- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: How bad are consumer finance accounts really?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How bad are consumer finance accounts really?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

@sarge12 wrote:For the sake of clarity, I will state the only place I have seen the negative reason codes for a CFA are on the earlier fico versions of fico used for mortgages or auto loans maybe. Due to the fact that my fico 8 scores were over 800 during this decade, I do not think it affects fico 8 scores in the same way. I think the negative reason codes being absent, and my scores not dropping significantly in fico 08 is evidence of that. I can not factually state that the lack of the negative reason code in fico 08 proves that it does not affect that score more than other loans, but I believe that to be true. Perhaps others will chime in...has anyone here seen it as a reason code in fico 08?

Wow so it looks like it's quite the ding. Frankly doesn't make any sense why it would be so bad but it is what it is. Luckily I refinanced my mortgage before the loans. That said 2 years to pay them off plus another 10 is a long time. So it sounds like this could cause me to miss out on a mortgage down the line because I have paid off CFAs on my account. Im sure it's subjective, but assuming all other credit aspects are in gear are CFAs really a potential dealbreaker?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

@EaglesFan2006 wrote:

@sarge12 wrote:For the sake of clarity, I will state the only place I have seen the negative reason codes for a CFA are on the earlier fico versions of fico used for mortgages or auto loans maybe. Due to the fact that my fico 8 scores were over 800 during this decade, I do not think it affects fico 8 scores in the same way. I think the negative reason codes being absent, and my scores not dropping significantly in fico 08 is evidence of that. I can not factually state that the lack of the negative reason code in fico 08 proves that it does not affect that score more than other loans, but I believe that to be true. Perhaps others will chime in...has anyone here seen it as a reason code in fico 08?

Wow so it looks like it's quite the ding. Frankly doesn't make any sense why it would be so bad but it is what it is. Luckily I refinanced my mortgage before the loans. That said 2 years to pay them off plus another 10 is a long time. So it sounds like this could cause me to miss out on a mortgage down the line because I have paid off CFAs on my account. Im sure it's subjective, but assuming all other credit aspects are in gear are CFAs really a potential dealbreaker?

CFAs I do not believe will be a sole or even major reason to be denied, it will just be score ding, no telling how much (a lot or a little), but as long as your scores and rest of your profile is in order, it should not be any sort of deal breaker just because they are present.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

@Anonymous wrote:

@EaglesFan2006 wrote:

@sarge12 wrote:For the sake of clarity, I will state the only place I have seen the negative reason codes for a CFA are on the earlier fico versions of fico used for mortgages or auto loans maybe. Due to the fact that my fico 8 scores were over 800 during this decade, I do not think it affects fico 8 scores in the same way. I think the negative reason codes being absent, and my scores not dropping significantly in fico 08 is evidence of that. I can not factually state that the lack of the negative reason code in fico 08 proves that it does not affect that score more than other loans, but I believe that to be true. Perhaps others will chime in...has anyone here seen it as a reason code in fico 08?

Wow so it looks like it's quite the ding. Frankly doesn't make any sense why it would be so bad but it is what it is. Luckily I refinanced my mortgage before the loans. That said 2 years to pay them off plus another 10 is a long time. So it sounds like this could cause me to miss out on a mortgage down the line because I have paid off CFAs on my account. Im sure it's subjective, but assuming all other credit aspects are in gear are CFAs really a potential dealbreaker?

CFAs I do not believe will be a sole or even major reason to be denied, it will just be score ding, no telling how much (a lot or a little), but as long as your scores and rest of your profile is in order, it should not be any sort of deal breaker just because they are present.

Denial is not the only issue with the mortgage scores...your middle mortgage scores are used to set the interest rate. When you are talking about a 30 year mortgage it could cost you an extra 50 bucks a month, or even 100, for 30 long years. Ideally, you want approval at the lowest possible interest rate.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

@sarge12 wrote:

I can't attribute all the lower scores to that alone, but my fico scores used in mortgages were about 50 points lower than fico 08 scores.

