- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Paypal Credit CLI

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Paypal Credit CLI

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paypal Credit CLI

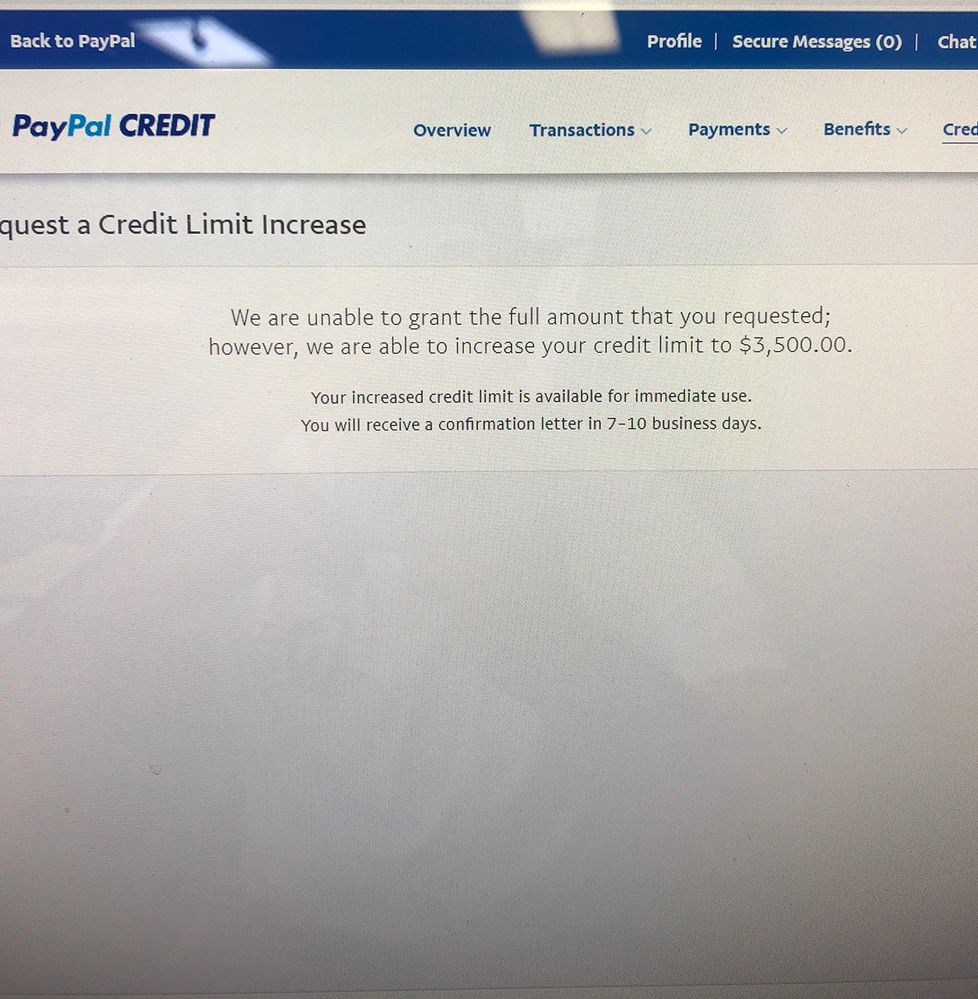

I've been a member of Paypal since 2003 although I cant remember when I applied for Paypal Credit, I think it was 2008ish, decided to login to my account via PC and noticed that Paypal Credit gives your Fico 8 TU score and also you can request a credit limit increase now. SL was 2,800 and asked for $10K. Declined for $10K but did recieve an additional $700.

Has anyone confirmed if the tradeline will report or stay hidden?

Fico 8 TU 728

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paypal Credit CLI

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paypal Credit CLI

This was just posted... CSR indicates reporting is set to begin in the next month or two...

Congrats on your CLI!

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paypal Credit CLI

Congrats, I had since BillMeLater whatever year that was.

I heard from a Top Tier Rep (I called) She Said: "That Older Accounts would Report sometime Around September."

She was Very Firm on This.

New Accounts are already reporting. as posted by several people, in another myFICO Thread.

what is I am still waiting to see is the actual account opening date. lots of debate on this.

The Top Tier Rep Could not Give Me a Solid Answer, as Some things were not disclosed from the higher up.

so its a wait an see on The Actual opening Date. I will believe it, when I see it Report to the 3 big CRA's,

as to what the facts will be.

it would be nice to have "that age" Factored in to my Age of All Accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paypal Credit CLI

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paypal Credit CLI

@Anonymous wrote:

Thanks for the replies guys. I hope it reports the original opened date as well as that would help my AAOA. My oldest card is a 6 yr old Capital One.

I can Guarantee that, if it does not report the History of Payments, and opening Date.

There are going to be some complaints filed, and probably some accounts closed, for that very reason.

I think some closed ahead of time. I took The "wait & See Approach"

it is possible that the Older Accounts not Reporting till September Thing (per The Old Pay Pal CSR)

That is not completely set in stone.

but it could be possible, they have to Gather all The Old Account Information to Report?

That is only a Hopeful Guess on my end, at this point.

as you pointed out, The AAOA would be nice. not so worried about it being a "Hidden" TL at this point.

anyhow, since this is The Approvals Thread, I probably should Limit my rambling.

as I have probably overspent My Nickel.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paypal Credit CLI

It hit my credit report last month. reported 2 years. I've had it much longer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paypal Credit CLI

Does anyone know if the CLI does a hard inquiry? I actually want to pay the account off and close it with the new interest rate but am in the middle off buying a house and closing the account could hurt me more than it already has by reporting.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content