- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

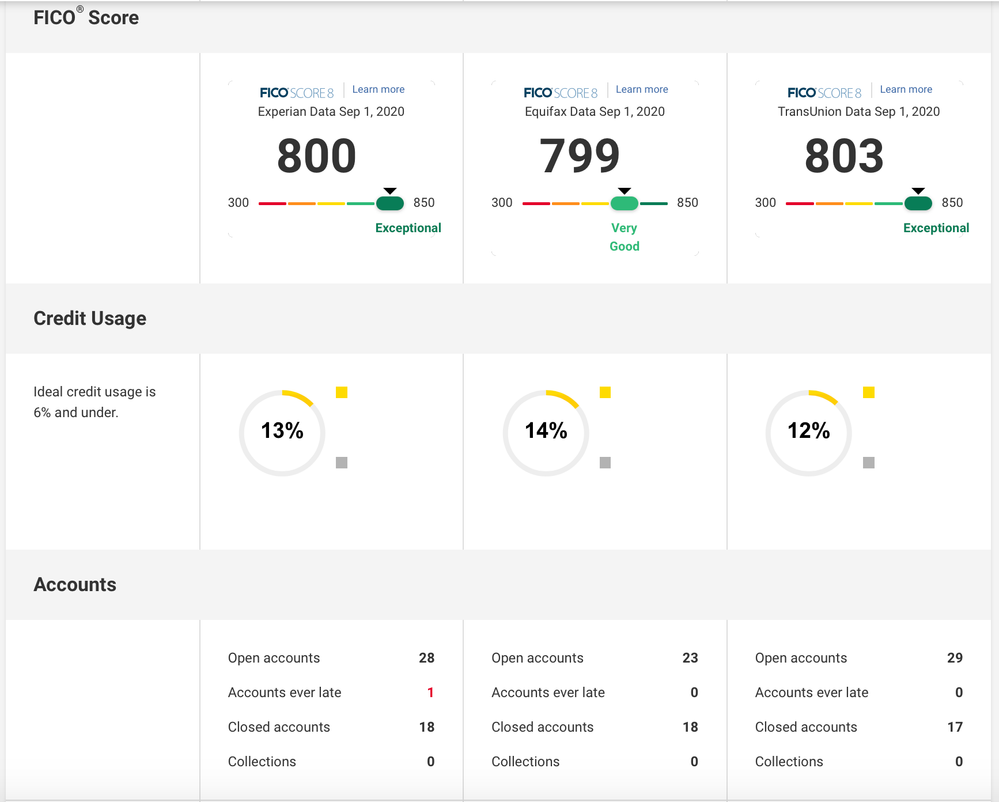

Achieved 800 FICO with 30-day late reporting

I personally have not seen this before and I remember asking and searching about this as well. It's an interesting data point and I'm concerned it might be a fluke. Since I have not seen this posted before thought I'd post and see if this is common or not and what you think.

Woke up to an Experian alert showing a 24pt increase reaching 800 after one 30 late from 2014 was removed. Still have a 30 day late from June 2016 which I thought was very odd to reach such a boost with a relatively recent 30 day late. Was not aware you could reach 800 with derogatories present? Simulator shows 830 within 3 months as well with the same late reporting. Since this late is being disputed could it be that EX artificially suppressed it from affecting my scores even thought it's still reporting?

EQ bumped 29pts from 770 to 799 when the same late was removed. Clean report now.

TU is showing 803 with a clear report now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved 800 FICO with 30-day late reporting

Your 30-day late is 4 years old; it probably has lost much of its "punch."

I have a 30-day late from TransUnion which is 7 years old. It was 800 a month ago; now, it's 799. And with a new car lease on file. I sense that it lost most of its "punch" after two years.

It would be different if it was a 60-day late and beyond.

I should update my scores: EQ: 801; TU: 799; EX: 798

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved 800 FICO with 30-day late reporting

Can't speak from experience but it has been noted on several other posts that dispute items are not considered while under dispute which has subsequently increased some scores at times until resolved.

In regard to point gain for removal of a 30 day, here's a post for a removal of a lone 30 day 6+years aged. Big gain (a bit of an outlier it seems) and goes on to discuss the possible score gain range as a result of a 30 day removal and the impact a 30 day could have for the full 7 years.

EDIT: I've reached 800 on each bureau with a 30D on my report.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved 800 FICO with 30-day late reporting

I had a 30 day late from August 2013 that wasn't reporting on TU, but was on EX and EQ. My EX and EQ FICO 8 scores were about 780, TU was about 810. The late dropped off EX and EQ a couple of months ago and scores went up about 30 points to be similar to TU.

AoOA: closed: 40 years, open: 30 years; AAoA: 14 years

Amex Gold, Amex Blue, Amex ED, Amex Delta Blue, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA, Sync Lowes, total CL 203k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved 800 FICO with 30-day late reporting

OP, it's definitely profile specific. On a thick/aged file a lone 30 day that's half way aged off is going to be a lot less meaningful than if it were present on a thin/young file. I see no reason that an 800 score wouldn't be possible if everything else was in check.

I had a 3-4 year old 90 day present on my report and due to a thick/aged file was able to grab near 770 on TU.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved 800 FICO with 30-day late reporting

Seems like we are all saying similar things, but I'll add my voice to the chorus.

I'm on the thick/aged scorecard with new accounts and a single 30d from 2+ years ago. All scores are around 765. First (i.e. largest) negative reason code everywhere is the delinquency. I have cards with individual Util of 50% and 40%, so those are probably costing me around 15 points. When I did some credit seeking within the past year, I lost about 20 points. Seems totally plausible that the 30d is costing me the ~30 points that @FlaDude posits, and that I'll be right around 800 when my Util is optimized and my credit seeking is unscorable.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved 800 FICO with 30-day late reporting

Congrats on the 800 club!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved 800 FICO with 30-day late reporting

Thanks for all the responses. I didn't think it was possible. Wonder now what it`ll be without that 30-day late.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved 800 FICO with 30-day late reporting

Congratulations for sure!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved 800 FICO with 30-day late reporting

@Anonymous wrote:I personally have not seen this before and I remember asking and searching about this as well. It's an interesting data point and I'm concerned it might be a fluke. Since I have not seen this posted before thought I'd post and see if this is common or not and what you think.

Woke up to an Experian alert showing a 24pt increase reaching 800 after one 30 late from 2014 was removed. Still have a 30 day late from June 2016 which I thought was very odd to reach such a boost with a relatively recent 30 day late. Was not aware you could reach 800 with derogatories present? Simulator shows 830 within 3 months as well with the same late reporting. Since this late is being disputed could it be that EX artificially suppressed it from affecting my scores even thought it's still reporting?

EQ bumped 29pts from 770 to 799 when the same late was removed. Clean report now.

TU is showing 803 with a clear report now.

Items in dispute are not used by the Fico algorithms in scoring. An aged 30 day late will continue to impact score negatively, if being considered. The aged penalty is nominally 25 to 30 points, assuming one or two isolated lates. By my estimate, a Fico 8 score of 820 should be achievable with a 30 day late given the file is otherwise near optimal.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950