- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: The Truth about Credit Card Utilization

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

The Truth about Credit Card Utilization

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Truth about Credit Card Utilization

@HeavenOhio wrote:

@OmarRwrote:Do store cards count towards the "minimum 3 cards for best score" rule?

Yes, with one caveat. On a few profiles, we've seen that if a store card is the one card to report a non-zero balance, the score isn't quite as high as when the non-zero balance is on a major card.

One other caveat....some store credit cards do not report to all 3 major CRA's, so if it only reports to one the other 2 CRA's would see it as no credit card usage.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Truth about Credit Card Utilization

@Anonymous wrote:Wish I could slam that post with 100 Kudos! Very very very awesome read! You hit a grand slam sir!

Now, if by chance youre still around these parts - TU 669 99%/95% utlization on 2 cards....Just paid both off leaving balances at $50 or so on each $1k limit card.... No derogs, lates, negs. something like 6 year AAOA...

What will i see tomorrow in way of a score jump? The Myfico simulator says 669 > 799, have a guess for me?

It will jump quite a bit, but I don't think it will be 130 pts, maybe half of that. I believe the simulator on default set, is over 24 months, thus aging the accounts another two years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Truth about Credit Card Utilization

By default it is set to 24 months , but once you slide the payment amount the months revert down to 1 month. Im ok being at a 750 but 800 is the goal and never looking back. I'll update so people can make use of my info.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Truth about Credit Card Utilization

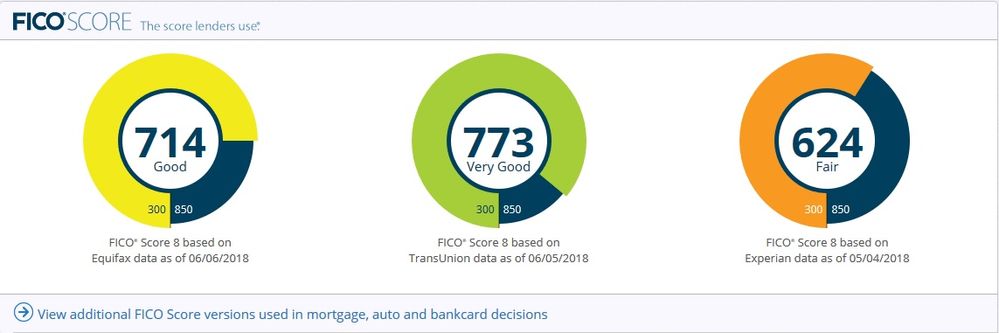

There is the results of paying UT down to 8%/3% on 2 cards..

One more bureau to update!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Truth about Credit Card Utilization

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Truth about Credit Card Utilization

99%/95% utlization on the 2 cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Truth about Credit Card Utilization

Well after having spent just over a year in the garden...I suspect I have blown my score this month badly. I had about 3500 loan on my 3 wheel goldwing that I paid off to get the title. I then took out a discover personal loan for 3500 to replinish the depleted checking account. I have now made 1 payment on this of 108.14 plus an extra 50 bucks. Then I recieved a credit card offer for Bank of America for 18 month 0 fee 0 interest on balance transfers and purchases...so I applied, instant approval for 7000. Transferred 3300 of the discover loan to it, and will pay the rest of the discover loan off by July 6 due date....less than 100 dollars. So in 2 months I will have closed a secured installment account, opened an unsecured installment loan, closed that installment loan, opened a new credit card with 7000 limit and transferred 3300 to it. Also 2 hard pulls. No idea how many points all this will knock off my 825+ credit scores. What do you guys think. On a good note, I now have title to the wing and the money owed on it is now at 0% interest for 18 months, and not even a transfer fee. Will set that card at 200 per month auto pay and sd the card since it has absolutely no rewards.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Truth about Credit Card Utilization

Sarge, what was your AoYA prior to the new recent accounts?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Truth about Credit Card Utilization

@Anonymous wrote:Sarge, what was your AoYA prior to the new recent accounts?

BBS...about 1 year and 1 month....I just had gotten my 1 yr spade in the garden a few weeks before I decided to pay off the 3 wheeler. I could have just withdrawn it from my 401k, but that might make me pay taxes on too much of my social security, so I went this route. I just wanted a clear title in case I decide to sell the goldwing. I never rode it once last summer, and have only ridden it once so far this year. Being disabled does not prevent me from riding, it just prevents it from being enjoyable.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Truth about Credit Card Utilization

@sarge12 wrote:Well after having spent just over a year in the garden...I suspect I have blown my score this month badly. I had about 3500 loan on my 3 wheel goldwing that I paid off to get the title. I then took out a discover personal loan for 3500 to replinish the depleted checking account. I have now made 1 payment on this of 108.14 plus an extra 50 bucks. Then I recieved a credit card offer for Bank of America for 18 month 0 fee 0 interest on balance transfers and purchases...so I applied, instant approval for 7000. Transferred 3300 of the discover loan to it, and will pay the rest of the discover loan off by July 6 due date....less than 100 dollars. So in 2 months I will have closed a secured installment account, opened an unsecured installment loan, closed that installment loan, opened a new credit card with 7000 limit and transferred 3300 to it. Also 2 hard pulls. No idea how many points all this will knock off my 825+ credit scores. What do you guys think. On a good note, I now have title to the wing and the money owed on it is now at 0% interest for 18 months, and not even a transfer fee. Will set that card at 200 per month auto pay and sd the card since it has absolutely no rewards.

To recap you went from no new accounts under 12 months to adding 3 new accounts (2 CCs and a personal loan). The personal loan is now closed and you have no open loans on file. Your AAoA certainly will drop but, we don't know the before/after ages at this time. Your individual card utilization is $3300/$7000, about 47%. That will impact your score some as well. Aggregate UT% is still quite low so no impact there. Not sure how your 3 inquiries were distributed among the CRAs.

Just a wild guess - I'd put your score in the 785 range +/- 10 points depending on CRA.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950