- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- NFCU SSL DP and Options

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

NFCU SSL DP and Options

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NFCU SSL DP and Options

NFCU SSL DP and Options

I was looking at options to improve my credit mix and increase my credit scores across the board. I have seen how this loan has helped so many that are rebuilding or starting out with fresh credit. I wish I had a clean file and starting out fresh it appears to be easier in my opinion and seen how some have grown fast versus those who are credit challenged.

Well I fall into the latter and could use the boost to both thicken my credit file while improving my credit mix. I asked a few questions about approaching the loan with different payment options and to see how it would affect my credit scores if I were not to pay the ssl loan down to 8.9% as many have. My goal was to test the market with increments of 5% and see how and if the bump in credit scores will still come and how much if any would the credit bumps me. The point of doing this is that I have heard some have paid the loan down and had troubles with the loan reporting a loan for a lesser amount versus the origination amount of the loan.

Here is what I did, I asked the general questions of the loan.

- Term of loan options

- Will there be a hard pull

- Can I pay the loan down fast without penalty

- What is the max loan amount.

- How to setup auto payment

- Where would the funds be deposited once loan is completed

- When will I have access to the funds after payment is made or when loan closes

- Can I pay loan with an external account

- Can I open a second savings account so that the loan payment will be deposited in that account so they are easier to track and I can double my savings

- Can you change the payment date: (NO)

The good news is that they were able to help me with my 10 questions and it was pretty straight forward. To get the answer of the term of the loan, I needed to let them know how much was I considering for the loan, I told them $3,200. The rep explained to me that it could be 36 months up to 60 months based on approval. She then asked if I would like to proceed an apply, my answer was yes, and could you please inform them I would like to get 60 months if at all possible. No problem I will check that off for you.. Rep let me know that there will be no hard pull for this loan at all because it is secured with your own money and that we will deposit the money into your savings account once the loan is approved an processed. But first you will see that your funds in your savings account will disappear until the loan is approved an processed and then that same amount will show a deposit in your savings account and you can do as you wish with it including paying back your loan. My thought was that I wanted to save more money or double it up so I asked if I could create the second savings account and leave the original deposit amount in my original savings account. She said wow you get it, most people will not do this and get confused because there is no tracking of the loan and they think they will have all this money save, but they don’t they just have the original amount less the interest. So I will proceed with paying the loan back from an external account so that I never touch the original $3,200. So that will always be saved as a rainy-day fund, and the repayment of the SSL will go into the new saving account so that I am paying myself forward and forcing myself to save additional money. At the end of five years, I will have approximately $6,400 saved, the way I am doing this is that I also moved $200 from my checking into the new savings account so that it will make up for the interest that I will pay on the loan over the course of 5 years. Now I will have matching savings accounts in five years the first savings account will be slightly higher due to interest it will gain over 60 months.

Rep explained that the loan will have a total interest of 2.25% and that my monthly payment will be slightly under $60 per month. That is awesome to force myself to save an extra 60 bucks a month less interest paid on new ssl loan.

I told rep that on certain months I will apply two to four times the amount of the payment and she said that will be no problem, your loan will take a few days to process the payment applied and your loan new balance will update, and your loan next payment will be pushed out to reflect how many payments you have paid. That was great info.

The max loan amount was $5,000 i did not see a need for that, but others will and it will help them based on what they are seeking to accomplish.

The auto payment with NFCU is probably the easiest setup that I have ever experienced. So I set that up for the monthly payment to come from my external account so that new money is always showing up in my NFCU savings account.

Where would the funds of my loan be deposited once loan is completed. Rep explained that the original loan funds will be deposit in your first savings account as you selected. The repayment funds will be deposited into your second account in 24-48 hours after your payment is processed. I originally thought the funds would be deposited once loan has been completed, but that is not the case. Your funds are made available to you shortly after loan payment is process and the risk is getting lower and lower while your savings account keeps improving. Its a win-win for all.

When will I have access to the funds being repaid? Within 24-48 hours after each payment is made towards NFCU SSL, some shared loans will not provide you access to these funds until the loan is repaid, in addition they will also do a hard pull. Absolutely love NFCU SSL loan.

Can I pay loan with an external account? Yes, you can pay with an outside account, you will need to set that up. It was easier for me to have the rep setup that account and they would make two small deposit an I would need verify the account by providing the deposit amounts. I did that prior to applying for the loan knowing I was going to do the loan at some point. You can also setup internal payments, but I find it easier to track the monthly payment when it is coming from outside of NFCU just for savings purposes and to double up on my savings.

