- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Score Not Increasing Much...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Score Not Increasing Much...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Score Not Increasing Much...

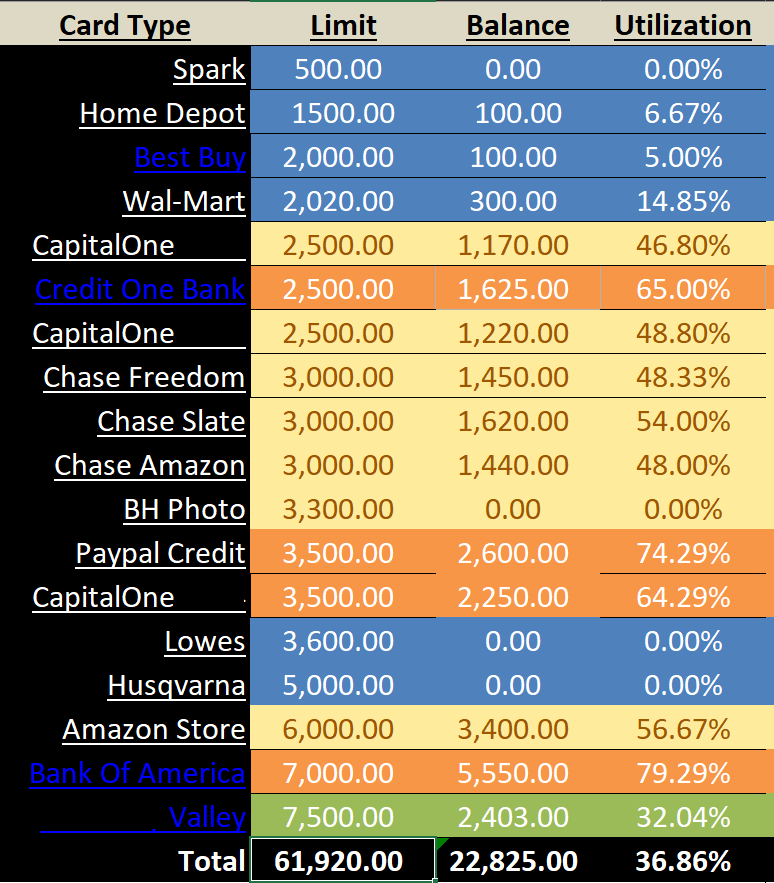

Six months ago I had 4 of the below cards over 90% utilization and 4 more over 80%. My total CC debt was very close to $44,000 dollars. I have been working on paying down my debt and as you can see below, it is in much better shape. I hope to have zero debt after the first of the year. I have no late payments since 2017, when I had a 30 day late on my auto loan. The only derogatory was a 2018 medical collection of my spouse, which was immediately paid.

Six months ago my FICO scores were 648, 631 and 614. They are currently 670, 660 and 639. My Vantage Score is 740, but I don't know what it was to begin with. So I saw a 20-30 point jump. Considering the number of cards that dropped below multiple thresholds and the overal utilization dropping so much, shouldn't I have seen a bigger jump? Additionally, the FICO score simulator says that even paying down all my CC debt would only get me a score in the low 700s. Is the single 30 day late and the collection holding me down? The collection is only reported on my Equifax, which is the highest score (670).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Not Increasing Much...

As long as you have any derogatory your score will be held down.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Not Increasing Much...

@KeithW wrote:Six months ago I had 4 of the below cards over 90% utilization and 4 more over 80%. My total CC debt was very close to $44,000 dollars. I have been working on paying down my debt and as you can see below, it is in much better shape. I hope to have zero debt after the first of the year. I have no late payments since 2017, when I had a 30 day late on my auto loan. The only derogatory was a 2018 medical collection of my spouse, which was immediately paid.

Six months ago my FICO scores were 648, 631 and 614. They are currently 670, 660 and 639. My Vantage Score is 740, but I don't know what it was to begin with. So I saw a 20-30 point jump. Considering the number of cards that dropped below multiple thresholds and the overal utilization dropping so much, shouldn't I have seen a bigger jump? Additionally, the FICO score simulator says that even paying down all my CC debt would only get me a score in the low 700s. Is the single 30 day late and the collection holding me down? The collection is only reported on my Equifax, which is the highest score (670).

Congratulations. You're making good progress. Keep up the good work.

If you're primarily interested in getting the scores to rise more quickly, I would focus on trying to get each account down to 28%. Then, when you've accomplished that, start zeroing them out. But if your primary goal is to get out of debt then what you're doing is perfect.

You might also want to try attacking the negatives by sending verification letters to the bureaus; that sometimes precipitates their falling off.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Not Increasing Much...

@Brian_Earl_Spilner wrote:As long as you have any derogatory your score will be held down.

The good news is that even though the 30 day late won't drop off for 7 years, it will have less effect as it ages. I had FICO 8 scores above 780 before my last 30 day late dropped off. Of course, waiting for derogs to age is like watching paint dry.

AoOA: closed: 40 years, open: 30 years; AAoA: 14 years

Amex Gold, Amex Blue, Amex ED, Amex Delta Blue, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA, Sync Lowes, total CL 203k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Not Increasing Much...

He is doubly right ^^^👍👍

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Not Increasing Much...

The 30 day was with Ford Credit and while they have since given us another 0% loan, they won't remove that 30 day.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Not Increasing Much...

