- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Free Transunion Credit Based Insurance Scores ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Free Transunion Credit Based Insurance Scores thru CK

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Free Transunion Credit Based Insurance Scores thru CK

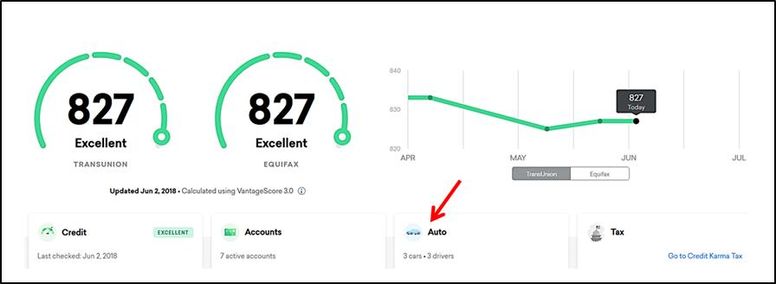

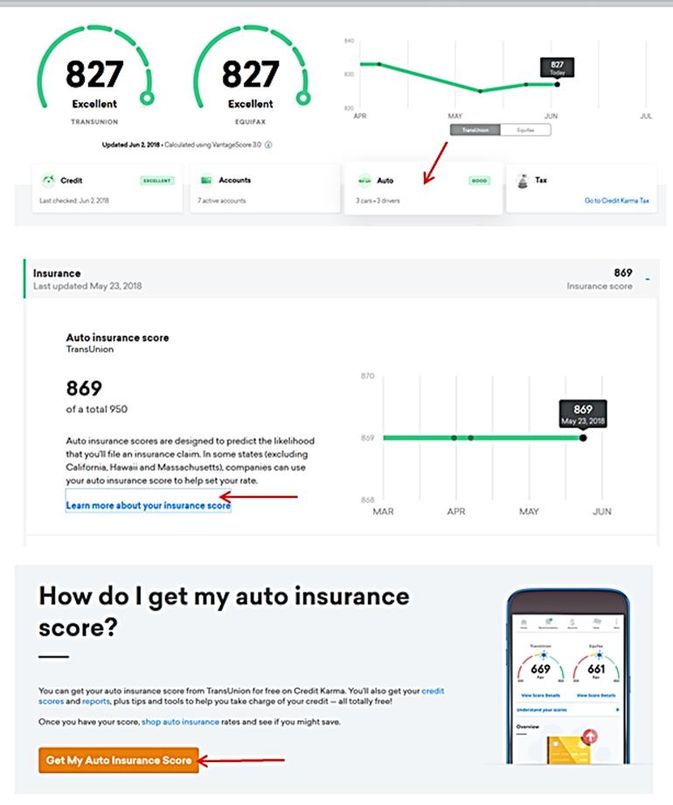

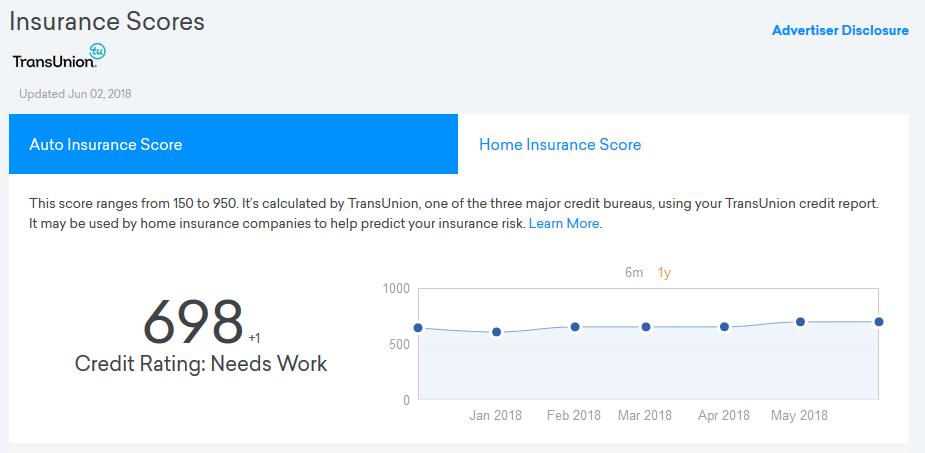

I went on CK to check out my VS 3 scores and found an easy link to CBIS scores from Transunion. Just click on the Auto Icon. (see paste below).

