- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: FICO Score Stress Indicators/Indexes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@Anonymous I just read what I wrote above and it sounded like I was saying that you updated my scores, but I was letting you know I updated my scores so that you can check them out. I wrote that wrong.

All good. I knew what you meant, and updated the table with your new score+date shortly after you posted it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

Highlights from an interview with Sally Taylor, VP of Scores at FICO, concerning the FICO Resilience Index.

SEP 18, 2020 - PDF Transcript Link - Interviewer was Peter Renton, Founder of Lend Academy ( Source link to Podcast )

- "...first of all, the FICO Resilience Index looks at the same underlying data as the FICO score." (Page 5)

- "...it is used in conjunction with the FICO score..." (Page 5)

- "Delinquencies really doesn't have as much of a play in the Resilience Index as it does in the FICO score..." (Page 5)

- "...the more sensitive ones will have a more newly opened trade, less a variety of credit just because they just have less experience on credit." (Page 5)

- "... the interest from lenders has been phenomenal." (Page 6)

- "...it's already available at Equifax, at Experian and will be available at all three." (Page 7)

She said that during the Great Recession, delinquencies doubled 'across the board', meaning all score bands.

Some interesting information about coding of forbearances and how the FICO score looks at those codes, on Page 3.

I wonder if we'll start seeing an EX Resilience Index score in October? She said it was already available there, and the interview was less than 2 weeks ago. It might show up sometime soon at myFICO or Experian's CMS.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

