- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Reducing utilization and scoring impact

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Reducing utilization and scoring impact

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

@sarge12 wrote:

@Thomas_Thumb wrote:

@sjt wrote:Hi All,

Someone mentioned to me that when you reduce our utilization from 75% to less than10% you will get a score bump but not as high as one would think. The scores would gradually increase in the coming months providing you keep your utilization down.

Can anyone confirm this.

Aggregate utilization (all cards combined) is a significant factor in Fico scoring models. The impact of utilization on score is "point in time". Thus, if data is pulled to calculate your credit score, you will see the full impact based on current utilization.

For example, if you drop aggregate utilization from 75% to 8% and maintain it there the full benefit will be seen the 1st time your score is computed at the lower utilization. If everything in your file is maintained "constant" and utilization remains below 9% your score would not continue to rise due to any cummulative effect of low utilization. Other factors such as increased AAoA, HPs falling off over time and paydown of loans contribute to increases over time.

As a general rule aggregate utilization under 30% is considered responsible credit management. That being said, if you want to leverage the utilization factor to optomize score, you should maintain aggregate utilization below 9%. Aggregate utilization at 70% and above is a red flag and represents elevated risk which translates to a significant drop in Fico score relative to an under 30% condition. Aggregate utilization above 90% is in "max out" territory and this threshold has major impact on score.

As mentioned above, the improvement in score associated with a drop in utilization % is profile dependent. Regardless, dropping aggregate utilization from above 75% to under 9% should result in a substantial point increase that will be realized as soon as scores are pulled after the lower utilization is reflected on CRA reports.

Note: Utilization % on individual credit cards does NOT influence scores to the degree that aggregate utilization does. Many profiles can allow a card to show utilizations in the 70% to 80% range without negative affect if aggregate utilization is maintained.

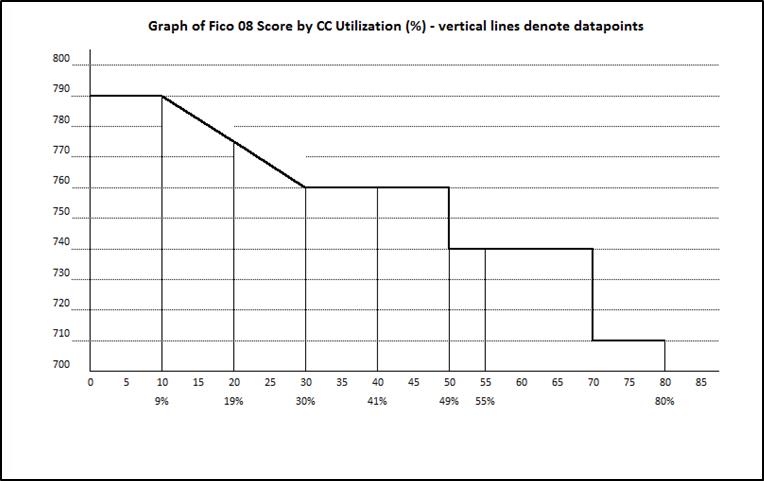

Shown below is a graph based on illustrative data presented by another poster possibly relating to a thin file. I think it is insightful but the score shifts are rather extreme and not representative.

This is an outstanding chart to have...and I believe it is probably fairly typical as to the degree of effect on most profiles except a few. I have been told that if you are a wealthy individual and do a lot of traveling, utilization may become discounted. Say every month you run your card up to 80%, and then PIF before due dates. My understanding is in this case, over time, the alogorythm used will recognise this as normal for that individual, and will discount the importance of utilization. After all...this is exactly how many wealthy business men use their cards. I have never seen this chart, and I thank you for posting it.

Doubtful, algorithm can only see what's on the report and what the cards are being used for isn't on there.

Lenders don't care if you have the assets to support the spending, but FICO doesn't look at assets or income by design. I think it's a bit of a stretch as a result, and the few ultra wealthy people I've run into have worse credit scores than I do, non-trivially in some cases. FU money applies to credit reports and scores too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

This is an awesome thread and information everyone needs to understand when they get credit cards.I only had a $1,000 card last year and bought a tv on a "36 month, zero interest" card thinking it would improve my credit,....wrong! it went from 680 to 630 overnight. I finally figured out the deal with UTIL and can personally vouch for getting good increases immediately. When I figured out the UTIL, i was down to 49% and my score improved to 645. I read some info (and I dont remember where) but it was like a credit Karma site where they were explaining the UTIL tiers and what the AVERAGE score was from their clients that reported at the different tiers. It was in jumps of 10% increments, so I made my on chart that calculated and filled in the gaps with estimated scores for each percentage point.

Here is what I use, and so far it is very close to my experience. This was used in just the past 3 months when I made the chart. As I said above, at 49% I was at 645, the next month I went down to 37%, my scores went up to 658, next month 16%, my scores went up to 697 which is where I am at now. I should be at 12% for September, so we'll see what happens there. I have some 7 Year old baddies that are falling off this year, so I feel that is why I am a little lower than the chart. Also I assume that since the scores are an average representation, there is going to be some junk in their files too that should make this a fair chart for most people to use. I have perfect payments for last 6 years, AAoA is 2yrs, 11 months, 2 baddies, no real estate.

