- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Total credit limits go down, TU FICO 8 goes up

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Total credit limits go down, TU FICO 8 goes up

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Total credit limits go down, TU FICO 8 goes up

@iv wrote:

@SouthJamaica wrote:

As noted above, it wasn't excluded from the TU report, and the particulars were reported accurately, so there is no reason to think it was 'completely excluded' from scoring.Excluded from scoring isn't the same thing as disappearing from the report.

It's well known, for instance, that an account under dispute status may be displayed on a report, but not included in scoring.

I'm suggesting that whatever status indicator your "suspended" account had may have been treated in the same way - excluding it temporarily from scoring. (And thus raising your effective AAoA for scoring purposes briefly.)

It wouldn't have affected my average age of accounts by more than half a month, and not near any thresholds.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 689 TU 684 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Total credit limits go down, TU FICO 8 goes up

It may have influenced other aging factors, namely Age of Youngest as well, or whatever the new accounts reason code looks at beyond that.

There are some patterns in FICO which we don't fully understand, and we know new accounts have an effect on the reason codes and probably scorecard assignment (not sure if that's utterly nailed down yet) and wouldn't surprise me if you fell into this sort of rabbit hole.

I agree with iv, suspended probably is similar to dispute in the sense that something is off with the tradeline and therefore it makes sense to exclude it from the scoring algorithm. Exactly why that would make a difference I don't know, would be interesting to see if reason codes shifted.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Total credit limits go down, TU FICO 8 goes up

@Revelate wrote:It may have influenced other aging factors, namely Age of Youngest as well, or whatever the new accounts reason code looks at beyond that.

There are some patterns in FICO which we don't fully understand, and we know new accounts have an effect on the reason codes and probably scorecard assignment (not sure if that's utterly nailed down yet) and wouldn't surprise me if you fell into this sort of rabbit hole.

I agree with iv, suspended probably is similar to dispute in the sense that something is off with the tradeline and therefore it makes sense to exclude it from the scoring algorithm. Exactly why that would make a difference I don't know, would be interesting to see if reason codes shifted.

It didn't affect age of youngest account.

It didn't affect average age of accounts.

If it were being treated as a dispute, the score would have gone down not up.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 689 TU 684 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Total credit limits go down, TU FICO 8 goes up

Does exclusion of the suspended account affect # of open accounts under 12 months age?

