- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- The many flavors of FICO:__Editions, versions, and...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

The many flavors of FICO:__Editions, versions, and variations

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

@Anonymous wrote:I understand your reply and appreciate the post but a difference ofover 50 points from te "old" version to the "new" version is an algorithm error on thepart of FICO. The FICO systme is flawed if two banks can pull the same exact credit report- line for line- and be over 50 points off. There is no arguing that point. This is why companies like SoFi are moving away from FICO. Unless FICO inputs an ability to pay formula into their equation- it will become antiquated. Picture person A and person B. A has a salry of 75k per year and the same exact credit utilization/history/etc as B. Person B has a salary of 500k per year. In the monds of FICO- A and B should have the same credit score. Blasphemy!! Progress or get left behind...

Actually I can argue that one easily ![]()

Banks don't compare their dataset with anyone else's, they only compare it against their own. So they pull the same score(s) over and over before the aforementioned painstakingly slow process to switch score versions. You're compared against the rest of their customer data and experience based on the same score, so 50 points difference between models eh, whatever.

You're also conflating the entire underwriting process with just FICO, and lenders don't do that: every single one of them (mandated now) has to take into account ability to pay. Credit score is just one part of the UW equation, and in some cases a small part. Why would it matter if FICO puts ability to pay in there or not? As an example I've met a near billionaire and his credit score is way way worse than mine. Income is not a guaruntee of someone getting paid, just if there's enough assets that an eventual court battle would make sense. Does it matter sure, but it's not the end-all-and-be-all of risk analysis.

Everyone's entitled to their opinions and I can empathize with the fustruation (50 points? Hah, I have a 94 point difference between my EQ FICO 9 and my EQ FICO 04, Beacon 5.0 which is actually used for a mortgage and therefore I care about it), but you're attempting to simplify a complex animal and making some potentially awkward assumptions in doing so.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

@Anonymous wrote:I'm sorry to be negative but the variety of FICO scores is a HUGE problem. I recently paid off 90% of my credit utilization and each of the three credit agencies have recognized this fact. No missed payments in over 5 years and all other factors are solid. The newest FICO version on this website has my score at a 707- but three different banks (soft pulls) are using the "old version" which has my score at 651...!!!?? I had the banks review my report line by line and allhad the same accounts as paid off. If FICO is still aloowing te banks to use the old versions- what's the point in paying this website for a "new version" score. And how can two exact same credit reports have a plus 50 point difference. Frustrating is not even close to the worid I would use...

The driving force behind new credit scoring models by Fico, VantageScore or other 3rd party scorers such as NexisNexis are creditors, not consumers. Newer models are tweaked to better align score rating with actual results on credit worthiness. Therefore, score shifts should be expected with changes in models. If there were no score shifts for certain types of profiles then what would be the point of rolling out a "better" model.

Frustration is understandable. My EQ Fico 04 score typically tracks 41 points below my EQ Fico 08 score. Not a problem as I have come to realize that's just how my file scores under "normal" conditions. However, a couple times I allowed all my credit cards to report "small" balances. On those two occassions my EQ Fico 4 plunged resulting in scores 85 and 86 points below EQ Fico 8. Not pleasant but I now know what not to do if I have a need to maximize Fico 4 score.

All algorithms reward those with clean files having good credit history and relatively low utilization. Fundamentally it looks like you have the right strategy - avoiding lates and keeping utilization in check. If you are looking for new credit, its important to know what model(s) a creditor may be using. It's also helpful to know what short term tweaks can be used to boost score - impact of these tweaks does vary my model.

As Revelate said, credit scoring companies offer products for sale to clients. They do not dictate what a creditor uses. Their business is to sell tools to help companies manage financial risk by offering a portfolio of products. More differentiated products => increased revenue potential. Also worth noting: creditors and insurance companies quite often use there own internal model coupled with a credit based scoring model in lending decisions or setting premiums.