I am anxious to see if my scores do change and stay with the chart. Obviously, YEMV, but it has really helped me in calculating what I need to do to get my scores where I want.

Score UTIL% Score UTIL% Score UTIL%

753 1 719 10 671 30

749 2 716 11 670 31

745 3 713 12 668 32

741 4 710 13 667 33

738 5 707 14 665 34

735 6 704 15 664 35

731 7 701 16 662 36

727 8 698 17 661 37

723 9 695 18 659 38

692 19 658 39

690 20 656 40

688 21 655 41

686 22 653 42

684 23

682 24

680 25

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

Excellent information here! Many thanks to all contributors!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

terryj

I'm not really understanding where you got the numbers you posted in your chart. Your chart suggets a 100 point scoring difference in going from 1% utilization to about 40% utilization which seems much larger than I would expect. Furthermore, utilization as far as I know follows certain thresholds... 9%, 29%, etc. so I wouldn't expect a score change for every single digit % change. Were you just sort of shooting from the hip and estimating those numbers or are they all concrete, actual measured numbers? If they are actuals, how do you know that other factors such as AAoA aging, inquirings aging, baddies aging, etc. weren't the variables impacting the score changes outside of simply utilization?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

BBS -

From what I can tell the table assumes a linear relationship and does not factor in threshold step changes. Four data points were presented as follows:

"As I said above, at 49% I was at 645, the next month I went down to 37%, my scores went up to 658, next month 16%, my scores went up to 697 which is where I am at now."

The 13 point bump up going from 49% to 37% utilization could relate to other factors (such as a change in # cards reporting) as opposed to a drop in utilization. The 29 point bump up dropping from 37% to 16% is an order of magnitude greater but so is the shift in utilization. So, the linear relationship hypothesis is understandable although not valid based on other findings.

Side note: composite data presented on MyFICO overwhelmingly supports the existance of Ag UT% binning for scoring purposes

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

Brutalbodyshots/TT- I appreciate your comments and certainly understand your questions. I am not a young person, but I am/was completely ignorant on how credit works as of just this past July when I first started trying to fix my credit from a bad 2009. I bought a car in 2014 and they told me then I had a 680 and my wife had a 630.

We bought a tv in Nov 2015 on a 36mo 0% SYNC I was approved for $3,300 (the TV was $3,250)....tickled I had improved my score with the new card and new CL (I only had a BoA card 1k which I kept around 50%...btw, the bank told me that was where I should keep it), I figured we were starting to turn around our credit. January I did a free credit check...I had a 630???? I was thoroughly confused and baffled why the score dropped.

In June/July I got a mind set to try and figure the credit thing out...I setup my USAA acct to pull my EX and my score was 645. My sync bl was $2,400. I got a Cap1 in Jan 2016 and set it up for a monthly check up and found on their website, the utili Percentages (I had 49% at this point)

In a search for knowledge I started reading all I could on util and found a site that had an article trying to the effects of util to score. There was a chart that showed, in 10% increments, going from 0-50% what the average score was for their customers, in each of those bracket, for people in their customer base (I think the website was a reporting service like credit sesame or karma...I don't remember nor could I back track to it). But basically what they were saying that for their customers, with a 10% total UTILI, their averages scores was 719, for 20% the average was 690, etc....

I was fascinated by it and extrapolated the data in between each bracket to to each % point and came up the the chart I posted. At the time I had 49% util, my score was 645 on my USAA EX pull...it very closely matched my chart...I paid down my SYNC card the next month and I went to 37%, and the next update, it went to 655. It also was very close and was probably a little lower because I had 5 baddies from 2009. I got much more aggressive running 0 on all cards and only $1,400 for a 15.7% util and all my scores went to almost 700...they avg 695.

Now, I went into so much background on this because I know the scores from what I was seeing, but I didn't know anything about all the FAKOs or what scores I was pulling. It appears what I had been looking and were VantageScore 3.0. I went through quite a few of the cheaper reporting services and have since dropped everything and am on the myFico 3B monthly so I can track proper data.

In answer to your question TT, I was very stable and was not doing much except for one HP when I asked BoA for a cli (which they denied). My Cap1 upgraded me to a QS and CLI to $2,750. That helped in getting my util down to 16%. I won’t be able to gauge when I go below 10% because I did have a lot of activity in August/Sept. Because of personal needs I had to get a new car my DTI is less than 30% (and still is) ...I also applied for and got and AMEX ED 2k, and a CSP 5k... total of 9 inq's my scores as of yesterday are 662 - 675 fico8, my fico4 run 685 to 730. Now having all fico scores documented moving forward, I can more fairly assess any accuracy to my chart. I only know it was very close using the VS3.0 scores.

