- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Fico score question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Fico score question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fico score question

My business went south thanks to the lockdowns. As a result I had 14 late payments in year 2020 including three 90 day and 120 day late ones. I took care of all the late payments at the end of the year. I am now debt free.

My credit utilization is 10-15%. I plan to keep it there or reduce it further. I have credit limit of $7000.

My Fico scores are 646/680/650.

Any idea when I can hit 700+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico score question

@bobnathan0295 wrote:My business went south thanks to thelockdownss. As a result I had 14 late payments in year 2020 including three 90 day and 120 day late ones. I took care of all the late payments at the end of the year. I am now debt free.

My credit utilization is 10-15%. I plan to keep it there or reduce it further. I have credit limit of $7000.

MyFicoo scores are 646/680/650.

Any idea when I can hit 700+

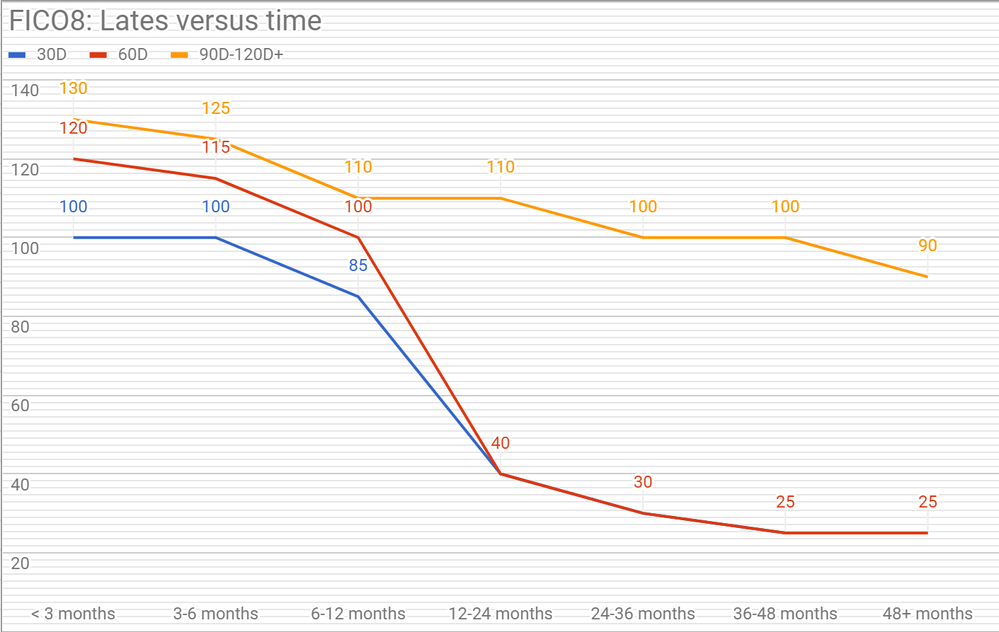

Time heals most wounds. Your 680 score may have a shot at crossing 700. Those 90, 120 day delinquencies will suppress your scores for a while.

See https://ficoforums.myfico.com/t5/Rebuilding-Your-Credit/Time-Since-Late/m-p/5138396

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico score question

Thanks for the informative response.

I had three of these

- 90D late or worse

- Chargeoff

That does not look good. Your chart put a ceiling of 720 on my credit score

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico score question

I do have an otherwise stellar credit history of 30+ years. I have had a couple of missed payments (30 days or so)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico score question

@bobnathan0295 wrote:Thanks for the informative response.

I had three of these

- 90D late or worse

- Chargeoff

That does not look good. Your chart put a ceiling of 720 on my credit score

Where those 90 day lates or worse the ones leading up to the charge off?

If yes, have you addressed the charge off?

If yes, then it will help your scores some once it reports $0.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico score question

@bobnathan0295 wrote:I do have an otherwise stellar credit history of 30+ years. I have had a couple of missed payments (30 days or so)

30, 60 day delinquencies are not too bad. It's the 90, 120 ones that can stay with you a long while.

Unfortunately, with the FICO algorithms, it looks at non derogatory or derogatory information at that moment in time when your credit report/scores are pulled.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico score question

The 120 day late lead to the chargeoff. There was only 1 chargeoff. There were 2 additional 120 day ones.

The chargeoff reports zero dollars owed today.

You make it sound like the word "chargeoff" does not make any difference

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico score question

The 120 day late led to the chargeoff. There was only 1 chargeoff. There were 2 additional 120 day ones. The chargeoff reports zero dollars owed today. You make it sound like the word "chargeoff" does not make any difference

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico score question

Is it possible that the chart in this post reflects the fact that folks who had multiple 120 day late histories do have true underlying credit

issues ?

https://ficoforums.myfico.com/t5/Rebuilding-Your-Credit/Time-Since-Late/m-p/5138396

My problems are personal and unique. They do not reflect overall financial picture

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico score question

@bobnathan0295 wrote:The 120 day late lead to the chargeoff. There was only 1 chargeoff. There were 2 additional 120 day ones.

The chargeoff reports zero dollars owed today.

You make it sound like the word "chargeoff" does not make any difference

Glad you were able to resolve the charge off.

Not quite sure how the word "charge off" does not make a difference in my post if I omitted addressing it? It isn't good for your profile either if it is reporting monthly with a balance. Your other post stated you took care of it. I can only presume that paying or settling it will help. Thus, I didn't address it fully in this post.

For your other 30, 90, 120 day, etc. lates, I would suggest a GW Good Will campaign.

I would recommend reading the below from BrutalBodyShots

The Saturation Technique: Best GW adjustment odds.