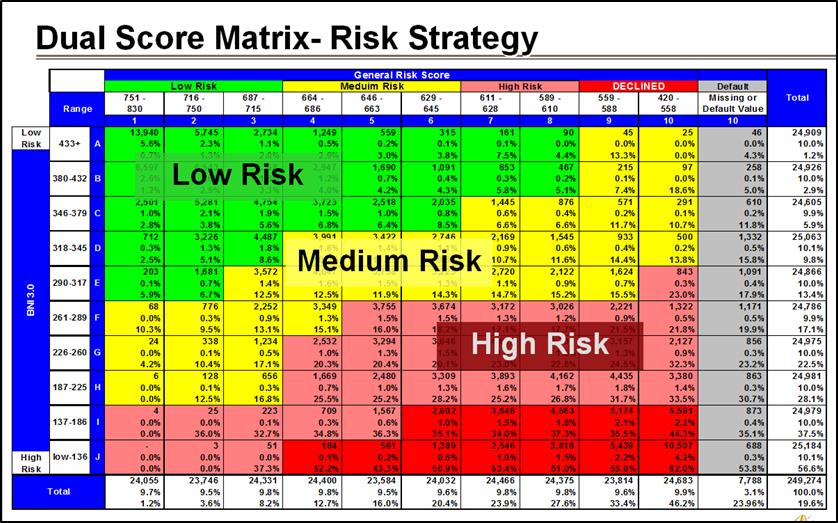

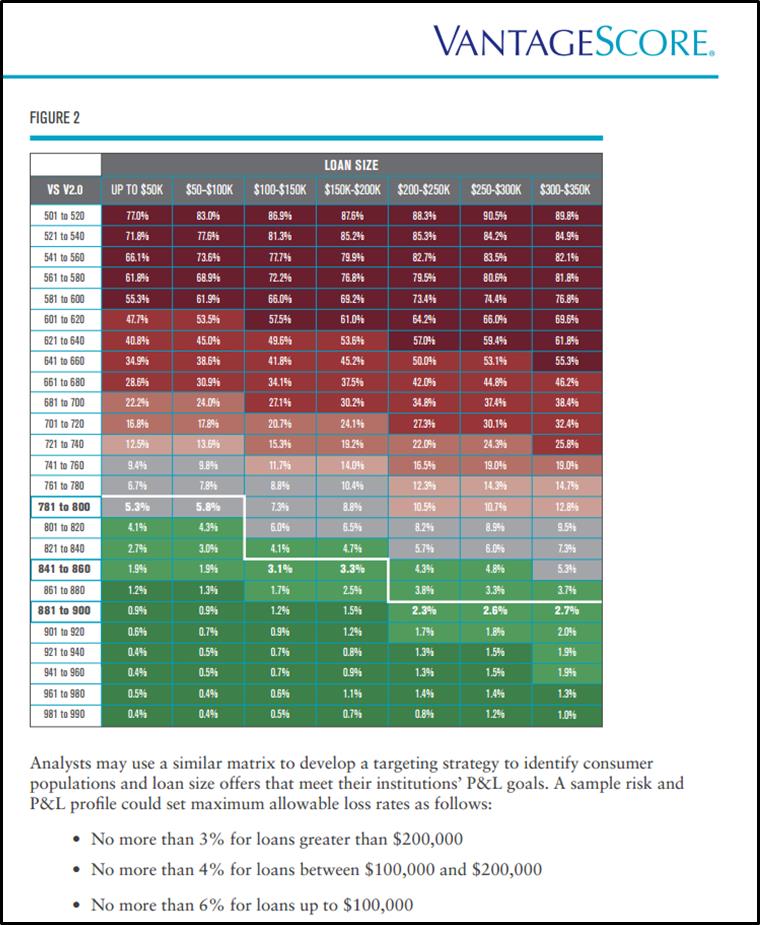

By regulation Fico and VantageScore models can't take income into consideration - nor should they. Demonstrating ability to manage financial obligations and live within one's means is the driver for creditworthiness scoring. Income, debt and countless other factors come into play when internal models are included in the credit granting decision process. I'll paste an example of this for reference below.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

@Anonymous wrote:

I'm going to have to disagree on a couple points. I've been a commercial lender/canker for 18 years and have a good idea on the underwriting criteria for banks small, large, credit unions etc. the home equity I was going for required a minimum score of 680. No exceptions. Two reports-both the same-one 651,one 705. Also, ability to pay is the hallmark of underwriting. Once again, my example is ALL OTHER FACTORS being the same-a 500k income and a 50k income can have the same credit score with identical debt. Should never be the case. Why can't FICO simply update their system to not allow the old version to be supported. While I'm on my soapbox, why is a credit score-which is as important to an individual as their ssn- not free. It's MY score. Why the need to pay?

Certainly income is important in approval/denial of credit cards and establishing of credit limits. I understand debt to income is a critical factor in approval of installment loans and loan amounts. That's expected. However, analyzing capacity for repayment is the responsibility of the lender.

