- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Score Not Increasing Much...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Score Not Increasing Much...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Not Increasing Much...

@Anonymous wrote:

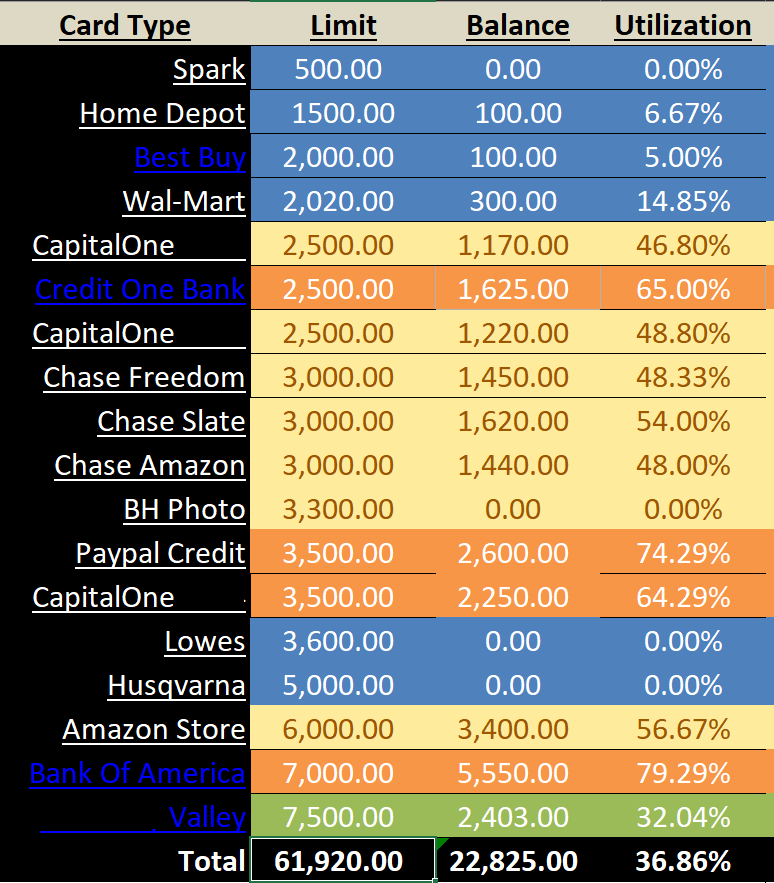

@KeithW wrote:Six months ago I had 4 of the below cards over 90% utilization and 4 more over 80%. My total CC debt was very close to $44,000 dollars. I have been working on paying down my debt and as you can see below, it is in much better shape. I hope to have zero debt after the first of the year. I have no late payments since 2017, when I had a 30 day late on my auto loan. The only derogatory was a 2018 medical collection of my spouse, which was immediately paid.

Six months ago my FICO scores were 648, 631 and 614. They are currently 670, 660 and 639. My Vantage Score is 740, but I don't know what it was to begin with. So I saw a 20-30 point jump. Considering the number of cards that dropped below multiple thresholds and the overal utilization dropping so much, shouldn't I have seen a bigger jump? Additionally, the FICO score simulator says that even paying down all my CC debt would only get me a score in the low 700s. Is the single 30 day late and the collection holding me down? The collection is only reported on my Equifax, which is the highest score (670).

You have at least 3-4 cards reporting $0 balances. FICO doesn't like $0 balances. So, while the low balances have a positive effect on aggregate util, my understanding is that FICO algorithms punishes for $0 balances. Not as counterintuitive as one might think. So, you may be getting penalized. Someone else can chime in more on this.

This is wrong

As long as there is at least 1 card with a balance you will not get the scoring penalty. There is nothing wrong with having some cards reporting $0 and absolutely no reason to report a balance on every card from a scoring perspective.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Not Increasing Much...

Indeed. All other things being equal, you want 2 cards out of 3 reporting a zero balance. Actually, 2 *accounts* out of 3, I think.

@KeithW - some years back, my scores were in the mid-600's. I had one 30-day late (BoA), and that limited my scores to the low/mid 700's. It wasn't until that late dropped off my record that I was able to get my scores into the high 700's. (They've stayed north of 800 for 2+ years now.)

So, as others have said, for scoring, focus on getting & keeping single-card utilization below 79 / 49 / 28 percent, and the aggregate will take care of itself.

