- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

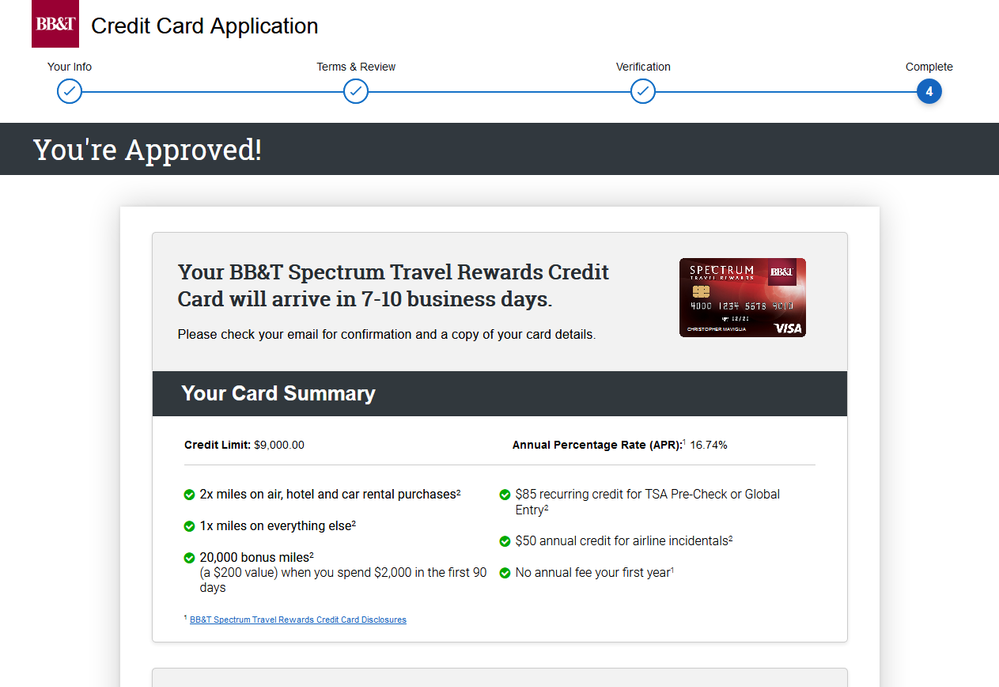

The floor is very slippery! TD Cash, Cap1 QS, BBT

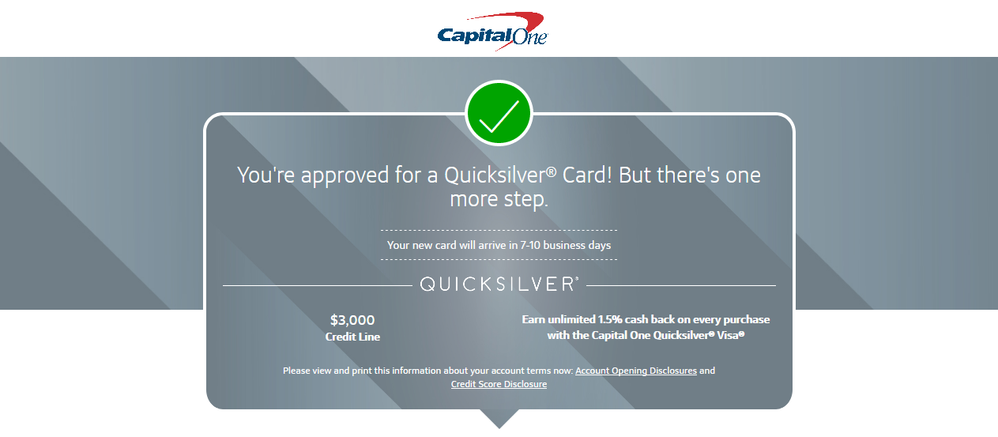

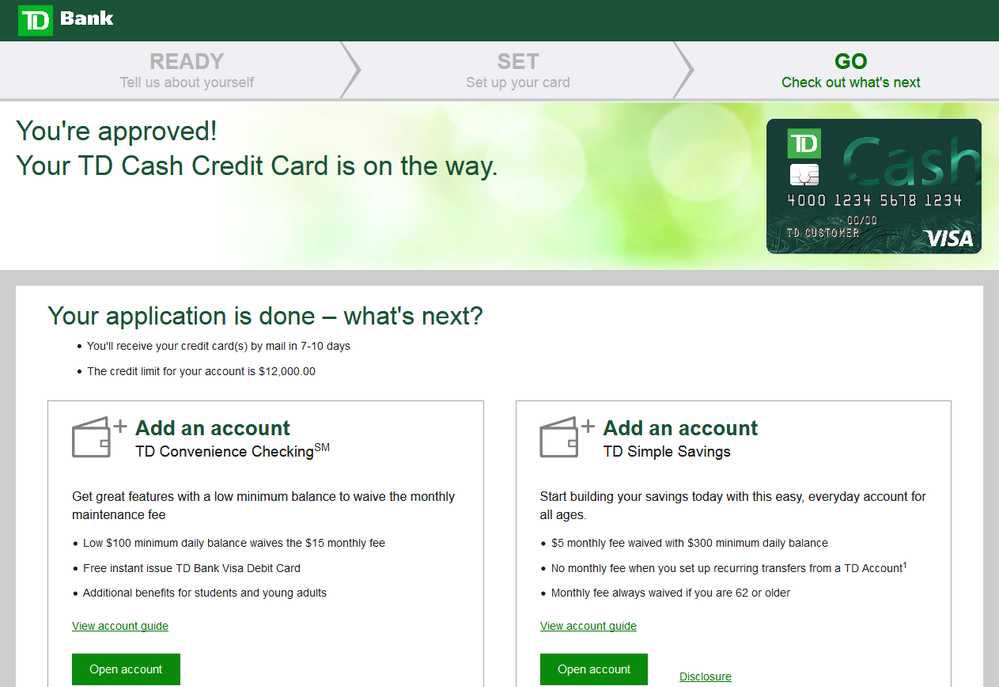

Going on a trip and gonna be on a spending spree, so looked for some SUB CC's. I was supposed to be gardening since I'm prob King Inquiry by now with all my apps, not fearing rejections, as I can wait 2 years for them to drop off. Closed my Citi as the annual fee anniversary was coming up and I was looking for a perk to keep it open, not some lame 7500 mi/$1k and $99 credit after $99 spend. So anyway...

(PS. Closed the QS the day after it was approved since I apparently clicked on pre-qual and some other offer came up so no SUB or promo apr, also the SL is lame considering you can't merge with other Cap1 cards)

(PPS. My open credit is crazy, over 3X income. Once my apr promo's expire on 3 CC, I'll close them since I was only churning them anyway and the rewards aren't worthy of DD status)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The floor is very slippery! TD Cash, Cap1 QS, BBT

Congrats on the approvals!! That credit for TSA pre-check is nice!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The floor is very slippery! TD Cash, Cap1 QS, BBT

Congrats on yer approvals!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The floor is very slippery! TD Cash, Cap1 QS, BBT

@Anonymous wrote:Going on a trip and gonna be on a spending spree, so looked for some SUB CC's. I was supposed to be gardening since I'm prob King Inquiry by now with all my apps, not fearing rejections, as I can wait 2 years for them to drop off. Closed my Citi as the annual fee anniversary was coming up and I was looking for a perk to keep it open, not some lame 7500 mi/$1k and $99 credit after $99 spend. So anyway...

(PS. Closed the QS the day after it was approved since I apparently clicked on pre-qual and some other offer came up so no SUB or promo apr, also the SL is lame considering you can't merge with other Cap1 cards)

(PPS. My open credit is crazy, over 3X income. Once my apr promo's expire on 3 CC, I'll close them since I was only churning them anyway and the rewards aren't worthy of DD status)

Congrats on your approvals. But why close a card and not keep it at least a year after all the hits you took to get it? Oh well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The floor is very slippery! TD Cash, Cap1 QS, BBT

