- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Now Wells Fargo offer FREE FICO 9 from EX!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Now Wells Fargo offer FREE FICO 9 from EX!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now Wells Fargo offer FREE FICO 9 from EX!

@Anonymous wrote:

@Anonymous wrote:

@Thomas_Thumb wrote:Same here. I have checking and savings accounts with WF - no credit card or loans though. Never received a Fico score from WF before. Went on-line and after seeing the OP's post and yes! -WF now is providing me with an EX Classic Fico 9 updated monthly.

OP - Thanks for the heads up

Now receive 4 flavors of Fico scores, 3 VantageScores and the odd EX National Equivalency for free to compare monthly:

1) EX Classic Fico 9 (WF)

2) EX Classic Fico 8 (AMEX & Discover scorecard)

3) TU Classic Fico 8 (Discover)

4) EQ Bankcard Fico 8 (Citi)

5) EX VS 3.0 (Credit Sesame & Credit.com)

6) TU VS 3.0 (CK)

7) EQ VS 3.0 (CK)

8) EX NE (Credit.com)

Looking forward to getting some score data on VS 4.0

YW. Correct! It is available on my online banking for checking and saving account. I do not have credit with WF. I'm very happy they offer free FICO9 version instead of FICO8. I'm eyeing on one of PenFed Credit cards now, since they using FICO9 EQ to determine the approval, so I have an idea for the application in the near future with them. I hate wasting a HP for denial

But isn't the WF score drawn on EX? The difference between two bureaus (drawn on the same model) can sometimes be far more than the difference between two models (drawn on the same bureau).

Of course if your FICO 8's are usually almost the same (EQ vs. EX) due to the two reports having identical data then your EX FICO 9 will probably be very close to your EQ.

@Anonymous was i meant @ CreditGuyInDixie, my Fico 8 almost the same (EQ vs. EX). So I assume my Fico 9 (EQ vs. EX) will be very close.

At least, i will have general idea about my FICO 9 from EQ when Im ready to apply Penfed credit card in near future.

Yes, Wells Fargo FICO 9 is from EX. Sorry for the confusion. My apology ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now Wells Fargo offer FREE FICO 9 from EX!

For some reason, mine hasn't been updated yet. It still shows the August 30's score. It's suposed to be updated monthly too, not quarterly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now Wells Fargo offer FREE FICO 9 from EX!

I like the 09 score. Shows me at 814 where the 08 scores are all around 800.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now Wells Fargo offer FREE FICO 9 from EX!

@Thomas_Thumb wrote:Same here. I have checking and savings accounts with WF - no credit card or loans though. Never received a Fico score from WF before. Went on-line and after seeing the OP's post and yes! -WF now is providing me with an EX Classic Fico 9 updated monthly.

OP - Thanks for the heads up

Now receive 4 flavors of Fico scores, 3 VantageScores and the odd EX National Equivalency for free to compare monthly:

1) EX Classic Fico 9 (WF)

2) EX Classic Fico 8 (AMEX & Discover scorecard)

3) TU Classic Fico 8 (Discover)

4) EQ Bankcard Fico 8 (Citi)

5) EX VS 3.0 (Credit Sesame & Credit.com)

6) TU VS 3.0 (CK)

7) EQ VS 3.0 (CK)

8) EX NE (Credit.com)

Looking forward to getting some score data on VS 4.0

My DD stopped home this weekend and I had her check her Wells Fargo Fico score. She has a credit card with WF. Interestingly, her score remains EX Bankcard Fico score 2 (listed range 250 to 900).

Are those of you with WF credit cards still getting EX Bankcard Fico score 2 (Bankcard Fico 98 version) updates?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now Wells Fargo offer FREE FICO 9 from EX!

Anyone notice increase Pre-screen or PQ offers for WF.

Only have a new Biz Checking acccount, and was issued a $15K CL for Biz Plat at Prime +9.9% and 1.5X CB, 0% APR 9 Months, first Biz credit but with PG, but all CRB are frozen and No hard pull and prior relationship with WF. Also PQ for a Biz LOC upto $50k Prime +1.75% but probalbly need to unfreeze, waiting till next week, not sure if WF can pull info from the FICO's my FICO 9 should be north of 800 from last myfico in March, as the FICO 8 was 817 earlier today and similar on the last all scores Myfico. I think I will a few days till next month to allow WF to give me a score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now Wells Fargo offer FREE FICO 9 from EX!

I know this is an old thread but this is an interesting topic. I don't have a WF product but as my mom is getting up there in age I 'back her up' with her finances to make sure nothing goes awry. Anyway, she has a WF mortgage so I just jumped online to have a look.

