- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: My Creditor is Helping Me Thread. #TeamMyFICO

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

My Creditor is Helping Me Thread. #TeamMyFICO

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Creditor is Helping Me Thread. #TeamMyFICO

@Remedios wrote:

@Anonymous wrote:

@Remedios wrote:

@Anonymous wrote:

@Remedios wrote:About BECU loan

If you go for it, third step is picking whether you want to use "existing application", or start a new one.

The existing application only refers to some info being already prefilled, and not having to sign again.

Per my chat with CSR, DO NOT use that option as it "creates confusion" in terms of APR (regular APRs, different terms attached to it).

So, use "Start New Application".

I toyed with it a few times trying to figure out how the online process was going to work with no promo code and that had me a bit confused.

@Anonymous I asked about that, it's not needed.

Ok, gotcha. Did you end up going through with it? Or just inquired about it?

No, not yet.

I asked for CLI, and I got it, HP good for 30 days, so I'm still thinking about it.

Awesome! Suppose you'll have to call in to recycle it - correct? Or did a miss a post some where when reading up on them that their system now auto does it online?

Also did you ask if your CLI would have any impact on whether or not you applied for it? In the same boat, sorta, as I just got approved for a card with them. So wondering if they would see a new app or CLI as a negative factor when considering the loan.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Creditor is Helping Me Thread. #TeamMyFICO

@Anonymous you can call or do it online. I've never gotten a second HP when within 30 days, I typically ask for everything and a cookie after HP.

Out of state members sometimes experience a brief snag with their hyperactive fraud dept, but after that it's smooth sailing. I've been a member over 15 years, and I'm still gushing.

If you want that loan, just apply. It wont impact your card approval, nor does the card approval lessens your chance of being approved for relief loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Creditor is Helping Me Thread. #TeamMyFICO

@Remedios wrote:@Anonymous you can call or do it online. I've never gotten a second HP when within 30 days, I typically ask for everything and a cookie after HP.

Out of state members sometimes experience a brief snag with their hyperactive fraud dept, but after that it's smooth sailing. I've been a member over 15 years, and I'm still gushing.

If you want that loan, just apply. It wont impact your card approval, nor does the card approval lessens your chance of being approved for relief loan

Ok, cool. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Creditor is Helping Me Thread. #TeamMyFICO

@Anonymous wrote:Hey everyone. I was looking through my auto loan with Capital One and noticed that they added a link on the auto loans main page. It asks if you are impacted by the Coronavirus. If you select yes, it is giving you the option to apply for an extension of 1-2 months to skip your next 1-2 payments. The terms say that interest will continue to accrue during this time. Maybe this will help someone out there.

Thanks, @sassynycgirl! I was waiting to call CapOne when I had several hours available, as I figured it would be a long hold time. I'm so glad you pointed this out, because I've probably missed it everyday when I look for something (getting old! ![]() ). My DW is temporarily laid off without pay, so I opted for the 2 month deferment. Not sure how it works with us being paid up a month in advance, maybe we essentially get 3 months?

). My DW is temporarily laid off without pay, so I opted for the 2 month deferment. Not sure how it works with us being paid up a month in advance, maybe we essentially get 3 months?

Need to cancel recurring payments after signing up, otherwise they auto-draft even when signing up for deferment.

I'm posting some pics of the process to help others.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Creditor is Helping Me Thread. #TeamMyFICO

New: I have added a new thread in the Smorg Section. Verizon just texted me that they gave me 15gb for free from 3/25 to 4/30 for mobile hot spots. I have the 5gb carryover plan a month. Please contribute. Link in Post #1 also for new readers.

https://ficoforums.myfico.com/t5/SmorgasBoard/Cell-Phone-Companies-Come-Thru-Now/td-p/5964376

BK Free Aug25

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Creditor is Helping Me Thread. #TeamMyFICO

@masscredit wrote:A few people asked about DCU. A friend contacted them to see what they can do for her auto loan. She should hear back in a day or two. I'm going to contact them after I find out what they do for her. I'll let you know how that goes.

6 months. All you have to do is ask for is 6 months of deferred payments. Very easy process

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which banks are allowing Payment Deferrals?

Today I saw in my Bank of America credit card account they are offering payment deferrals.

Please post if you are seeing any others from banks.

Message from BoA:

"Your personal accounts may be eligible if your future payment due date is on or before May 15, 2020.

Your business accounts may be eligible if your future payment due date is on or before June 15, 2020.

If your account payment is currently 150 days or more past due, it is not eligible for a payment deferral."

I will attach a screenshots:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Which banks are allowing Payment Deferrals?

Just got this email from FNBO offering to skip April & May CC payments, if needed:

| ||

| Important information about your FNBO Credit Card Account | ||

|

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Creditor is Helping Me Thread. #TeamMyFICO

@M_Smart007 wrote:

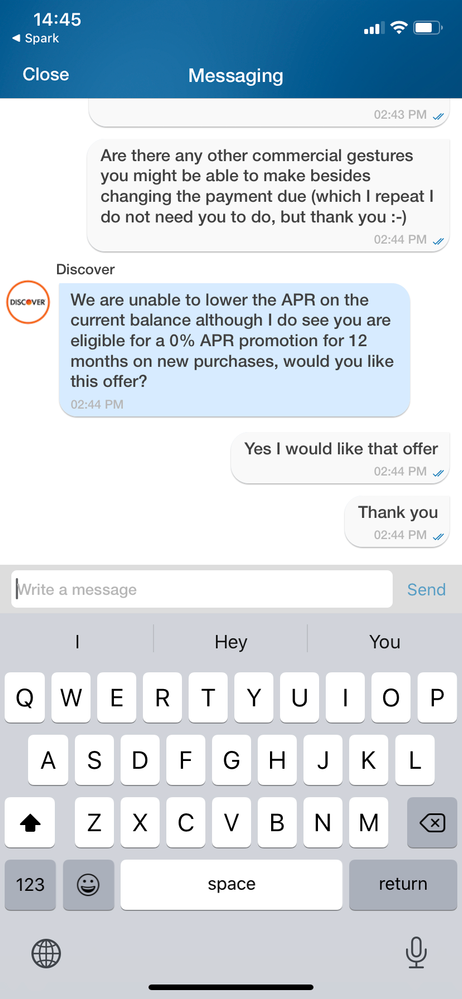

@Anonymous wrote:Y'all rule. Just messaged Discover. They said I could change my due date and skip the next payment. Also, 0% APR on new purchases for 12 months. Yyyyaassss!!

They had given Me the same thing a few months back. Nice to have.

My 2nd IT card turn's one year In April, it will be interesting to see what they will do on that one.

@M_Smart007

I got it back in November I believe, and yes, definitely good to have ![]()

Potential Future Cards

Closed Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Creditor is Helping Me Thread. #TeamMyFICO

Update Alliant Emergency Loan - Approved - $5000/48 months 9% - Two paystubs.

FYI - The reason I took this loan is I opened my membership with Alliant over 4 years ago so I could get my first SSL.

I completed it and since then have never taken advantage of my membership. This will help me build my relationship and I also applied for a Visa card. I know they're a great credit union to have.

Current Fico8 - (8.2022) EX - 744/EQ - 728/TU - 740