- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Penfed offers

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Penfed offers

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed offers

@Trinzero wrote:Hello MyFico Fam!

I hope this year is treating ya'll well!

Wondering if anyone knows what is happening here.

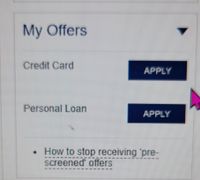

So Penfed is showing this:

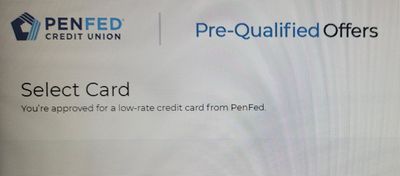

But when I click on apply it shows me:

But no cards ever populate. 🤔

Any thought or guidance or commiseration welcome 😁

Pre approved not always solid.. got one was denied.. 2nd one went thru a month later

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed offers

@Trinzero wrote:Hello MyFico Fam!

I hope this year is treating ya'll well!

Wondering if anyone knows what is happening here.

So Penfed is showing this:

But when I click on apply it shows me:

But no cards ever populate. 🤔

Any thought or guidance or commiseration welcome 😁

Have you tried a different device? Also, if you have pop-up blocker, it won't open - ever. So, try a different device or pay attention to address bar once you click "apply" to see if built-in pop up blocker activates.

But yeah, Penfed website do be glorified Word document.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed offers

@Credit-hoarder wrote:I got the same 2 offers also. Was able to get the loan app to load but not the credit card. Would have been nice to finally get the last $3800 I need to make my Promise a $50k card.

Is Penfed still allowing cards up to 50K? I read that was a thing of the past.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed offers

Good suggestions all.

Before posting, I tried a different browser (3), different device, turning off adblock, incognito, clearing cookies...

Nothing worked. Both offers are still there on the main page and show when I go into credit score, it just wont show the details on the credit card, only the loan. I guess its not meant to be that I see it! 🤷♂️

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed offers

If you are interested, just apply. You will get same terms as pre-approval.

While pre-approvals are nice and cute, it ain't over until they do a HP, which you'd get with or without pre-approval.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed offers

I have a 21k card with them and I was under the impression, from posts I have read here, that the offers allowed the opportunity to CLI without HP. Are these not sp offers?

Mostly though I was just curious to see this imaginary offer! 😁

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed offers

@Trinzero wrote:I have a 21k card with them and I was under the impression, from posts I have read here, that the offers allowed the opportunity to CLI without HP. Are these not sp offers?

Mostly though I was just curious to see this imaginary offer! 😁

Used to be that way, I believe that is no longer the case. I believe @coldfusion can shed some more light on this.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed offers

Yes...they used to extend targeted offers on Jan/Apr/Jul/Oct 1 for auto loans and/or a credit card or in some cases your choice of a card. Card offers had a defined SL, and if you accepted an offer it was only a soft pull.

If the offer listed a card you already held they processed it as a CLI on your existing card, not a 2nd card of the same type.

A few people got targeted offers after less than a year of membership but it was more common to have to wait closer to 2 years to start getting offers.

FICO 8 (EX) 850 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed offers

@coldfusion wrote:Yes...they used to extend targeted offers on Jan/Apr/Jul/Oct 1 for auto loans and/or a credit card or in some cases your choice of a card. Card offers had a defined SL, and if you accepted an offer it was only a soft pull.

If the offer listed a card you already held they processed it as a CLI on your existing card, not a 2nd card of the same type.

A few people got targeted offers after less than a year of membership but it was more common to have to wait closer to 2 years to start getting offers.

That's the way I thought offers work(ed) also. The offered me a card 4 years ago at twice the CL of the existing card (Promise) I had with them at the time of the offer. I opted to take it as a CLI and never received a HP. And I had been with them for less than a year at that time also.

BUSINESS

BUSINESS

Rewards Pts.-Miles: UR-MR-TYP-Venture

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Penfed offers

@CerebralZulu wrote:

@Credit-hoarder wrote:I got the same 2 offers also. Was able to get the loan app to load but not the credit card. Would have been nice to finally get the last $3800 I need to make my Promise a $50k card.

Is Penfed still allowing cards up to 50K? I read that was a thing of the past.

You can still only go up to $50k--but if it's a new card after the change took place a sometime back (can't remember exactly when)--it's $25k max per card up to 2 cards.

BUSINESS

BUSINESS

Rewards Pts.-Miles: UR-MR-TYP-Venture