- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Utilization Help on Closed Accounts 60pt Score...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Utilization Help on Closed Accounts 60pt Score Difference

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Utilization Help on Closed Accounts 60pt Score Difference

Hi All,

After working on raising my scores across the board, I’ve narrowed down the one difference between my Vantage FAKO vs. FICO (on all three reports) and it appears to come down to how util. is factored on closed accounts with balances, so was hoping to find some suggestions on whether taking out a new card (pre-approved for Discover IT 0% BT for 18 months) or perhaps doing a debt consolidation loan on the two closed cards with balances would help out more.

Current Open Cards:

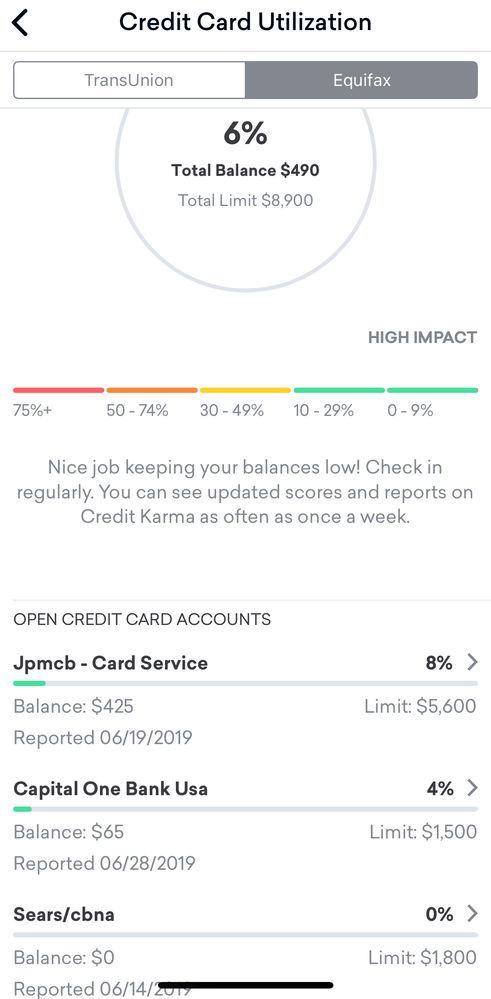

Chase Freedom Unlimited: $425 Balance / $5600 Limit

Capital One Quicksilver One: $65 Balance / $1500 Limit

Sears Mastercard: $0 Balance / $1800 Limit

Closed Cards with Balances: (not charged off, current on all payments)

Chase Sapphire Preferred: $1900 Balance / $5000 Limit

Bank Of America Amex: $2060 Balance / $500 Limit (was reduced prior to closure back in 2015)

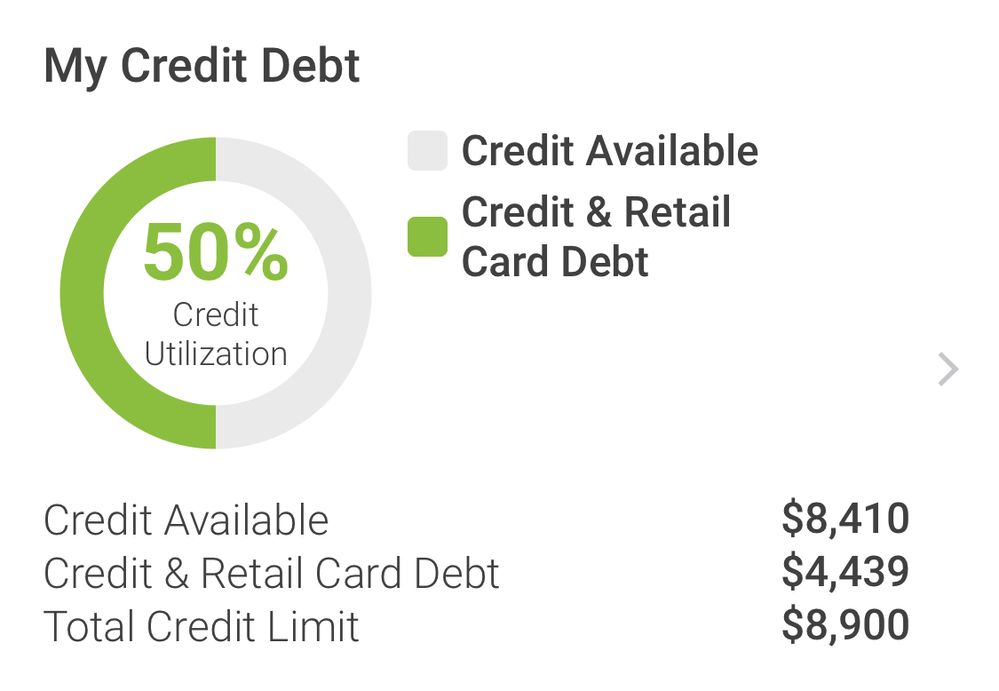

Both Credit Karma and FICO both show total credit limit of $8900. However Credit Karma shows only 6% Utilization (3 open cards), and FICO shows 50% Utilization (all 5 cards). My score with CK is 735 across the board, and FICO is around 680. I would imagine if I could get these closed balances paid, my FICO score will increase significantly if I can get out of the 50% util that is reporting there. (Two screenshots below on FICO vs. CK)

Are my best options to 1) Pay closed balances as soon as I can 2) go for the discover pre-approval and transfer those two balances over to a new card or 3) do a debt consolidation loan for those two balances and pay them off that way?

Thanks again for the suggestions!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content