2025 Goal: save 3 months' net income

Starting FICO8: 666 (give or take a FICO)

[ Last INQ 14-Sep-2025 ]

| EQ | 8?? | 0 INQ | 7y4m |

| EX | 840 | 4 INQ (2 CC, 2 auto) | 7y |

| TU | 8?? | 1 INQ (CC) | 6y8m |

| 3/24 | 1/12 | AoYA 10m | AoOA 24y2m | ~1% |

FICO 9 is 837.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Not Increasing Much...

Half of my cards have 0 balances and never penalized for it. However, the rest have under 5% utilization. When things with the economy got a bit shaky, I decided to pay off my cards. I did notice that just one card with a high utilization can sting. While I concentrated on the smaller accounts first my score barely moved. It wasn't until I got the two with the high use down that my score jumped 33 points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Not Increasing Much...

@Anonymous wrote:

......

You have at least 3-4 cards reporting $0 balances. FICO doesn't like $0 balances. So, while the low balances have a positive effect on aggregate util, my understanding is that FICO algorithms punishes for $0 balances.

That is absolutely untrue. The more zero balances the better. It rewards zero balances, and does not punish them.

The only thing it punishes in that regard is having ONLY zero balances.

If you have one account reporting a small balance, you're golden.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Not Increasing Much...

@FlaDude wrote:

......

I was under the impression that when accounts are closed by issuer that you could continue to pay monthly, you just can't add new charges. .........

That's correct.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Not Increasing Much...

.....They can request payment in full at any time.....

I'm pretty sure that's false.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Not Increasing Much...

@SouthJamaica wrote:.....They can request payment in full at any time.....

I'm pretty sure that's false.

I checked a couple of my cardmember agreements and don't see any verbiage that would require paying the full balance on account closure. BOA's does say full payment can be required in the case of default.

AoOA: closed: 40 years, open: 30 years; AAoA: 14 years

Amex Gold, Amex Blue, Amex ED, Amex Delta Blue, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA, Sync Lowes, total CL 203k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Not Increasing Much...

hopefully none of his accounts get closed down, but whether they force you to pay in full, or you decide you have to, is a factor

i had a sync with a balance closed down - i didnt want it to report as 100% utilization (due to there being a balance with no CL to calc % on )

so i paid it off that month - so i feel like i was 'forced' to

to the OP -

1. you have been doing a great job paying down - congrats!

2. create a 29% plan

by this i mean do minimum payments + $10 on all accounts below 29% - then put all your extra funds towards the ones over 69%

once everything is below 69%, put all extra funds towards the accounts over 49% - rinse and repeat until ALL accounts are below 29%

then pay them off based on the highest interest accounts

good luck to you

Jan 25/2024 EX. 774 EQ. 751 TU 758

Inq. EX 2 EQ 3 TU 6 - - CC 2x24, 0x12

Amex BCP $35k - Apple GS $21k - BMW/Elan $19k - Cap1 QS $16.7k - Chase Amazon $13.6k - Chase Bonvoy Bountiful $10k - Chase United Club Infinite $26k - Citi CustomCash $3k - Citi DC $14.5k - CreditUnion1 $9k - DiscoverIT $31.5k - PayBoo - $15.6k - Penfed Gold - $19.3k - USB AltitudeGO -$19k- USBank Cash+ -$25k - PenFed LOC - $20k - USB LOC - $15k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Not Increasing Much...

@RSX wrote:hopefully none of his accounts get closed down, but whether they force you to pay in full, or you decide you have to, is a factor

i had a sync with a balance closed down - i didnt want it to report as 100% utilization (due to there being a balance with no CL to calc % on )

so i paid it off that month - so i feel like i was 'forced' to

to the OP -

1. you have been doing a great job paying down - congrats!

2. create a 29% plan

by this i mean do minimum payments + $10 on all accounts below 29% - then put all your extra funds towards the ones over 69%

once everything is below 69%, put all extra funds towards the accounts over 49% - rinse and repeat until ALL accounts are below 29%

then pay them off based on the highest interest accounts

good luck to you

That rarely happens. Usually, while it is true that for the purposes of computing aggregate utilization the limit is not counted but the balance is counted, on an individual account basis it is usually reported with the actual credit limit.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Not Increasing Much...

I am feeling a little better. Even though I haven't had any credit alerts showing big balance changes for a few weeks, this morning two of my scores jumped up about 15-20 points. I am hoping to get into the 700s when all my cards are below 30% util.