- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: How bad are consumer finance accounts really?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How bad are consumer finance accounts really?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

@Hex wrote:@Anonymous

Caputal One auto financing is not coded as a CFA. It's considered a regular bank auto loan.

That makes sense because Capitol One is a bank! American Honda finance is owned by the manufacturer. I imagine all of the major auto manufacturers have a finance company so they can provide financing without as much regulation. In fact, I doubt they could legally own a bank. I think the main difference is you don't deposit money in a finance company, so is not subjected to possible bank examiner's audits. Since banks are owned by stockholders, and are responsible for the funds of depositers, and insured by the FDIC, I think they are more regulated...or suppose to be.(Can't prove that by Wells Fargo though)

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

@sarge12 wrote:

@Hex wrote:@Anonymous

Caputal One auto financing is not coded as a CFA. It's considered a regular bank auto loan.

That makes sense because Capitol One is a bank! American Honda finance is owned by the manufacturer. I imagine all of the major auto manufacturers have a finance company so they can provide financing without as much regulation. In fact, I doubt they could legally own a bank. I think the main difference is you don't deposit money in a finance company, so is not subjected to possible bank examiner's audits. Since banks are owned by stockholders, and are responsible for the funds of depositers, and insured by the FDIC, I think they are more regulated...or suppose to be.(Can't prove that by Wells Fargo though)

by that logic though aren't personal loans through things like Upstart backed by credit unions? I am pretty sure my Upstart loan is. And I know I have eligibility for Upgrade line of credit since I was approved for it a while ago, but I've never used it. So that one doesn't report at all. All told when looking at TU my personal loans show as 'other loans' and i don't see the term 'Consumer Finance Account' anywhere, however when I look at my free scores through various cards that is always listed as the 2nd negative item impacting my score.

All confusing to me. At the end of the day I just hope that when my personal loans are all paid off and i'm at my debt free goal in a couple of years, that I won't get punished for ever having had them when it comes time to move or buy a new car or anything like that.

Good stuff on this thread thanks for the input

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

I wish I had read this sooner... I took out a CFA for some home improvements. I actually had cash to pay for it, but I thought that this loan would count as an "installment loan" so would help boost my credit score by giving me a good "mix" of credit types. Turns out it has hurt my score instead, as my mortgage scores are about 30 pts less than my other scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

@Anonymous wrote:I wish I had read this sooner... I took out a CFA for some home improvements. I actually had cash to pay for it, but I thought that this loan would count as an "installment loan" so would help boost my credit score by giving me a good "mix" of credit types. Turns out it has hurt my score instead, as my mortgage scores are about 30 pts less than my other scores.

Not necessarily, I now have no CFA accounts and my mortgage scores are still probably 30 points lower. They are totally different scoring alogorithms, and from what I have seen posted here, most peoples fico 08 scores are higher than the scores used for mortgages. Were your fico 08 and mortgage scores the same before the CFA loan? You can't just look at the difference between fico 08 and the fico 2, 3, and 5 scores used for mortgages and assume those scores are lower because of the CFA. Did the fico 02, 03, and 05 all drop 30 points right after the CFA account started reporting?

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

Hi,

I use Experian to obtain FICO scores. I do have a closed Affirmed account on my file (only Experian) that I leveraged for a 0% promotional offer, paid off in the 12 month offering period (never late). When I check my FICO8, FICO2 (Mortgage) and various FICO Auto and BankCard scores, none of them list a "Consumer Financing Account" as a negative item.

Does this mean that its not impacting my score? At what point does it impact (ie more than 1)?

Thank you to this forum/thread, i will never apply to any credit offer that can give an impression of a CFA. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

@sarge12 wrote:

@Anonymous wrote:I wish I had read this sooner... I took out a CFA for some home improvements. I actually had cash to pay for it, but I thought that this loan would count as an "installment loan" so would help boost my credit score by giving me a good "mix" of credit types. Turns out it has hurt my score instead, as my mortgage scores are about 30 pts less than my other scores.

Not necessarily, I now have no CFA accounts and my mortgage scores are still probably 30 points lower. They are totally different scoring alogorithms, and from what I have seen posted here, most peoples fico 08 scores are higher than the scores used for mortgages. Were your fico 08 and mortgage scores the same before the CFA loan? You can't just look at the difference between fico 08 and the fico 2, 3, and 5 scores used for mortgages and assume those scores are lower because of the CFA. Did the fico 02, 03, and 05 all drop 30 points right after the CFA account started reporting?

Unfortunately I don't know the answers to your questions as I just got myFico for the first time a couple days ago. My scores are:

myFico Bankcard 5/4/2 .....819, 813, 834

myFico Auto 5/4/2 ............816, 797, 825

myFico Mortgage 5/4/2 ....796, 788, 808

Those are all 5/4/2 model, but the Mortgage is much lower, like 20-30 pts in each category especially vs. Bankcard. So this is not due to the CFA? If not, why is it so different if it's the same scoring model? Also it says all over my report that the CFA is a negative for me?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

@Anonymous wrote:

@sarge12 wrote:

@Anonymous wrote:I wish I had read this sooner... I took out a CFA for some home improvements. I actually had cash to pay for it, but I thought that this loan would count as an "installment loan" so would help boost my credit score by giving me a good "mix" of credit types. Turns out it has hurt my score instead, as my mortgage scores are about 30 pts less than my other scores.