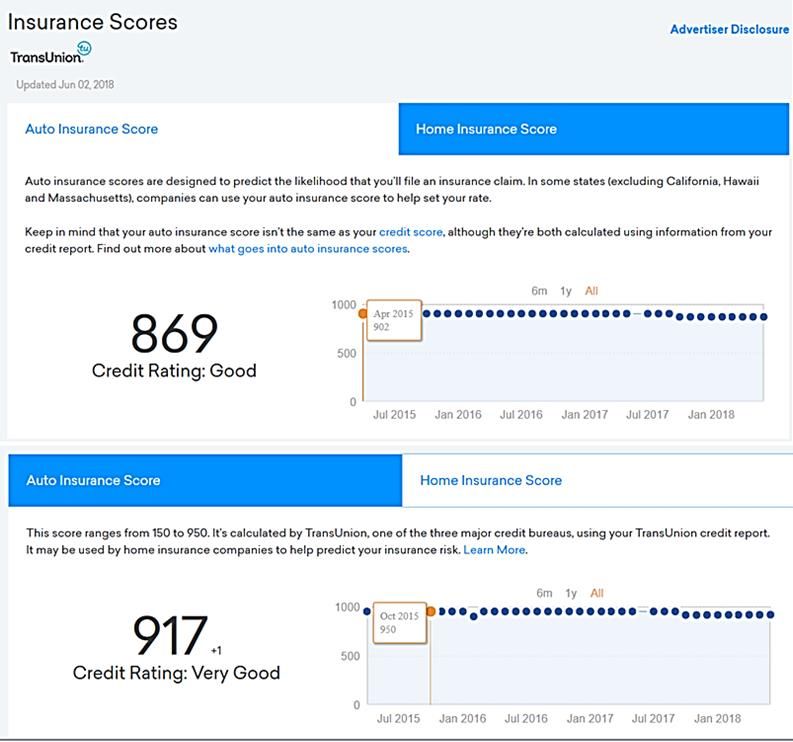

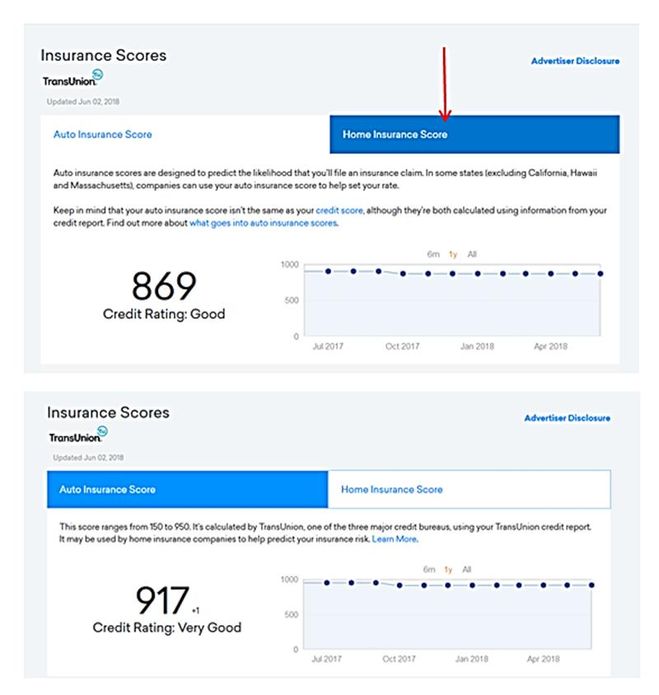

I was a bit shocked to see a major drop in score. I then clicked on "learn more about your insurance score" and was able to access my Home CBIS. A major hit on this score as well. One lousy inquiry drops my TU CBIS Auto score 33 points (902 to 869) and Property/Home score also dropped 33 points (950 to 917). [Note these two CBIS scores don't always change in unison but, the inquiry impact is the same]

I would pay to check my LexisNexis CBIS as well - but those scores are no longer available ![]()

![]() The takeaway for me is CBIS models appear to be very sensitive to credit seeking relating to HPs alone. I shudder to think how the models would treat a bunch of new accounts (particularly store cards).

