- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREA...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Navy Federal Thread for CLI and Additional Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:

Excited for you - let us know. Just remember the CSR's / Bank personnel are often wrong so take much of their info with a grain of salt! IMO Navy Fed loves people in the 650 to 700 range with lots of cards. I see so many large SL's on 6xx scores on the credit pulls database....That does seem to fit me - FICO scores of 662 to 697, 10 active cards. I wonder if it might help to tell them that I'm looking for lower-APR cards that I can use anywhere to replace a high-APR card that I can only use in one place? I assume they review apps manually like other credit unions, so...?

In my experience only pending apps or CLIs have gone to manual....have a feeling youd get an instant approval. If you get instant you can recon for a higher line/lower APR with the points you mentioned via secure message in the app

@Callesun Yes, you do see alot of ppl with 650 to 700 range get large SL's. What you don't see in most cases is that they may have really low DTI, really high income, or a clean profile, maybe all of the above. Navy is amazing, but you should never base your success with a lender on others as every profile/situation is different. The CPDB is fun for checking who they pull in a certain state, but its really really outdated now. Most of the approvals are from 2016 or older sadly. The game has cahnged alot since a year ago, let alone 2016.

I really have to agree with that last part; I've never found that database to be of any real use, because I have never been able to find any significant information for any of the cards I'm interested in in my state (Virginia). And given that it's not regularly updated, it's becoming, frankly, more and more useless except possibly for seeing who pulls what in a given state - but even that can and does change.

Anyway, I'm feeling pretty nervous this morning with a mild case of cold feet. I'm bouncing back and forth on whether to apply for cashRewards, or just go for the Platinum and hope to PC it later on. My DTI (calculating from gross monthly income) is 19%, which is pretty decent (well below the 43% maximum advised by CFPB), I'm 4+ years past BK filing, and while my income as a Federal government employee is a good deal more modest than what I suspect many other MF regulars make, I recently applied for a merit promotion and if I get it it'll open the way for me to get up to 3 grades higher on the General Schedule. Soooooooo....

No need to fret over which card to get. There are people on here who have done a PC before they even get the first statement (seriously) - it's that easy with NFCU. As long as you don't apply for the Flagship the underwriting is identical (thus how you can freely change from one to another). The only card you can't freely PC to (or from) is the Amex.

In a nut-shell, if you want the absolute lowest APR, go with the Platinum. On the other hand, if you will be able to easily spend $1000 in the next 90 days, you might consider going with the Cash Rewards for the $100 bonus. You can always PC it to a Platinum for a lower APR once you collect the sign up bonus.

Also note that you can request a lower APR once your account is a year old. When my Platinum was a year old, I sent them a secure message and they lowered my rate by 1% (I admit I was hoping for better). The next year I sent them another request, this time they reduced my rate to the lowest available for the Platinum, currently 7.74%.

Good luck whatever you decide! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@UncleB wrote:

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:

Excited for you - let us know. Just remember the CSR's / Bank personnel are often wrong so take much of their info with a grain of salt! IMO Navy Fed loves people in the 650 to 700 range with lots of cards. I see so many large SL's on 6xx scores on the credit pulls database....That does seem to fit me - FICO scores of 662 to 697, 10 active cards. I wonder if it might help to tell them that I'm looking for lower-APR cards that I can use anywhere to replace a high-APR card that I can only use in one place? I assume they review apps manually like other credit unions, so...?

In my experience only pending apps or CLIs have gone to manual....have a feeling youd get an instant approval. If you get instant you can recon for a higher line/lower APR with the points you mentioned via secure message in the app

@Callesun Yes, you do see alot of ppl with 650 to 700 range get large SL's. What you don't see in most cases is that they may have really low DTI, really high income, or a clean profile, maybe all of the above. Navy is amazing, but you should never base your success with a lender on others as every profile/situation is different. The CPDB is fun for checking who they pull in a certain state, but its really really outdated now. Most of the approvals are from 2016 or older sadly. The game has cahnged alot since a year ago, let alone 2016.

I really have to agree with that last part; I've never found that database to be of any real use, because I have never been able to find any significant information for any of the cards I'm interested in in my state (Virginia). And given that it's not regularly updated, it's becoming, frankly, more and more useless except possibly for seeing who pulls what in a given state - but even that can and does change.

