- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Those with an 850 score, please provide DPs!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Those with an 850 score, please provide DPs!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

Please do update what happens -- I keep a lot of data from a lot of people so I can finally once and for all break down the FICO algorithm just throwing s__t at the wall until everything sticks in patterns, lol.

I have very very little data points from those in the 800s. Most of my data points are from people with junk credit because that's who looks to make it better, usually. But once they get into the 700s, the data points stop (common here at the forums because people disappear once they "fix" it enough, with a percentage returning in 2 years when their lessons weren't learned).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

@Anonymous wrote:

@marty56 wrote:So it seems 850 is the new 760.

I disagree. To me, it seems 720 is the new 760. I keep reading about people on here getting approved with top notch rates on loans/mortgages with scores in the low 700's.

Credit (score) goals are all relative and situational. Few if any people start out with a goal of 850. First goal may be 700. Once achieved perhaps it's 750. Then 800. I think those with an 850 goal are people with scores already nearing 850 and they're simply wanting to see a perfect score for S&Gs. The end goal is always excellent credit, but it's accomplished in increments, much the way a touchdown drive is achieved by moving the sticks and getting a new set of downs several times.

When my scores were in the 600's not so long ago, I was super geeked when I crossed the 700's. Next goal was to get 700's across the board, then 760's, and now 800's across the board. But also the focus on which scoring model changes. Although I love my Fico 8 scores, I'm more currently interested in my mortgage scores - where a 740 or above across the board would just make me happy - and a 760 or higher across the board is the ultimate as far as I'm concern.

Personally, I never thought I could reach 850 on any of the CBs. My highest past Fico 8 score that I'm aware of was 760. My initial goal when joining this community was simply to get back to where I was before. Now I've surpassed that score on all three CBs, I've caught the myfico score chasing bug I guess. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

@Anonymous wrote:Please do update what happens -- I keep a lot of data from a lot of people so I can finally once and for all break down the FICO algorithm just throwing s__t at the wall until everything sticks in patterns, lol.

I have very very little data points from those in the 800s. Most of my data points are from people with junk credit because that's who looks to make it better, usually. But once they get into the 700s, the data points stop (common here at the forums because people disappear once they "fix" it enough, with a percentage returning in 2 years when their lessons weren't learned).

Will do. I love this community and I think it's one of the rarest treasures on the web! Truely!

Work life keeps me fairly busy nowadays, but this site is a mainstay as far as I'm concern. So much more that can be gleaned from this site outside of increasing one's score. My involvement comes in spurts due to busy life, but the moment I get some free time, this community is my first stop, so to speak. ![]()

I'm certainly entering the next-phase of my financial and personal security and growth and will be using this site every step of the way and will gladly share datapoints, or even help figure out possible breakpoints for mortgage, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

LOTR, do you use WalletHub by chance? If not, I highly recommend it, as it's a free service. You'll get daily updates to your TU file, so you could check daily to see if a negative item drops off that you are expecting to see come off any day. At the time you see it come off from WH you could then go ahead and pull your 3B reports.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

@Anonymous wrote:LOTR, do you use WalletHub by chance? If not, I highly recommend it, as it's a free service. You'll get daily updates to your TU file, so you could check daily to see if a negative item drops off that you are expecting to see come off any day. At the time you see it come off from WH you could then go ahead and pull your 3B reports.

WalletHub has been acting goofy since November, saying it did a pull today but certainly did not as the data was something 5 days old for sure!

