- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Inquiry categories and binning

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Inquiry categories and binning

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry categories and binning

@Anonymous wrote:

@dragontears wrote:

@Anonymous wrote:

OK so the algorithm divides scoreable inquiries into credit card, mortgage, and non-mortgage loan from my understanding. Now I don’t know if there are bins inside each of those categories or only inside some of them. I do know that except for credit card inquiries, we will have to take into account de-duplication.

so one would say at TU I have 1 mortgage inquiry, 2 loan inquiries, de-duplicated, three not de-duplicated and 2 CC inquiries.

Maybe inq-

TU-2CC, 1Mt, 3Ln (2de-dupped)

EQ-3CC, 1Mt, 0Ln

EX-2CC, 1Mt, 1Ln

Maybe a format something like this but we’re going to have to keep track of how many scoreable inquiries are within each of those categories if we ever hope to understand where the thresholds for bins are.You forgot about HP for apartments, employment, utilities, etc. I believe those are not classified under the groups you listed.

Also auto HP are deduped like mortgage HP where HP for other types of loans are not deduped (to the best of my knowledge)

@dragontears apartments employment, those are all soft pulls and don't affect score. See the inquiry section of the Scoring Primer I think it's post 4.

De-duplication Occurs for all installment inquiries but as I said they are categorized again see post 4, Scoring Primer

Ummm no they are not always SP. I have personally gotten HP for apartment applications

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry categories and binning

However we have a big clue as to whether the algorithm thinks it’s a installment loan or a credit card. The 30 day buffer.

If you take the penalty immediately it’s marked as a Credit Card inquiry. If it’s 30 days before you get the point loss to the day, then it was coded as a loan although I don’t know whether mortgage or non-mortgage.

**Edit: If there is a category of loans that do not apply this logic (the "other loans"), which is something we have to determine, then it would have immediate point loss as well, if not binned.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry categories and binning

I like it. I'll go through my reports tomorrow and get the breakdown of all my pulls to post up. And @Anonymous , you are correct, the "mortgage" inquiry I took on EQ9 was for the PenFed PCR.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry categories and binning