Anyway, I'm feeling pretty nervous this morning with a mild case of cold feet. I'm bouncing back and forth on whether to apply for cashRewards, or just go for the Platinum and hope to PC it later on. My DTI (calculating from gross monthly income) is 19%, which is pretty decent (well below the 43% maximum advised by CFPB), I'm 4+ years past BK filing, and while my income as a Federal government employee is a good deal more modest than what I suspect many other MF regulars make, I recently applied for a merit promotion and if I get it it'll open the way for me to get up to 3 grades higher on the General Schedule. Soooooooo....

No need to fret over which card to get. There are people on here who have done a PC before they even get the first statement (seriously) - it's that easy with NFCU. As long as you don't apply for the Flagship the underwriting is identical (thus how you can freely change from one to another). The only card you can't freely PC to (or from) is the Amex.

In a nut-shell, if you want the absolute lowest APR, go with the Platinum. On the other hand, if you will be able to easily spend $1000 in the next 90 days, you might consider going with the Cash Rewards for the $100 bonus. You can always PC it to a Platinum for a lower APR once you collect the sign up bonus.

Also note that you can request a lower APR once your account is a year old. When my Platinum was a year old, I sent them a secure message and they lowered my rate by 1% (I admit I was hoping for better). The next year I sent them another request, this time they reduced my rate to the lowest available for the Platinum, currently 7.74%.

Good luck whatever you decide!

Makes me feel better! ![]() Actually, I don't think I'll go for the Flagship; I'm not interested in an annual-fee card (well, I do pay for Amazon Prime, but that's not a card annual fee as such; I think the only real annual fee I pay is for Club O on the Overstock store card). So my want list looks like cashRewards, Platinum and More Rewards, in that order. Let's see...if I put all my grocery spend (which is usually cash) on the cashRewards, plus some other stuff (like upcoming property tax on my car, $200 or so), I should be able to swing $1000 on that card from September to the end of November and get the SUB. If I get a decent APR (and I'll keep that bit about applying for lower APR's later on in mind), I may not even need to "gear down" to Platinum...we'll see what we'll see.

Actually, I don't think I'll go for the Flagship; I'm not interested in an annual-fee card (well, I do pay for Amazon Prime, but that's not a card annual fee as such; I think the only real annual fee I pay is for Club O on the Overstock store card). So my want list looks like cashRewards, Platinum and More Rewards, in that order. Let's see...if I put all my grocery spend (which is usually cash) on the cashRewards, plus some other stuff (like upcoming property tax on my car, $200 or so), I should be able to swing $1000 on that card from September to the end of November and get the SUB. If I get a decent APR (and I'll keep that bit about applying for lower APR's later on in mind), I may not even need to "gear down" to Platinum...we'll see what we'll see.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

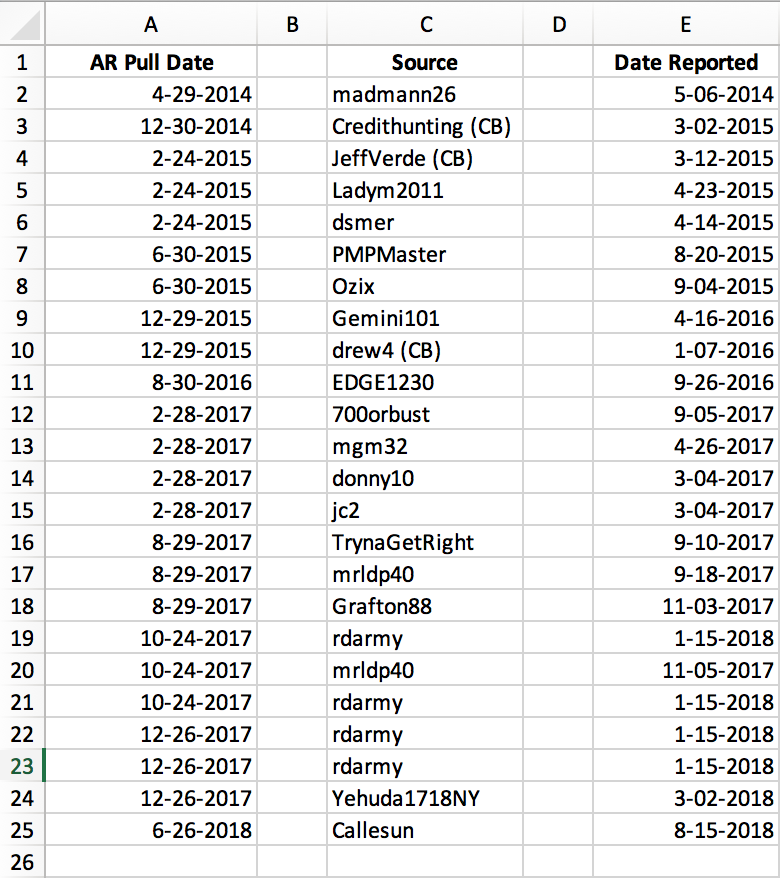

My Cash Rewards card is now 105 days old and I'm anxiously counting down the days to the next AR so I can apply for a CLI. To kill the time I've spend several hours searching for mentions of the actual date when Navy performed an Account Review based on Equifax credit reports. For those curious I used the Google search term:

