- myFICO® Forums

- Types of Credit

- Credit Cards

- 2% back no AF from SoFi - Data Points

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

2% back no AF from SoFi - Data Points

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% back no AF from Sofi

Also, do they issue an instant card number after approval?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% back no AF from Sofi

@Credit12Fico wrote:Also, do they issue an instant card number after approval?

No. You are told to wait 10 days for the card to arrive and then activate it. You don't get/see it in advance of that.

Not sure on your statement questions...habent gotten there yet.

Thanks @Matt9543 regarding the future CLI questions.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% back no AF from Sofi

@cashorcharge wrote:

@Credit12Fico wrote:Also, do they issue an instant card number after approval?

No. You are told to wait 10 days for the card to arrive and then activate it. You don't get/see it in advance of that.

Not sure on your statement questions...habent gotten there yet.

Thanks @Matt9543 regarding the future CLI questions.

That being said, I was able to add my card to Apple Pay immediately after being approved, so there's that possibility for getting instant access to your CL.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% back no AF from Sofi

Interesting. So I take it you clicked "activate" in the app before you had your card inhand?

I did see that link but didn't want to activate the card before it was in my hand considering the holidays and USPS mail delays going on.

Congrats!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% back no AF from Sofi

Yes and no?

I was approved yesterday and went under the "add to google" tab and it has a button that said "hide card number" and I just turned it off and it showed all numbers including expiration date and code.

I checked again this morning and it wasn't there anymore. ☺

I was hesitant to use it before they mailed me a card so I'm just waiting for the card to be here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% back no AF from Sofi

@cashorcharge wrote:Interesting. So I take it you clicked "activate" in the app before you had your card inhand?

Yes. I decided to activate precisely because I thought it might be delayed (I just got a different card replacement that was mailed on 11/20). ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% back no AF from Sofi

Does anyone have info for those of you who have Sofi points, how many points does a direct deposit give? Is there a minimum amount that needs to be deposited; and do they give more points the more DD you have (e.g., bi weekly vs monthly)?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% back no AF from Sofi

@MoneyBurns wrote:Does anyone have info for those of you who have Sofi points, how many points does a direct deposit give? Is there a minimum amount that needs to be deposited; and do they give more points the more DD you have (e.g., bi weekly vs monthly)?

Curious on min redepemption threshold as well.. Sure it is in the Terms and Conditions of the card, but yet to look it up.. Will try to do later today if min redemption threshold which most likely there is, what it is I do not know currently.

edit: actually not seeing any min redemption threshold from what I can see.. Yet to play with it to see as still awaiting the card, but have got points for just logging in daily... Think I am at a whopping .70 cents...

Anyways document can be seen here.. SOFI CREDIT CARD REWARDS

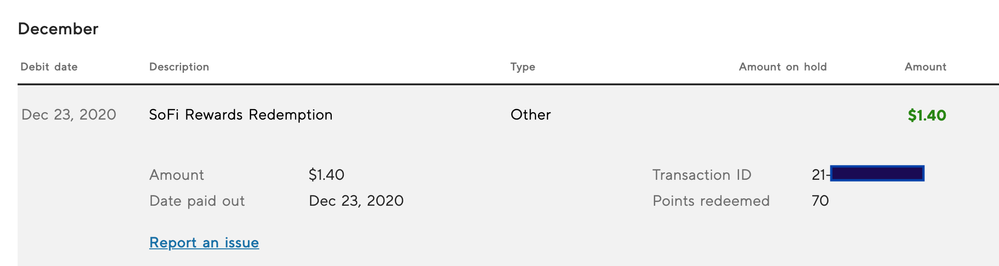

edit no min. Just transferred 70 sofi points to sofi money from logging in day for 7 days on app and $1.40 got transferred into SOFI money so kinda nice no redemption thresholds and get $1.40 a week without any spend if willing to just login to app each day plus other ways of getting points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% back no AF from Sofi

@Matt9543 wrote:

@Credit12Fico wrote:For those approved, does anyone know the following?

1) Is the statement closing date the same day of every month? (like Chase or BOA) or does it move around avoiding weekends like Citi? Do they let you change it?

2) What is the length of time between statement closing and the payment due date? The law is minimum 21days and I know some banks are stingy and want it right after 21 days, others give you closer to 27-28 days. Just wondering where this card fits in as I'm not familiar with the bank of missouri.

Edit: To answer question number 2, the terms say Your due date is 25 days after the close of each billing cycle.

I don't have exact answers, but I did call on Friday asking and I got a weird answer. She told me that my statement was supposed to close the 15th and be generated the 16th, but I didn't have one there. She then told me that since this billing period wasn't a full 30 days, the next statement will close on January 15th, resulting in close to a 50 day billing period. She told me also that you have at least 25 days until your payment is due, but could get up to 28 days.

I did ask about CLI's and she said product is too new to allow them, but to look forward for them in the future. She also said that I shuold keep an eye out for any promotions or possible point earning additions.

Finally, I've been having an issue where let's say I log into the app at 11:55PM, but stay signed in, and check the app at 12:10AM (15 mins later) it does not give me the points. I already let CS know about the bug and they just manually added my points.

Update for those who are curious. The customer service representative who I spoke with was completely incorrect. My statement closed yesterday (30 days after opening the card) and it shows my payment due date as January 17th. Minimum payment $35.

FICO Scores (current as of November 24, 2020): Equifax: 740 | Experian: 751 | TransUnion: 732

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% back no AF from Sofi

@Matt9543 wrote:

@Matt9543 wrote:

@Credit12Fico wrote:For those approved, does anyone know the following?

1) Is the statement closing date the same day of every month? (like Chase or BOA) or does it move around avoiding weekends like Citi? Do they let you change it?

2) What is the length of time between statement closing and the payment due date? The law is minimum 21days and I know some banks are stingy and want it right after 21 days, others give you closer to 27-28 days. Just wondering where this card fits in as I'm not familiar with the bank of missouri.

Edit: To answer question number 2, the terms say Your due date is 25 days after the close of each billing cycle.

I don't have exact answers, but I did call on Friday asking and I got a weird answer. She told me that my statement was supposed to close the 15th and be generated the 16th, but I didn't have one there. She then told me that since this billing period wasn't a full 30 days, the next statement will close on January 15th, resulting in close to a 50 day billing period. She told me also that you have at least 25 days until your payment is due, but could get up to 28 days.

I did ask about CLI's and she said product is too new to allow them, but to look forward for them in the future. She also said that I shuold keep an eye out for any promotions or possible point earning additions.

Finally, I've been having an issue where let's say I log into the app at 11:55PM, but stay signed in, and check the app at 12:10AM (15 mins later) it does not give me the points. I already let CS know about the bug and they just manually added my points.

Update for those who are curious. The customer service representative who I spoke with was completely incorrect. My statement closed yesterday (30 days after opening the card) and it shows my payment due date as January 17th. Minimum payment $35.

Thanks so much!