I was very interested in the chart that is posted on this thread that shows effects of utils to what looks like is better established accounts, rather than 600-700 people with issues on this accounts. In other words, no real-estate, payment issues, baddies, etc…

I have 6 yr perfect payments, no real-estate, 5 baddies (during this period, I am now done to one), 3 revolving with tcl 4k may-9k in July

If you think my post is mis-leading people...I have no problem taking the chart off. That was not my intention to mis-lead....I just wanted to get valuable feedback and maybe be able to help someone else trying to understand, how to improve the scores, and why to keep your revolving down below 10% for the maximum benefit for your circumstances which includes things you cant control.

Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

@terryj wrote:Brutalbodyshots/TT- I appreciate your comments and certainly understand your questions. I am not a young person, but I am/was completely ignorant on how credit works as of just this past July when I first started trying to fix my credit from a bad 2009. I bought a car in 2014 and they told me then I had a 680 and my wife had a 630.

Now, I went into so much background on this because I know the scores from what I was seeing, but I didn't know anything about all the FAKOs or what scores I was pulling. It appears what I had been looking and were VantageScore 3.0. I went through quite a few of the cheaper reporting services and have since dropped everything and am on the myFico 3B monthly so I can track proper data.

In answer to your question TT, I was very stable and was not doing much except for one HP when I asked BoA for a cli (which they denied). My Cap1 upgraded me to a QS and CLI to $2,750. That helped in getting my util down to 16%. I won’t be able to gauge when I go below 10% because I did have a lot of activity in August/Sept. Because of personal needs I had to get a new car my DTI is less than 30% (and still is) ...I also applied for and got and AMEX ED 2k, and a CSP 5k... total of 9 inq's my scores as of yesterday are 662 - 675 fico8, my fico4 run 685 to 730. Now having all fico scores documented moving forward, I can more fairly assess any accuracy to my chart. I only know it was very close using the VS3.0 scores.

I was very interested in the chart that is posted on this thread that shows effects of utils to what looks like is better established accounts, rather than 600-700 people with issues on this accounts. In other words, no real-estate, payment issues, baddies, etc…

I have 6 yr perfect payments, no real-estate, 5 baddies (during this period, I am now done to one), 3 revolving with tcl 4k may-9k in July

If you think my post is mis-leading people...I have no problem taking the chart off. That was not my intention to mis-lead....I just wanted to get valuable feedback and maybe be able to help someone else trying to understand, how to improve the scores, and why to keep your revolving down below 10% for the maximum benefit for your circumstances which includes things you cant control.

Thanks again!

No need to remove the chart.

It is a representation of your hypothesis. Nothing wrong with presenting it as something you developed and found helpful in managing your credit.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

I don't think you need to remove your chart, I just think it's important to let everyone know that results will vary strongly. Your chart suggests around a 100 point score change for a 39% reduction in utilization (40% to 1%) and when I reduced my utilization by almost exactly this amount 3 months ago I saw an average of 3 points gained on each bureau. 3 points verses 100 points. Certainly quite different results.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

@Anonymous wrote:I don't think you need to remove your chart, I just think it's important to let everyone know that results will vary strongly. Your chart suggests around a 100 point score change for a 39% reduction in utilization (40% to 1%) and when I reduced my utilization by almost exactly this amount 3 months ago I saw an average of 3 points gained on each bureau. 3 points verses 100 points. Certainly quite different results.

Right, I wish so much hadn't changed for me in August and September, because as I reduce util below 10%, I can't draw any conclusions from it anymore. My guess is I won't be at 753 when I reach zero. What the information there shows is the AVERAGE score for people at those levels of util. My guess is your credit is much stronger than mine, which would be why it didn't affect yours as much. I only had 2 types of credit, no real-estate, no other loans, only 3 CCards, and 2 car payments (6 years perfect payments, 4 baddies)

If you don't mind, could I ask what your status is? tcl, scores, types of accts, ....that would be valuable info for me to learn from.

Let me ask a question here that I just ask in the GC, I have paid my SYNC down to $1,100 and was thinking about asking my CU for a secured loan for that amount to PIF, that would leave me at zero Util, a TCL 16k, and a third type of loan? My problem is I have 9 HP's and I don't wont anymore.....do you think they would do that without a pull? I would like to do it today before I join the garden...

Also, how do I insert a picture here?

Thanks BBS, I always appreciate yours (and TT's) comments!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reducing utilization and scoring impact

Chances are my file was a bit thicker than yours and I agree that's why I only saw about 3 points per bureau when I dropped utilization significantly.

At the time I dropped my utilization, my AAoA was 7 years across 20 accounts, oldest account 15 years. 3 real estate loans (2 paid off), 7 auto loans (5 paid off) and the other 10 were revolvers, all but 2 were closed. Baddies on 3 of 20 accounts, 1 minor, 2 majors, all late payments and accounts that were PIF. 1-2 inquiries on each bureau as well at the time. Total credit line at the time was only $13k, average FICO 08 at the time was 735 or 736. Hopefully that info is helps.