- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: ‘ Short Revolving History ‘ / ‘ Long Credit Hi...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

‘ Short Revolving History ‘ / ‘ Long Credit History ‘

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous Just real quick, I want to make sure that I am understanding the negative reason code "short credit history" (not "you have not establsihed a long revolving and/or open-ended account credit history") This involves AAoRA/AoORA and not overall AAoA?

When I click on the "?" for "short account history" this is what I see and it does not specifically state revolving/open-ended accounts, but I would like to be more certain:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous wrote:@Anonymous Just real quick, I want to make sure that I am understanding the negative reason code "short credit history" (not "you have not establsihed a long revolving and/or open-ended account credit history") This involves AAoRA/AoORA and not overall AAoA?

When I click on the "?" for "short account history" this is what I see and it does not specifically state revolving/open-ended accounts, but I would like to be more certain:

@Anonymous that is a AAoA and/or AoOA. But since AoOA is a segmenter, we know its AAoA.

then you have the one for AoORA and/or AAoRA. Then same for installment and then same for open installment. Ect.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous wrote:

@Anonymous wrote:@Anonymous Just real quick, I want to make sure that I am understanding the negative reason code "short credit history" (not "you have not establsihed a long revolving and/or open-ended account credit history") This involves AAoRA/AoORA and not overall AAoA?

When I click on the "?" for "short account history" this is what I see and it does not specifically state revolving/open-ended accounts, but I would like to be more certain:

@Anonymous that is a AAoA and/or AoOA. But since AoOA is a segmenter, we know its AAoA.

then you have the one for AoORA and/or AAoRA. Then same for installment and then same for open installment. Ect.

By the part bolded above, are you implying that a single characteristic can't be used for both scoring and segmentation?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Curious_George2 wrote:

@Anonymous wrote:

@Anonymous wrote:@Anonymous Just real quick, I want to make sure that I am understanding the negative reason code "short credit history" (not "you have not establsihed a long revolving and/or open-ended account credit history") This involves AAoRA/AoORA and not overall AAoA?

When I click on the "?" for "short account history" this is what I see and it does not specifically state revolving/open-ended accounts, but I would like to be more certain:

@Anonymous that is a AAoA and/or AoOA. But since AoOA is a segmenter, we know its AAoA.

then you have the one for AoORA and/or AAoRA. Then same for installment and then same for open installment. Ect.

By the part bolded above, are you implying that a single characteristic can't be used for both scoring and segmentation?

@Curious_George2 Yes, that is my belief.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

What about these?

* AoYA - segmenter in mortgage scores, and the source of the New Account reason.

* Number of accounts - segmenter for thick v. thin and the basis for Too Few or Too Many Accounts reason.

* Baddies - segementers for dirty scorecards and the source of several significant scoring penalties and reasons.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Curious_George2 wrote:What about these?

* AoYA - segmenter in mortgage scores, and the source of the New Account reason.

* Number of accounts - segmenter for thick v. thin and the basis for Too Few or Too Many Accounts reason.

* Baddies - segementers for dirty scorecards and the source of several significant scoring penalties and reasons.

@Curious_George2 AoYA is a segmenter for the mortgage scores, but a scoring factor for 8/9. I have not seen evidence of it being a scoring factor for 542 yet. Not saying it's not, but....

Number of Accounts is a Segmentation Factor in 8/9 indeed and this has bothered me, but I've only seen too many accounts as a reason for 5/4/2. Number of bankcards is a Scoring Factor for 8/9.

I have often wondered if 5/4/2 uses Number of Revolvers for Thick/thin?

I have never really considered baddies. There's always the possibility I'm wrong as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Curious_George2 The more I think about it, I don't think we could escape them doing double duty for dirty cards with the baddies.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

First scorecard segmentation is clean vs. dirty. This is what they mean by "baddies." No 60-day late in the past 2 years, no collections, judgements, liens, etc. moves you into clean. Then the clean segments a few more times. A 60-day late within 2 years or something worse brings you over to dirty cards and the segment into a few different categories as well.

Focusing just on the clean side, once you determine you are clean, next I believe is thick vs. thin. It is believed that 4 tradelines is often sufficient to be considered thick. So at this point, you might be clean & thick.

Next I believe is Mature vs. Young. The theory is that 3 yrs AoOA is mature for the newer versions (FICO 8, maybe 9) and 2 yrs is Mature for FICO 2/4/5 or the "mortgage scores." So at this point, you might be clean/thick/young (no derogs, more than 4 TLs and low AoOA), or clean/thin/mature (no derogs, few total tradelines, but at least account older than 2 or 3 years), or clean/thick/mature or clean/thin/young. Here, AoOA only segments you into a card, but doesn't add or subtract points. Once assigned to a card, AAoA then adds or subracts points, but AAoA isn't believed to segment.

The last segmentation is the age of your youngest account, which is AoYA. This varies by score type. I'm currently battling this one for mortgage scores and it is believed to be in the 17-18 month range. Other score versions are different. You can read the primer that a bunch of kind posters put together to get a more detailed rundown.

