- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Inquiry categories and binning

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Inquiry categories and binning

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry categories and binning

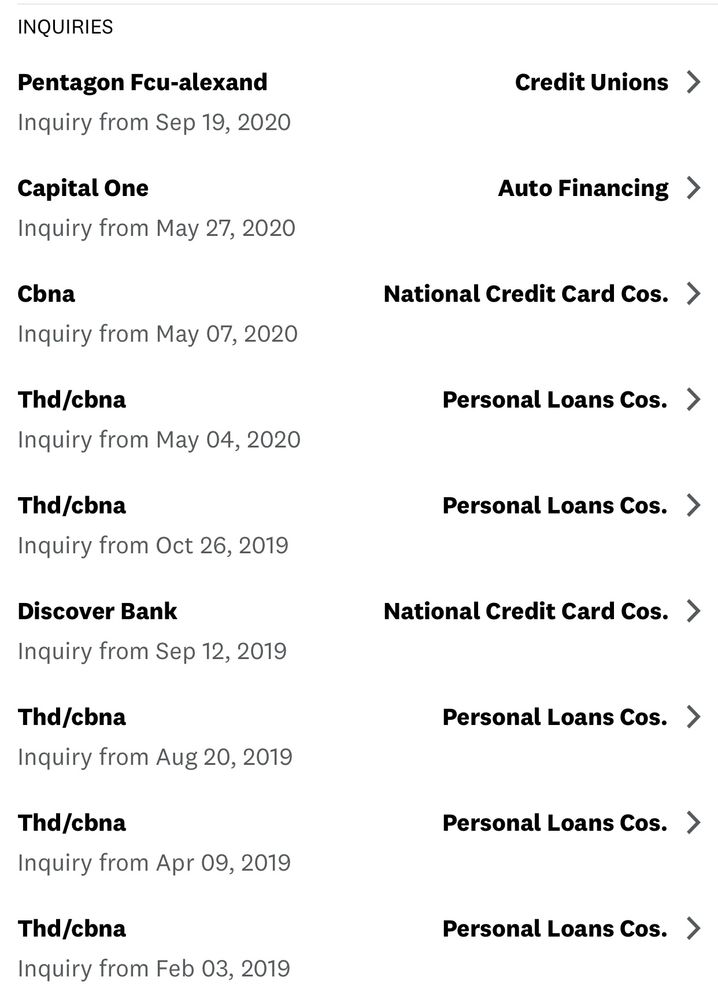

I don't believe I did. Here's the CK screenshot:

The THD/CBNA pulls were CLI tries from Citi on my Home Depot card (that was a battle I won't fight again). Disco pull was for my second card. CBMA in May was taking a stab at a Citi DC card. CapOne was for the car via Auto Navigator, and PenFed was for the PCR card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry categories and binning

@Anonymous Can you tell me the point loss for each under 12 months, if any, or if buffered 30 days?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry categories and binning

Yes. I'm at work right now getting settled in. I'll pull my notes and compare my score change chart with the inquiry dates and give you the changes for each pull in just a bit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry categories and binning

@Anonymous , see below. I have charts showing dates of score changes per bureau, along with the new score showing that day. The point losses/gains at each inquiry date are as follows, newest to oldest per the screenshot above. All point/score references are for EQ FICO8:

9/19/2020: -4

5/27/2020: 0

5/7/2020: -2

5/4/2020: +10 (this was during my big UTI paydown and I had two cards report right around this date, dropping individual usage from 80+% to zero); likely my point gain was higher than that, and the inquiry cost me a few of those points, with a net +10 when the dust settled

10/26/2019: no data unfortunately - I did not have a MF subscription at the time

As noted above, for 5/4/2020 there were large balance reductions happening at the same time so that DP can't be considered - I'm unable to break out score change due to balances separately from score change due to the inquiry. For all others, no balance changes happened on those days.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry categories and binning

@Anonymous wrote:@Anonymous , see below. I have charts showing dates of score changes per bureau, along with the new score showing that day. The point losses/gains at each inquiry date are as follows, newest to oldest per the screenshot above. All point/score references are for EQ FICO8:

9/19/2020: -4

5/27/2020: 0

5/7/2020: -2

5/4/2020: +10 (this was during my big UTI paydown and I had two cards report right around this date, dropping individual usage from 80+% to zero); likely my point gain was higher than that, and the inquiry cost me a few of those points, with a net +10 when the dust settled

10/26/2019: no data unfortunately - I did not have a MF subscription at the time

As noted above, for 5/4/2020 there were large balance reductions happening at the same time so that DP can't be considered - I'm unable to break out score change due to balances separately from score change due to the inquiry. For all others, no balance changes happened on those days.

@Anonymous totally awesome thank you for the wonderful data points! very much appreciated brother!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry categories and binning

Anytime my friend. I'll go over TU and EX also since I have loan inquiries on those bureaus as well, and dated score change charts for them too. Won't be relevant to PenFed but it's still loan-inquiry-point DPs. I'll put those together too and post them just to add to the available info.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry categories and binning

Below is link to apartment inquiries

https://www.bankrate.com/finance/credit-cards/does-rental-application-hurt-credit-score/

JC Penney 10/2008 4,700 US Bank Cash 08/2010 12,000 Citibank Custom Cash 5/2015 14,100, State Dept. FCU 06/2023 25,000 02/2024 Redstone FCU Signature VISA 10,000 08/23/2024 Commonwealth Credit Union 15000 07/25 Walmart One 5000 12/04/25

Banking: Lafayette FCU Fortera FCU State Department FCU Redstone FCU Hughes FCU Commonwealth FCU

My personal blacklist Axos Bank, Bank of America, Synchrony Bank Capital One TD Bank Comerica Bank BMO US Bank Wells Fargo