- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Requested Discover CLD... but got removed from...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Requested Discover CLD... but got removed from future CLIs

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Requested Discover CLD... but got removed from future CLIs

@Creditaddict wrote:

the whole point of having the CL with a bank like chase and adding another card is you can easily move the cl and open the other card...

That's not going to work because that requires a phone call. If you've been abusing Chase, once human eyes are on your account it's game over for you. Especially now with the 5/24 "rule", which may not be quite what it seems. Always keep humans out of your junk.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Requested Discover CLD... but got removed from future CLIs

@Creditaddict wrote:

@core wrote:

@Anonymous wrote:I might be missing something but I just don't understand requesting a "lower" credit limit.

One legit reason is to increase your odds of instant approval on a subsequent card app. To avoid having to call recon and be questioned about all sorts of things, including "why do you appear to be reward seeking?".

nope nope nope... if anything I see people talking to reps (chase) and can't get a CLI or anything but then apply for a new account and get approved for $15k+ when they were told by human that they were at exposure limit... I would never CLD in thinking that's going to make a new app with the same bank go through... the whole point of having the CL with a bank like chase and adding another card is you can easily move the cl and open the other card... why take away from your cl!

This whole thread lacks logic to me but i guess i have 95 credit cards so that lacks logic for most.

"subsequent apps" aren't at the same bank (necessarily) and you never want to have to talk to a rep after an app, so you can't offer to move CL then. The whole game is to avoid "eyes on the account" and so instant approval is necessary.

It's a different goal from your "collecting" style. The idea is to get as many big bonuses as possible and this means, as core said, you don't want to be asked questions about reward seeking. (I'm sure you can get asked that about credit seeking, but it's easier to make explanations about how you need that card, rather than why you need your third Citi AA card for example!)

ETA: core beat me

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Requested Discover CLD... but got removed from future CLIs

There are definitely times when requesting a CLD can be necessary and effective but this wasn't one of them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Requested Discover CLD... but got removed from future CLIs

@Anonymous wrote:There are definitely times when requesting a CLD can be necessary and effective but this wasn't one of them.

+1

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Requested Discover CLD... but got removed from future CLIs

@core wrote:

@Creditaddict wrote:

the whole point of having the CL with a bank like chase and adding another card is you can easily move the cl and open the other card...That's not going to work because that requires a phone call. If you've been abusing Chase, once human eyes are on your account it's game over for you. Especially now with the 5/24 "rule", which may not be quite what it seems. Always keep humans out of your junk.

+1. Chase does not feel that the "whole point" of having their cards is so you can move the limits as you pick and choose. If people continue to abuse their policies, it will simply come down to not being able to move limits at all and/or them requiring a HP for it to discourage it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Requested Discover CLD... but got removed from future CLIs

@Anonymous wrote:

@Anonymous wrote:I had $20,500 CL on my discover and just for the sake of making it a whole number requested for a CLD to $20k by reducing $500... My CL was reduced as requested and 3 days after that got a message stating that since I requested for CLD, my account will be removed from future account reviews for CLIs. What??????... Message continues to say, to be restored for account reviews for CLI, I will have to request for CLI. HUH????? Anyone else had this situation. Discover is weird.

They may be weird but asking for a CLD of $500 to get to an even number is to me......weird :-)

+1 leave well enough alone sometimes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Requested Discover CLD... but got removed from future CLIs

@TRC_WA wrote:

@axlm wrote:I received 3 CLIs from Discover in the past 4 months, and each time I adjusted the slider down in order to have a 'nice looking' number. Should I seek help too?

Possibly?

Or am I just weird for not giving a flip if a CL is $10,500 or $4,750?

Im guessing op would go nuts with barclays then.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Requested Discover CLD... but got removed from future CLIs

I like round numbers too. If my last Discover CLI had the slider, I would have chosen to go to 21K instead of 21.3K. But ask for a CLD to get there? No way, never!

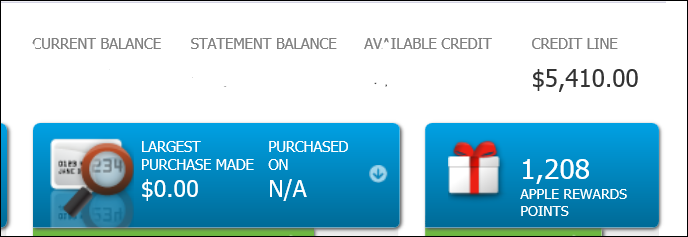

Starting Score: EX:570, 8/2011

Current

Scores(8/30/18): EX08:850; EQ08:850,

TU08:847 Inqs(12 mo): EX/0, EQ/0, TU/0

Goal Scores: 800+

My Cards: BoA Rewards: 30K, Discover IT: 50K, Arrival : 13.3K, CDP: 30.1K, Amex PRG, Amex ED: 22.5K, Amex BCP: 20K, FU: 21K, CSR: 35K, Amazon Store: 20K, Macys:10K, Diners Club:40K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Requested Discover CLD... but got removed from future CLIs

@taxi818 wrote:

@TRC_WA wrote:

@axlm wrote:I received 3 CLIs from Discover in the past 4 months, and each time I adjusted the slider down in order to have a 'nice looking' number. Should I seek help too?

Possibly?

Or am I just weird for not giving a flip if a CL is $10,500 or $4,750?

Im guessing op would go nuts with barclays then.

Well, that would make ME flip for sure. ![]()

Last update: NOV 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Requested Discover CLD... but got removed from future CLIs

I think the odd CLs are a secret code they use to communicate things about you to other companies who view your report. Kinda like a hobo writing with chalk on the sidewalk near your house.