Finall

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

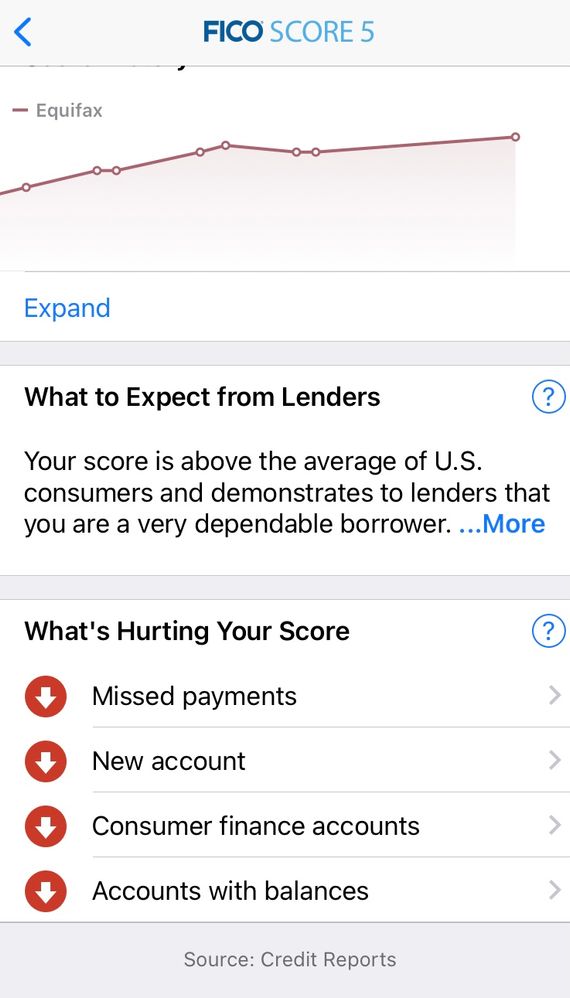

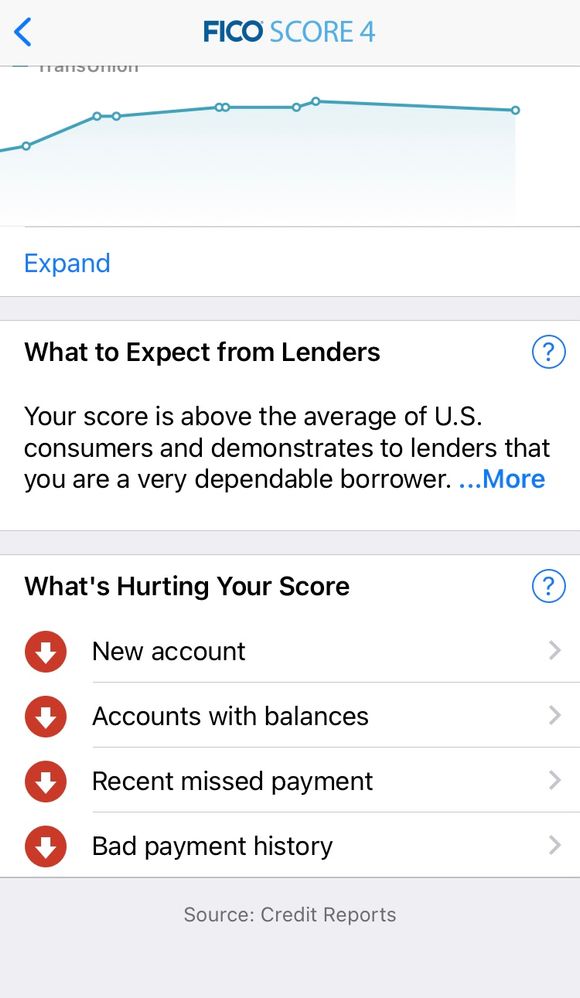

Agreed. Also, here's evidence that New Account is a scoring factor for two of the mortgage scores:

ETA: My "agreed" comment was directed at Birdman's post. I type too slowly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous wrote:First scorecard segmentation is clean vs. dirty. This is what they mean by "baddies." No 60-day late in the past 2 years, no collections, judgements, liens, etc. moves you into clean. Then the clean segments a few more times. A 60-day late within 2 years or something worse brings you over to dirty cards and the segment into a few different categories as well.

Focusing just on the clean side, once you determine you are clean, next I believe is thick vs. thin. It is believed that 4 tradelines is often sufficient to be considered thick. So at this point, you might be clean & thick.

Next I believe is Mature vs. Young. The theory is that 3 yrs AoOA is mature for the newer versions (FICO 8, maybe 9) and 2 yrs is Mature for FICO 2/4/5 or the "mortgage scores." So at this point, you might be clean/thick/young (no derogs, more than 4 TLs and low AoOA), or clean/thin/mature (no derogs, few total tradelines, but at least account older than 2 or 3 years), or clean/thick/mature or clean/thin/young. Here, AoOA only segments you into a card, but doesn't add or subtract points. Once assigned to a card, AAoA then adds or subracts points, but AAoA isn't believed to segment.

The last segmentation is the age of your youngest account, which is AoYA. This varies by score type. I'm currently battling this one for mortgage scores and it is believed to be in the 17-18 month range. Other score versions are different. You can read the primer that a bunch of kind posters put together to get a more detailed rundown.

Finall

@Anonymous very well said. The last segmentation point we have updated the nomenclature for recently. The older Scores segment on any new account < 18 months. The newer Scores segment on new revolvers or open ended accounts < 12 months. And it was me that put the Primer together with @Anonymous's wonderful assistance, but based upon personal & collective knowledge from the Community.

@Curious_George2 yes you are 100% correct that the mortgage scores segment on all new accounts.