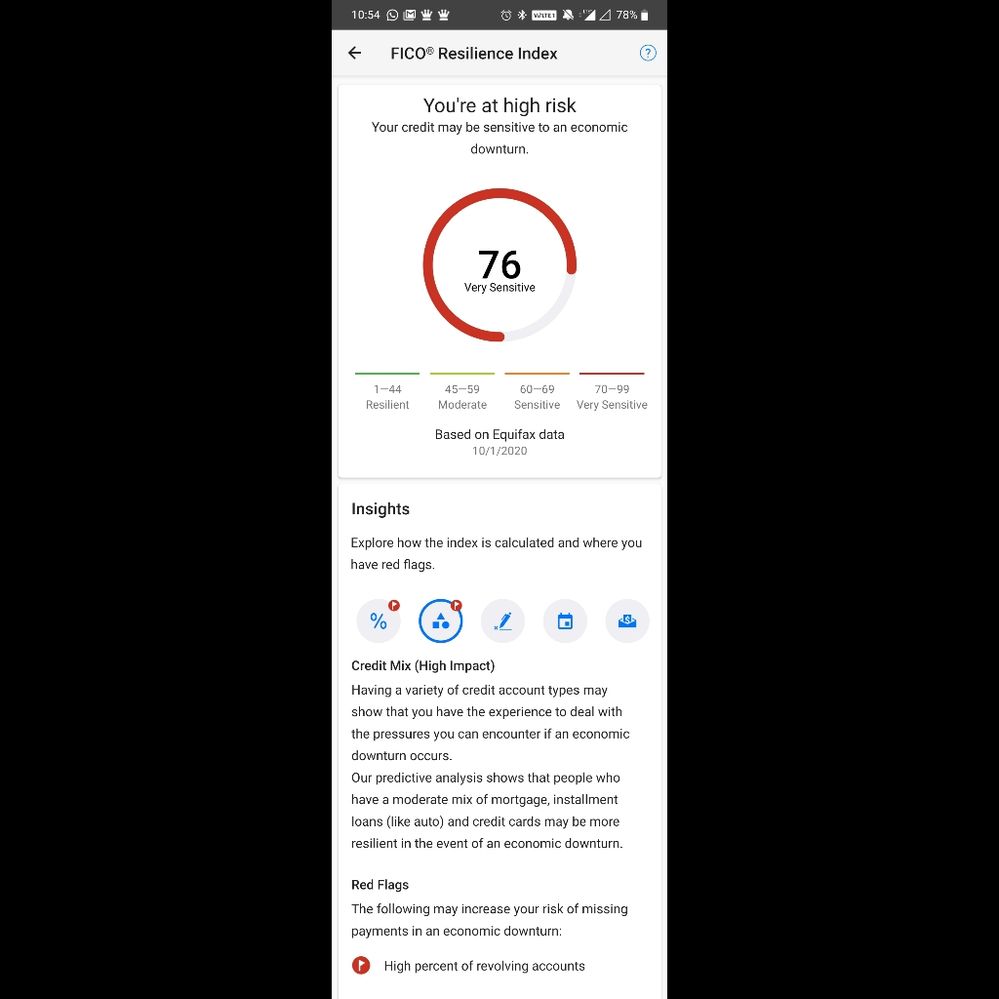

@Anonymous just got a score update. 76 with a 3rd flag added for credit mix, specifically high percent of revolving accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

It's interesting that the score supposedly goes from 1-99, but in the most extreme examples we've collected, it has only ranged from 37-75.

That's only a 38 point delta between "worst" and "best".

So the middle score seems to be 56, with a range of only +/- 19.

And if you remove the lone highest/lowest outliers, then you get a middle score of 56.5 with a range of only +/- 16.5

Not sure what to make of that data, just seems interesting to me.

Total SL: $78k

Total SL: $78kUnited 1K - 725,000 lifetime flight miles | Chase Status: 4/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Brian_Earl_Spilner wrote:@Anonymous just got a score update. 76 with a 3rd flag added for credit mix, specifically high percent of revolving accounts.

@Brian_Earl_Spilner: lol What a legend. 'The Stuffed Penguin Incident', posting a pic of you getting pulled over by FICO police, and now this?

Upon further review...Incomplete Post. The clock will be reset until you post a snapshot of that 76.

The referees trust you and I trust you, but I need something to show to Dogbert before taking away The Golden Sword! (You will also get The Golden Chalice, of course.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

Since it appears that we get punished both for having available credit, and for not having available credit, I don't think it's possible with this algorithm to have a score even remotely close to a perfect "1".

Total SL: $78k

Total SL: $78kUnited 1K - 725,000 lifetime flight miles | Chase Status: 4/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:The referees trust you and I trust you, but I need something to show to Dogbert before taking away The Golden Sword! (You will also get The Golden Chalice, of course.)

Why does last place seem to be the High Honor?

Now I want to app to see how badly I can screw up what's left of my resilience.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:

@Brian_Earl_Spilner wrote:@Anonymous just got a score update. 76 with a 3rd flag added for credit mix, specifically high percent of revolving accounts.

@Brian_Earl_Spilner: lol What a legend. 'The Stuffed Penguin Incident', posting a pic of you getting pulled over by FICO police, and now this?

Upon further review...Incomplete Post. The clock will be reset until you post a snapshot of that 76.

The referees trust you and I trust you, but I need something to show to Dogbert before taking away The Golden Sword! (You will also get The Golden Chalice, of course.)

Ask and ye shall receive.

I wish it was a triforce though

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@GApeachy wrote:

@Anonymous wrote:The referees trust you and I trust you, but I need something to show to Dogbert before taking away The Golden Sword! (You will also get The Golden Chalice, of course.)

Why does last place seem to be the High Honor?

Now I want to app to see how badly I can screw up what's left of my resilience.

lol I know what you mean.

It's because most of the people in the 60+ or Sensitive to Very Sensitive range don't have any problem getting approved for CLIs, new cards, or even a mortgage with the lowest rate.

People from FICO talk about the Index as a way for lenders to better evaluate applicants with a score under 700. '680' is commonly mentioned - it's in the interview (VP FICO Scores) I posted earlier, in FICO's explanatory text, and the FICO CEO even talked about these sort of 'edge cases' on an earnings call.

At this point, I think Jeff Bezos would probably get a 90+. lol