- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Score seems to have plateaued for some time .....

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Score seems to have plateaued for some time .. Is age the only thing that i can do (i.e wait)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Score seems to have plateaued for some time .. Is age the only thing that i can do (i.e wait)

Trying to figure out what i have left to do to try to coax my score up .. its been stagnant for a bit..

Have 3% utilization... AZEO, a SSL, even have some savings and such put aside....

For example...

Any insight into things to try to nudge it?

-J

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score seems to have plateaued for some time .. Is age the only thing that i can do (i.e wait)

I'm in a spot rather like yours - my EX FICO 8 has basically been stuck around 697 all year. I'm pretty sure I know what's holding it back, though; first of all my 2014 BK, which won't vanish until 2024, then the overall age of my accounts*, then the accounts (all IIB) that still show up on my report as having lates though they should drop off in a few more years.

*My oldest account by far is my student loan, which was originally consolidated in 1994; all my other active accounts have been opened over the past two years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score seems to have plateaued for some time .. Is age the only thing that i can do (i.e wait)

TIme is what you need for it to grow. Best bet once your AAoA hits those key brackets you'll start seeing score increases. Depending on what yours is you'll see increases as your accounts age up the 6-7 year mark since it seems anecdotally you'll see minimal/no gains after that mark.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score seems to have plateaued for some time .. Is age the only thing that i can do (i.e wait)

What are the key brackets for AAoA? This is one area i'm not very knowledgable in...

Presuming 2 years is one.....

-J

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score seems to have plateaued for some time .. Is age the only thing that i can do (i.e wait)

I'll try to find the posts I've read on it. Best guess is every year starting from year 2 on i.e. 2 -> 3 -> 4 and so on til you reach 6-7 years you'll see score increases.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score seems to have plateaued for some time .. Is age the only thing that i can do (i.e wait)

@simplynoirI'll try to find the posts I've read on it. Best guess is every year starting from year 2 on i.e. 2 -> 3 -> 4 and so on til you reach 6-7 years you'll see score increases.

I know for a fact (at least on my profile) that 6.5 years is an AAoA threshold. If one half-year interval is a threshold, it would seem to me that others very well could be as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score seems to have plateaued for some time .. Is age the only thing that i can do (i.e wait)

@joltdudeTrying to figure out what i have left to do to try to coax my score up .. its been stagnant for a bit..

Have 3% utilization... AZEO, a SSL, even have some savings and such put aside....

Hi Jolt. Your age of accounts factors are definitely your constraint to score growth here. If you've already got clean reports (which you do based on your scores), are at AZEO and have installment loan utilization at < 8.9%, you're really doing all you can on your end to maximize score. I am a bit curious regarding your comment pointing to savings though, as I don't see what that has to do with your score? If you already shared them above and I missed them I apologize, but could you list out what your AoOA, AAoA and AoYA are?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score seems to have plateaued for some time .. Is age the only thing that i can do (i.e wait)

BBBs, if you need to go back and see the original post select the 'View discussion in a popup' while you are typing a reply (option only available while you are replying). It will open the thread you are responding to in a seperate window that will allow you to switch between windows. Or if you have the space or 2 monitors, side-by side.

I only figured this trick out recently.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score seems to have plateaued for some time .. Is age the only thing that i can do (i.e wait)

The advice to let your accounts age is good. Often people implicity mean some other things as well, which is to not apply for any new accounts, allow existing inquiries that are < 365 days old cross over to > 366, allow age of youngest account to cross to > 12 months, etc.

Here are the many factors that are helped by gardening:

AAoA

AoOA (Age of Oldest Account always increases as long as it is not a closed account that falls off).

AoYA (over 1 year will help you a good bit)

Percentage of your accounts that are > 1 year in age (even when your AoYA < 1, getting this percentage higher is still a help and it is not the same thing as AoYA)

Inquiries

I don't think we have a definite answer on whether your SSL is paid to under 8.99% and whether it is your only installment account (loans, car leases, etc.).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score seems to have plateaued for some time .. Is age the only thing that i can do (i.e wait)

@joltdude wrote:What are the key brackets for AAoA? This is one area i'm not very knowledgable in...

Presuming 2 years is one.....

-J

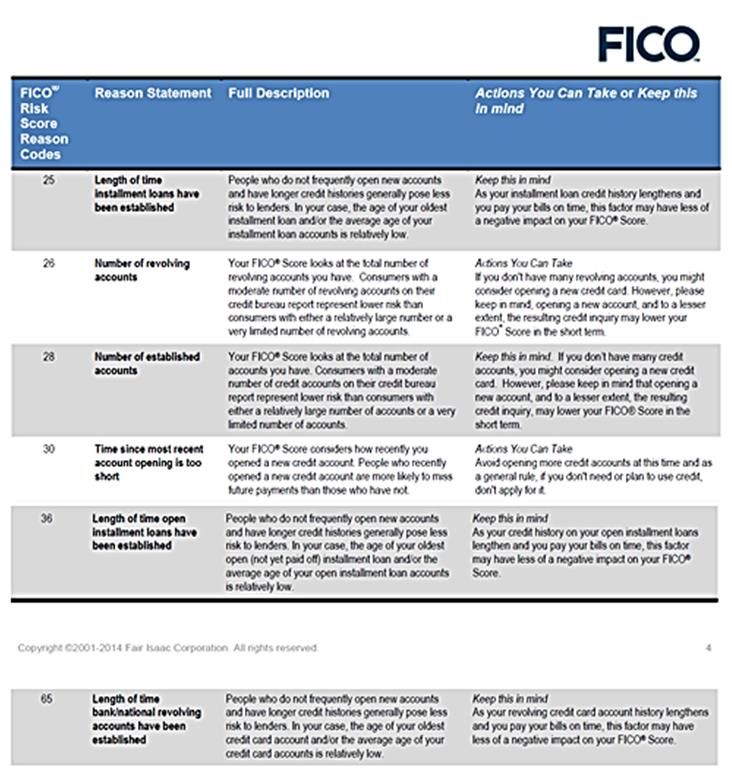

Indications are Fico looks at age factors for both installment accounts and revolving accounts separately. Fico also has reason codes that suggest age of installment loans are looked at open only vs all loans for age related attributes. The following age factors may come into play:

1) Age of file (oldest account on record) open or closed

2) Revolving credit history - AoYA, AAoA and AoOA

3) Installment credit history open - AoYA and AAoA

4) Installment credit history all accounts - AAoA and AoOA

Some milestones appear to be 3 months, 6 months, 12 months and 24 months. Look at your file specific to installment loans vs revolving credit. A "clean" scorecard ceiling under 800 could be caused by a aged 30 day late, lack of either an installment loan account or revolving account on file or a young file.

For example, if AoOA is under 5 years and AAoA is under 2 years that may hold score below 800 on a clean scorecard. This is particularly true if the file has AoYA an under 12 months and the file is thin.

In this case my guess is the score holdback might be associated with a low installment loan AoOA coupled with an AAAoA under 24 months. Unfortunately, given unknowns relating to file account details the cause quite speculative.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950