@KeithW wrote:Six months ago I had 4 of the below cards over 90% utilization and 4 more over 80%. My total CC debt was very close to $44,000 dollars. I have been working on paying down my debt and as you can see below, it is in much better shape. I hope to have zero debt after the first of the year. I have no late payments since 2017, when I had a 30 day late on my auto loan. The only derogatory was a 2018 medical collection of my spouse, which was immediately paid.

Six months ago my FICO scores were 648, 631 and 614. They are currently 670, 660 and 639. My Vantage Score is 740, but I don't know what it was to begin with. So I saw a 20-30 point jump. Considering the number of cards that dropped below multiple thresholds and the overal utilization dropping so much, shouldn't I have seen a bigger jump? Additionally, the FICO score simulator says that even paying down all my CC debt would only get me a score in the low 700s. Is the single 30 day late and the collection holding me down? The collection is only reported on my Equifax, which is the highest score (670).

The late and collection are suppressing your scores. These are the obvious ones. Your aggregate utilization is only "fair" at 36.86%. In addition, individual util on 2-3 cards are theoretically near a "maxed out" threshold. When you cross a threshold fair -> good -> excellent, you gain points back. Go the other way, you lose points.

The individual cards with 60% + util are considered "poor" from a utilization standpoint. You have to get those paid down more.. Your BofA card at 79.29% is considered to be "very poor" from a utilization standpoint. It's near or is basically maxed out. Herein lies the risk; your credit limit can get reduced - a lot of banks are doing this - or the card can be shut down with a demand for the full balance.

You have at least 3-4 cards reporting $0 balances. FICO doesn't like $0 balances. So, while the low balances have a positive effect on aggregate util, my understanding is that FICO algorithms punishes for $0 balances. Not as counterintuitive as one might think. So, you may be getting penalized. Someone else can chime in more on this.

If the collection gets reported to Ex and TU, your scores will take a hit. That would suck, and would also be accurate reporting. In case you haven't, remember to go for pay-for-delete (PFD) for all collections if possible.

However, a paid collection is better than an unpaid one.

Get the balances down, fast. Get an installment tradeline to gain points for credit mix. Pay down Bofa card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Not Increasing Much...

@Anonymous wrote:

Herein lies the risk; your credit limit can get reduced - a lot of banks are doing this - or the card can be shut down with a demand for the full balance.

You have at least 3-4 cards reporting $0 balances. FICO doesn't like $0 balances. So, while the low balances have a positive effect on aggregate util, my understanding is that FICO algorithms punishes for $0 balances. Not as counterintuitive as one might think. So, you may be getting penalized. Someone else can chime in more on this.

I was under the impression that when accounts are closed by issuer that you could continue to pay monthly, you just can't add new charges. I hadn't read here about lenders requiring full payment immediately upon closing.

To clarify, FICO doesn't like all cards to have a zero balance, for optimum score you need to leave a small balance on one card (AZEO). Other than that FICO does like to see all cards with zero balances.

AoOA: closed: 40 years, open: 30 years; AAoA: 14 years

Amex Gold, Amex Blue, Amex ED, Amex Delta Blue, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA, Sync Lowes, total CL 203k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Not Increasing Much...

@FlaDude wrote:

@Anonymous wrote:

Herein lies the risk; your credit limit can get reduced - a lot of banks are doing this - or the card can be shut down with a demand for the full balance.

You have at least 3-4 cards reporting $0 balances. FICO doesn't like $0 balances. So, while the low balances have a positive effect on aggregate util, my understanding is that FICO algorithms punishes for $0 balances. Not as counterintuitive as one might think. So, you may be getting penalized. Someone else can chime in more on this.

I was under the impression that when accounts are closed by issuer that you could continue to pay monthly, you just can't add new charges. I hadn't read here about lenders requiring full payment immediately upon closing.

To clarify, FICO doesn't like all cards to have a zero balance, for optimum score you need to leave a small balance on one card (AZEO). Other than that FICO does like to see all cards with zero balances.

They can request payment in full at any time. Closing the account is usually the way they do that. It actually wasn't that uncommon back in the day, you would have to set up a payment arrangement. Some lenders figured that once they closed the account people wouldn't make them a priority to pay back so balance would be demanded in full upon closure. Cap1 did that to me long ago, so did US Bank.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Score Not Increasing Much...

@Brian_Earl_Spilner wrote:

@FlaDude wrote:

@Anonymous wrote:

Herein lies the risk; your credit limit can get reduced - a lot of banks are doing this - or the card can be shut down with a demand for the full balance.

You have at least 3-4 cards reporting $0 balances. FICO doesn't like $0 balances. So, while the low balances have a positive effect on aggregate util, my understanding is that FICO algorithms punishes for $0 balances. Not as counterintuitive as one might think. So, you may be getting penalized. Someone else can chime in more on this.

I was under the impression that when accounts are closed by issuer that you could continue to pay monthly, you just can't add new charges. I hadn't read here about lenders requiring full payment immediately upon closing.

To clarify, FICO doesn't like all cards to have a zero balance, for optimum score you need to leave a small balance on one card (AZEO). Other than that FICO does like to see all cards with zero balances.

They can request payment in full at any time. Closing the account is usually the way they do that. It actually wasn't that uncommon back in the day, you would have to set up a payment arrangement. Some lenders figured that once they closed the account people wouldn't make them a priority to pay back so balance would be demanded in full upon closure. Cap1 did that to me long ago, so did US Bank.

I am pretty sure the laws changed and credit card lenders can NOT demand full payment on a closed account, you are required to make the minimum payment on closed accounts.