- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Chase Bank, how I covet thee 5/24 CC!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase Bank, how I covet thee 5/24 CC!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Bank, how I covet thee 5/24 CC!

I'm not sure where the "they dont use that information for credit cards" is coming from.

They will use any and all information available to them. In my case, that was both Providian and WaMu

Whether they got over it or not, is whole another story.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Bank, how I covet thee 5/24 CC!

@Remedios wrote:I'm not sure where the "they dont use that information for credit cards" is coming from.

They will use any and all information available to them. In my case, that was both Providian and WaMu

Whether they got over it or not, is whole another story.

With the information I am getting here, I suspect my course of action will be to apply and if I am denied either recon or wait for the AA letter to arrive for the reason(s) for denial.

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Bank, how I covet thee 5/24 CC!

@Medic981 wrote:

@Remedios wrote:I'm not sure where the "they dont use that information for credit cards" is coming from.

They will use any and all information available to them. In my case, that was both Providian and WaMu

Whether they got over it or not, is whole another story.

With the information I am getting here, I suspect my course of action will be to apply and if I am denied either recon or wait for the AA letter to arrive for the reason(s) for denial.

Lets hope you get approved and those extra steps are unnecessary

I was just letting you know that info is available to them in most cases, but what they do with it is something that only application answers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Bank, how I covet thee 5/24 CC!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Bank, how I covet thee 5/24 CC!

@Medic981 wrote:

@Anonymous wrote:

Your lucky because I was in a similar situation as yours. I defaulted on a WaMu credit card 10 years ago. It’s obviously not on my credit report anymore, but, CHASE does have it on their own records. I know this for a fact, because I was applying for a SBA loan through them, and they will not approve it because of it. However, last week I did get the Amazon Prime card from Chase. They DONT use that old information for their cards, but absolutely do for SBA loans. So you can apply, that WaMu won’t hurt you now. Also, Chase told me if the WaMu card was less than 4K, they don’t care also. Mine was 5k! Doah! So literally I will never ever be able to get a business loan from them, even 30 years from now, but CC are different.Thank you. That bit of info has lifted a weight off my shoulders. My WaMu card had a $1000 CL and I don't recall how much I defaulted for. Knowing that when I get out of the garden I am not blacklisted when I apply for a Chase card is a relief. Again, thank you for the info.

Given the fact that it was $1K, the CO occurred in 2009, and you established a good credit history, I don't think you would have a problem getting in with Chase.

Have you gone to their pre-qual site?

Bank of America: Alaska Air Atmos Summit Visa Infinite

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Globe WLMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 12.24, EX: 816 / EQ: 825 / TU: 818

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Bank, how I covet thee 5/24 CC!

There may be instances where it may not be an issue. But, to @Remedios' point, if you search through a variety of past threads, those predecessor [WaMu, First Chicago/NBD, Bank One] CO/IIB accounts have been cited as reasons for being declined for a variety of applicants.

On the upside, most have been able to get reconsidered and approved if all else profile-wise checks out, but outcomes will still vary.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Bank, how I covet thee 5/24 CC!

@sjt wrote:

@Medic981 wrote:

@Anonymous wrote:

Your lucky because I was in a similar situation as yours. I defaulted on a WaMu credit card 10 years ago. It’s obviously not on my credit report anymore, but, CHASE does have it on their own records. I know this for a fact, because I was applying for a SBA loan through them, and they will not approve it because of it. However, last week I did get the Amazon Prime card from Chase. They DONT use that old information for their cards, but absolutely do for SBA loans. So you can apply, that WaMu won’t hurt you now. Also, Chase told me if the WaMu card was less than 4K, they don’t care also. Mine was 5k! Doah! So literally I will never ever be able to get a business loan from them, even 30 years from now, but CC are different.Thank you. That bit of info has lifted a weight off my shoulders. My WaMu card had a $1000 CL and I don't recall how much I defaulted for. Knowing that when I get out of the garden I am not blacklisted when I apply for a Chase card is a relief. Again, thank you for the info.

Given the fact that it was $1K, the CO occurred in 2009, and you established a good credit history, I don't think you would have a problem getting in with Chase.

Have you gone to their pre-qual site?

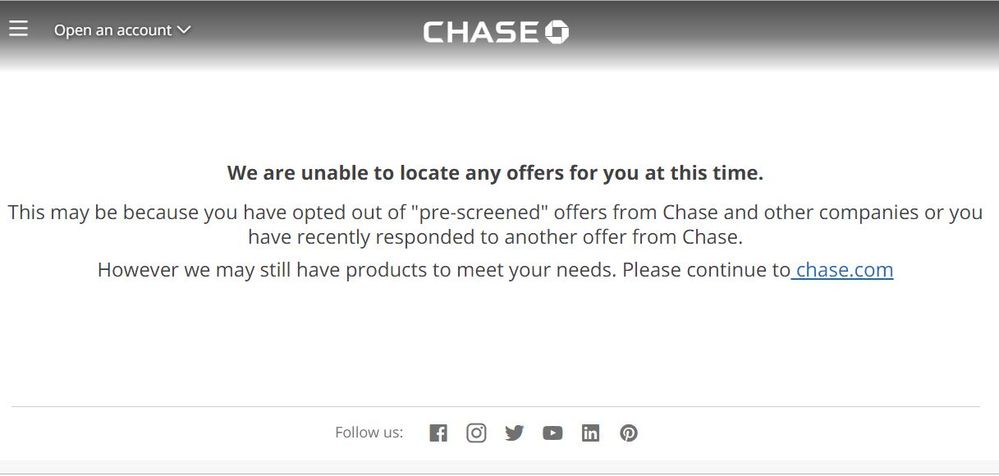

This is the message I get every time I check the prequalification page. I have never opted out of prescreening and I have unfrozen all of my credit bureau files before checking. I am still sitting at 9/24 and will be until Nov 2019, which is the only reason I can think of that might be causing this message.

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Bank, how I covet thee 5/24 CC!

@Medic981 wrote:

@Brian_Earl_Spilner wrote:All the departments are separate and don't influence the others. They also have different criteria. Auto will finance you 1 year after BK. Cards won't look at you for 10.

So you are saying that defaulting on a WaMu CC had no internal influence on getting a Chase auto finance? What will the effect be on trying to obtain a Chase CC?

No, auto doesn't see any of that. You could be overdrawn on your Chase checking and they would have no idea. As for the Chase CC, they will see it, and they will remind you of it. And if the amount is high enough, they will constantly remind you of it. There are people on here that can't do anything with their Chase cards without a recon because of their past relationships. There are also others that have had no problem once they get their foot in the door.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Bank, how I covet thee 5/24 CC!

@Brian_Earl_Spilner wrote:

@Medic981 wrote:

@Brian_Earl_Spilner wrote:All the departments are separate and don't influence the others. They also have different criteria. Auto will finance you 1 year after BK. Cards won't look at you for 10.

So you are saying that defaulting on a WaMu CC had no internal influence on getting a Chase auto finance? What will the effect be on trying to obtain a Chase CC?

No, auto doesn't see any of that. You could be overdrawn on your Chase checking and they would have no idea. As for the Chase CC, they will see it, and they will remind you of it. And if the amount is high enough, they will constantly remind you of it. There are people on here that can't do anything with their Chase cards without a recon because of their past relationships. There are also others that have had no problem once they get their foot in the door.

Sounds like a crapshoot! I guess I will have to see how Chase is going to treat me when I am below 5/24 and apply.

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content