- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Comprehensive list of 5% rotators...Anything m...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Comprehensive list of 5% rotators...Anything missing?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

To add further to 5% cards:

L&N FCU Visa Platinum Cash Back Rewards no limit 5% gas card

"If you live, work, worship, attend school, or belong to any legal entity in any of the following counties, YOU CAN NOW JOIN L&N!"

The geofence is in Kentucky and a couple counties of South Indiana and Ohio. $50 SUB for $1000 spend in 90 days (which is hard to hit with a gas card). I have not yet called to ask whether membership in a chamber of commerce is acceptable.

https://www.lnfcu.com/credit-cards.html

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

@Anonymous wrote:

@MrDisco99 wrote:Any strategy advice on how to get more than one USBank Cash+?

They seem to be pretty stingy with just the one. How long should one wait before applying for a second? Would it be easier to apply for something else and then PC?

I think I've seen a number of folks around here with 2 Cash+s. IIRC, the main difficulty is gardening for the 1/12 limit for each of the cards.

But why not try for the (more common, and easier) combination of a Cash+ and an Elan MCP? You wouldn't need to garden to 1/12 for the Elan card, and if you wanted to use one or both of the Cash+-only categories that aren't found on the Elan MCP (i.e., Select Clothing or Ground Transportation), just set your Cash+ to those categories.

Agreed. The ease of obtaining the Max Cash Preferred is making me question whether I'll ever go for the actually Cash +. I think I'd rather have the the MasterCard version of the MCP next time around for cell phone insurance.

Hover over cards to see limits and usage. Total CL - $608,600. Cash Back and SUBs earned as of 5/31/24- $21,590.43

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

@GatorCowboyLion wrote:To add further to 5% cards:

L&N FCU Visa Platinum Cash Back Rewards no limit 5% gas card"If you live, work, worship, attend school, or belong to any legal entity in any of the following counties, YOU CAN NOW JOIN L&N!"

The geofence is in Kentucky and a couple counties of South Indiana and Ohio. $50 SUB for $1000 spend in 90 days (which is hard to hit with a gas card). I have not yet called to ask whether membership in a chamber of commerce is acceptable.

https://www.lnfcu.com/credit-cards.html

@GatorCowboyLion Thanks for sharing, the L&N card looks like it would be a solid offering. That geo language looks a bit tough to get around, however. If someone wants an uncapped 5% gas card, Abound CU has open membership through American Consumer Council, and they added a quarterly rotating category as well. In either case, Citi basically walked in and said hold my beer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

@JNA1 wrote:

@Anonymous wrote:

@MrDisco99 wrote:Any strategy advice on how to get more than one USBank Cash+?

They seem to be pretty stingy with just the one. How long should one wait before applying for a second? Would it be easier to apply for something else and then PC?

I think I've seen a number of folks around here with 2 Cash+s. IIRC, the main difficulty is gardening for the 1/12 limit for each of the cards.

But why not try for the (more common, and easier) combination of a Cash+ and an Elan MCP? You wouldn't need to garden to 1/12 for the Elan card, and if you wanted to use one or both of the Cash+-only categories that aren't found on the Elan MCP (i.e., Select Clothing or Ground Transportation), just set your Cash+ to those categories.

Agreed. The ease of obtaining the Max Cash Preferred is making me question whether I'll ever go for the actually Cash +. I think I'd rather have the the MasterCard version of the MCP next time around for cell phone insurance.

@JNA1 Good choice going for the MCP (and the DW double too!), I like the larger Recreation and Entertainment categories. You might want the Cash+ if SP cli's are important (and Cash+ would give you ground transportation and clothing stores if you needed those)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

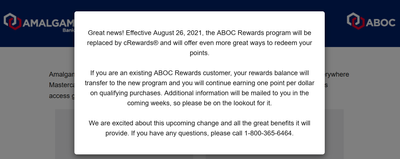

@Taurus22 wrote:Just FYI......I have the ABoC MC and it's become one of my least favorite cards. I was a fan of it for a long time and advocated for it here on the forum.....my thought justification was 3.75% is still better than most of the 3% mainstream card/categories. But I just don't ever use it (and they gave me a crap-ball SL and require a HP to get any CLI). It's honestly the one single regret I have in my entire credit repetoir, which is why I don't even bother to list it in my siggy.

Also, they are no longer accepting apps for this card, so the point is moot anyway. Wipe this one off your whiteboard.

EDIT: I have also made the decision to close this card in Jan 2022. They are also changing their rewards structure to cRewards.