I have a revolving calendar of free daily pulls on TU:

- Mondays, Credit Karma TU/EQ VantageScore -- sometimes they update more than weekly

- Tuesdays, WalletHub TU -- supposed to be daily, but sometimes data isn't fresh

- Wednesdays, Chase Credit Journey -- TU, not a complete report picture but decent overview

- Thursdays, CreditWise -- TU Vantage Score from Capital One

- Fridays, NerdWallet -- TU with very nice charts and graphs

Monthly:

- Credit.com -- free monthly EX Vantage Score with a pretty nice looking website

- FreeCreditScore.com -- free EX FICO 8, I try to do this around the 8th of each month

- CreditScoreCard.com -- free EX FICO 8, I try to do this around the 22nd of each month

- CreditSesame -- free monthly TU VantageScore, these guys have the most useless website, the worst spam and in general are useless, clueless and irrelevant

- CreditCards.com -- cardmatch can be useful for finding SUB deals, monthly TU VantageScore with a decently laid out site

- CreditSoup.com -- haven't tried it

- QLCredit.com -- haven't tried it

Quarterly:

- Quizzle.com -- free quarterly TU Vantage Score, useless site but I like their renderings

So if you want a daily TU pull other than wallethub, just schedule out your free pulls elsewhere. I wrote a little webscript that will check the day of the week and automatically load the proper site when I open my browser, lolol. Works great, takes 10 seconds when I start my day.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

@Anonymous wrote:LOTR, do you use WalletHub by chance? If not, I highly recommend it, as it's a free service. You'll get daily updates to your TU file, so you could check daily to see if a negative item drops off that you are expecting to see come off any day. At the time you see it come off from WH you could then go ahead and pull your 3B reports.

No...but just signed up. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

@Anonymous wrote:

@Anonymous wrote:LOTR, do you use WalletHub by chance? If not, I highly recommend it, as it's a free service. You'll get daily updates to your TU file, so you could check daily to see if a negative item drops off that you are expecting to see come off any day. At the time you see it come off from WH you could then go ahead and pull your 3B reports.

WalletHub has been acting goofy since November, saying it did a pull today but certainly did not as the data was something 5 days old for sure!

I have a revolving calendar of free daily pulls on TU:

- Mondays, Credit Karma TU/EQ VantageScore -- sometimes they update more than weekly

- Tuesdays, WalletHub TU -- supposed to be daily, but sometimes data isn't fresh

- Wednesdays, Chase Credit Journey -- TU, not a complete report picture but decent overview

- Thursdays, CreditWise -- TU Vantage Score from Capital One

- Fridays, NerdWallet -- TU with very nice charts and graphs

Monthly:

- Credit.com -- free monthly EX Vantage Score with a pretty nice looking website

- FreeCreditScore.com -- free EX FICO 8, I try to do this around the 8th of each month

- CreditScoreCard.com -- free EX FICO 8, I try to do this around the 22nd of each month

- CreditSesame -- free monthly TU VantageScore, these guys have the most useless website, the worst spam and in general are useless, clueless and irrelevant

- CreditCards.com -- cardmatch can be useful for finding SUB deals, monthly TU VantageScore with a decently laid out site

- CreditSoup.com -- haven't tried it

- QLCredit.com -- haven't tried it

Quarterly:

- Quizzle.com -- free quarterly TU Vantage Score, useless site but I like their renderings

So if you want a daily TU pull other than wallethub, just schedule out your free pulls elsewhere. I wrote a little webscript that will check the day of the week and automatically load the proper site when I open my browser, lolol. Works great, takes 10 seconds when I start my day.

Thanks for sharing these! My signing up for WalletHub is a bit overkill right now considering I have 1) monthly PAID 3B subscription here on myfico.com, 2) monthly PAID 3B subscription on USAA - nice thing about this is it is a daily pull, but I've found discrepancies with what is on screen vs. what is on the generated pdf report 3) free monthly update for Fico 8 score with Amex (EX), Citi/Costco (EQ), and Discover (TU).

After this month, I'm going to discontinue my USAA 3B subscription, so having a free daily outlet will be nice. For now, I'm keeping the myFico 3B subscription because it provides multiple scoring models for what I consider a very good price.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

@Anonymous wrote:I just found out I reached 850 on EX Fico 8:

I don't think my datapoints meets the 'less than perfect' criteria you're looking for, but you may/may not still be interested in the datapoints.

