- myFICO® Forums

- This 'n' That

- SmorgasBoard

- Re: the ULTIMATE 2-card combo

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

the ULTIMATE 2-card combo

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: the ULTIMATE 2-card combo

I would imagine the AOD Visa Signature coupled with Citi Custom Cash or Affinity Cash Rewards would yield the most straight up cash back than any other two card combination. It would obviously partially depend on one's spend, but can anyone think of anything that would result in more cash back?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: the ULTIMATE 2-card combo

@cws-21 wrote:I would imagine the AOD Visa Signature coupled with Citi Custom Cash or Affinity Cash Rewards would yield the most straight up cash back than any other two card combination. It would obviously partially depend on one's spend, but can anyone think of anything that would result in more cash back?

Yes, the key question on total cash back with only two cards lies with spend, and that entails two aspects. First ... WHERE someone spends their money since we're probably talking about some areas getting a higher cash back percentage. Second ... the AMOUNT of spend, since higher budget = higher spend = higher cash back. A third factor would be exactly which card/rewards program since the next limiting factor might be the annual > quarterly > monthly spending cap.

In general, I think the AOD FCU 3% Visa paired with any higher-earning cash back card (pick one, depending on preferences) would be hard to beat.

I don't know much about that Affinity CU card, their 5% categories beyond Amazon or bookstores, or how those rewards stack in real-time, but I've read a little on My Fico about it. It does sound like a potentially powerful combo when paired with the AOD FCU.

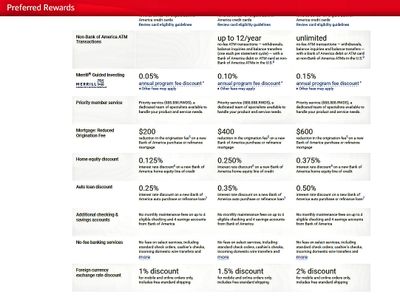

It's not applicable to everyone, but that first combo I mentioned might beat it if someone was able to have deposits or investments with Bank of America totaling $100K or more. (That could include moving investments or IRA's to Merrill Lynch.) I took the plunge in 2020 and that's one reason I acquired the Premium Rewards card. That puts you in Platinum Honors status of their Preferred Rewards program, giving a 1.75% multiplier to the base credit card earnings. Depending on spending patterns and/or levels as wells as how high those stacked rewards would go with Affinity, the Premium Rewards - Customized Cash Rewards combo could beat it, IMO.

But there's really no way to calculate which combo is always best since it depends on different financial profiles, credit profiles, and spending patterns. That's why this is a fun discussion, since there is no single correct answer. ![]()

That Bank of America combo covers a LOT of territory for most budgets:

So with just (2) cards, you would earn:

- 5.25% on selected category of gas, online shopping, dining, travel, drug stores, or home improvement/furnishings

- 3.50% on grocery stores and warehouse clubs

(*Capped at $2.5K/quarter or $10K annually for above two combined on Customized Cash Rewards)

- 3.50% on dining and travel, uncapped on Premium Rewards

- 2.625% on everything else, uncapped on Premium Rewards

As an aside from the Two-Card Combo discussion, I'll add the following. From my understanding, Bank of America will allow you to have at least two CCR cards, so by adding just one more card you could earn 5.25% on TWO of those six categories and/or raise your grocery/warehouse spend to a total of $20K annually. I've considered doing that, but I haven't for a few reasons. I wanted a couple of very high limit cards and my Premium Rewards card is one of those. I'm at max exposure with BofA at $99.9K, so adding more cards requires moving limits over. I hesitate putting too many eggs in one rewards basket, so that if BofA changed their rewards program it could ruin my whole lineup. ![]() And for the more likely areas I would use for spending on a second card (gas, dining, travel), I already have them covered pretty well at 4% or higher back with cash or travel rewards on other cards. The additional rewards would be incremental.

And for the more likely areas I would use for spending on a second card (gas, dining, travel), I already have them covered pretty well at 4% or higher back with cash or travel rewards on other cards. The additional rewards would be incremental.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$900K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0 - SYCH - 65.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: the ULTIMATE 2-card combo

@Aim_High wrote:Yes, the key question on total cash back with only two cards lies with spend, and that entails two aspects. First ... WHERE someone spends their money since we're probably talking about some areas getting a higher cash back percentage. Second ... the AMOUNT of spend, since higher budget = higher spend = higher cash back. A third factor would be exactly which card/rewards program since the next limiting factor might be the annual > quarterly > monthly spending cap.

In general, I think the AOD FCU 3% Visa paired with any higher-earning cash back card (pick one, depending on preferences) would be hard to beat.