The takeaway for me is CBIS models appear to be very sensitive to credit seeking relating to HPs alone. I shudder to think how the models would treat a bunch of new accounts (particularly store cards).

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion Credit Based Insurance Scores

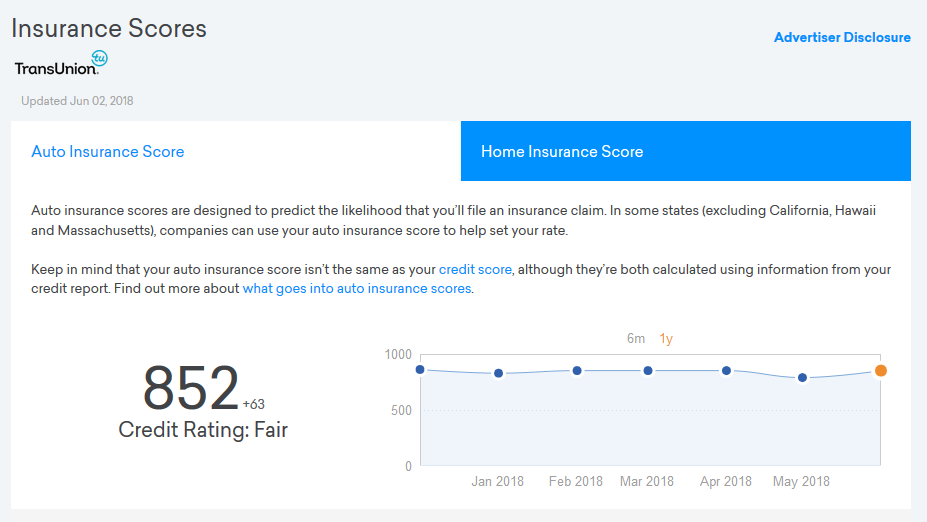

This is interesting! I don't actually own a car or pay car insurance myself but I'm an authorized driver on my grandparents 2000 Buick. The info still popped up when I clicked on the Auto icon.

I should also note that per CK my CBIS score is 852 while my VS 3.0 scores are 566 & 569 per CK. FICO scores are 566-575. I'm really curious what the factors and weights are for CBIS scores as I have two store cards, numerous lates, nine collections & charge-offs, four accounts less than 6 months old, and two inquiries on TU. I'm really surprised my CBIS score was as high as it is.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

Thanks for the data point. You should have access to both an Auto and Home CBIS score. Your CBIS score of 852 is, well, mind blowing given your credit file derogs and VS3 TU and Fico TU scores are under 600. Perhaps data is being pulled from a file that is not yours.

The TransUnion CBIS models are a bit of a mystery and there are few data points to utilize in getting a handle on how the model(s) score various attributes.

