- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Does Citi DC SP CLI use score on site?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Does Citi DC SP CLI use score on site?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Citi DC SP CLI use score on site?

@beautifulblaquepearl wrote:

@SouthJamaica wrote:

@beautifulblaquepearl wrote:

@SouthJamaica wrote:

@Gmood1 wrote:Nothing showing up here either. Let's see if it shows after 180 days from the last CLI.. should be at the end of this month.

Wow, so I guess it is a message that they're ready to give me something finally.

But I don't know if they've already gotten the new soft pull, or if I need to wait until the score on the site is updated.

If your instinct is to wait, then I would wait. Good luck!

Nah, my instinct is always to hit that lever. I'm not good at waiting.

But my brain is saying "restrain yourself"

Which one will win this time?

Usually my instinct wins out over my brain.

In this case it depends on whether I give in to my impulse during a weak moment ![]()

Believe it or not, I actually checked to see if Citibank has done a soft pull on my Equifax report since the 9/27 pull.... and it hasn't. So that encourages me to just wait. I've waited a year and a half, I can wait another month if I have to.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 699 TU 696 EX 673

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Citi DC SP CLI use score on site?

@Anonymous wrote:

@SouthJamaica wrote:I think I've pretty much answered my own question by reviewing the denial letter from my soft pull CLI request. It referred to an event which had disappeared from my Equifax report weeks before the CLI request. So it is clear to me that when I make the soft pull CLI luv button request on Citi's site, they're going to go with the old report referenced on the site as my FICO score.

So I've just got to wait for that score to update, and then I'll pull the lever again. Hopefully the soft pull language will still be there when I do.

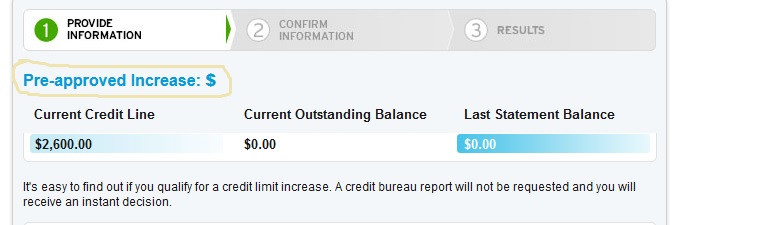

BTW I've noticed the language "Pre-Approved Increase: $"... I never noticed that before. Has that always been there when the soft pull language was in place?

Now that is new! The blue line for me just says "Your account." I hope Citi doesn't make us wait too much longer for a score update like last month. I'm still showing the SP from 9/27.

I've seen that as well but it means nothing at all - atleast to me. I was denied regardless.

| 769 | 774 | 764 | UTIL: 2% | AAoA: 5yr 8mos | Total Credit Line: $873,950 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Citi DC SP CLI use score on site?

@Ysettle4 wrote:

@Anonymous wrote:

@SouthJamaica wrote:I think I've pretty much answered my own question by reviewing the denial letter from my soft pull CLI request. It referred to an event which had disappeared from my Equifax report weeks before the CLI request. So it is clear to me that when I make the soft pull CLI luv button request on Citi's site, they're going to go with the old report referenced on the site as my FICO score.

So I've just got to wait for that score to update, and then I'll pull the lever again. Hopefully the soft pull language will still be there when I do.

BTW I've noticed the language "Pre-Approved Increase: $"... I never noticed that before. Has that always been there when the soft pull language was in place?

Now that is new! The blue line for me just says "Your account." I hope Citi doesn't make us wait too much longer for a score update like last month. I'm still showing the SP from 9/27.

I've seen that as well but it means nothing at all - atleast to me. I was denied regardless.

Wow, thanks for that info. I'm just going to wait until my higher EQ Bankcard 8 score kicks in on their site.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 699 TU 696 EX 673

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Citi DC SP CLI use score on site?

@Ysettle4 wrote:

@Anonymous wrote:

@SouthJamaica wrote:I think I've pretty much answered my own question by reviewing the denial letter from my soft pull CLI request. It referred to an event which had disappeared from my Equifax report weeks before the CLI request. So it is clear to me that when I make the soft pull CLI luv button request on Citi's site, they're going to go with the old report referenced on the site as my FICO score.

