- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Citizen's Bank Cash-Back + 19K Soft Approval -...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Citizen's Bank Cash-Back + 19K Soft Approval - Should I combine?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Citizen's Bank Cash-Back + 19K Soft Approval - Should I combine?

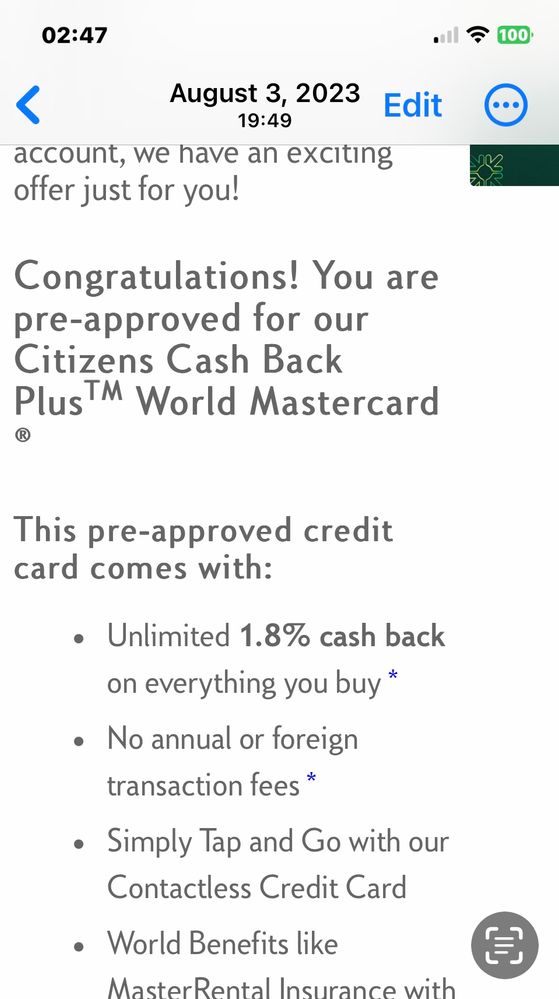

I already had a $13K CB+ card with them and asked for any SP CLI offers when I last visited a branch as this is one of my lower limit cards.

They informed me that I could get a CLI of $400 but also said that I had a soft pull approval for $19K...?

I called and couldn't get the 19K approval as a cli and that I'd have to get the card and then can immediately transfer the limit to my old card and then close the new account. What a waste of time on their part as well as time and AAoA on my side.

If I do this right away I'm wondering if they even report the new account at all?

Anybody do something similar and see the new account not show and not affect AAoA?

|

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|

Starting Scores (06/2016):

Current Fico8 Scores (Updated 11/12/24):

Current Fico10 Scores (Updated 11/12/24):

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citizen's Bank Cash-Back + 19K Soft Approval - Should I combine?

So citizens does not do a hard inquiry for credit card applications? Only soft pull on equifax?do you need to have a checking with them to apply for loans or not? Thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citizen's Bank Cash-Back + 19K Soft Approval - Should I combine?

@gordoncharles25 wrote:So citizens does not do a hard inquiry for credit card applications? Only soft pull on equifax?do you need to have a checking with them to apply for loans or not? Thanks

No.

Pre-qualified offers are SP. Applying for any direct products without a pre-approved or pre-qualified offer will typically result in a HP on EQ.

You can apply for CCs and other products without being a Citizen's Bank customer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citizen's Bank Cash-Back + 19K Soft Approval - Should I combine?

I did call up to combine the 2 accounts.

I started with 13K on first account and 19K on the new second account.

The only way they would do the transfer is to close one of the accounts and it seems like they have a hard cap of 25K on the CB+ card.

So result is my old account will be 25K and the new account will be closed.

Crappy that I had to open a new account to get what basically boils down to a decent cli but at least no HP.

|

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|

Starting Scores (06/2016):

Current Fico8 Scores (Updated 11/12/24):

Current Fico10 Scores (Updated 11/12/24):

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citizen's Bank Cash-Back + 19K Soft Approval - Should I combine?

@raisemysc0re wrote:I did call up to combine the 2 accounts.

I started with 13K on first account and 19K on the new second account.

The only way they would do the transfer is to close one of the accounts and it seems like they have a hard cap of 25K on the CB+ card.

So result is my old account will be 25K and the new account will be closed.

Crappy that I had to open a new account to get what basically boils down to a decent cli but at least no HP.

Well, HP impacts fade over time, but a new account would have a higher impact on AAoA than a single HP depending on one's overall credit profile. On the upside, you were able to shuffle some things around to get the limit you wanted based on that SP pre-approval.

That being said, this is a great DP for the community as far as credit limit reallocations go with Citizen's Bank.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citizen's Bank Cash-Back + 19K Soft Approval - Should I combine?

New account has already been reported... Don't know why I even hoped it wouldn't but it did.

Going to try to garden for 1 year now.

|

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|  |

|

Starting Scores (06/2016):

Current Fico8 Scores (Updated 11/12/24):

Current Fico10 Scores (Updated 11/12/24):

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citizen's Bank Cash-Back + 19K Soft Approval - Should I combine?

@FinStar wrote:

@gordoncharles25 wrote:So citizens does not do a hard inquiry for credit card applications? Only soft pull on equifax?do you need to have a checking with them to apply for loans or not? Thanks

No.

Pre-qualified offers are SP. Applying for any direct products without a pre-approved or pre-qualified offer will typically result in a HP on EQ.

You can apply for CCs and other products without being a Citizen's Bank customer.

SP, I didn't know that 🤔 Too bad the CC they keep offering me is 1.8% - really do not have a use for that ![]()

Potential Future Cards

Closed Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citizen's Bank Cash-Back + 19K Soft Approval - Should I combine?

@FinStar wrote:

@gordoncharles25 wrote:So citizens does not do a hard inquiry for credit card applications? Only soft pull on equifax?do you need to have a checking with them to apply for loans or not? Thanks

No.

Pre-qualified offers are SP. Applying for any direct products without a pre-approved or pre-qualified offer will typically result in a HP on EQ.

You can apply for CCs and other products without being a Citizen's Bank customer.

@FinStar do we know if this is still the case with Citizen when it pertains to pre-qualified offers?

Potential Future Cards

Closed Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citizen's Bank Cash-Back + 19K Soft Approval - Should I combine?

Last August I opened a Citizens Bank savings account because they were offering a small SUB for it. I already had a checking account. When I opened the savings account, there was some sort of error so I actually ended up opening two savings accounts at the same time and closing one the next day.

When I opened the savings account, there was a screen that offered me their 1.8% credit card. It showed the rate and the credit limit. I decided not to accept because I already have a number of 2% cards and I even have a 3% one too.

Citizens then started sending me snail mail reminders about the offer. They did this for about a month. I think they sent one every other day. Since I had inadvertently applied for two savings accounts I think they were sending me duplicates. It was crazy. I think I received about 20 or 30 of them.

Anyway if you open a Citizens Bank savings account you might get a soft pull preapproval. I'm not sure if happens if you aren't a current customer. They are Equifax pullers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citizen's Bank Cash-Back + 19K Soft Approval - Should I combine?

>>Anyway if you open a Citizens Bank savings account you might get a soft pull preapproval. I'm not sure if happens if you aren't a current customer. They are Equifax pullers.<<

Yeah, I am a Citizen's Bank Checking customer for a few years now, and I get this 1.8% CB (un-needed with my current set up) pre-qualified offers for the Cash Plus all the time. Just curious to see if it really is a SP for this card if I ever did decide to take the plunge ![]()

Potential Future Cards

Closed Accounts