@Taurus22 Great that you gave an early heads up on this steaming pile, especially now with ABOC dropping the rotating categories altogether.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

Ideally, eventually I would probaby like to have a MC MCP and a Cash +. That would give us 8 permanent 5% categories, to go along with 5% (actually 6.25% the way I redeem it) for travel with my Synovus card, 6% (technically 4.4% with the AF) groceries, streaming, and ground transportation on my BCP, 4% gas on my PNC, our 5% rotators and the Citi CC eventually) and 3% AOD catch all card. That would be probably as stout of lineup for a cash back fan who doesn't fly as you could get.

@PullingMeSoftly wrote:

@Taurus22 wrote:Just FYI......I have the ABoC MC and it's become one of my least favorite cards. I was a fan of it for a long time and advocated for it here on the forum.....my thought justification was 3.75% is still better than most of the 3% mainstream card/categories. But I just don't ever use it (and they gave me a crap-ball SL and require a HP to get any CLI). It's honestly the one single regret I have in my entire credit repetoir, which is why I don't even bother to list it in my siggy.

Also, they are no longer accepting apps for this card, so the point is moot anyway. Wipe this one off your whiteboard.

EDIT: I have also made the decision to close this card in Jan 2022. They are also changing their rewards structure to cRewards.

@Taurus22 Great that you gave an early heads up on this steaming pile, especially now with ABOC dropping the rotating categories altogether.

Agreed! At one time ABOC was near the top of my list of goal cards, but luckily I found out from the great folks here that it wasn't worth the trouble.

Hover over cards to see limits and usage. Total CL - $608,600. Cash Back and SUBs earned as of 5/31/24- $21,590.43

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

I ran accross another interesting no AF 5% card, dutifully recorded here for scientific documentation. The Credit One Best Friends Visa may actually be viable, especially for people with lots of pets or who make farm store purchases. I like that the rewards limit is yearly, allowing for cashback on larger purchases.

It offers "5% cash back rewards on eligible pet shop, and pet food and supply store purchases for the first $5,000 per calendar year, then 1% thereafter. Certain Non-Eligible Purchases: Pet grooming, unless pet grooming is an ancillary service to a pet shop or pet food and supply store; Pet sitting and boarding, unless pet sitting and boarding is an ancillary service to a pet shop or pet food and supply store; veterinary services; purchases made at discount supercenters (including but not limited to Wal-Mart and Target) and warehouse clubs (including but not limited to Sam’s Club and Costco); and purchases made with Paypal."

Disclaimer: Credit One has been reportedly difficult to work with and even predatory on those with no credit / poor credit / low information.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

@PullingMeSoftly wrote:

Nusenda Credit Union Platinum Cash Rewards (Update: Approved 6/2021, $25k)

Safe Credit Union Cash Rewards (Update: Approved 7/2021, $25k)

Can you share how you were able to get into Safe and Nusenda and who they pull? Thank you!

Biz |

Current F08 -

Current 2,4,5 -

Current F09 -

No PG Biz Credit in Order of Approval - Uline, Quill, Grainger, SupplyWorks, MSC, Amsterdam, Citi Tractor Supply Rev .8k, NewEgg Net 30 10k, Richelieu 2k, Wurth Supply 2k, Global Ind 2k, Sam's Club Store 11.k, Shell Fleet 19.5k, Citi Exxon 2.5k, Dell Biz Revolving $15k, B&H Photo, $5k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

@spiritcraft1 wrote:

@PullingMeSoftly wrote:

Nusenda Credit Union Platinum Cash Rewards (Update: Approved 6/2021, $25k)

Safe Credit Union Cash Rewards (Update: Approved 7/2021, $25k)

Can you share how you were able to get into Safe and Nusenda and who they pull? Thank you!

No prob, here are the stories:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

@PullingMeSoftly wrote:

@spiritcraft1 wrote:

@PullingMeSoftly wrote:

Nusenda Credit Union Platinum Cash Rewards (Update: Approved 6/2021, $25k)

Safe Credit Union Cash Rewards (Update: Approved 7/2021, $25k)

Can you share how you were able to get into Safe and Nusenda and who they pull? Thank you!

No prob, here are the stories:

Thank you! Looks like a couple tough membership nuts to crack.

Biz |

Current F08 -

Current 2,4,5 -

Current F09 -

No PG Biz Credit in Order of Approval - Uline, Quill, Grainger, SupplyWorks, MSC, Amsterdam, Citi Tractor Supply Rev .8k, NewEgg Net 30 10k, Richelieu 2k, Wurth Supply 2k, Global Ind 2k, Sam's Club Store 11.k, Shell Fleet 19.5k, Citi Exxon 2.5k, Dell Biz Revolving $15k, B&H Photo, $5k