- myFICO® Forums

- Welcome to the myFICO® Forums

- Take the myFICO Fitness Challenge!

- Re: June 2022 Check-In Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

June 2022 Check-In Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

June 2022 Check-In Thread

I know you are all hard at work with your credit goals. Have you progressed as far as you hoped? Were there any unforseen expenses that cropped up and may have thrown you off schedule?

As a reminder, participation in these monthly check-ins is optional, just encouraged. The goal is to help keep you on track, so feel free to post your progress updates here. This is a judgment-free zone. Feel free to say what's keeping you up at night or give yourself a Kudo for having it all together.

Did you hit any potholes or speedbumps? Achieve some milestones, either small or mighty? Change your goals or add new ones?

Let us know how you're doing!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2022 Check-In Thread

Last time I did anything was 2017. Scores have sat at 850 FICO 8 for five years. Must have lost my mind?!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2022 Check-In Thread

@Anonymous wrote:

Jumped out of the Garden and applied for two credit cards and one Home Equity Line of Credit. Also have closed three credit cards.

Last time I did anything was 2017. Scores have sat at 850 FICO 8 for five years. Must have lost my mind?!

With scores that high and after such a long time in the garden, you can afford a temporary escape after so long watering, pruning and cultivation. There's nothing wrong with adding a couple of different varieties of flowers to your garden when you have the means and life requires it. Now you can step back into the garden and tend to your new additions and enjoy the benefits they bring.

Best wishes on growing and tending to your new additions!

>>

>>FICO8 Scores as of JAN 2021:

FICO8 Scores as of JULY 2023:

FICO9 Scores as of July 2023:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2022 Check-In Thread

Happy June everyone!!

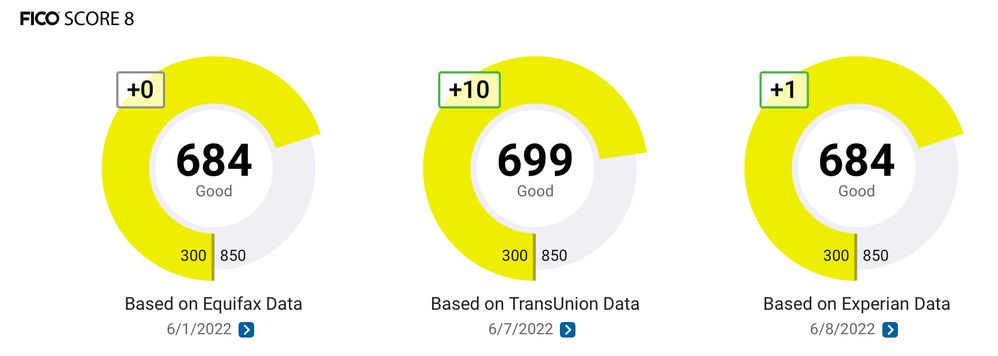

Well, my FICO jumped 1 point on EX, but I got a nice bump on TU and EQ!! Disco will report by Friday, so I am hoping the scores increase a little more. As of now my scores are at:

FICO 8: 683 EX / 684 EQ / 689 TU

FICO 9: 702 EX / 727 EQ / 693 TU)

Slowly making my way to meet my short-term summer goal of 700's (hopefully by August)!! Then, it's app for a travel card, garden for 6 months, and then app for a flat cash back card, and finally garden for a long long long time!!

>>

>>FICO8 Scores as of JAN 2021:

FICO8 Scores as of JULY 2023:

FICO9 Scores as of July 2023:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2022 Check-In Thread

1 point up on EQ and a nice bump on my TU score. It's becoming a reality! Although, I was thinking TU should have done a purse and backpack check for an extra point for me. I'm sure one of those employees is walking around with my extra point in their personal belongings 😆

>>

>>FICO8 Scores as of JAN 2021:

FICO8 Scores as of JULY 2023:

FICO9 Scores as of July 2023:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2022 Check-In Thread

Chugging along - didn't see much of a jump this month. Actually dropped 2 points on EX. Hovering around 630-640. better than where I started 6 months ago.

Currently Rebuilding Since 1/7/2022

Gardening Since 8/1/2023 (last inquiry 5/13/2023)

Starting Score: 611

Starting Score: 611Current Score: 694

Goal Score: 750

Take the myFICO Fitness Challenge

Was in high 400s in 2020-2021

Current Scores:

Fico 8 EQ: 691

Fico 8 EX: 694

Fico 8 TR: 702

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2022 Check-In Thread

Happy June! With most of my debt consolidated and now reported my utilization went from 80% to 10%. As expected my scores took a big jump from the start of my rebuild in February:

EQ F8 | 714 | +83 point increase |

EX F8 | 721 | +84 point increase |

TU F8 | 711 | +78 point increase |

TU is lagging behind EQ and EX in reporting $0 on my closed Comenity (formerly Barclays) account so I should get a small bump (5-10 points) when that finally reports. Curious to see where my FICO 9 and FICO 10 are now. Waiting for that Commenity account to report before I refresh my report. The high individual utilization with the Citi Costco card (only card I didn't consolidate) is still hurting my scores I’m sure. Plan to garden for a couple months and then apply for a 0% BT card so I can pay that off interest free.

Overall pleased with my progress and scores. Nice to be back into the 700’s. The big jump's are over I'm sure, not sure I'll be able to get to 740 until my loan utilization is paid down some.

Current Scores - June 2023

Goal Scores - January 2024

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2022 Check-In Thread

Applied and approved for the Chase Sapphire Preferred, waiting to see my score changes by the end of this month. My Amex just had its first statement and hasn't reported yet, neither has my CSP. So with those credit limit increases im anxious to see how much my scores will change.

Scores will be fluctuating due to limit increases and auto refinance inquiries.

Starting Score: 512

Starting Score: 512Current Score: 700

Goal Score: 700+

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2022 Check-In Thread

Hello. New to this sector of the forum. This month... has been... a fresh start. I'm rebuilding, my goal is to get back to my pre BK FICO scores and be financially solid by the end of this year.

A big part of rebuilding for me is adding in another card, and after a few bumps and mistakes last year... I'm happy to say as of this month I have another account added to my credit file (Discover!!).

Still working on finding my way with finances, but I'm actually rebuilding back better than I was before (when I looked great on paper but was anything but). Grateful to have this chance to .. find other ways to live and thrive.