So I've just got to wait for that score to update, and then I'll pull the lever again. Hopefully the soft pull language will still be there when I do.

BTW I've noticed the language "Pre-Approved Increase: $"... I never noticed that before. Has that always been there when the soft pull language was in place?

Now that is new! The blue line for me just says "Your account." I hope Citi doesn't make us wait too much longer for a score update like last month. I'm still showing the SP from 9/27.

I've seen that as well but it means nothing at all - atleast to me. I was denied regardless.

Interestingly, the language disappeared today. Instead of saying "Pre-approved Increase: $" it just says "Your Account". The soft pull language is still there.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 699 TU 696 EX 673

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Citi DC SP CLI use score on site?

@SouthJamaica wrote:

@Ysettle4 wrote:

@Anonymous wrote:

@SouthJamaica wrote:I think I've pretty much answered my own question by reviewing the denial letter from my soft pull CLI request. It referred to an event which had disappeared from my Equifax report weeks before the CLI request. So it is clear to me that when I make the soft pull CLI luv button request on Citi's site, they're going to go with the old report referenced on the site as my FICO score.

So I've just got to wait for that score to update, and then I'll pull the lever again. Hopefully the soft pull language will still be there when I do.

BTW I've noticed the language "Pre-Approved Increase: $"... I never noticed that before. Has that always been there when the soft pull language was in place?

Now that is new! The blue line for me just says "Your account." I hope Citi doesn't make us wait too much longer for a score update like last month. I'm still showing the SP from 9/27.

I've seen that as well but it means nothing at all - atleast to me. I was denied regardless.

Interestingly, the language disappeared today. Instead of saying "Pre-approved Increase: $" it just says "Your Account". The soft pull language is still there.

Same as happened to me in the past. I'm not hopeful honestly that I'd get any increase via SP.

| 769 | 774 | 764 | UTIL: 2% | AAoA: 5yr 8mos | Total Credit Line: $873,950 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Citi DC SP CLI use score on site?

In reading this, I jumped on Citi and hit them up for an increase. It had the preapproved language so hit my Simplicity, got it. Then I tried DC and said no! Now looking back I should have hit the DC first...oh well, 6 more months I guess!!

FICO scores TU 764 EX 739 EQ 745

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Citi DC SP CLI use score on site?

@JustBPatient wrote:In reading this, I jumped on Citi and hit them up for an increase. It had the preapproved language so hit my Simplicity, got it. Then I tried DC and said no! Now looking back I should have hit the DC first...oh well, 6 more months I guess!!

Some folks just have all the luck. Congrats.

| 769 | 774 | 764 | UTIL: 2% | AAoA: 5yr 8mos | Total Credit Line: $873,950 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Citi DC SP CLI use score on site?

Just checked again a few minutes ago. Citi AR 11/2/2016 showing now. The scores should update soon hopefully. Mine will dip a little I'm sure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Citi DC SP CLI use score on site?

OK so I waited for the FICO Bankcard 8 EQ score on the Citibank site to reset. My score jumped 73 points to 773.

I pulled the soft pull luv button and.......... instant denial.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 699 TU 696 EX 673

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Citi DC SP CLI use score on site?

@SouthJamaica wrote:OK so I waited for the FICO Bankcard 8 EQ score on the Citibank site to reset. My score jumped 73 points to 773.

I pulled the soft pull luv button and.......... instant denial.

I was hoping you'd update. I'm sorry to hear that they won't part with even a little bit this time around.

Mine updated today as well and about 20 minutes ago...instant denial as well. I'm going to continue to put spend through as I do love the 2% and I'm marking my calendar to try again 6 mos. Hopefully at this point, the can't give me the too many new accts or too many CLI attempts excuse. If I get denied again, I'll close it. I'm at the point I'd rather lose .5% in rewards and give the spend to NFCU than have to pay the DC off multiple times per month for non-category spend.