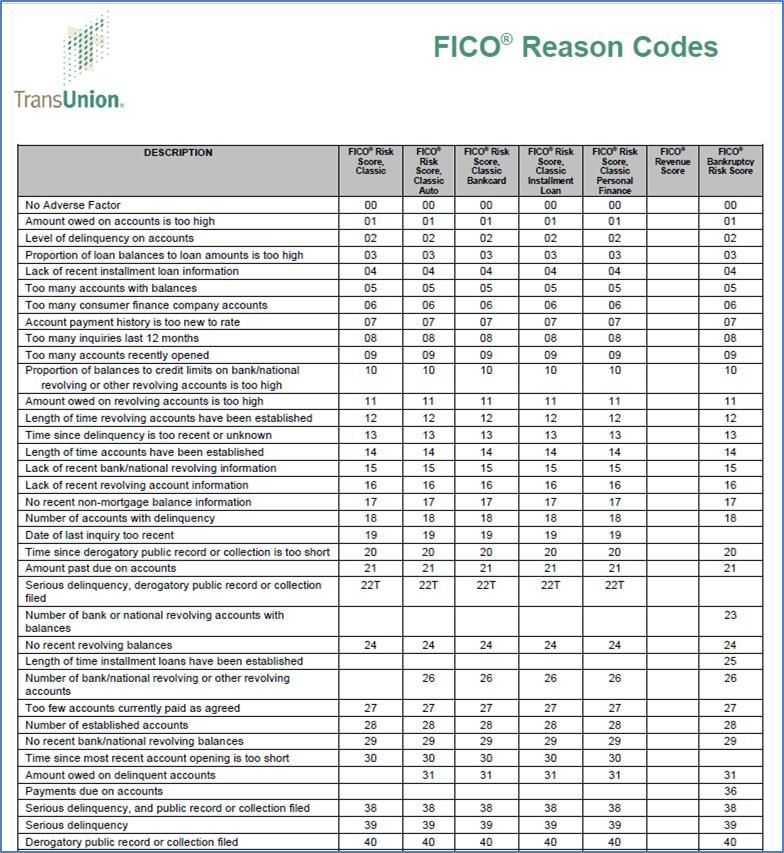

Reason for the question is Fico has a negative code: "too many accounts recently opened". Not sure how many "too many" is - could be profile dependent or what "recently" is defined as ( 3 months, 6 months or 12 months). Perhaps your card being suspended dropped count below some threshold (code 09)

https://www.nationalcrimesearch.com/wp-content/uploads/forms/FICOReasonCodes.pdf

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Total credit limits go down, TU FICO 8 goes up

@Thomas_Thumb wrote:Does exclusion of the suspended account affect # of open accounts under 12 months age?

Reason for the question is Fico has a negative code: "too many accounts recently opened". Not sure how many "too many" is - could be profile dependent or what "recently" is defined as ( 3 months, 6 months or 12 months). Perhaps your card being suspended dropped count below some threshold.

The account is 9 months old.

I don't see why it would be excluded as an account recently opened. The remark was "credit line suspended" not "account suspended". Even if the account had been marked as suspended, or even as closed, it would still have been "recently opened".

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 689 TU 684 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Total credit limits go down, TU FICO 8 goes up

As others have mentioned, an account in dispute is utterly ignored. Perhaps the suspended account where an error was made is being treated as such for the time being. Again, this is speculation. Based on the limited data you have provided, that's the best anyone can do.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Total credit limits go down, TU FICO 8 goes up

@Thomas_Thumb wrote:As others have mentioned, an account in dispute is utterly ignored. Perhaps the suspended account where an error was made is being treated as such for the time being. Again, this is speculation. Based on the limited data you have provided, that's the best anyone can do.

My speculation is that TU FICO 8 rewarded me for having 20k less in credit limit.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 689 TU 684 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Total credit limits go down, TU FICO 8 goes up

@SouthJamaicaMy speculation is that TU FICO 8 rewarded me for having 20k less in credit limit.

My first reaction to your statement above is that it's nonsense, but just for the sake of conversation what was your before/after TCL... meaning your TCL with the $20k included verses your TCL with the $20k ignored/suspended from calculation? Perhaps this before/after crosses a threshold of some sort at $500k (say) and a penalty imposed at $500k for being too high gets lifted. Super big stretch there, but just talking it out. TT, are there any negative reason codes that point to TCL being too high?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Total credit limits go down, TU FICO 8 goes up

@Anonymous wrote:are there any negative reason codes that point to TCL being too high?

Only on FICO NextGen (A2 - "Amount of credit available on revolving accounts"), but not on any of the FICO Classic reason code lists.

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Total credit limits go down, TU FICO 8 goes up

@Anonymous wrote:

@SouthJamaicaMy speculation is that TU FICO 8 rewarded me for having 20k less in credit limit.

My first reaction to your statement above is that it's nonsense, but just for the sake of conversation what was your before/after TCL... meaning your TCL with the $20k included verses your TCL with the $20k ignored/suspended from calculation? Perhaps this before/after crosses a threshold of some sort at $500k (say) and a penalty imposed at $500k for being too high gets lifted. Super big stretch there, but just talking it out. TT, are there any negative reason codes that point to TCL being too high?

@I know the MyFICO TU alert is not necessarily determinative, @Anonymous, but all it said was "all bankcard accounts total credit limits decreased". It said nothing about the account status. So although my guess may be wrong, I don't think it's necessarily nonsense.

Meanwhile, in your "super big stretch" you may well be on to something

Looking only at the reporting bankcard accounts, it would be:

before 403400

after 383400.

So maybe having more than 400k in total credit limits is a negative for my profile, and getting below was a positive.

Now if I only I could isolate this next month when TU has the info corrected.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 689 TU 684 EX 682