that's a Permalink to post 4, then go to section 4 subsection b

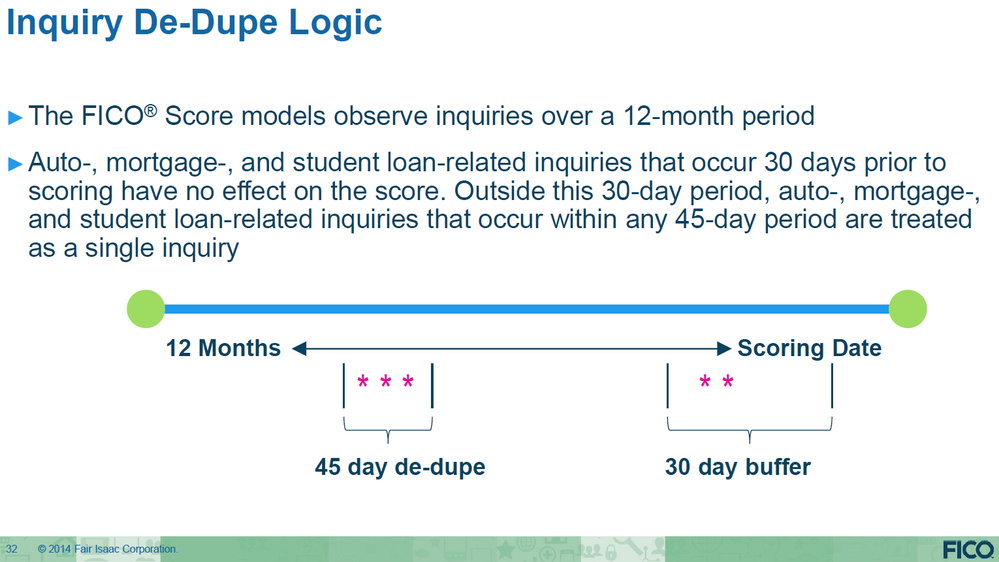

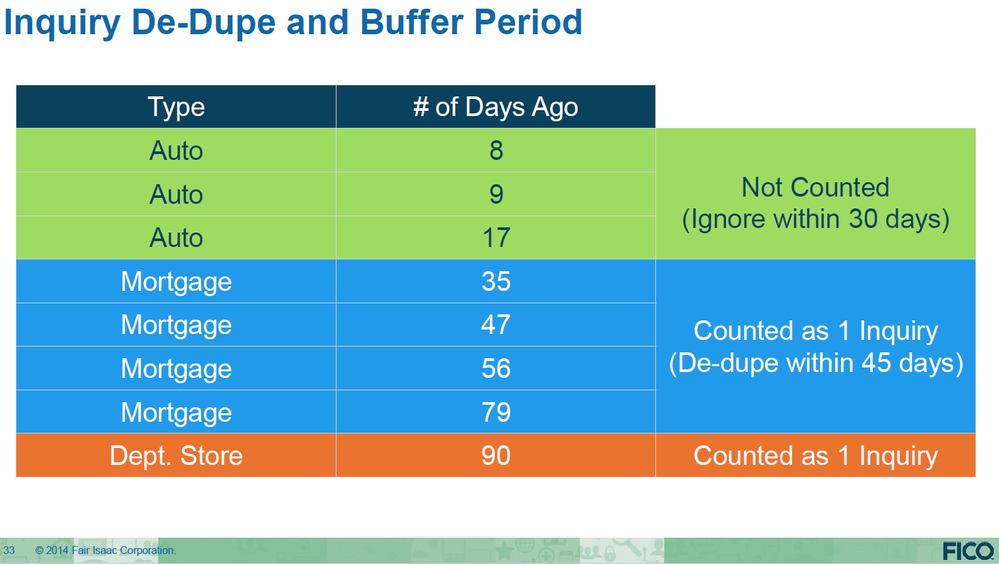

(i) Buffering/De-duplication of Installment Inquiries.

The point loss is immediate for most revolver HPs, but FICO ignores installment HPs (IF coded correctly) from the preceding 30 days. (Buffering.)

Installment HPs of the same type within 45 day windows are counted as 1 for scoring purposes by the algorithm (14 days for EX2). This is referred to as de-duplication and is designed to allow for rate-shopping. De-duplication does NOTcombine installment inquiries across types. A mortgage pull and an auto pull will not be de-duplicated. But 10 auto inquiries within 45 days will only penalize you as if it were 1, scorewise.

Please note that when applying for CCs, most lender computers simply see the raw number of inquiries, not de-duplicated. This causes auto denial for inquiry-sensitive lenders. A solution is not to apply to lenders that do not allow reconsideration (looking at you CapOne). If you apply and are denied for too many inquiries (credit-seeking), a quick call to UW explaining the multiple inquiries are from rate-shopping the same loan will usually cause manual reconsideration.

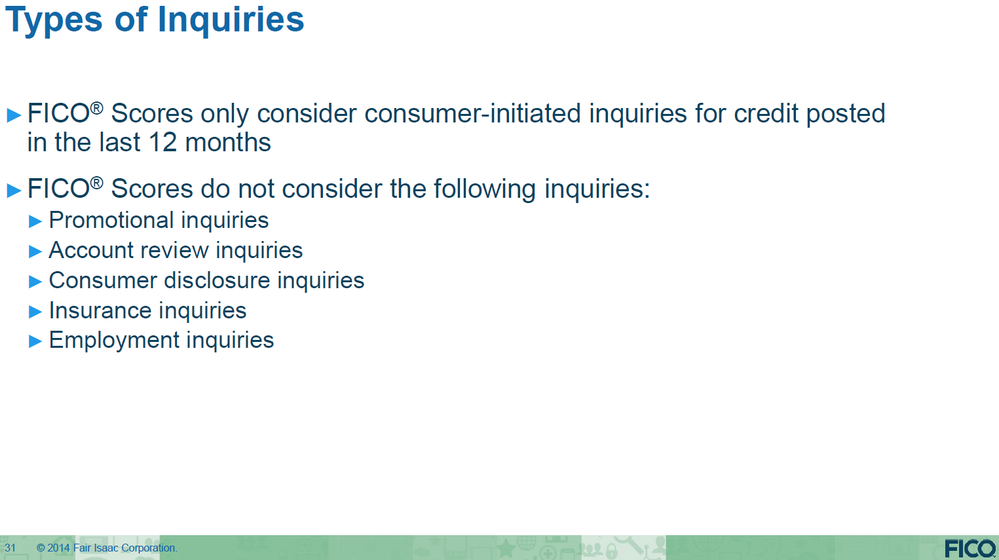

Soft inquires are inquiries done for various reasons, have no scoring impact and can only be disclosed to the consumer. Examples include: promotional, AR (account review), consumer disclosure, insurance, employment. The type of SP determines the data given.