Her EX FICO 9 is 12 points higher than her EX FICO 8. She has no collections, no charge offs, no late pays -- zero derrog credit. What she does have is 3 less-than-a-year-old credit cards (I did a little make over of her credit file in order to clear out the junk and to thicken it). Overall utilization is at 14%. No single card is greater than 26%.

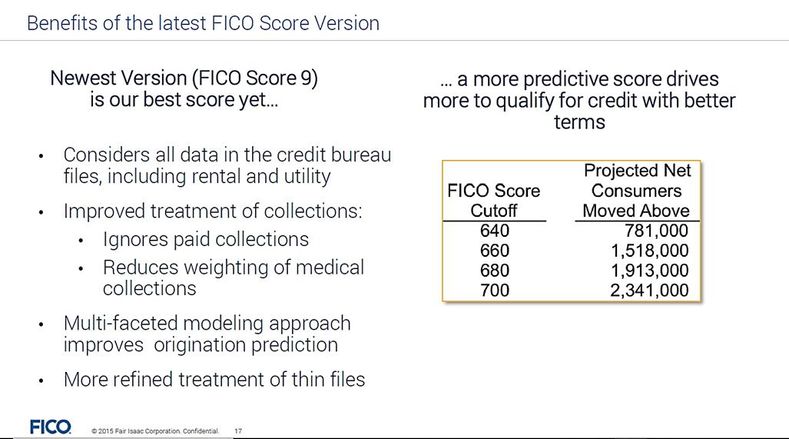

So the question of "what else" FICO 9 is factoring is interesting. Clearly the only changes aren't just the weight of paid/unpaid collections, medical collections, and nuisance collections.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now Wells Fargo offer FREE FICO 9 from EX!

How many open accounts does she have total (including cards, loans, etc.)?

Of these, how many are showing a positive balance?

How many open revolving accounts does she have total?

Of these, how many are showing a positive balance?

Is her mortgage the only installment account that she is? No other loans?

For each loan that she has, what was the original loan amount and how much does she owe now?

You are comparing her FICO 8 with her FICO 9. Were the two scores drawn on the same day? If not, is it possible that there could have been some slight changes in the report? Utilization? Answers to any of the questions above? Here is one subtle example: if the FICO 8 was generated based on data March 29 and the FICO 9 on data from April 3, all of her accounts would be one month older with FICO 9.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now Wells Fargo offer FREE FICO 9 from EX!

How many open accounts does she have total (including cards, loans, etc.)?

8

Of these, how many are showing a positive balance?

8

How many open revolving accounts does she have total?

7

Of these, how many are showing a positive balance?

7

Is her mortgage the only installment account that she is? No other loans?

Yes. No, no other loans.

For each loan that she has, what was the original loan amount and how much does she owe now?

208,000 / 206, 401 (She just recently bought this house. She's had several other houses but those loans have all since been paid in full and those accounts are closed.)

You are comparing her FICO 8 with her FICO 9. Were the two scores drawn on the same day? If not, is it possible that there could have been some slight changes in the report?

Yes, they were drawn on the same day. The FICO 9 was drawn on April 28th and then I decided to refresh her Experian Credit Works.

Utilization?

Total: 14%

Individual: 43% (One card was over the 30% utl, I didn't catch this when I first posted), 22%, 20%, 18%, 13%, 9%, 1%. Then of course the mortgage is at 100%.

You didn't ask but in case this is helpful:

AAofA: 5 years, 11 months

AoOA: 16 years, 5 months

AoYA: 9 months

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now Wells Fargo offer FREE FICO 9 from EX!

I had thought that contributor Thomas Thumb had conjectured that FICO 9 is more sensitive to the number of accounts reporting a positive balance than is FICO 8.

In her case, she has both a high integer number of accounts reporting (8 accounts of which 7 are revolving) and a high percentage (100%). If FICO 9 is more sensitive then that she should have a lower score. So perhaps that conjecture is not true.

TT knows more about FICO 9 so perhaps he'll chime in.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Now Wells Fargo offer FREE FICO 9 from EX!

Fico 8 put significant weight toward installment loans and installment utilization. Perhaps Fico 9 backed off on weight of this factor a bit. This could potentially be a reason for a higher Fico 9 score. The same may hold for aggregate and individual revolving utilization. In the OPs example aggregate was listed at 14% (above the 8.9% top tier threshold) and highest individual was over 29%.

Number of cards reporting is a factor in Fico 8 & Fico 9 but, utilization % carries more weight. I'll come back and paste some F8/F9 info to this post when I have time to find it in my archives. [Note Fico 9 did add a 13th scorecard for segmenting high credit card utilization]

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950