site:ficoforums.myfico.com nfcu OR "navy federal" +cli "ar" OR "account review"

This turned up several pages of hits that I've read and was able to compile the following datapoints:

The pattern I noticed is that Navy does Account Reviews pulls from Equifax on the fourth Tuesday of even-numbered months then updates member accounts with EQ FICO 9 scores during the first week of the following (odd-numbered) month. Would someone who is a long-standing NFCU member with access to their EQ credit reports be able to confirm this observation?

Finally, to test my hypothesis I applied for a CLI this morning (I know, I know I should wait for the AR to be announced but its already been 105 days ![]() ) and got the 24-hour notice. I'm assuming that its because even if Navy pulled the AR data from EQ on 8/28, it hasn't yet been updated in their systems.

) and got the 24-hour notice. I'm assuming that its because even if Navy pulled the AR data from EQ on 8/28, it hasn't yet been updated in their systems.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

Great DP. Assuming that I get approved today, I think my 91-day/3-month date would be around November 30, which is actually a few more days than that according to the calendar but let's allow it anyway. This means my first AR date would be...let me see...maybe October 23? And my score would update in the first week of November. So, hypothetically speaking, I'd have to wait about another five weeks after that before I could request my first CLI. Sound about right?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@Anonymous wrote:Great DP. Assuming that I get approved today, I think my 91-day/3-month date would be around November 30, which is actually a few more days than that according to the calendar but let's allow it anyway. This means my first AR date would be...let me see...maybe October 23? And my score would update in the first week of November. So, hypothetically speaking, I'd have to wait about another five weeks after that before I could request my first CLI. Sound about right?

Sounds about right although you can apply for a CLI in late November or December if you wanted to. However the conventional wisdom is to wait until after the December AR so that puts you into the first week of January 2019.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@Anonymous wrote:

@Anonymous wrote:Great DP. Assuming that I get approved today, I think my 91-day/3-month date would be around November 30, which is actually a few more days than that according to the calendar but let's allow it anyway. This means my first AR date would be...let me see...maybe October 23? And my score would update in the first week of November. So, hypothetically speaking, I'd have to wait about another five weeks after that before I could request my first CLI. Sound about right?

Sounds about right although you can apply for a CLI in late November or December if you wanted to. However the conventional wisdom is to wait until after the December AR so that puts you into the first week of January 2019.

Which, by one of these peculiar coincidences, is right about when I should be eligible for CLI on my Quicksilver Visa after having combined at the end of June!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

@Anonymous wrote:Finally, to test my hypothesis I applied for a CLI this morning (I know, I know I should wait for the AR to be announced but its already been 105 days

) and got the 24-hour notice. I'm assuming that its because even if Navy pulled the AR data from EQ on 8/28, it hasn't yet been updated in their systems.

Could be, but remember that an AR isn't a guarantee of not getting a HP, it only increases the chances of it not happening.

The only time I've ever requested a CLI from NFCU was a week after an AR, and it was still a HP. ![]()

(It was worth it, though.) ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

*checks clock* Close to zero hour...I'm going to talk about it with the banker once I get down there, but as of right now I think I'm going to go for CR. I think my profile is good enough for it but we'll see.

EDIT: Just got back, I've joined up and put in my initial funding on share savings and basic checking. I asked the banker about hard pulls and he seemed to confirm it for membership (I'm hearing-impaired so it was hard to tell), it also seems (DP for this thread!) that NFCU in Virginia pulls Equifax. I'm going to set up my online account now, and then it's game time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

Just applied for cashRewards. The application has been accepted and they pulled TU, I'll know within 24 hours. Maybe sooner.

P.S. I had been given to understand most applications were instant approval or denial, but I seem to have been sent to review. Guess my original guess was right??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal UPDATED CLI and 2ND ACCOUNT THREAD

...and literally just one minute later, I got the text message saying I've been approved! Time to put a new thread in Approvals.