- myFICO® Forums

- Welcome to the myFICO® Forums

- Take the myFICO Fitness Challenge!

- October 2022 Check In Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

October 2022 Check In Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

October 2022 Check In Thread

I know you are all hard at work with your credit goals. Have you progressed as far as you hoped? Were there any unforeseen expenses that cropped up and may have thrown you off schedule?

As a reminder, participation in these monthly check-ins is optional but encouraged. The goal is to help keep you on track, so feel free to post your progress updates here. This is a no-judge zone; feel free to say what's keeping you up at night or give yourself a Kudo for having it all together.

Did you hit any potholes or speedbumps? Achieve some milestones, either small or mighty? Change your goals or add new ones?

Let us know how you're doing!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2022 Check In Thread

As the Holidays start to creep in, we may be ahead of the game having an understanding on our debt!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2022 Check In Thread

This past month, I was able to pay down my utilization to 10%, using AZEO. My last collection should be dropping off my reports this month (paid off Midland). I also have a couple of 30 day lates, but they are roughly 4 years old, so I don't know if Goodwill letters will make a difference. I also have a paid charge-off with Capital One, so they have no incentive to remove it (5 years old). So at this point I plan to just continue to pay my bills on time, manage my debt and let the negatives age off. All in all, I think September was a successful month for me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2022 Check In Thread

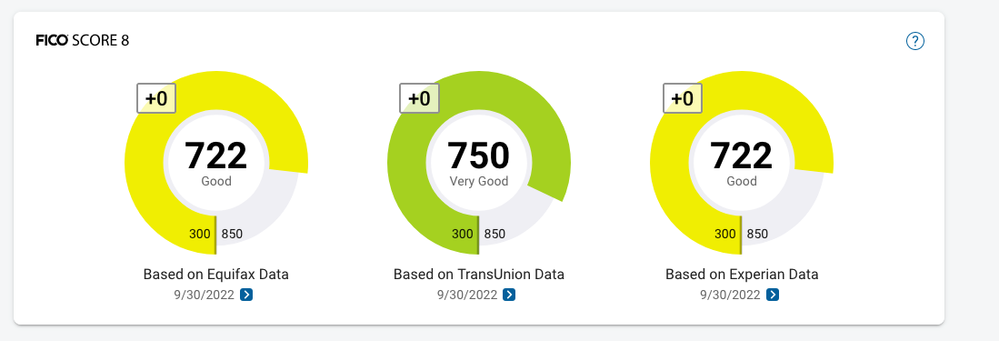

So I have updated my reports and my scores are as below. I played around with the simulator and the only thing to help me get 750 across all three is time and patience (that or getting lates removed from EQ and EX)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2022 Check In Thread

Hi everyone,

My build is going very well. My Discover graduated om 9/30/22 and also my Nfcu NRewards graduated last month. Scores are in my siggy.

>

> >

> >

> >

> >

> >

> >

> >

> >

>

Starting Score:

0

Current Score:

My highest 818

Goal Score:

850

Take the myFICO Fitness Challenge

/

/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2022 Check In Thread

I got impatient and decided to cold apply for one of my goal cards, the Affinity Cash Rewards, figuring that I could at least say I tried. Well, shockingly, they approved me! So I'm very happy about that 😁. Current plan is to garden for close to 2 years now to let all my new accounts age and eventually try for my other goal card, the Citi/Sears Shop Your Way. I already tried for it before, so know that I just need to wait on that one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2022 Check In Thread

I just pulled my 3B reports. I've been doing this every month for almost two years. For the first time ever, every single score went up!

I mean FICO 8, 9, 5/4/2, Auto 5/4/2, Auto 8, Auto 9, Bankcard 8, Bankcard 9, FICO 3, 10, 10T, Auto 10, Bankcard 10, across all three bureaus. 40 individual scores. Every one of them went up. Never had that before. I have, in the past, had a handful of scores slightly over 800. Even then I always had some go up, some go down, some stay the same. No 800s currently, highest score is 783 (TU Bankcard 9), down to a low of 722 (Eq 10 and Ex Auto 10). But they went up by an average of 14 points over my September 1 3B pull.

It won't hold. I'll have higher utilization on next month's reports due to some extra expenses I've recently had and more I know are coming in the next few weeks. So It may be a few months before I get back to this point, but I'll enjoy it while it lasts. I'm not planning to apply for anything before the first of the year anyway.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2022 Check In Thread

Checking in. Nothing new to report, just another month in the garden. About a 1 point gain. Simulator's predicting a fairly stagnant few months. See you all next month!

Currently Rebuilding Since 1/7/2022

Gardening Since 8/1/2023 (last inquiry 5/13/2023)

Starting Score: 611

Starting Score: 611Current Score: 694

Goal Score: 750

Take the myFICO Fitness Challenge

Was in high 400s in 2020-2021

Current Scores:

Fico 8 EQ: 691

Fico 8 EX: 694

Fico 8 TR: 702

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2022 Check In Thread

Ditto. Here's to an uneventful 4th quarter and EOY. Happy Halloween!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2022 Check In Thread

I recovered a couple points ao far since last month, my overall utilization went slightly above 30% but i just paid off my CSP and Amzon Prime, and paid down on my Amex CS and Discover card. So that should bring my utilization down quite a bit to 20ish% or a little lower. I still have to wait another month to be able to be eligible for a CLI on my Discover and December for Amex.

***As of 10/20/2022, after paying down those cards my Overall Utilization dropped from 33% down to 13% ! I know the goal should be below 10%. Come November thats the goal...

***10/25/2022, i was approved for the Amex Hilton Honors Surpass. My utilization climbed up again to 18% because of my high balance on my Freedom Flex (0% Interest until May 2023)

Starting Score: 512

Starting Score: 512Current Score: 700

Goal Score: 700+

Take the myFICO Fitness Challenge