Promotional inquiries, for instance, do not give account information, just contact demographics. AR gives everything and consumer disclosures give everything for example.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry categories and binning

so reading post 4 there is no data that there is only loan vs credit card inquiries..... and I still believe that the "other loan" type of HP are not deduped.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry categories and binning

@Anonymous wrote:

@SouthJamaica wrote:

@Anonymous wrote:@Anonymous and I were discussing how fico categorizes hps into CC, mortgage and non-mortgage loan categories. If we hope to find bin thresholds, we must begin tracking and reporting scoreable inquiries in their respective categories. Thoughts?

Most of my inquiries appear to be designated as "installment loan inquiries" even though they are usually for other things -- applying for (a) a credit union deposit account, or (b) a credit card.

@SouthJamaica right you are, that's actually what started this discussion between @Anonymous and I. He just took a hard inquiry for a credit card and it came back as a mortgage pull when it was EQ9, I think?

but you make a very valid point there is some coding issues especially with credit unions and there are times when inquiries are going to be miscoded, so it's not gonna be without bumps.

The vast majority of my inquiries are "installment loan inquiries" although I've had only about 5 or 6 actual installment loan inquiries during the 5 years or so that I have been paying attention to such things. I believe I have an occasional "credit card inquiry" when I apply for a credit card. I'm guessing that about 90% of my inquiries are being "miscoded" to use your terminology, so I fail to see how it would ever be possible to determine the distinctions between different types of inquiries.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry categories and binning

@dragontears wrote:

@Anonymous wrote:

@dragontears wrote:

@Anonymous wrote:

OK so the algorithm divides scoreable inquiries into credit card, mortgage, and non-mortgage loan from my understanding. Now I don’t know if there are bins inside each of those categories or only inside some of them. I do know that except for credit card inquiries, we will have to take into account de-duplication.

so one would say at TU I have 1 mortgage inquiry, 2 loan inquiries, de-duplicated, three not de-duplicated and 2 CC inquiries.

Maybe inq-

TU-2CC, 1Mt, 3Ln (2de-dupped)

EQ-3CC, 1Mt, 0Ln

EX-2CC, 1Mt, 1Ln

Maybe a format something like this but we’re going to have to keep track of how many scoreable inquiries are within each of those categories if we ever hope to understand where the thresholds for bins are.You forgot about HP for apartments, employment, utilities, etc. I believe those are not classified under the groups you listed.

Also auto HP are deduped like mortgage HP where HP for other types of loans are not deduped (to the best of my knowledge)

@dragontears apartments employment, those are all soft pulls and don't affect score. See the inquiry section of the Scoring Primer I think it's post 4.

De-duplication Occurs for all installment inquiries but as I said they are categorized again see post 4, Scoring Primer

Ummm no they are not always SP. I have personally gotten HP for apartment applications

@dragontears I believe I mispoke when I included apartment inquiries. I retract that. But mortgage, auto and SLs are counted separately and de-dupped separately. I will have to find my reference for that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry categories and binning

@SouthJamaica wrote:

@Anonymous wrote:

@SouthJamaica wrote:

@Anonymous wrote:@Anonymous and I were discussing how fico categorizes hps into CC, mortgage and non-mortgage loan categories. If we hope to find bin thresholds, we must begin tracking and reporting scoreable inquiries in their respective categories. Thoughts?

Most of my inquiries appear to be designated as "installment loan inquiries" even though they are usually for other things -- applying for (a) a credit union deposit account, or (b) a credit card.

@SouthJamaica right you are, that's actually what started this discussion between @Anonymous and I. He just took a hard inquiry for a credit card and it came back as a mortgage pull when it was EQ9, I think?

but you make a very valid point there is some coding issues especially with credit unions and there are times when inquiries are going to be miscoded, so it's not gonna be without bumps.

The vast majority of my inquiries are "installment loan inquiries" although I've had only about 5 or 6 actual installment loan inquiries during the 5 years or so that I have been paying attention to such things. I believe I have an occasional "credit card inquiry" when I apply for a credit card. I'm guessing that about 90% of my inquiries are being "miscoded" to use your terminology, so I fail to see how it would ever be possible to determine the distinctions between different types of inquiries.

@SouthJamaicaNothing is ever going to be perfect, but we gotta start somewhere or give up. If the point loss is immediate, its coded CC, if it's exactly 30 days later it's installment. We'll take it case by case from there.