- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Opinions on utilization thresholds/FICO scorin...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Opinions on utilization thresholds/FICO scoring?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on utilization thresholds/FICO scoring?

@Anonymous wrote:

@AnonymousI do not myself have an opinion about whether FICO models do in fact use them in the way you originally mentioned. I.e. suppose Bob and Jane have total credit limits of $4000 and $400,000 respectively. Both start at $20 of CC debt. Bob goes to $320 and Jane goes to $32,000 (8% each). Will FICO view Jane's higher dollar figure of debt as an additional risk (with a scoring penalty)? I don't know because nobody here has ever tested it. I have never tested it because I keep my spending low.

CGID, thanks for the reply. In your example above where you say you don't know if the dollar amounts are taken into consideration, naturally I don't either. But, IMO, they should. I think without question Jane above has become a greater risk than Bob. If Jane loses her job, incurs massive medical expenses, dies, etc. the chance of default/default on her 8% is far greater than Bob's 8%.

This exact example above goes back to where TT and I aren't seeing eye to eye above. Where TT is talking about different bins and statistics, I'm not sure I can be convinced that Jane above isn't a greater risk than Bob even if Jane is in the same "bin" where Bob has moved to a different bin. To me, that just doesn't make logical sense. Of couse, no one said the FICO algorithm had to be logical or make sense to us... so it's fine that we have our own opinions on these things

I'm jumping in here late, but I don't see how fico could penalize Jane more due to the amount alone. Since income is not included in the report, Jane may make a million annually and have 10 million in savings, so 32000 might be nothing for Jane. Bob might work at burger barn for 10 hours a week at minimum wage and have a great deal of trouble repaying 320 dollars.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on utilization thresholds/FICO scoring?

If FICO does it, they'd be doing it for the same reason they do anything else. Because, considered as a group, people with 32k in CC debt are statistically more likely to become seriously delinquent than those who have small dollar amounts of debt.

The fact that certain individuals might be exceptions to a general trend doesn't change how the algorithm works if indeed the thing in question is a strong marker for risk (when considering consumers in the mass).

I don't have access to the huge datasets that FICO does (and am not a skilled statistician) so I don't know if raw dollar values are indeed a strong predictor apart from CC utilization.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on utilization thresholds/FICO scoring?

@Anonymous wrote:If FICO does it, they'd be doing it for the same reason they do anything else. Because, considered as a group, people with 32k in CC debt are statistically more likely to become seriously delinquent than those who have small dollar amounts of debt.

The fact that certain individuals might be exceptions to a general trend doesn't change how the algorithm works if indeed the thing in question is a strong marker for risk (when considering consumers in the mass).

I don't have access to the huge datasets that FICO does (and am not a skilled statistician) so I don't know if raw dollar values are indeed a strong predictor apart from CC utilization.

I still can not believe that historical utilization data is not used in the models. If someone has their utilization or debt amount gradually increase from 20 dollars to 32000 over a 2 year period, it likely means they are habitually spending more than they make. If someone has for years maintained a low balance and utilization, and then in a matter of weeks runs up a balance to 32k, it might just mean they went on a long delayed dream vacation, and will PIF when they return. Most who file BK, do so after gradually becoming more and more in debt over years.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on utilization thresholds/FICO scoring?

I agree that historical/trended data use would be ideal in terms of having an algorithm that makes more "sense." Unfortunately, we're not there yet, so we've got to BS about the hand that we've currently been dealt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on utilization thresholds/FICO scoring?

@Thomas_Thumb

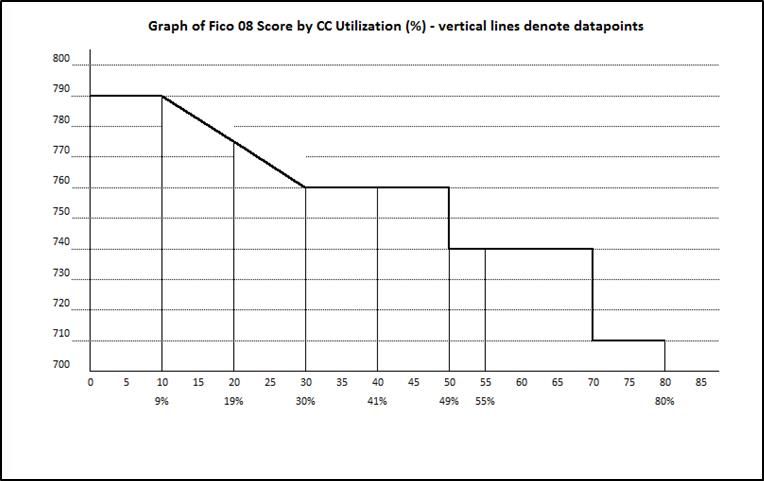

It appears that FICO uses stepwise linear which means each step has easier to perform statistical operations due to each step being linear. This is why I believe the data isn't simply a non-linear curve that runs from 0-100% utilization. However, I agree with you and feel like FICO could make smaller bins to more accurately model changes. Like 0-1%, 1-2%, 2-3%, ... are all their own bins allowing for more accurate data. I guess this would be extremely rough on sites like creditscorecard.com to explain the whole system with so many bins unless they say stick to saying keep utilization under 30%.

