. Either way, the plan makes sense. We would be interested in feedback on results.

Note 1: The charge offs will continue to impact Fico 08 score negatively even when they are paid off. Try to negotiate removal of the charge offs (with the original creditor) as part of the plan in paying them off. Although leverage is minimal with the paid charge offs, writing a good will letter to the creditor(s) requesting the charge offs be removed can't hurt.

Note 2: My understanding is charge offs that show a zero balance are ignored as a negative in Fico 09 - but not any of the earlier Fico scoring models.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

@Thomas_Thumb wrote:

@sjt wrote:Hi All,

Someone mentioned to me that when you reduce our utilization from 75% to less than10% you will get a score bump but not as high as one would think. The scores would gradually increase in the coming months providing you keep your utilization down.

Can anyone confirm this.

Aggregate utilization (all cards combined) is a significant factor in Fico scoring models. The impact of utilization on score is "point in time". Thus, if data is pulled to calculate your credit score, you will see the full impact based on current utilization.

For example, if you drop aggregate utilization from 75% to 8% and maintain it there the full benefit will be seen the 1st time your score is computed at the lower utilization. If everything in your file is maintained "constant" and utilization remains below 9% your score would not continue to rise due to any cummulative effect of low utilization. Other factors such as increased AAoA, HPs falling off over time and paydown of loans contribute to increases over time.

As a general rule aggregate utilization under 30% is considered responsible credit management. That being said, if you want to leverage the utilization factor to optomize score, you should maintain aggregate utilization below 9%. Aggregate utilization at 70% and above is a red flag and represents elevated risk which translates to a significant drop in Fico score relative to an under 30% condition. Aggregate utilization above 90% is in "max out" territory and this threshold has major impact on score.

As mentioned above, the improvement in score associated with a drop in utilization % is profile dependent. Regardless, dropping aggregate utilization from above 75% to under 9% should result in a substantial point increase that will be realized as soon as scores are pulled after the lower utilization is reflected on CRA reports.

Note: Utilization % on individual credit cards does NOT influence scores to the degree that aggregate utilization does. Many profiles can allow a card to show utilizations in the 70% to 80% range without negative affect if aggregate utilization is maintained.

Shown below is a graph based on illustrative data presented by another poster possibly relating to a thin file. I think it is insightful but the score shifts are rather extreme and not representative.

This is an outstanding chart to have...and I believe it is probably fairly typical as to the degree of effect on most profiles except a few. I have been told that if you are a wealthy individual and do a lot of traveling, utilization may become discounted. Say every month you run your card up to 80%, and then PIF before due dates. My understanding is in this case, over time, the alogorythm used will recognise this as normal for that individual, and will discount the importance of utilization. After all...this is exactly how many wealthy business men use their cards. I have never seen this chart, and I thank you for posting it.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

@sjt wrote:Hi All,

Someone mentioned to me that when you reduce our utilization from 75% to less than10% you will get a score bump but not as high as one would think. The scores would gradually increase in the coming months providing you keep your utilization down.

Can anyone confirm this.

As others have stated....utilization has no history, therefore it is only important to maximize the effect shortly before applying for credit. Extremely high utilization however, can easily lead to AA by your current credit card accounts. If you keep utilization near 80%, do not be surprised if creditors request 4506-t, or CLD, or even do an account closure. Very high utilization makes creditors nervous. While utilization is very high, you would be wise to not request CLI, as this will call attention to high utilization, and may trigger AA. This is assuming that your high utilization is not due to very small credit limits, if it is, then a CLI might be needed.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

I've noticed that as my UT goes down I gain a few points, and if it goes up I get dinged on my score.