Datapoints (from EX free report website):

- Open Credit Cards: 7

- Open Retail Cards: 1

- Open Real Estate Loans: 0

- Open Installment Loans: 1

- SSL opened in 12/2016 - paid down as per instructions from myFico.com

- Accounts Ever Late: 0

- Collections Accounts: 0

- Time Since Negative: Never

- Average Account Age: 10 Years 1 Month

- Oldest Account 22 Years 3 Months

- Latest Open account: 1 yr

- Late Payments: 0

- Collections: 0

- Negative Public Records: 0

- Revolving Util %: 1%

- Actually <1%

- Accounts with balances: 2

- SSL and one revolving has a balance

- Inquiries in Last yr: 0

- note: 2 inquiries are listed on the report that are due to be deleted in Nov. 2018

Also, something that may be of interest -

EX just removed two 30-day lates from one account (my only baddies on EX) that were due to fall off the report in Feb and March of 2018. Prior to these two 30-day lates being deleted, my EX Fico 8 score was 810.

I haven't pulled my Fico 3B reports this month yet, so I'm assuming that EX will reflect the same score when I do.

Nice data point: 2 aged 30 day lates removed and Fico 8 score goes from 810 => 850. This along with ABCD's data certainly support the hypothesis that 820 is achievable with one aged 30 day late on file. Furthermore, it suggests that a profile with an aged 30 late can be on a lower tier "clean" scorecard which may have a ceiling score around 820-825.

Fico does allow "non serious or mild delinquencies" in their clean scorecard segmentation:

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

@Thomas_Thumb wrote:

Nice data point: 2 aged 30 day lates removed and Fico 8 score goes from 810 => 850. This along with ABCD's data certainly support the hypothesis that 820 is achievable with one aged 30 day late on file. Furthermore, it suggests that a profile with an aged 30 late can be on a lower tier "clean" scorecard which may have a ceiling score around 820-825.

Fico does allow "non serious or mild delinquencies" in their clean scorecard segmentation:

^^^ that being said, this may be a bit interesting to you:

The account with the lates orignally had three 30-day lates (11/2010, 02/2011, and 03/2011):

July 2017:

809 EX Fico 8 score.

11/2010, 02/2011, and 03/2011 30-day lates listed on the EX CR.

Aug. 2017:

809 EX Fico 8 score.

The 11/2010 30-day late was automatically deleted from the EX CR.

The 02/2011and 03/2011 30-day lates were listed on the EX CR.

Sept. 2017:

809 EX Fico 8 score.

The 02/2011 and 03/2011 30-day lates were listed on the EX CR.

Oct. 2017:

809 EX Fico 8 score.

The 02/2011 and 03/2011 30-day lates were listed on the EX CR.

Nov. 2017:

810 EX Fico 8 score.

The 02/2011 and 03/2011 30-day lates were listed on the EX CR.

5 CCs turned 1 yrs old this month.

1 INQ turned over 1 yrs old this month

Dec. 20th, 2017:

850 EX Fico 8 score.

The 02/2011 and 03/2011 30-day lates were deleted from the CR.

1 additional INQs turned over 1 yrs old this month.

1 additional CC turned 1 yrs old this month.

[edited]: corrected 840 to 850

Hope that helps!

Life happens. Adjust accordingly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

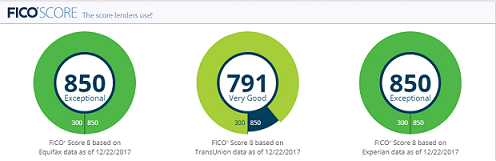

...more datapoints. I just reached 850 on EQ yesterday! (whoo hoo!)

Since I did not get any myfico alerts when the one remaining 30-day late was removed from my EQ CR earlier this month, I don't know what my EQ score was immediate after it was removed. However, EQ finally deleted my state tax lien and my 3B Fico 8 scores are now:

The TU Fico 8 score of 791 reflects two 30-day lates (my only baddies). I expect them to fall off the CR in Jan and Feb 2018 at the latest.

Also, going into the month of Dec, EQ Fico 8 score was 775 reflecting one state tax lien and one 30-day late.

Life happens...Adjust accordingly.