@ChurnNburn yeah it looks like you were the victum of Cap1 sliding scale on the preapprovals page. I want to say "new sliding scale" but I cannot really pinpoint when it went into affect. SUB, intro APR % and intro time period seems to be the varible terms from the prequalification page. If you prequalify you can back out and get better terms. There were a 1-2 threads about iirc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The floor is very slippery! TD Cash, Cap1 QS, BBT

Congrats on your approvals!!

I am curious, I know the TD Cash card has a 3% on dining. That's nice given that the Uber is dropping. Do you have to have a TD account with them to get approved?

Also, I know that they are the backer of the Nordstrom card. Anyone know if that helps or hinders someone if they have that card?

Closed - Capital One Secured ($500) - It is not in my wallet. :-) - Sony/Sync ($2400)

Goal - To get in with Chase.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The floor is very slippery! TD Cash, Cap1 QS, BBT

@FireMedic1 wrote:Congrats on your approvals. But why close a card and not keep it at least a year after all the hits you took to get it? Oh well.

Because it's worse to close it a year after it's open. I'd rather close it immediately and wait out for it to offset. Also, I already have 2 other Cap1 cards that collect dust, can't close them because they are my older cards. Also, the rep I spoke to was an **bleep**, so that made it easy to close it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The floor is very slippery! TD Cash, Cap1 QS, BBT

@Anonymous wrote:@ChurnNburn yeah it looks like you were the victum of Cap1 sliding scale on the preapprovals page. I want to say "new sliding scale" but I cannot really pinpoint when it went into affect. SUB, intro APR % and intro time period seems to be the varible terms from the prequalification page. If you prequalify you can back out and get better terms. There were a 1-2 threads about iirc.

Yup. One of the reps I spoke to suspected that the pre-qual popped up, and those are the terms I get since I'm already pre-qual. I'd would have been better off cold app'ing and then I'd get an accept or decline. Since the stupid pre-qual came up in the middle of the app, I got duped. Oh well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The floor is very slippery! TD Cash, Cap1 QS, BBT

@dsotm76 wrote:Congrats on your approvals!!

I am curious, I know the TD Cash card has a 3% on dining. That's nice given that the Uber is dropping. Do you have to have a TD account with them to get approved?

Also, I know that they are the backer of the Nordstrom card. Anyone know if that helps or hinders someone if they have that card?

3% dining isn't great when there are plenty of other cards out that with the same offer, the Savor offers 4% beating out the likes of Marvel too. But yes, I have an active account with them. Prob why they instant approved me. 3rd time.