I don't know much about that Affinity CU card, their 5% categories beyond Amazon or bookstores, or how those rewards stack in real-time, but I've read a little on My Fico about it. It does sound like a potentially powerful combo when paired with the AOD FCU.

It's not applicable to everyone, but that first combo I mentioned might beat it if someone was able to have deposits or investments with Bank of America totaling $100K or more. (That could include moving investments or IRA's to Merrill Lynch.) I took the plunge in 2020 and that's one reason I acquired the Premium Rewards card. That puts you in Platinum Honors status of their Preferred Rewards program, giving a 1.75% multiplier to the base credit card earnings. Depending on spending patterns and/or levels as wells as how high those stacked rewards would go with Affinity, the Premium Rewards - Customized Cash Rewards combo could beat it, IMO.

But there's really no way to calculate which combo is always best since it depends on different financial profiles, credit profiles, and spending patterns. That's why this is a fun discussion, since there is no single correct answer.

That Bank of America combo covers a LOT of territory for most budgets:

So with just (2) cards, you would earn:

- 5.25% on selected category of gas, online shopping, dining, travel, drug stores, or home improvement/furnishings

- 3.50% on grocery stores and warehouse clubs

(*Capped at $2.5K/quarter or $10K annually for above two combined on Customized Cash Rewards)

- 3.50% on dining and travel, uncapped on Premium Rewards

- 2.625% on everything else, uncapped on Premium Rewards

As an aside from the Two-Card Combo discussion, I'll add the following. From my understanding, Bank of America will allow you to have at least two CCR cards, so by adding just one more card you could earn 5.25% on TWO of those six categories and/or raise your grocery/warehouse spend to a total of $20K annually. I've considered doing that, but I haven't for a few reasons. I wanted a couple of very high limit cards and my Premium Rewards card is one of those. I'm at max exposure with BofA at $99.9K, so adding more cards requires moving limits over. I hesitate putting too many eggs in one rewards basket, so that if BofA changed their rewards program it could ruin my whole lineup.

And for the more likely areas I would use for spending on a second card (gas, dining, travel), I already have them covered pretty well at 4% or higher back with cash or travel rewards on other cards. The additional rewards would be incremental.

Actually, @Aim_High, you're almost certainly correct. I was not considering Platinum Honors status with the Premium Rewards + Customized Cash Rewards combo as I do not see that strategy being an option for most people. I was suggesting the AOD Visa, Signature with either the Affinity Cash Rewards or Citi Custom Cash as likely yielding the most cash back, somewhat contingent on spend, for regular people like me ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: the ULTIMATE 2-card combo

@Aim_High wrote:

@cws-21 wrote:I would imagine the AOD Visa Signature coupled with Citi Custom Cash or Affinity Cash Rewards would yield the most straight up cash back than any other two card combination. It would obviously partially depend on one's spend, but can anyone think of anything that would result in more cash back?

Yes, the key question on total cash back with only two cards lies with spend, and that entails two aspects. First ... WHERE someone spends their money since we're probably talking about some areas getting a higher cash back percentage. Second ... the AMOUNT of spend, since higher budget = higher spend = higher cash back. A third factor would be exactly which card/rewards program since the next limiting factor might be the annual > quarterly > monthly spending cap.

In general, I think the AOD FCU 3% Visa paired with any higher-earning cash back card (pick one, depending on preferences) would be hard to beat.

I don't know much about that Affinity CU card, their 5% categories beyond Amazon or bookstores, or how those rewards stack in real-time, but I've read a little on My Fico about it. It does sound like a potentially powerful combo when paired with the AOD FCU.

It's not applicable to everyone, but that first combo I mentioned might beat it if someone was able to have deposits or investments with Bank of America totaling $100K or more. (That could include moving investments or IRA's to Merrill Lynch.) I took the plunge in 2020 and that's one reason I acquired the Premium Rewards card. That puts you in Platinum Honors status of their Preferred Rewards program, giving a 1.75% multiplier to the base credit card earnings. Depending on spending patterns and/or levels as wells as how high those stacked rewards would go with Affinity, the Premium Rewards - Customized Cash Rewards combo could beat it, IMO.

But there's really no way to calculate which combo is always best since it depends on different financial profiles, credit profiles, and spending patterns. That's why this is a fun discussion, since there is no single correct answer.