Credit scoring models look at how well a person manages credit obligations relative to an established level of credit [payment history]. Utilization and balance to loan ratio are metrics used to gauge if someone appears to be over leveraging credit. Creditworthiness focuses on credit management; it's not a wealth metric.

Having access to these credit scores is a good thing. Unfortunately, consumers don't even have the potential for paid access to a vast majority of scores used to categorize a person's character [Check out "The scoring of America"]. The practice of charging or not charging consumers is a business decision. It costs money to maintain the infrastructure and shareholders want a return on their investment. The credit scoring systems are not taxpayer funded.

A small majority of people have Classic Fico 04 and Fico 98 "mortgage" scores below their Classic Fico 8 score. A drop in score is an unwelcome surprise.

P.S. Information from Discover.com indicates their credit score cutoff for home equity loans is in the 620 to 640 range. You may want to investigate.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

It was suggested I post in this forum regarding my most recent credit score pull, which I signed up for today. Some of the things in this spreadsheet aren't in my report that I can find, and some of the categories I edited to reflect what was in my report. Hope this is of interested. And FWIW, I wasn't planning to pull scores and so there were WAY more accounts reporting that I would have thought would give 850 for FICO Classic 8 and 9. I'm going to keep the number of accounts posting balances low and see what that does to the other scoring models when I get another shot at those (am I correct that those will update again in three months?).

| 3B Report Data | 6/19/16 | ||

| Classic Scoring Model | EQ | TU | EX |

| AAOA (yr, mo) | 10yr, 1mo | 9 yr, 3 mo | 10 yr, 1 mo |

| Cards reporting | 6 of 8 | 6 of 8 | 6 of 8 |

| Card reporting % | 75% | 75% | 75% |

| Inquiries under 12 mo | 0 | 0 | 0 |

| AG revolving CC UT | 3.1% | 3.1% | 3.1% |

| Ag installment (bal/loan) | 58.0% | 58.0% | 58.0% |

| Classic Scoring Model | EQ | TU | EX |

| Fico Classic 09 | 850 | 850 | 850 |

| Fico Classic 08 | 850 | 850 | 850 |

| Fico Classic 04, EX FICO 2&3 | 804 | 782 | 811(2), 804 (3) |

| Fico Classic 98 | *** | *** | ??? |

| VantageScore 3.0 | ?? | ??? | ??? |

| Auto Scoring Model | EQ | TU | EX |

| Fico Auto 09 | 872 | 869 | 875 |

| Fico Auto 08 | 870 | 887 | 883 |

| Auto EQ 5, TU 4, EX 2 | 810 | 811 | 845 |

| Bankcard Scoring Model | EQ | TU | EX |

| Fico Bankcard 09 | 863 | 857 | 861 |

| Fico Bankcard 08 | 873 | 882 | 880 |

| Bankcard EQ 5, TU 4, EX 2 | 833 | 794 | 829 |

FWIW, the large number of accounts with balances really seems to show up in the TU scores, for reasons I cannot fathom!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

@disdreamin wrote:It was suggested I post in this forum regarding my most recent credit score pull, which I signed up for today. Some of the things in this spreadsheet aren't in my report that I can find, and some of the categories I edited to reflect what was in my report. Hope this is of interested. And FWIW, I wasn't planning to pull scores and so there were WAY more accounts reporting that I would have thought would give 850 for FICO Classic 8 and 9. I'm going to keep the number of accounts posting balances low and see what that does to the other scoring models when I get another shot at those (am I correct that those will update again in three months?).

FWIW, the large number of accounts with balances really seems to show up in the TU scores, for reasons I cannot fathom!

Disdreamin, thanks for posting your data set. The 3B report has all the Fico scores listed in the template (except VantageScores). As an FYI:

1. EQ Fico score 5, TU Fico score 4 and EX Fico score 3 are all Fico 04 model based.

2. EX Fico score 2 is based on the older Fico 98 model.

Classic Fico 08 and Classic Fico 09 are very tolerant to # cards reporting balances without causing a score drop. On a February 3B report all 6 of my cards were reporting balances without penalty on Classic Fico 08 or Fico 09. In contrast, Fico 04 scores experienced some significant drops. It is a commonly held belief that Fico 04 scoring is more responsive to changes in credit card utilization and # cards reporting than Fico 98, Fico 08 and likely Fico 09.