Also if a scoring system is more accurate, it doesn't necessarily make it more profitable. FICO continues it's monopoly with it's current model so it has no inventive to switch. However if vantage score used a more accurate model like the one I described and became more profitable as a result; FICO would obviously have to change up to my model to compete.

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on utilization thresholds/FICO scoring?

I don't know that you'd need bins every 1%-2%, although I do believe that more = better. I just think the current 20% between them is a bit silly, especially if you're talking someone with moderate-high overall credit limits.

As for CMS lingo, all of them are essentially "wrong" in the sense that all tell you to keep utilization below 30% [suggesting that's ideal] when we all know that FICO scores are maximized at 8.9% utilization and under. The addition of additional bins/thresholds IMO wouldn't have any bearing on their generalized 30% recommendation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on utilization thresholds/FICO scoring?

There is historical data on reports, date opened/closed, CL, and highest CL reported/used. There will never be a historic record of utilization because that data could be flawed. What matters is payment history and what current utilization is when applying for credit.

As far as thresholds, I use the rule of thumb, high is bad and low is good and when I'm applying for credit the lower the better. Having high utilization in some months when not applying for credit doesn't really matter. I have had as high as over 40% in one month for a home improvement project and then back down to under 10% the next month, I would never apply for credit during that period.

The most important part of credit is paying on-time and paying off balances, utilization is just one piece of the pie that changes monthly and has no memory.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on utilization thresholds/FICO scoring?

@redpat wrote:There is historical data on reports, date opened/closed, CL, and highest CL reported/used. There will never be a historic record of utilization because that data could be flawed. What matters is payment history and what current utilization is when applying for credit.

As far as thresholds, I use the rule of thumb, high is bad and low is good and when I'm applying for credit the lower the better. Having high utilization in some months when not applying for credit doesn't really matter. I have had as high as over 40% in one month for a home improvement project and then back down to under 10% the next month, I would never apply for credit during that period.

The most important part of credit is paying on-time and paying off balances, utilization is just one piece of the pie that changes monthly and has no memory.

Hi RedPat. I am not sure there will never be a historic record of utilization. That wasn't possible for a very long time because the credit bureaus did not collect a month by month history of what your balance was and what your payments were. If a creditor pulled your report, all he saw was the latest balance and he saw no information whatsoever about payment amounts.

That changed a few years ago. Now when a creditor pulls your report he can see not only what your balance was in May 2018, but also in April, March, Feb (etc.) stretching back 24 months. Likewise the CRAs enable a CC issuer to report the dates and amounts of all your payments. And there is also a historic record of your credit limit each month.

With a given credit card all those data might not be there yet, because not every CC issuer is reporting them (yet). But the point is that in the past CRA databases did not have a place for them -- so FICO could not have considered factors related to historic use and payment patterns if it wanted to -- and now CRA databses do have a place for the richer historic data and some CC issuers are reporting all of that.

The richer data that began being reported a few years ago are called trended data.

If most or all CC issuers end up reporting full trended data, FICO would be able (in some future model) to drop its huge overemphasis on current and ultralow utilization and shift toward looking at whether the consumer paid his cards in full each month, which is more predictive. FICO might still look at both, but the historic pattern of balances and payments would get much greater emphasis (which now gets no emphasis, unless the CC holder is late).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on utilization thresholds/FICO scoring?

Of course, CK maintains a historical record on aggregate utilization ![]()

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on utilization thresholds/FICO scoring?

@CGID....I not only believe that trended data will be used in the future, I fear it might be used in the wrong way. Specifically, I fear it might be used to identify strict transactors, who due to never paying issuers any interest, are of course less profitable, if profitable at all. I know some might say the credit card issuers still make a profit due to transaction fees, but at least in my case...no way!!! With most of my cards having recieved 150-250 dollars SUB alone, and then 1.5-5% rewards, there is no way they recoup that with transaction fees alone. The credit card issuers for a fact lose money on my CC accounts...period!!! I am sure they will not cite failure to carry a balance as the reason for rejection, but they will list something else that will not be rejected for the more profitable revolvers. I believe they are already using this trended data with them to deny CLI's, and have been for some time. I hope I'm wrong, but statistics show CC issuers lose money on two groups, those with problems managing credit who wind up with BK or default, and to a lesser degree to strict transactors. It is the responsible revolvers in the middle of these 2 extremes that are most profitable for the CC issuers.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20