That Bank of America combo covers a LOT of territory for most budgets:

So with just (2) cards, you would earn:

- 5.25% on selected category of gas, online shopping, dining, travel, drug stores, or home improvement/furnishings

- 3.50% on grocery stores and warehouse clubs

(*Capped at $2.5K/quarter or $10K annually for above two combined on Customized Cash Rewards)

- 3.50% on dining and travel, uncapped on Premium Rewards

- 2.625% on everything else, uncapped on Premium Rewards

As an aside from the Two-Card Combo discussion, I'll add the following. From my understanding, Bank of America will allow you to have at least two CCR cards, so by adding just one more card you could earn 5.25% on TWO of those six categories and/or raise your grocery/warehouse spend to a total of $20K annually. I've considered doing that, but I haven't for a few reasons. I wanted a couple of very high limit cards and my Premium Rewards card is one of those. I'm at max exposure with BofA at $99.9K, so adding more cards requires moving limits over. I hesitate putting too many eggs in one rewards basket, so that if BofA changed their rewards program it could ruin my whole lineup.

And for the more likely areas I would use for spending on a second card (gas, dining, travel), I already have them covered pretty well at 4% or higher back with cash or travel rewards on other cards. The additional rewards would be incremental.

For me, any two-card combo can't be with a bank or the same place. So BOA would be out for sure. Plus, no way I put that much money with a bank in order to get their best rates. In fact, I already regret getting anything from Chase. Citi and FNBO are ok so far. So my strategy will be moving towards CU's for sure. I mean just the customer service I have received from Affinity (and BECU as well) is amazing and it makes you realize how bad big banks really are. Plus Credit Unions are investing back into their members and community which is always better.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: the ULTIMATE 2-card combo

@cws-21 wrote:

@Aim_High wrote: ... In general, I think the AOD FCU 3% Visa paired with any higher-earning cash back card (pick one, depending on preferences) would be hard to beat ... It's not applicable to everyone, but that first combo I mentioned might beat it if someone was able to have deposits or investments with Bank of America totaling $100K or more.

- 5.25% on selected category of gas, online shopping, dining, travel, drug stores, or home improvement/furnishings

- 3.50% on grocery stores and warehouse clubs

- 3.50% on dining and travel, uncapped on Premium Rewards

- 2.625% on everything else, uncapped on Premium Rewards

Actually, @Aim_High, you're almost certainly correct. I was not considering Platinum Honors status with the Premium Rewards + Customized Cash Rewards combo as I do not see that strategy being an option for most people. I was suggesting the AOD Visa, Signature with either the Affinity Cash Rewards or Citi Custom Cash as likely yielding the most cash back, somewhat contingent on spend, for regular people like me

Yes, point taken @cws-21 that many "regular" people wouldn't seriously consider this combo since they may not have assets to put with BofA or they choose to keep investments elsewhere. I haven't always been in a position to consider something like this. I've had an IRA account for decades but it wasn't large enough to qualify for a long time plus I choose to keep it with a different investment firm. It's only in the past few years I've had enough additional assets to consider such a move. However, I think it's worth mentioning, especially in the context of moving some investments like an IRA since many people may be able to do that if they think outside of the box instead of assuming they have to park large sums of money in a routine checking account.

But yes, that's why in my first posting after mentioning the Bank of America combo that I moved right into the AOD + <5% card> option. For not requiring any investments or deposits, that's undoubtedly the next-best two-card combo and for some people, it might even do as well or better than the Bank of America one, depending on those nebulous spend factors we discussed.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$900K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0 - SYCH - 65.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: the ULTIMATE 2-card combo

@Crowhelm wrote:

@Aim_High wrote:

@cws-21 wrote:I would imagine the AOD Visa Signature coupled with Citi Custom Cash or Affinity Cash Rewards would yield the most straight up cash back than any other two card combination. It would obviously partially depend on one's spend, but can anyone think of anything that would result in more cash back?

... It's not applicable to everyone, but that first combo I mentioned might beat it if someone was able to have deposits or investments with Bank of America totaling $100K or more ...

That Bank of America combo covers a LOT of territory for most budgets:

- 5.25% on selected category of gas, online shopping, dining, travel, drug stores, or home improvement/furnishings

- 3.50% on grocery stores and warehouse clubs

- 3.50% on dining and travel, uncapped on Premium Rewards

- 2.625% on everything else, uncapped on Premium Rewards

For me, any two-card combo can't be with a bank or the same place. So BOA would be out for sure. Plus, no way I put that much money with a bank in order to get their best rates. In fact, I already regret getting anything from Chase. Citi and FNBO are ok so far. So my strategy will be moving towards CU's for sure. I mean just the customer service I have received from Affinity (and BECU as well) is amazing and it makes you realize how bad big banks really are. Plus Credit Unions are investing back into their members and community which is always better.