***CBIS data points from additional posters are encouraged***

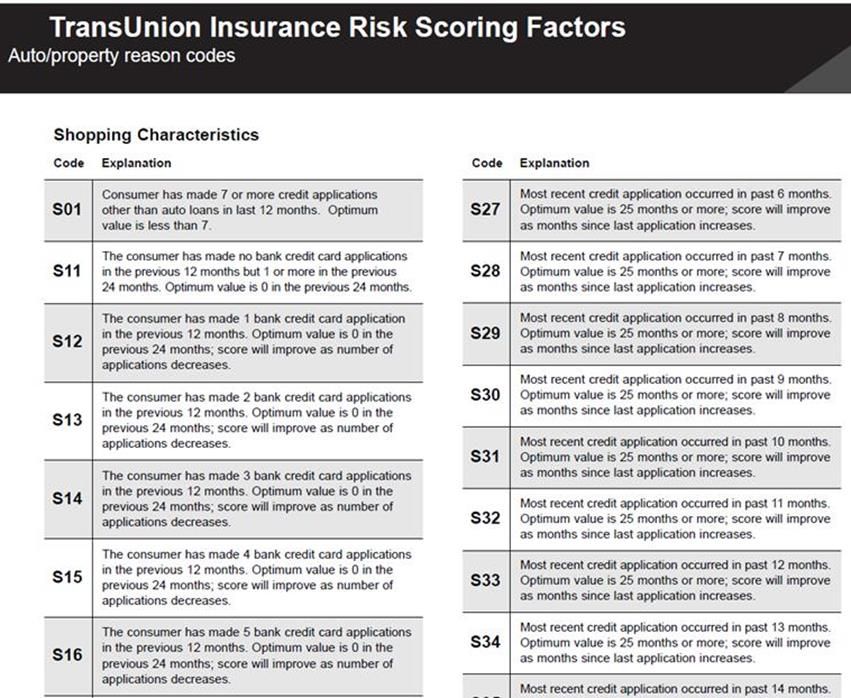

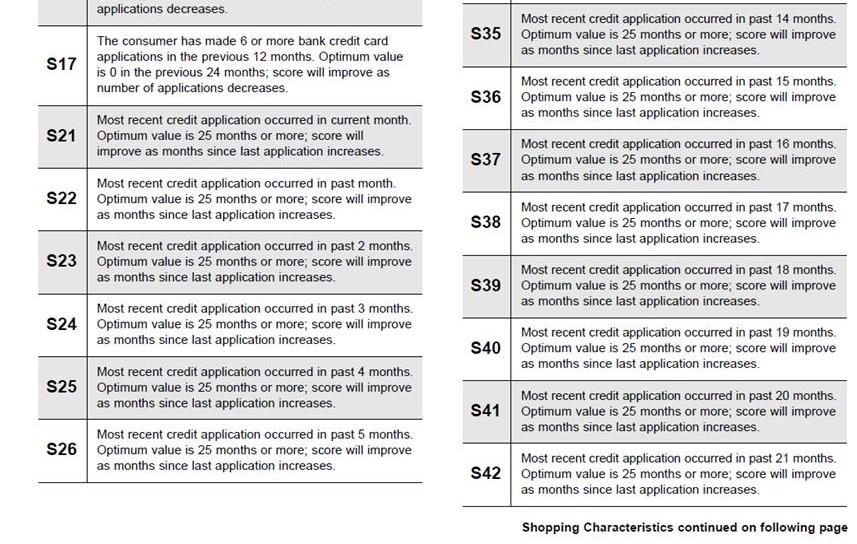

Pasted below is a dated, 14 year old, CBIS reason code table from TU.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion Credit Based Insurance Scores

@Thomas_Thumb wrote:Thanks for the data point. You should have access to both an Auto and Home3 CBIS score. Your CBIS score of 852 is, well, mind blowing given your credit file derogs and VS3 scores are under 600..

The TransUnion CBIS models are a bit of a mystery and there are few data points to utilize in getting a handle on how the model(s) score various attributes. Other CBIS data points are encouraged

I didn't see two tabs on mine like you show in your screenshot - perhaps the option only shows if they have data on you?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

As I recall you have to click on more information to go from the auto only graph to another web page that offers both scores and an extended history.

