- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: New American Express Cash Magnet Card

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

New American Express Cash Magnet Card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

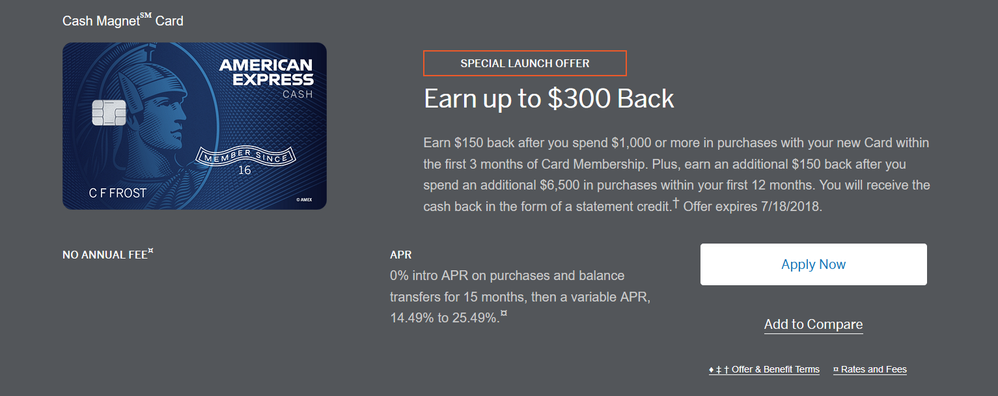

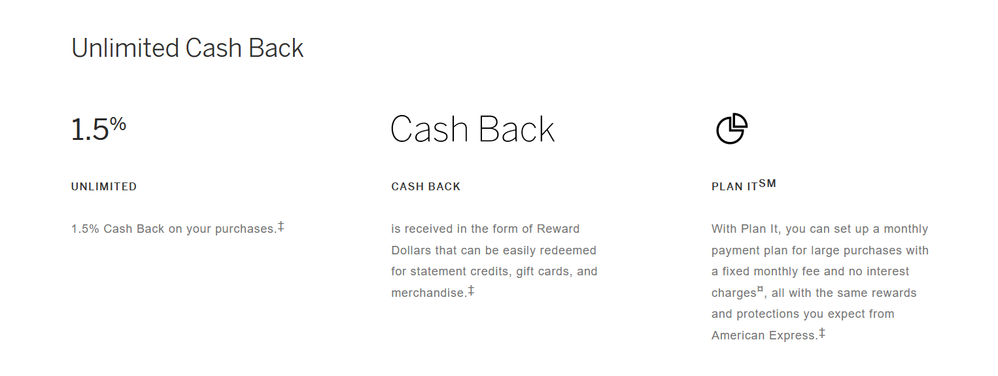

New American Express Cash Magnet Card

This is an curious new offering from American Express.

It seems to be a copy of the Capital One Quicksilver being that the rewards are cash-back and not MR points. The sign-up bonus is generous, especially for those who are able to hit the secondary threshold to trigger the additional $150 cash back.

At one time this would have been a no-brainer for many, but due to Amex's recent policy updates regarding churning bonuses this might not be as popular as it otherwise might have been.

The facts are rather straight-forward, but DoC elaborates on the particulars here: https://www.doctorofcredit.com/american-express-launches-cash-magnet-card-300-sign-up-bonus-1-5-ever...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New American Express Cash Magnet Card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New American Express Cash Magnet Card

@j615 wrote:

Oh, I wish this was a 2% card instead.

I know... I'm actually giving it some thought, but I would have to shift some 3% spend to reach the threshold for the second bonus. ![]()

The math 'works' to do so, but afterwards I'd be left with (yet another) card for the SD, save for the occasional Amex Offer.

Decisions, decisions...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New American Express Cash Magnet Card

@j615

I agree 100%. 2% cash back should be the new minimum standard.

The best cash back card I've come across is the Visa Signature Card

from Alliant FCU. 3% cash back year 1, and 2.5% every year thereafter.

A quality card like this one is worth the $59 annual fee.

http://www.alliantcreditunion.org/borrow//#filter=credit-cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New American Express Cash Magnet Card

It showed up on my "preapproved" screen this morning, along with the 2 top tier Delta SkyMiles cards, but I'm closing on a house in a month and have to sit tight for the moment. Pretty card, whatever that's worth, sort of LOOKS like a Cap1 Venture.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New American Express Cash Magnet Card

I agree. I won't even look at a card that earns less than 2% cash back.

Sock Drawer: PenFed Promise • NFCU cashRewards • Chase Sapphire Preferred • Chase Freedom Unlimited • United Explorer • UNFCU Azure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New American Express Cash Magnet Card

AMEX seems to be doing some new things.

I am going to renew my push for 3% and 2% dining category on the Blue Cash Preferred and Blue Cash Everyday, respectively. The CSR told me that if more people call in requesting this, it has a better chance of happening. I will go down fighting!!

The new "Cash magnet" card is worse than my Quicksilver, because it is not as widely accepted, plus it has horrible foreign transaction fees. I agree, they should have made it a 2% card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New American Express Cash Magnet Card

@Anonymous wrote:

I agree 100%. 2% cash back should be the new minimum standard.

The best cash back card I've come across is the Visa Signature Card

from Alliant FCU. 3% cash back year 1, and 2.5% every year thereafter.

A quality card like this one is worth the $59 annual fee.

http://www.alliantcreditunion.org/borrow//#filter=credit-cards

How do redemptions work on the Alliant visa signature? I see that you can choose statement credit or checking deposit. Is there a minimum? Does the cashback appear at the end of the statement? Or is there a delay, like Amex?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New American Express Cash Magnet Card

@Anonymous wrote:AMEX seems to be doing some new things.

I am going to renew my push for 3% and 2% dining category on the Blue Cash Preferred and Blue Cash Everyday, respectively. The CSR told me that if more people call in requesting this, it has a better chance of happening. I will go down fighting!!

The new "Cash magnet" card is worse than my Quicksilver, because it is not as widely accepted, plus it has horrible foreign transaction fees. I agree, they should have made it a 2% card.

Ugh... I didn't notice the 2.7% foreign transaction fee. ![]()

To be fair, the target market for this card likely isn't travelers... they have their charge cards/MR earning cards for that demographic.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New American Express Cash Magnet Card

I just product changed my BCP to this card mainly to remove the yearly fee plus i don't use AMEX much for my daily expenses.

Shell FCU : 5K

Shell FCU : 5K