Great discussion points, @Crowhelm. I'd like to offer some of my own perspective. To make it easier to read, I'll break it up into a few separate posts. First, about lender diversity and the original hypothesis I offered in post one of this thread.

I'm a huge advocate of lender diversity, so I totally agree that I wouldn't ever narrow down my card options to only two cards, both invested with a single lender. That wasn't really the point of the thread, per-se. It was more of a hypothetical discussion in the spirit of simplying a wallet lineup to squeeze a majority of the rewards value out of a minimal number of cards, thereby reaching a balance between rewards and simplicity. In my mind, I was thinking about MORE than ONE single two-card combo, and I may move in that direction. I have more cards than I choose to manage and would prefer to keep things somewhat simple, yet receive a reasonable rewards payout. However, I could never see myself going down to only TWO cards and I wouldn't recommend that anyone else do it either, but especially if they were both with the same lender.

When choosing sets of cards, it seems the larger lenders make it worth your while to sometimes get two or even more cards to optimize rewards programs. They are trying to offer value-added and get more of a customer's business along the way. Some cards just "play well together." Cases in point are for travel points such as:

- Chase Ultimate Rewards points (URs) and the Chase Bi-Tri-Quad-fecta cards: Sapphire Reserve or Preferred; Freedom Flex; Freedom Unlimited; original Freedom; INK Cash; INK Business Unlimited; INK Business Preferred.

- American Express Member Rewards points (MRs): Personal or Business charge card - Platinum, Gold, or Green; Personal Everyday or Everyday Preferred; Business Blue Plus.

- Citibank Thank You points (TY) - Citi Prestige (grandfathered members); Premier; Double Cash; Rewards Plus; and Dividend (grandfathered).

I tried to pick my two most powerful out of those combos including one that gave strong uncapped and uncategorized rewards as a baseline card. For Freedom Unlimited, the 1.5% cash payout is worth up to 3% if converted to URs and transferred to travel partners. The 2x MRs on AMEX Blue Business Plus would be worth up to 4% if transferred to travel partners. And the 2% on Double Cash could be worth up to 3.4% if converted to TY points and transferred to partners. Of course, getting maximum value out of any of those requires some effort and being able to optimize transfer valuation. And with the Citi and Chase cards in particular, you MUST have that second card in order to facilitate the transfer of points, so having two cards with a single lender is part of the concept.

The Bank of America cards work well together for cash back since the increased rewards value of the Premium Rewards and Customized Cash Rewards with enough deposits makes them both an exceptional value. But again, this is contingent on the large total deposits. To me, this would be only one of several "combos" within my total lineup with others from other lenders.

Interestingly enough, some of those other travel point combos listed above may actually give a higher rewards rate than either the Bank of America combo (OR) the AOD + <5% card> option I was discussing with @cws-21. However, those rewards are in travel points, not the CA$H value that he was seeking so I disregarded them. Many of our members either don't travel or don't choose to play the travel points systems for rewards. And those systems do work better for some of our members than others, depending on if they are frequent travelers with loyalty status and they types of travel they normally pursue.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$900K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0 - SYCH - 65.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: the ULTIMATE 2-card combo

@Crowhelm wrote:For me, any two-card combo can't be with a bank or the same place. So BOA would be out for sure. <responded above>

Plus, no way I put that much money with a bank in order to get their best rates.

In fact, I already regret getting anything from Chase. Citi and FNBO are ok so far. So my strategy will be moving towards CU's for sure. I mean just the customer service I have received from Affinity (and BECU as well) is amazing and it makes you realize how bad big banks really are. Plus Credit Unions are investing back into their members and community which is always better.

We've had other members state that they wouldn't move assets just to get the best credit card rates, @Crowhelm, and I do understand that sentiment. I wrestled with it a bit myself before I did it. But I also think some of our forum members see this and become disenchanted before they fully consider what it exactly means. This isn't just about trading a lower interest rate on deposits or about only getting a boost on credit card rewards. It's larger than that. I can't tell you how many times I've clarified with some of our members that moving $20K, $50K, or $100K to qualify for Gold - Platinum - Platinum Honors levels of Preferred Rewards (see link) doesn't require you to plop a huge sum of money into a basic checking account earning the pathetic interest rate that big banks often pay. Deposits invested with Bank of America's Merrill Lynch division also count for total deposits. And you don't have to pay exorbitant fees on your investments. Merrill Lynch has three investment tiers, starting at a "Self-Directed" approach that has unlimited $0 online stock, ETF and option trades, with no annual account fees or balance minimums. You can also choose the "Guided Investing" level that charges a smaller base fee for some online broker assistance and advice (as little as .0045%), or the full "Dedicated Advisor" route for personal service at a higher fee. (*Incidentally, Bank of America just unveiled their Diamond and Diamond Honors levels for those with $1M or $10M in deposits. See this link.)