Can I open a second savings account so that the loan payment will be deposited in that account so they are easier to track and I can double my savings? The answer was yes, and the rep said she wish that all new loan applicants did this because the tracking of the loan is better for both NFCU and credit union member. So, I opened my second savings account and it is very easy to track the deposit as I have already made several payments to test the water.

Snapshot of how this has worked.

I applied for the loan on 2-22-21 Loan was approved in about 20 minutes could have been faster, but I was not checking. Loan documents signed right after I received email approval. $3,200 disappeared from my first savings account. Two hours later the $3,200 appeared in my first savings account. I asked the rep when will this loan report to CRA's she said my first payment date is more than 60 days out so it would be hard to guess when it will appear on your credit report. No Problem, she mentioned that you cannot change your payment date like you can change your credit card payment date.

So here you have it.

Loan Amount: $3,200

Term: 60 months

Payment: $58 and change

Now some good points because I have elected to do this different from most. I made four payments on the loan. 1 payment from internal nfcu account to see how it processed. It processed payment and depsoit on into second savings account within an hour. I made three other payments all from an external account, these payments were all done on their own day to see how long they will take to process. Each payment took 24 hours to process being that they were all made on a weekday. I setup auto payment for the payment amount from an external account.

This is my advice to all to get the loan to appear on your credit report faster. Make payments from external account. Make a minimum of four total payments, do not make the initial jump to paying the loan down to 8.9% until after the ssl loan reports to avoid the possible headache of it reporting the wrong loan amount.

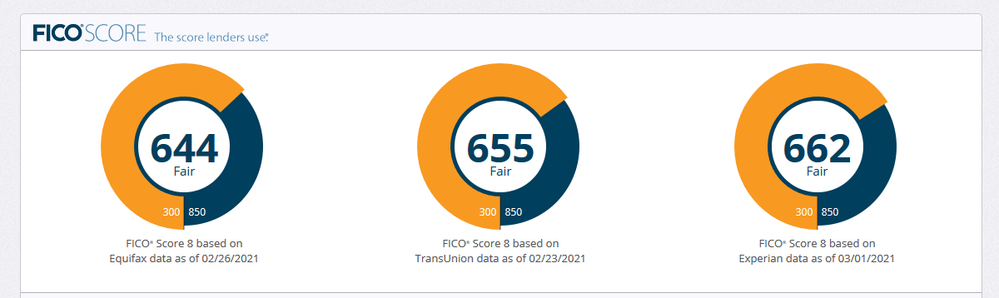

What is the outcome for this, it will differ for all but here is how it worked for me. By making a payment each day for four days, I paid the loan down by 5% total. So, 95% of the loan is still not paid. By doing it this way, I could be wrong, but I could be right! The loan has already appeared on my credit report as of 3-1-21 showing that I have a new account on my report. Here is the kicker. Up 11 points so far will only paying down the loan by 5%. The loan is already on my credit report in 7 days. Good luck everyone!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL DP and Options

Navy usually reports SSL's on the 1st of the month.

No matter when you open it. just an FYI

Many threads on this subject .. if you use the search box at the top of the page.

I had immediately paid mine below 8.9% .. and seen roughly a 35 point FICO8 increase depending on credit bureau.

Congrats! ..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL DP and Options

@M_Smart007 wrote:Navy usually reports SSL's on the 1st of the month.

No matter when you open it. just an FYI

Many threads on this subject .. if you use the search box at the top of the page.

I had immediately paid mine below 8.9% .. and seen roughly a 35 point FICO8 increase depending on credit bureau.

Congrats! ..

+1

It's been researched to the hilt as to do with other FI's as well.

<9% or under immediate reduction yields expected results. Numbers reporting depending on profile

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL DP and Options

@M_Smart007 wrote:Navy usually reports SSL's on the 1st of the month.

No matter when you open it. just an FYI

Thank you for the reply and sharing that information and that it reports no matter what on the first of the month.

Many threads on this subject .. if you use the search box at the top of the page.

Awesome!

I had immediately paid mine below 8ho.9% .. and seen roughly a 35 point FICO8 increase depending on credit bureau.

It was not a challenge or to dispute the 8.9% method, great job and glad it worked out for you.

Congrats! ..

Thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL DP and Options

@CreditMagic7 wrote:

@M_Smart007 wrote:Navy usually reports SSL's on the 1st of the month.

No matter when you open it. just an FYI

Many threads on this subject .. if you use the search box at the top of the page.

I had immediately paid mine below 8.9% .. and seen roughly a 35 point FICO8 increase depending on credit bureau.

