- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- This can't be possible...My balance increases and ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

This can't be possible...My balance increases and THIS!?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This can't be possible...My balance increases and THIS!?

When was the last time you had a reported balance on the card?

I wouldn't think a dormant card reporting a balance would result in a 14 point gain in and of itself. Maybe others can comment on that. If it does in fact count, there's got to be some sort of limit (like one) time that can happen.

For example, if someone has 14 open credit cards, 7 of which have been dormant and they switch from having tiny reported balances on their usual 7 to having identical tiny reported balances on the dormant 7 (thus still remaining at 50% of accounts with balances) someone with a 752 Fico score isn't going see their Fico score max out at 850 due to a 98 point gain from 7 dormant accounts becoming active. Conversely, if this person had an 850 score and 7 accounts of theirs became dormant, their score isn't going to drop to 752.

I could see this being more of an issue on a single card file or a file with just a couple of cards, but looking at your info it doesn't appear that's the case for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This can't be possible...My balance increases and THIS!?

@PutThatMoneyOnTheTable wrote:

@Anonymous wrote:

@PutThatMoneyOnTheTable wrote:I got a decent bump recently for increased usage of an inactive card.

@PutThatMoneyOnTheTable tell us more please

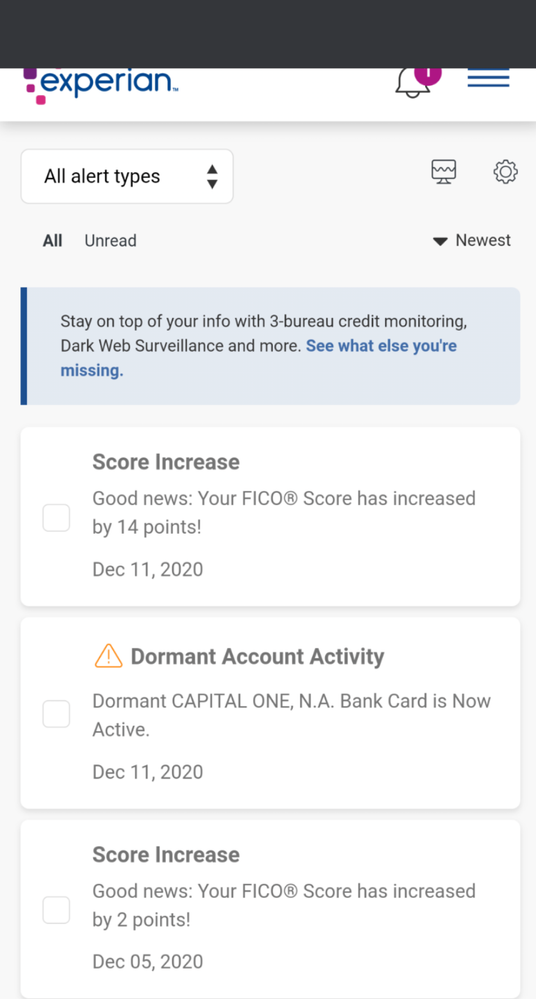

I'm a little late with the update but this is a screenshot from Ex. Cap 1, although used monthly, have never reported a balance for 2020. They switched up the statement date on me and $117 got reported ($850 CL). Nothing else changed on my report.

@PutThatMoneyOnTheTable are there any other changes that happened on that day because that does seem quite peculiar.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This can't be possible...My balance increases and THIS!?

Right, also worth noting that 6 days elapsed between the two alerts pictured... so other score-impacting but non-alertable changes may have happened during that time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This can't be possible...My balance increases and THIS!?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This can't be possible...My balance increases and THIS!?

@Anonymous wrote:Right, also worth noting that 6 days elapsed between the two alerts pictured... so other score-impacting but non-alertable changes may have happened during that time.

The alert on the 5th was due to me BOA reporting zero, a decrease from $10 that was reported the month prior. The next card to report is the capital one which is around the 8th or 9th. All my other cards close end of the month ( between 22nd and 28th). I'm not yet at the 5 year aging threshold, IIRC I'm 4yrs 4mths.

Chase FU $19.6k

BOA Cash Rewards $36k

BJs Perks Plus M/C $22k

Cap1 QS $4,950 (AU)

Best Buy $4k

Wells Fargo Active Cash $11.3

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This can't be possible...My balance increases and THIS!?

The only significant thing that happened was the cap 1 reporting a balance. The last time it reported a balance was mid 2019

Chase FU $19.6k

BOA Cash Rewards $36k

BJs Perks Plus M/C $22k

Cap1 QS $4,950 (AU)

Best Buy $4k

Wells Fargo Active Cash $11.3

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This can't be possible...My balance increases and THIS!?

Anyone else have opinions on this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This can't be possible...My balance increases and THIS!?

@PutThatMoneyOnTheTable how many cards were reporting a balance? What that the only one?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This can't be possible...My balance increases and THIS!?

Question was the card being updated monthly?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This can't be possible...My balance increases and THIS!?

@Anonymous wrote:@PutThatMoneyOnTheTable how many cards were reporting a balance? What that the only one?

Total of 5 cards and my amex and BJs always reports a balance. BJs reported a balance of $142 and Amex was $42. BOA and Chase had a balance of $0. No new inquiry or account.

Chase FU $19.6k

BOA Cash Rewards $36k

BJs Perks Plus M/C $22k

Cap1 QS $4,950 (AU)

Best Buy $4k

Wells Fargo Active Cash $11.3