- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: bureau delay? or odd experience

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: bureau delay? or odd experience

Let a small balance report and you’ll get your points back.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: bureau delay? or odd experience

https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/General-Scoring-Primer-and-Version-8-Mas...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: bureau delay? or odd experience

@Anonymous wrote:

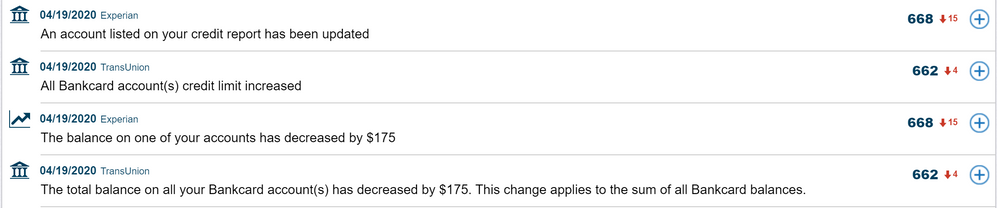

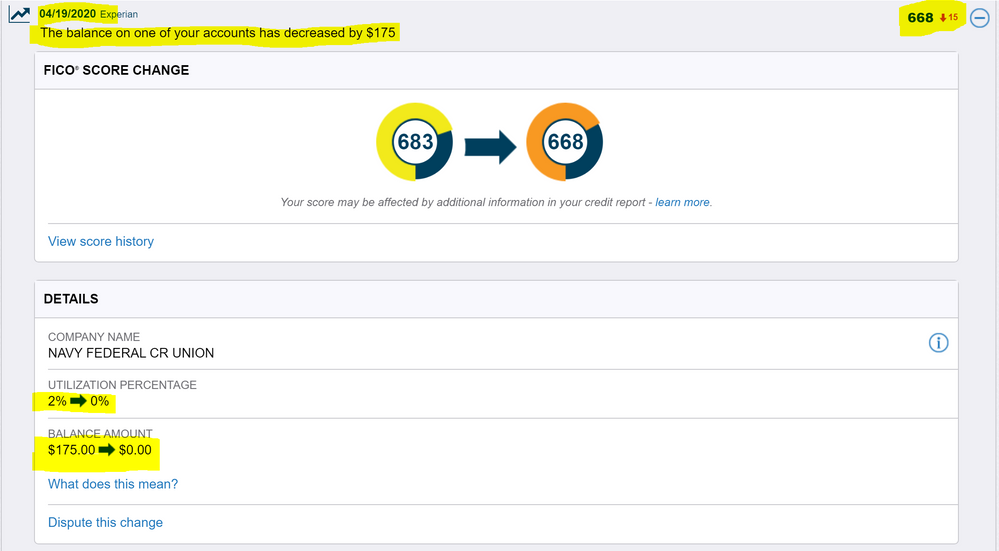

@TekkenQQ7Mystery solved a AU AZ penalty!

Let a small balance report and you’ll get your points back.

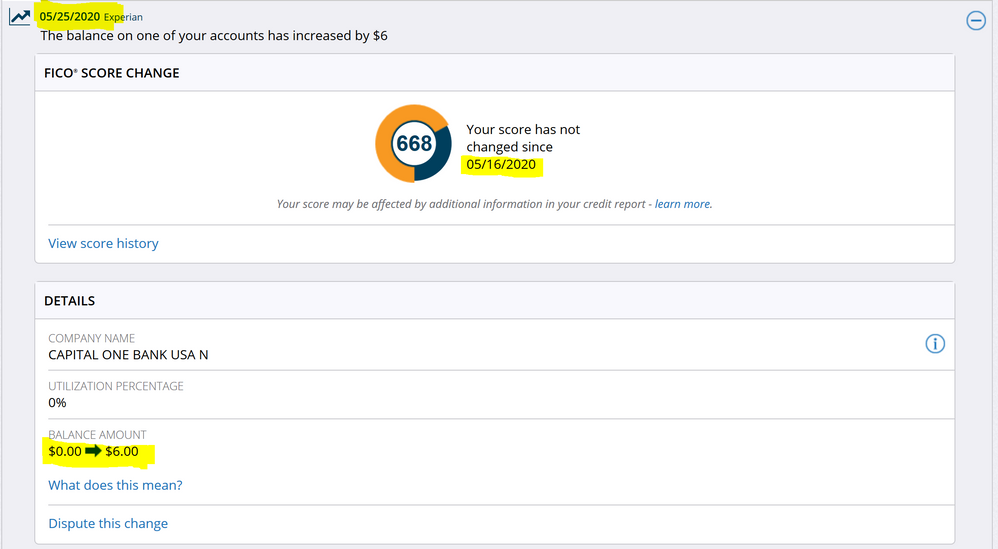

@AnonymousSad to say, but I did let another card to report $6 balance as you see in the pic, but no increase. Thanks for your time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: bureau delay? or odd experience

Your points will return when an authorized user card reports a balance while you still have a balance on at least one of your primary cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: bureau delay? or odd experience

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: bureau delay? or odd experience

@Anonymous wrote:

The authorized user accounts and primary accounts are looked at independently. If all cards in either set report zero balances, there is a penalty which is reversed when a balance appears on one of those in each set again.