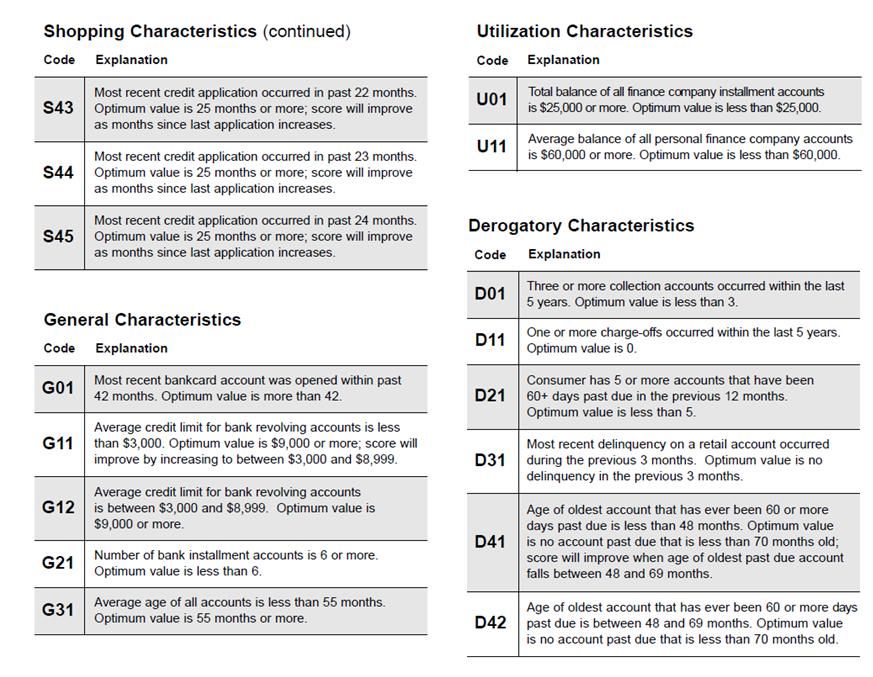

Included below is summary data showing average insurance premiums by CBIS rating category (The Zebra, "The State of Auto Insurance 2018"). For reference there is also a rating graph from TransUnion for CBIS score (not avaliable through CK).

Also pasted is a distribution of scores put together by TT in 2016.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion Credit Based Insurance Scores

@beutiful5678 wrote:

I didn't see two tabs on mine like you show in your screenshot - perhaps the option only shows if they have data on you?

I've never been able to find my insurance scores through Credit Karma's interface. And while a direct link has been posted here from time to time, I always lose it.

A great way to get in that's hard to forget is to Google credit karma insurance score. Hit the link, and "Auto Insurance Score - Credit Karma" will top the list. Follow it, and on the page that comes up, scroll to the bottom until you see a button that says "Get My Auto Insurance Score." Hit the button, and you'll be prompted to log in. And voila! You'll see the score. Hit the Home Insurance Score tab at the top of that page, and you'll see that score too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion Credit Based Insurance Scores

@Thomas_Thumb wrote:I went on CK to check out my VS 3 scores and found an easy link to CBIS scores from Transunion. Just click on the Auto Icon. (see paste below).

I was a bit shocked to see a major drop in score. I then clicked on "learn more about your insurance score" and was able to access my Home CBIS. A major hit on this score as well. One lousy inquiry drops my TU CBIS Auto score 33 points (902 to 869) and Property/Home score also dropped 33 points (950 to 917). [Note these two CBIS scores don't always change in unison but, the inquiry impact is the same]

I would pay to check my LexisNexis CBIS as well - but those scores are no longer available

The takeaway for me is CBIS models appear to be very sensitive to credit seeking relating to HPs alone. I shudder to think how the models would treat a bunch of new accounts (particularly store cards).

@Anonymous @Thomas_Thumb

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free Transunion Credit Based Insurance Scores thru CK

Pasted below is the full sequence I used to navigate to CBIS after logging in to CK. Refer to the red arrors. Each click takes you to a new screen sequenced top to bottom. You will need to scroll down on some of the screens to get to the display pictured.

*** please add data points***

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion Credit Based Insurance Scores

Nice find TT!

Looks like my Auto insurance score dropped 10 points with 1 recent inquiry.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion Credit Based Insurance Scores

Very helpful step-by-step instructions!

My home insurance score "needs work" - it's probably a good thing that I don't own a home, LOL.

https://www.creditkarma.com/auto/i/insurance-scores-affect-car-insurance-rates/