- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Re: My wife shocking Chase pre-approval starting l...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

My wife shocking Chase pre-approval starting line.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My wife shocking Chase pre-approval starting line.

Congrats to your wife!!!!

Rebuild Cards

Goal Cards

Loans

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My wife shocking Chase pre-approval starting line.

Sounds like wherever you got her score from is seriously wrong. The real score was much higher or Chase did something weird.

My Chase page looks like yours as well and I only have cards. Chase is however known to change up the layout of their site rather unexpectedly. I would not be shocked if some customers have been selected to suffer through experimental layouts. The other option is that in the settings a different layout might be selected. I did not check recently but am certain that Chase offers some rather extensive customization.

Active:

Bank of America (Unlimited Cash Rewards WMC, Customized Cash Rewards WMC, Customized Cash Rewards VSC), Capital One Savor WEMC, Chase(Amazon Prime VSC, Freedom Flex WEMC [x2], Freedom Unlimited VC), Citi Dividend MC, Citizens GreenSense WMC, Curve WEMC(Suspended), Discover It C, FNBO Ducks Unlimited VSC, GBank VSC, PenFed (Platinum Rewards VSC, Pathfinder Rewards VSC), Santander Ultimate Cash Back WMC, Synchrony PayPal Cashback WMC, UMB Simply Rewards VC[Milford Federal], US Bank (Altitude Go VSC, Cash+ VSC [x2], Pick n Save/Metro Market WEMC)

Wishlist: AAA Daily Advantage, AOD Signature, Bellco Colorado Rewards, Citi Custom Cash, Nusenda Platinum Cash Rewards, PCMCU Platinum Rewards, Redstone FCU Signature

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My wife shocking Chase pre-approval starting line.

@zerofire wrote:Sounds like wherever you got her score from is seriously wrong. The real score was much higher or Chase did something weird.

My Chase page looks like yours as well and I only have cards. Chase is however known to change up the layout of their site rather unexpectedly. I would not be shocked if some customers have been selected to suffer through experimental layouts. The other option is that in the settings a different layout might be selected. I did not check recently but am certain that Chase offers some rather extensive customization.

Her Experian is 636 through Experian.com and her Transunion is 609 through Discover, both FICO 08s. I’m going to check Equifax and will report back. Chase did not pull any credit, seems it was via a soft pull.

She has a Chase (now Freedom) since 2011 that was $500 CL and paid in full every month. Recently auto CLI to $1800.

She has a 3 defaulted student loans and 1 charge off for $9k. Utilization is at 10%. AAoA 9 years, oldest account backdated AMEX From 1999.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My wife shocking Chase pre-approval starting line.

@Anonymous wrote:

Hey there. Did your wife just cross the 620 threshold or has she been steady in the high 630's? Once you get ove 620 offers start piling up.

If she has recently paid down debt, or has been working on her credit she will receive more offers Congratulations and be careful!

My Chase page looks like yours and my husband's looks like hers. However, he has business and personal credit cards with some high digits

I just have a personal with much lower (4) digits.

We knew her credit was shot so we didn’t even checked her credit until the approval came through for that initial CL. She has been slowly climbing.

Did you check your marketing settings to see if they were Off like mine where?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My wife shocking Chase pre-approval starting line.

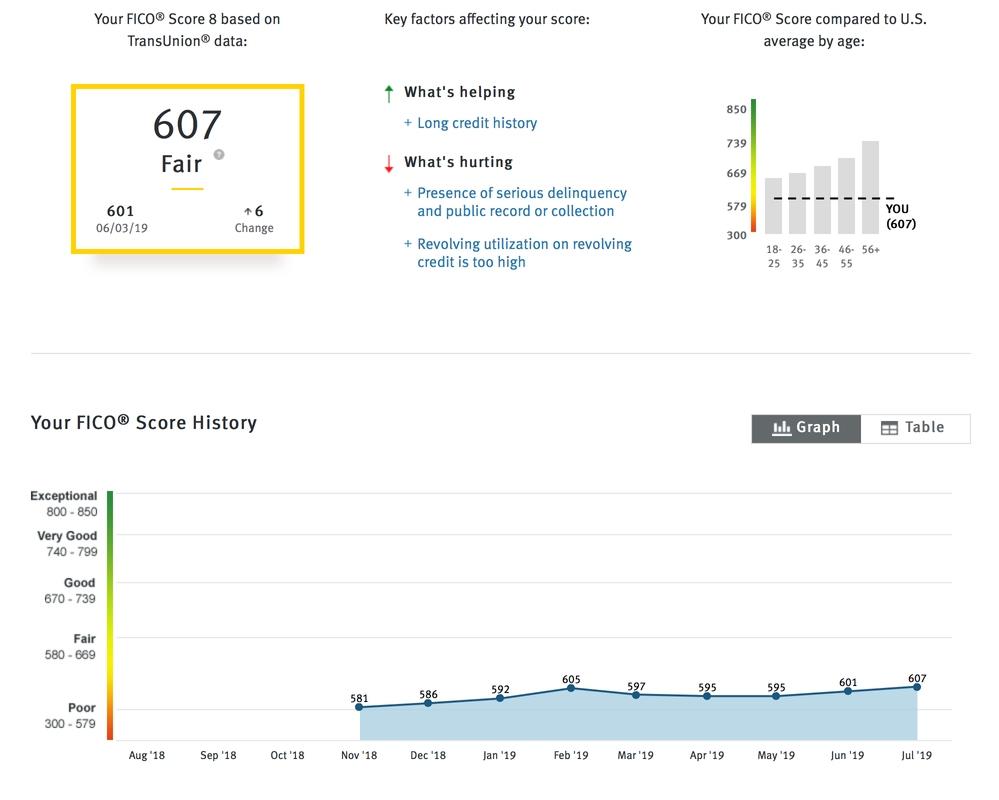

This is her score track since Jan of this year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My wife shocking Chase pre-approval starting line.

Discover also gave her a $12k line back in October pulling her Experian when she had a 633 FICO. For now we`ll hold on the app and see if we can get the baddies removed. She had an 802 FICO in Experian back in 2010 so I'm not sure if that has to do anything with it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My wife shocking Chase pre-approval starting line.

How long have you been banking with Chase? If your checking account with them isn't very new, did anything change recently, like did she add her paycheck as a direct deposit or did she open any other accounts with them like savings? I am just trying to see if the reationship with Chase might have something to do with it (I have another post related to that, and am trying to figure out if you can, in fact, help yourself by having a strong banking relationship with Chase outside of credit cards.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My wife shocking Chase pre-approval starting line.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My wife shocking Chase pre-approval starting line.

And I checked the marketing preferences and it was all turned on.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My wife shocking Chase pre-approval starting line.

Huge congrats!

And remember - it's not just the score, but her overall profile.