Congrats! ..

+1

It's been researched to the hilt as to do with other FI's as well.

I believe everyone missed the point of what I wrote.

<9% or under immediate reduction yields expected results. Numbers reporting depending on profile

I think people whom have had success doing this feel that I challenged the method. The fact is I was not challeging the method i was showing other options and testing different parameters for those that are looking to save money while still getting a bump with their credit scores.

Looking through the forum and I am sure some of you woud agree that many people rebuilding their credit using methods like SCT and not wanting to pay off bad debt, or just building credit go into debt without saving any money. Many are challenged to even use $500 to get a secure loan while others do not have that problem. Many rebuilding or starting out new credit do not have rainy day funds or a savings account that matters to help them in the long run. Many whom have done the SSL have been confused that when paying back the loan they do not get a double savings. They get confused because the one savings account shows the held secured amount as a savings and then they think when paying it back they have that money and the new money in the savings acccount and that is not the case. It is not just a point towards NFCU it reflects that in several credit union shared secure loan products and it can be confusing.

So I wanted to point it out that its ok to add a second savings account, its ok to leave the money in the savings account and not go spend the money. By doing that you have the chance to double your savings and that is a true benefit. It also allows the person to easily track how the money is moving through their accounts. Many do not really understand banking and lending that is why they get into trouble in the first place. So for those that its not broken down for I wanted to help them in a different manner.

Will someone still benefit the way that I have pointed it out, absolutely. Will they get a credit bump, absolutely. They may not get the 30 point bump in the beginning but they will get the 30 bump overtime. I did the SSL to test to see if you can still gain the 30 points over a six month to 12 motnh period. It was just a test because I wanted to try it. If I do not get the bump over that time, did I fail? No, i still gained by the credit mix, I have a chance to double my savings and not rush out and use the extra $3,200 that I think I have.

Remember, I never tried to dispute the method, I wanted to show more options. I am pretty sure that I will receive the 30 point bump. On one of my fico reports I jumped more than 20 points and that is only paying down the ssl loan by 5%. No matter what the outcome, the ssl loan is still a win-win scenario no matter how you approach it. Some do not need the 30 point jump right away.

My method only shows how to add a second savings and save money along the way. I will update every month that I pay down the loan by 5% to see if I receive the any additional bumps.

Good luck to everyone.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL DP and Options

Thank you for sharing your journey. Nice to see results of your test too. And having separate accounts - 2 savings accounts providing clarity on the process.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL DP and Options

Paying down to 8.9% right after process approval is accurate and exhibits exactly what their policy utilizes.

No ifs, ands, or buts. It forwards a next payment date in advance AND general concensus is precise as well. Set a recurring monthly payment where that each month a payment IS RECORDED and that's that.

An installment Loan is of immense benefit to any credit profile and especially to the precise numbers for optimum results that keep.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL DP and Options Update

Since applying for the NFCU SSL my score has climbed over the first three months of the loan. I opted out of paying it down immediately but paid it down over the course of three months. Here are the results of paying it down by percentages.

1st month paid down by 5 percent: Credit score gain: TU: 0, EX: 8, Eq: 7

2nd month paid down by 5 percent: Credit score gain TU: 2, EX: 6, Eq: 10

3 month paid down by 81 percent: Credit score gain TU: 12, EX: 4, Eq: 13

So through all of this I may have not done it the traditional way and it may have cost me a few points. I am not sure if it has or not. I did not gain the 30 credit points across the board, but gain 14 transunion points, 18 experian points, and 30 equifax points. I am pleased because I gained points, improved my credit mix and most important cleaned up some of my baddies. By paying it down over time I made sure not to face that dreaded response that you have a total loan balance of $300 versus the original amount of $3105. It has also forced me to save the money that I used for the loan to begin with rather than spending thinking that I have extra money. Its a win win for me.

I feel that it is important to do what works for you, and most have had success with following the forum way. I just wanted to find away to save money and still gain points and not be impulsive.

Thank you myfico forum for helping me build my credit and gaining some much needed credit growth.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL DP and Options

@M_Smart007 wrote:Navy usually reports SSL's on the 1st of the month.

No matter when you open it. just an FYI

Thanks for that reporting date info, @M_Smart007! I thought I read that they report 'toward the end of the month', so I positioned myself to give them a call on Tuesday June 1st! I think I'll hedge, cancel my reminder, and call them on Thursday instead. ![]()

Thanks again. I'm trying to avoid the 100% reporting and no sense it cutting close either way.

Starting Score: 429

Starting Score: 429