- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Walgreens is offering a credit card via Sync

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Walgreens is offering a credit card via Sync

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walgreens is offering a credit card via Sync

@Grizzly1 wrote:Seems like it would be a good idea if you shop there enough but I'd rather have my cash back to do as I choose.

Walgreens introduces a ‘health’ rewards credit card (consumeraffairs.com)

Agreed, I wont waste my time with this card, there is not much in the store that I buy anyway.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walgreens is offering a credit card via Sync

@northface28 wrote:Does this mean the cashier will harass me to sign up for a credit card? Brick and mortar will go away not because of online shopping but because you're harassed at almost every store to sign up for a shoddy store card.

It is amazing that companies have yet to realize that most customers do not want a hard push for a CC every single time they shop somewhere.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walgreens is offering a credit card via Sync

Cabelas/Bass pro is probably the worst offender of this. Just getting in the store involves trying to navigate past them trying to sign you up for their credit card.

9/2021: EQ 684, TU 662, EX 671

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walgreens is offering a credit card via Sync

@kdm31091 wrote:

@northface28 wrote:Does this mean the cashier will harass me to sign up for a credit card? Brick and mortar will go away not because of online shopping but because you're harassed at almost every store to sign up for a shoddy store card.

It is amazing that companies have yet to realize that most customers do not want a hard push for a CC every single time they shop somewhere.

@kdm31091 I shop at Walgreen's quite a bit, and no Walgreen's cashier or other employee has ever even mentioned the Card to me yet. I don't think that you can apply at a register right now, as you can at other stores. You can actually save quite a bit of money at Walgreen's if you take advantage of their sales and promotions. For example, yesterday I purchased items totaling about $104, and I received about $94 in MyWalgrens cash rewards.

You can use the prequalification tool to determine if you're likely to be approved. So there wouldn't be a hard pull, unless you choose to accept Synchrony's offer. According to Synchrony, you can prequalify up to four times a day. That seems kind of funny to me, since most people's credit profiles don't change that frequently.

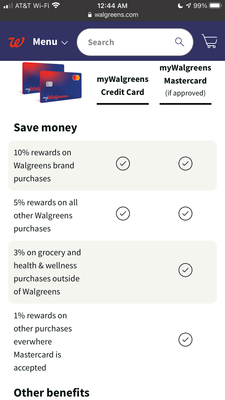

In my case, the process involved providing the last four digits of my social security number and my cell phone number. Synchrony then sent a text message to my cell phone. After I entered the code from the text message, Synchrony asked for more information, including my date of birth and annual income. They were able to locate my full social security number based upon the information I provided. I clicked on the continue button to see my offer. Unfortunately, Synchrony only prequalified me for the MyWalgreen's Credit Card. The amount of the credit limit was not specified to me. So I didn't continue past that point. I'm still tempted, as this would be a neat card for me to have, but it has significantly less value to me if I can only earn rewards when shopping at Walgreen's. Also, I would prefer not to get a card that (potentially) has a low credit limit. When I later reviewed my TransUnion credit report, there was a soft pull only from Synchrony on the date that I submitted the prequalification request.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pre-Qualify for the New Walgreens Pharmacy Store Card or MC

Not sure who has Walgreens Pharmacy in your area but they have debuted their new Walgreens Store Card and Mastercard. If you go on to Walgreens.com and in the very top is says "New! "My Walgreens Credit Card" and click on it and you have the option to pre-qualify. It is with Synchrony Bank.

EX 748

TU 749

EQ 755

FICO 9 783

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walgreens is offering a credit card via Sync

I tried the prequalification process again. There was one step in the prequalification process that I forgot to mention. In the previous prequalification, after I verfied my social security number, and entered my date of birth and income, I was taken to another page before I could view my offer. On this page, I was shown the last four digits of two cell phone numbers that I may have had in the past, and the option to verify one of the numbers. I no longer have either of the cell phone numbers that Synchrony showed me in the previous prequalification. But the page gave me the options of clicking "Don't See Your Number?," as well as "Skip This Step." I clicked on "Don't See Your Number" This may have affected the previous prequalification process because...

When I retried the prequalification process a few minutes ago, Synchrony again provided me with two cell phone numbers to verify. This time, they listed a cell phone number that I still have. Synchrony sent me a code to this cell phone and I verified it. My offer was still for a MyWalgreens Credit Card, not a MyWalgreens MasterCard. However, this time the offer specified the credit limit. As I mentioned in the above post, I was concerned that since it's a store card, Synchrony would assign a really low credit line to me--like $300 or something like that. But they offered me a credit limit of about $1K. I guess a lot of people here will think that's still very low, and it is lower than any of the other credit cards that I've recently been approved for. But given the fact that I shop at Walgreens frequently, I decided to accept the offer. Synchrony then performed a hard pull from my TransUnion credit report (I know because I immediately received alerts from credit monitoring services that I subscribe to), and approved my application instantly. They provided me with a page containing a bar code that can be scanned in stores until I receive my permanent card, and added the new MyWalgreens Card as the primary payment method for Walgreen's online purchases. Maybe in the future Synchrony will let me convert the store card to a Walgreen's MasterCard. But it's fine for now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walgreens is offering a credit card via Sync

I received the MyWalgreens credit card today.

Synchony also sent me a letter advising me of my credit score.

I thought that it might be helpful for people to know what score Synchrony used.

They used Vantage Score 4.0 from TransUnion. This a different score from the Vantage Scores that all the free services provide (I believe they use Vantage 3.0). The only reason I know is because I also have a Synchrony MasterCard, and Vantage 4.0 is the score they show me when I login.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walgreens is offering a credit card via Sync

@joltdude wrote:

Seems Walgreens is offering either a store or cobranded MC with interesting options esp if you use their pharmacy

If I understand the fine print correctly, no rewards are earned on prescription purchases in Arkansas, New Jersey, and New York, or on combined purchases which include prescriptions in those states. Correct me if I'm wrong about that.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 689 TU 684 EX 685

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walgreens is offering a credit card via Sync

I was offered the MC for $10,000 at 17.99%. My Synchrony Vantage 4.0 today was 817.

Not taking it, but adding a DP.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walgreens is offering a credit card via Sync

I did not realize until recently that Synchrony may do two hard pulls after you're preapproved for the MyWalgreens Card, if you accept the offer, and for other Synchrony credit cards.

This didn't happen to me when I accepted the MyWalgreens credit card, but it did when I applied for Synchrony's eBay MasterCard (they pulled TU and Experian).

The reason for this appears to be that Synchrony, according to the terms of its applications, now verifies social security numbers with the social security database if they are unable to determine who you are in the preapproval process. If you read the terms of their preapproved offers (or application process in general), you will see that they state this.

It is my belief that the preapproval / credit line / general underwriting is based upon TU data, and that the Experian hard pull is done to verify a social security number.

Had I known that Synchrony was going to do two hard pulls in conjuction with my eBay MasterCard application, I don't think that I would have applied. I thought that it would be helpful for people to know of this possibility.