I expect you will see a solid 10 point increase on Fico 08 and Fico 09 enhanced scores by reducing # cards reporting a balance from 6 of 8 to 3 of 8. Your enhanced Fico 04 scores (other than EQ Fico 04 bankcard) should go up even more. Your Bankcard EQ 5 score of 833 is quite high given # cards reporting, not sure why.

FYI - Below is a link to a table that lists score ranges and real world max scores by credit scoring model

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

Just double-checked the Bankcard EQ Score 5, and it was indeed 833. Negatives shown are:

- You opened a new credit account relatively recently.

- You have too many credit accounts with balances.

- You have too many credit cards carrying balances.

- The balances on your non-mortgage credit accounts are too high.

Thank you for the info on the scoring models - I had no idea! So I'm (like an idiot) looking through the table like "what goes here?! Why don't I see that?!" I'll try to get things cleaned up and post a corrected version that mirrors yours at some point though, now that I know where to put the various things.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

7/2020: EQ - 842; TU - 832; EX - 848

10/2017: EQ - 823; TU - 835; EX - 824

05/2016: EQ - 712; TU - 706; EX - 710

11/2015: EQ - 694; TU - 651; EX - 653

5/2015: EQ - 670

5/2014: EQ - 653

11/2013: EQ - 645

05/2013: EQ - 656

11/2012: EQ - 646

Eight CCs ($179,500 CL, 0%-1% UTIL)

AoOA = 18.6 years, AAoA = 60 mos., AoYA = 18 mos.

One mortgage, one HELOC, no car loans.

Derogs from 2009 and 2010 now gone after 7 years. I started paying attention to credit scores in about 2014. It's taken a few years but credit scores are now good after starting in the high 500s back in 2011

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

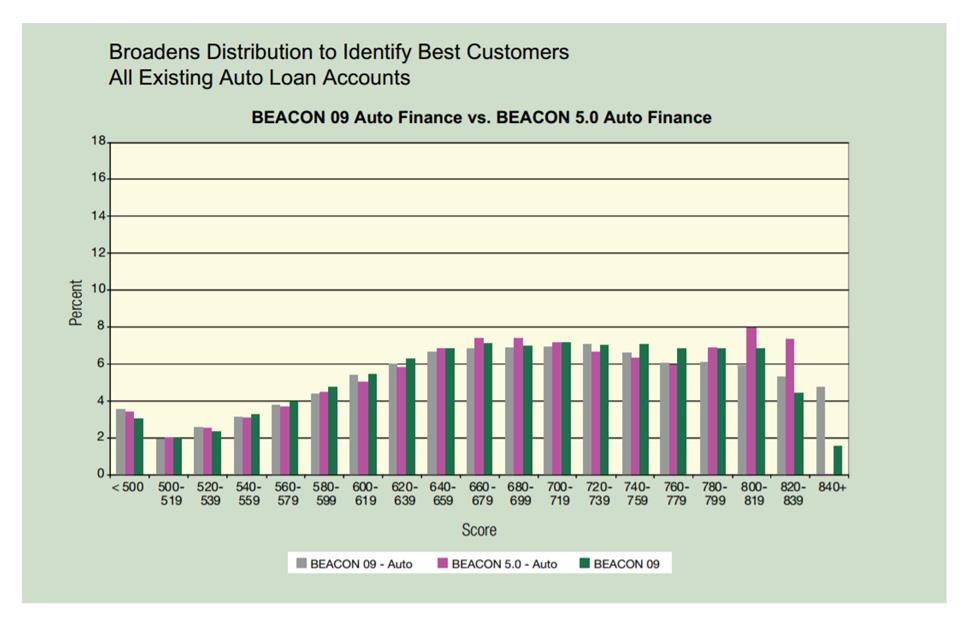

FWIW - Pasted below is a recent score distribution graph from Equifax on Fico Auto scores.

http://www.equifax.com/pdfs/corp/EFS-913-ADV-BEACON-09-Auto-Industry-Option.pdf

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The many flavors of FICO:__Editions, versions, and variations

@Thomas_Thumb wrote:FWIW - Pasted below is a recent score distribution graph from Equifax on Fico Auto scores.

http://www.equifax.com/pdfs/corp/EFS-913-ADV-BEACON-09-Auto-Industry-Option.pdf

Seeing that graph now I know why FICO came up with a different nomenclature recently. Beacon 9.0 = FICO 8 for reference's sake.

That comparison is interesting though, so much for AU being generally higher than baseline FICO 8 looking at that graph, wonder what sorts of profile get slotted into those buckets. Also the push towards lower scoring in the worst scorecards on AU.