I don't think you can blame the CFA for that, or even a portion of that based on that fact alone. My mortgage scores for a large portion of time ran 40-50 points lower than my Fico8s and I never had any CFAs. That's just the way it is on some profiles.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

I am sure glad I ran across this thread. Helps me with my decision to keep my old truck running another few years until I can get going on a mortgage first when my last baddie drops off next year. Thanks to all who post their experience.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

@sarge12 wrote:For the sake of clarity, I will state the only place I have seen the negative reason codes for a CFA are on the earlier fico versions of fico used for mortgages or auto loans maybe. Due to the fact that my fico 8 scores were over 800 during this decade, I do not think it affects fico 8 scores in the same way. I think the negative reason codes being absent, and my scores not dropping significantly in fico 08 is evidence of that. I can not factually state that the lack of the negative reason code in fico 08 proves that it does not affect that score more than other loans, but I believe that to be true. Perhaps others will chime in...has anyone here seen it as a reason code in fico 08?

I have seen it on EQ8.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

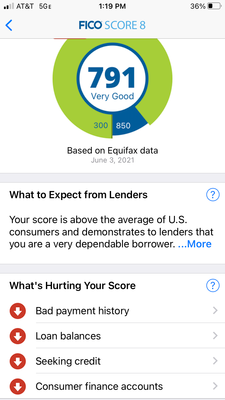

This is one topic that no one has a definite answer for. With all things being equal, my Experian fico 8 score has been my lowest score at 756. There are currently 3 CFA showing paid that go back since 2018. Since I'm not looking for a mortgage anytime soon I've never really dug into it.

Currently, it's listed as the second negative item on my Experian, so it has some impact but it's hard to quantify how much!

The fact that it's my lowest score across the board tells me that it has some impact.

I wished I was warned of those CFA, but that's another story for another day!!![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

@Anonymous wrote:

@sarge12 wrote:

I can't attribute all the lower scores to that alone, but my fico scores used in mortgages were about 50 points lower than fico 08 scores.I don't think you can blame the CFA for that, or even a portion of that based on that fact alone. My mortgage scores for a large portion of time ran 40-50 points lower than my Fico8s and I never had any CFAs. That's just the way it is on some profiles.

So it sounds like these ding you after they're paid off.

Curious if these can really hurt your mortgage chances. I'm not looking again for another few years at least. But I have a few CFAs on my reports now. My regular scores are low 700s. Assuming when these are paid off and I have good DTI and all will they really make more mortgage scores that much lower?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

FWIW, my spouse and I both had CFAs in early 2020 and we each hit 850 while they were still active. We admittedly have long, clean credit histories, but after hearing all the negatives about CFAs, I didn't think it would happen. We hit a rough business stretch again earlier this year and took out several loans from Lending Club and Lightstream (unclear to me as to whether or not that reports as a CFA) and we are still in the low 800's.

Edited to add: We have a paid off mortgage that will fall off our reports in 2 years, and these are our only active loans.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

@Curious_George2 wrote:

@sarge12 wrote:For the sake of clarity, I will state the only place I have seen the negative reason codes for a CFA are on the earlier fico versions of fico used for mortgages or auto loans maybe. Due to the fact that my fico 8 scores were over 800 during this decade, I do not think it affects fico 8 scores in the same way. I think the negative reason codes being absent, and my scores not dropping significantly in fico 08 is evidence of that. I can not factually state that the lack of the negative reason code in fico 08 proves that it does not affect that score more than other loans, but I believe that to be true. Perhaps others will chime in...has anyone here seen it as a reason code in fico 08?

I have seen it on EQ8.

I learned something new...I only ever saw it on earlier fico versions. I wonder why the reason code never appeared on my fico 08, while it always showed on the fico versions used for mortgages?

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20