Not necessarily, I now have no CFA accounts and my mortgage scores are still probably 30 points lower. They are totally different scoring alogorithms, and from what I have seen posted here, most peoples fico 08 scores are higher than the scores used for mortgages. Were your fico 08 and mortgage scores the same before the CFA loan? You can't just look at the difference between fico 08 and the fico 2, 3, and 5 scores used for mortgages and assume those scores are lower because of the CFA. Did the fico 02, 03, and 05 all drop 30 points right after the CFA account started reporting?

Unfortunately I don't know the answers to your questions as I just got myFico for the first time a couple days ago. My scores are:

myFico Bankcard 5/4/2 .....819, 813, 834

myFico Auto 5/4/2 ............816, 797, 825

myFico Mortgage 5/4/2 ....796, 788, 808

Those are all 5/4/2 model, but the Mortgage is much lower, like 20-30 pts in each category especially vs. Bankcard. So this is not due to the CFA? If not, why is it so different if it's the same scoring model? Also it says all over my report that the CFA is a negative for me?

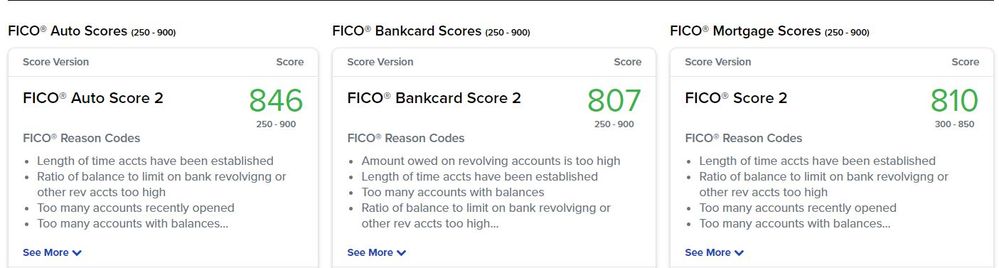

The fico 5, 4, and 2 are not actually originally designed as mortgage scores. Those were just the earlier versions of fico chosen for use by Fannie Mae, and Freddie Mac, and I think the US congress, for mortgages. Scores used for Auto lending, and Credit card lending are modified and tailored for those kind of loans. The ones for Autos might give more weight in scoring to installment debt. The scores modified for Credit cards might be tailored for added weight of revolving debt. Between the 3 major CRA's there are 29 fico scores that we have easy access to. That is not by any means all the scores that exist, and some lenders even have their own scoring models they use. Following is a screenshot of my 3 fico 02 scores from experian. Look carefully and you will see that even the scale is different. The Auto and Bankcard scores run 250-900, and the fico 02 runs 300-850. They all use the same credit report, but completely different alogorithms. I am not sure any 2 of my 29 scores are the same, but if so, it is a coincidence.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

@sarge12 wrote:

@Anonymous wrote:

@sarge12 wrote:

@Anonymous wrote:I wish I had read this sooner... I took out a CFA for some home improvements. I actually had cash to pay for it, but I thought that this loan would count as an "installment loan" so would help boost my credit score by giving me a good "mix" of credit types. Turns out it has hurt my score instead, as my mortgage scores are about 30 pts less than my other scores.

Not necessarily, I now have no CFA accounts and my mortgage scores are still probably 30 points lower. They are totally different scoring alogorithms, and from what I have seen posted here, most peoples fico 08 scores are higher than the scores used for mortgages. Were your fico 08 and mortgage scores the same before the CFA loan? You can't just look at the difference between fico 08 and the fico 2, 3, and 5 scores used for mortgages and assume those scores are lower because of the CFA. Did the fico 02, 03, and 05 all drop 30 points right after the CFA account started reporting?

Unfortunately I don't know the answers to your questions as I just got myFico for the first time a couple days ago. My scores are:

myFico Bankcard 5/4/2 .....819, 813, 834

myFico Auto 5/4/2 ............816, 797, 825

myFico Mortgage 5/4/2 ....796, 788, 808

Those are all 5/4/2 model, but the Mortgage is much lower, like 20-30 pts in each category especially vs. Bankcard. So this is not due to the CFA? If not, why is it so different if it's the same scoring model? Also it says all over my report that the CFA is a negative for me?

The fico 5, 4, and 2 are not actually originally designed as mortgage scores. Those were just the earlier versions of fico chosen for use by Fannie Mae, and Freddie Mac, and I think the US congress, for mortgages. Scores used for Auto lending, and Credit card lending are modified and tailored for those kind of loans. The ones for Autos might give more weight in scoring to installment debt. The scores modified for Credit cards might be tailored for added weight of revolving debt. Between the 3 major CRA's there are 29 fico scores that we have easy access to. That is not by any means all the scores that exist, and some lenders even have their own scoring models they use. Following is a screenshot of my 3 fico 02 scores from experian. Look carefully and you will see that even the scale is different. The Auto and Bankcard scores run 250-900, and the fico 02 runs 300-850. They all use the same credit report, but completely different alogorithms. I am not sure any 2 of my 29 scores are the same, but if so, it is a coincidence.

+1

Also remember "mortgage" scores don't actually go to 850, the real world max is lower with the lowest max being 818....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

Have you seen anyone with a FICO2 Mortgage or Bankcard score >850?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How bad are consumer finance accounts really?

@mystro9876 wrote:Have you seen anyone with a FICO2 Mortgage or Bankcard score >850?

No. The highest possible FICO 2 score is 844. I don't know the max possible FICO Bankcard Score 2, just that the official range ends at 900.