- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Comenity Cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Comenity Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Cards

@Anonymous wrote:

@credit_endurance wrote:

@Anonymous wrote:Guess I will have to see what happens at end of November when I try for CLI on Total Rewards Visa. After my Barneys CLI to $45,700 recently, I was feeling encouraged.

I also wonder if Comenity is tying CLI's more to usage now? I use my card every month for a few small purchases, but not sure if those not receiving CLI's are using the card or not using the card. I do know that in the past usage was not a factor, but that may be different now.

Just speculating and trying to figure out with everyone else what may be going on.

Is it even possible to try a CLI with robolady on the Mastercards and Visas, or are those online only? I've only ever gotten CLI's online with Total Rewards Visa. Conversely, Barneys would never once give me a CLI online using the button, but always yielded success with robolady. I don't believe robolady is an option with Visas and Mastercards, however.

You may be on to something humu. I havent used my Overstock and Wayfair cards in the last 6 months but still recieved my monthly cli's up unti this month. But did make a purchase on my Jcrew card last month made my payment and as soon as the statement cut tried a cli increase and if gave me one on regular schedule 31 days out.

Well I use my NY&CO card every month and I got the message as well. I'm only at $2200 with them. I might see it because I'm attempting to try early. I'm going to wait and see what happens on Nov 30th.

Here might be the opposite of your idea. The only card not getting regular use is my Overstock card and its the only one without that message. So who knows!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Cards

@Ysettle4 wrote:

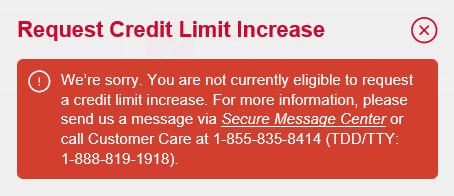

@CreditMagic7 wrote:Is this the message you guys and girls have been seeing too?

I keep a strict schedule on the 4 month plus a day SP CLI Request but this is all I see anymore.

(2) Comenity bankcards over 1 year with reasonable usage and always PIF.

Should I let a balance post maybe to draw a SP CLI again?

This is the first time those 2 cards didn't get one and their limits are 4300 & 6300 respectively.

You're not the only one. I've been getting that on my TR Visa. it's current line is $25,500 so I suspect comenity will not extend any more to me.

Ysettle, have you been using the card monthly? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Cards

@Anonymous wrote:

@Ysettle4 wrote:

@CreditMagic7 wrote:Is this the message you guys and girls have been seeing too?

I keep a strict schedule on the 4 month plus a day SP CLI Request but this is all I see anymore.

(2) Comenity bankcards over 1 year with reasonable usage and always PIF.

Should I let a balance post maybe to draw a SP CLI again?

This is the first time those 2 cards didn't get one and their limits are 4300 & 6300 respectively.

You're not the only one. I've been getting that on my TR Visa. it's current line is $25,500 so I suspect comenity will not extend any more to me.

Ysettle, have you been using the card monthly? Thanks.

Every month and I leave small balances as well (roughly $500 - $700). Last statement, I left a $100 balance.

| 769 | 774 | 764 | UTIL: 2% | AAoA: 5yr 8mos | Total Credit Line: $873,950 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Cards

Tried again today.

Same result.

Have to wait until next month and the next statement cut to see where this is.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Cards

@CreditMagic7 wrote:Tried again today.

Same result.

Have to wait until next month and the next statement cut to see where this is.

CM7.

Got that message with JCrew last week. Currently at $17K with them. Figured that I'm at a level with them that I'll no longer get anymore increases. Overstock has only given me increases every 2-3 months, so I figure no more increases for me in that direction either. Pottery Barn did give me an incrase from $8k to $9.5K. I would like to hopefully get 1 more increase with Pottery Barn to $11K as there is a bed and armoire I would like to purchase for my daughter.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Cards

@Anonymous wrote:

@CreditMagic7 wrote:Tried again today.

Same result.

Have to wait until next month and the next statement cut to see where this is.

CM7.

Got that message with JCrew last week. Currently at $17K with them. Figured that I'm at a level with them that I'll no longer get anymore increases. Overstock has only given me increases every 2-3 months, so I figure no more increases for me in that direction either. Pottery Barn did give me an incrase from $8k to $9.5K. I would like to hopefully get 1 more increase with Pottery Barn to $11K as there is a bed and armoire I would like to purchase for my daughter.

Yeah, what I wonder is that with more than just a few members sharing same results lately, if Comentiy has a similar maximum exposure limit like Synchrony (or some new one) across all of their cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Cards

I recently got the Pottery Barn card and saw that same message. So I called the automated number and got a 2K bump that way.

My Williams Sonoma VISA has that same message, and when I tried the phone system it tried to transfer me to a CSR.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Cards

@someg33k wrote:I recently got the Pottery Barn card and saw that same message. So I called the automated number and got a 2K bump that way.

My Williams Sonoma VISA has that same message, and when I tried the phone system it tried to transfer me to a CSR.

Thanks for sharing your result.

So seems the store cards can still get a bump via the auto phone call but not the Visa Cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Cards

CM7, can you even do autolady CLI with the Visas and Mastercards?

I know that autolady can work with the store cards, but I haven't called in probably 9 months re/ my Comenity Visas. I seem to remember the last time I did, that it tried to connect me to a live person, so I hung up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Cards

JCrew, Wayfair and Overstock just gave me the usual $300 bump this week when I hit the button. (I'm on $5.8K, $2.1K and $2.7K respectively)

Sportsman's Guide just gave me a bump when I hit the CLI button. That was about 5 months after they gave me an auto CLI.

I haven't tried HSN, Fashion Bug or Express for several months... they are on my scrap list as soon as I get around to calling in and closing, so I don't want to get used to having the extra padding for util.

Total Cards: 24 | Total Limit: $304,250

Current FICO 8 Scores: EQ: 841| TU: 815 | EX: 814

Hard Inquiries: 1