@Birdman7 If I remove myself from the AU card, do you think I should get my points back? if that's the case I will be happy to do so.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: bureau delay? or odd experience

@elixerinI do apologize for posting here, I didn't mean to jump your post but I will be happy to start a new one if you want.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: bureau delay? or odd experience

@TekkenQQ7 wrote:

@Anonymous wrote:

The authorized user accounts and primary accounts are looked at independently. If all cards in either set report zero balances, there is a penalty which is reversed when a balance appears on one of those in each set again.If I remove myself from the AU card, do you think I should get my points back? if that's the case I will be happy to do so.

@TekkenQQ7 Yes you would, but there may be other consequences.

First, if you remove yourself then if the OC doesn't remove it from the report, then you have to dispute it off, which it is the easiest dispute there is. So no big deal there.

But scorewise it would reduce aggregate CL, so if that caused you to cross any thresholds that could affect score. It would also remove it from aging metrics, so that could affect scores if it causes you to cross any thresholds.

How many cards do you have on your credit report open and closed? Because if you've got a very small number, it could potentially affect score a little, but if you've got a old thick file and plenty of credit limit, yeah you're good, you can just remove it and you should get your points back.

But if you've got a really young thin file and this card is helping your age or if you have insufficient credit limit and this is helping you as a cushion, then you may not want to remove it because it could adversely affect score for those reasons.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: bureau delay? or odd experience

@Anonymous wrote:

@TekkenQQ7 wrote:

@Anonymous wrote:

The authorized user accounts and primary accounts are looked at independently. If all cards in either set report zero balances, there is a penalty which is reversed when a balance appears on one of those in each set again.If I remove myself from the AU card, do you think I should get my points back? if that's the case I will be happy to do so.

@TekkenQQ7 Yes you would, but there may be other consequences.

First, if you remove yourself then if the OC doesn't remove it from the report, then you have to dispute it off, which it is the easiest dispute there is. So no big deal there.

But scorewise it would reduce aggregate CL, so if that caused you to cross any thresholds that could affect score. It would also remove it from aging metrics, so that could affect scores if it causes you to cross any thresholds. I just closed ollo -$2000 will see if that will put me back to my previous threshold.

How many cards do you have on your credit report open and closed? Because if you've got a very small number, it could potentially affect score a little, but if you've got a old thick file and plenty of credit limit, yeah you're good, you can just remove it and you should get your points back.

But if you've got a really young thin file and this card is helping your age or if you have insufficient credit limit and this is helping you as a cushion, then you may not want to remove it because it could adversely affect score for those reasons.

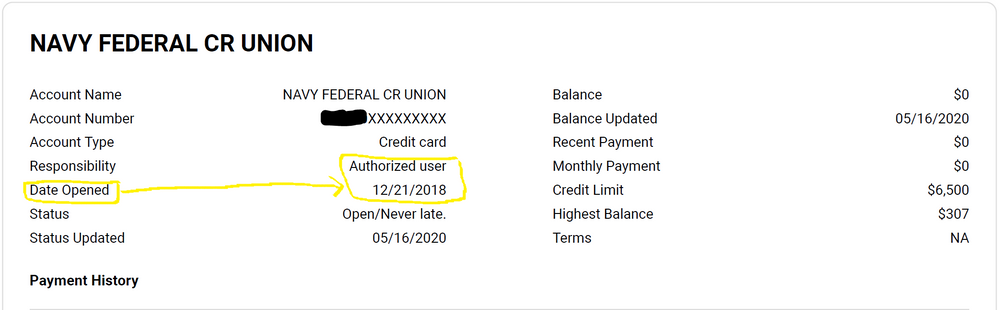

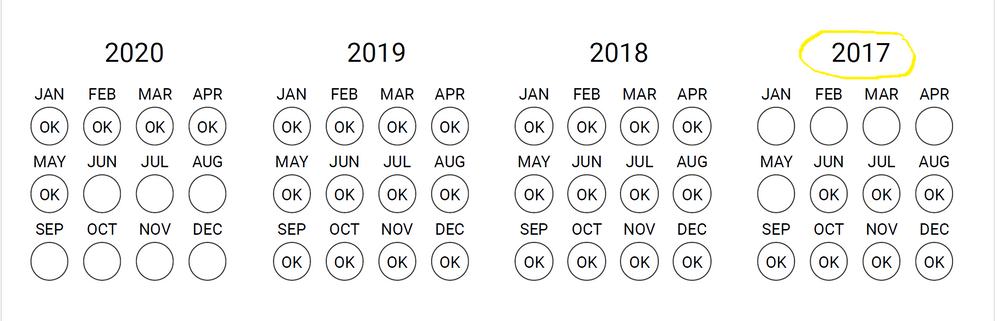

@AnonymousI looked deep into my credit report and find out that NAVY backed my reporting to 2007 when I had my own card. By the way, I am an AU under my DW's Acc. Look at the pics I Attatched. Thank you so much for your help, I know this subject is your specialty and any help to understand will be appreciated.