Plus, the deposits that qualify someone for Preferred Rewards status offer discounts on many other banking products and services beyond the credit card rewards. Those discounts also apply to Merrill Lynch Guided Investing.

The way I look at it is that with my Merrill Lynch Self-Directed account, I can park some money in the stock market that I would have invested otherwise somewhere else while also reaping the other Preferred Rewards benefits. I was moving in this direction before the AOD FCU Visa was released and it was the best deal available at the time. It's still a great deal and I like having this awesome backup in the event the AOD card program is nerfed to lower rewards at some point.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$900K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0 - SYCH - 65.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: the ULTIMATE 2-card combo

@Crowhelm wrote:... I already regret getting anything from Chase. Citi and FNBO are ok so far. So my strategy will be moving towards CU's for sure. I mean just the customer service I have received from Affinity (and BECU as well) is amazing and it makes you realize how bad big banks really are. Plus Credit Unions are investing back into their members and community which is always better.

In all fairness, I've had accounts with both large banks and small credit unions over the years and I cannot say one is always unequivocally superior to the other. It's always Your Mileage May Vary (YMMV). I've had great customer service from large banks and lousy from small credit unions, and vice-versa. I honestly like having a mixture of both.

My customer service from many of the large banks has been very prompt, attentive, and pleasant. For a huge bank, I think Chase is doing an awesome job right now and especially when I call about any issues on my Sapphire Reserve card, which has a dedicated customer support line. However, they've even reached out to me from the local branch level to make contact. Bank of America does "feel" like a big bank and needs to up their customer service game. My interaction with AOD FCU employees, on the other end of the spectrum, has also been great. However, I like having cards with large banks because I know if something comes up with my account at midnight on a Saturday, I can quickly get ahold of someone whereas that's not the case with most small local CUs. I have a love-hate relationship with one of my primary local credit unions over the years. They've offered me some great products but have irritated me along the way over some issues. I think the mobile apps and websites are often far superior on the big bank cards and accounts and I think fraud prevention and support is often more sophisticated.

Credit Unions frequently do offer more attractive interest rates and fee structures on their deposit or card products. Most of my deposit account activity has been with credit unions for a long time. However, there are ways to waive the fees on large bank deposit accounts and having them can be convenient also. While there are "network ATMS" for credit union accounts that won't charge fees, it seems to be much easier to find ATMs when traveling that are associated with the large national banks like Chase or Bank of America or US Bank.

For credit card rewards and benefits, credit unions often struggle to compete with the big banks. Yes, there are some outliers that we know about on My Fico such as AOD, Affinity, or Nusenda, but by-and-large these are a very small minority of credit unions and card issuers. For anyone not on the My Fico forums, it would be difficult if not impossible to even learn about some of the opportunties with small credit unions. Especially when it comes to travel perks and rewards, the large issuers dominate.

Some credit unions are a lot more dedicated to serving their membership and the community than others. I've looked into many that didn't offer the same competitive rates that many of them offer, and didn't seem to be as active in the community. In other words, the leadership of each one can decide how much they give back versus using profits to pay staff or grow their business. In some cases, I've gotten a distinct "bank" feel from credit unions.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$900K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0 - SYCH - 65.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: the ULTIMATE 2-card combo

Hi all! This was great to read through. Excellent throughout the entire discussion. Thank you @Aim_High for starting this!

I have a little query/monkey wrench. Let's say, you wanted the following:

A. A simple 2-card lineup

B. A decent SL and CLI opportunity

C. 3-5% return on each category of spending.

D. No foreign transaction fee. We are moving overseas for quite some. Or even a traveling mindset would be applicable. Undoubtedly, the United States has the best CC's in the world.

In my mind, I think it becomes the AOD 3% and MAYBE Affinity Sig?

I think BOA is out because the CCR has 3% FTF.

Any combination involving Discover gets tossed, their imprint isn't big enough.

Amex combinations are interesting. I am a big Amex fan. Although their imprint is larger than Discover, Visa and MC have them beat. However, the Amex Gold paired with AOD, may be decent.

I do think the Citi Premier gets a call out as well. Maybe that with either Amex Gold or AOD.

5%/points back on every category with no FTF? A challenge? ![]()

Edit: Any combination with Amex Gold becomes problematic because the grocery store category is only good for US grocery stores...